S. S. Mundra

Deputy Governor & Appellate Authority FOREWORD Reserve Bank of India places a great deal of importance on customer service in the banks and towards this end, it has formulated the Banking Ombudsman Scheme (BO Scheme) which provides for a free and easily accessible alternate complaints redressal mechanism for bank customers. The Scheme, which has been in existence since 1995, has been amended from time to time to enhance its coverage in terms of nature of complaints and service offerings. This Scheme has proved to be an effective and reasonably quick mechanism for redressal of customer complaints, especially those emanating from poor and middle class customers. 2. Consumer Protection, Financial Education and Financial Stability are a triad for the efficient functioning of the Financial System. The word ‘Customer’ and ‘Consumer’ are often used interchangeably though they are subtly different. For the present, Reserve Bank of India’s protection efforts are focused on the customers of banks. In any financial service, the customer is the targeted beneficiary and essentially he/she is a central focus of financial services regulation. The customers can confidently transact only when there is a robust, effective and fair protection regime available to him/her. Only such regime can drive customer confidence in financial services and help the regulators earn the trust and respect of financial services providers. Customer protection need not only be oriented towards protecting the interests of existing customers but should also help inspire confidence in the financial system for potential future customers. It primarily aims at offsetting the information asymmetry between service providers and the receivers of financial services by placing certain restrictions on the former. Without a proper customer protection framework, ill-informed and less financially literate bank customers would remain vulnerable to inappropriate products and services. 3. Charter of Customer Rights: For further augmentation of the Customer Protection measures, Reserve Bank of India has put out a draft Charter of Customer Rights taking into consideration the global best practices in this regard. The Charter of Customer Rights comprises five rights namely a) Right to Fair Treatment, b) Right to Transparency, Fair and Honest Dealing, c) Right to Suitability, d) Right to Privacy and e) Right to Grievance Redress and Compensation, covering the essential rights of a bank customer not only for the pre and post-availment of financial services but also throughout the life cycle of the product/services offered. 4. Indeed, a reliable and robust redress mechanism is a core component of an effective customer protection framework. Such mechanism should ensure that disputes between customers and financial service provider are dealt with fairly and expeditiously. Over the years, RBI instituted BO Scheme has gained wide acceptance among bank customers for being an independent, transparent, cost-effective and expeditious grievance redressal framework. The Scheme has benefitted common bank customers, who quite often do not have means to approach other forum such as Courts, Tribunals etc. During the last five years, on an average 70,000 plus complaints were received by the Offices of Banking Ombudsmen. During 2013-14, BO Offices received 76573 complaints. It is heartening to note that 96% of the complaints were disposed by the end of the year. The success of the scheme is evident in these figures. 5. The report highlights the need to spread wider awareness about the BO Scheme i.e. about the jurisdiction of the Scheme, grounds of complaints, mechanism of Appellate Authority etc. Presently, most of the complaints received under the Scheme emanate from the metros and large cities. As the banks increase their penetration in under-banked and hitherto unbanked smaller towns and rural areas, going forward our focus also needs to be on increasing the public awareness about the Scheme in these places. Sd/-

(S. S. Mundra) Vision and Goals of the Banking Ombudsman Offices Vision • To act as a visible and credible dispute resolution agency for common persons utilizing banking services. Goals • To ensure redress of grievances of users of banking services in an inexpensive, expeditious and fair manner that provides impetus to improve customer services in the banking sector on a continuous basis. • To provide policy feedback/suggestions to Reserve Bank of India towards framing appropriate and timely guidelines for banks to improve the level of customer service and to strengthen their internal grievance redress systems • To enhance awareness of the Banking Ombudsman Scheme. • To facilitate quick and fair (non-discriminatory) redress of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through capacity building. 1. Customer Service Initiatives by the Reserve Bank of India 1.1 Customer protection primarily aims at providing level playing field between suppliers and consumers of financial services by reducing the imbalance and inequality between the two parties. The imbalance essentially stems from information asymmetries, limited product choices, largely monopolistic nature of service providers etc. The imbalances are particularly pronounced in financial services as the products and services tend to be complex, vulnerable to market forces, and offer very limited exit options to the customers. In this scenario, the role of regulatory authorities in consumer protection in the financial sector, which was always important, assumes greater significance in times of market and competition driven pricing of financial services. The regulator's role is all the more important in our country, where literacy and awareness levels are low. The RBI initiated several measures to strengthen customer protection during the year. Some of the important customer service measures initiated by RBI during the year under review are given below. 1.2 Comprehensive Consumer Protection Regulations: The first Bi-monthly Monetary Policy Statement released on April 1, 2014 stated that “consumer protection is an integral aspect of financial inclusion and proposed to frame comprehensive consumer protection regulations based on domestic experience and global best practices”. The proposed statutory framework will come with explicit rights, the customers enjoy and the implicit duties that are cast on the banker. In compliance with this announcement in early September 2014, RBI has placed on its website a draft Charter of Customer Rights comprising five basic customer rights and explanatory notes on each right for public comments. (See Box I) The draft Charter of Customer Rights to deal with entities regulated by the Reserve Bank of India, has been framed based on global best practices of consumer protection as also discussions and interaction with various stakeholders. The Charter spells out the rights of the customer and the responsibilities of the financial service providers. Box I . Charter of Customer Rights 1. Right to Fair Treatment: Both the customer and the financial services provider have a right to be treated with courtesy. The customer should not be unfairly discriminated against on grounds such as gender, age, religion, caste and physical ability when offering and delivering financial products. 2. Right to Transparency, Fair and Honest Dealing: The financial services provider should make every effort to ensure that the contracts or agreements it frames are transparent, easily understood by and well communicated to, the common person. The product’s price, the associated risks, the customer’s responsibilities and the terms and conditions that govern its use over the product’s life cycle, should be clearly disclosed. The customer should not be subject to unfair business or marketing practices, coercive contractual terms or misleading representations. Over the course of their relationship, the financial services provider cannot threaten the customer with physical harm, exert undue influence, or engage in blatant harassment. 3. Right to Suitability: The products offered should be appropriate to the needs of the customer and based on an assessment of the customer’s financial circumstances and understanding. 4. Right to Privacy : Customers’ personal information should be kept confidential unless they have offered specific consent to the financial services provider or such information is required to be provided under the law or it is provided for a mandated business purpose (for example, to credit information companies). The customer should be informed upfront about likely mandated business purposes. Customers have the right to protection from all kinds of communications, electronic or otherwise, which infringe upon their privacy. 5. Right to Grievance Redress and Compensation: The customer has a right to hold the financial services provider accountable for the products offered and to have a clear and easy way to have any valid grievances redressed. The provider should also facilitate the redress of grievances stemming from the sale of third party products. The financial services provider must communicate its policy for compensating mistakes, lapses in conduct, as well as non-performance or delays in performance, whether caused by the provider or otherwise. The policy must lay out the rights and duties of the customer when such events occur. 1.3 Simplified KYC norms: In the light of practical difficulties/constraints expressed by bankers/customers in obtaining/submitting fresh KYC documents at frequent intervals banks were advised to continue to carry out on-going due diligence with respect to the business relationship with every client and closely examine the transactions in order to ensure that they are consistent with their knowledge of the client, his business and risk profile and, wherever necessary, the source of funds. Full KYC exercise is required to be completed at least once every two years for high risk individuals and entities, every ten years for low risk and at least once every eight years for medium risk individuals and entities. Positive confirmation (obtaining KYC related updates through e-mail/letter/telephonic conversation/forms/interviews/visits, etc.), required to be completed at least every two years for medium risk and at least every three years for low risk individuals and entities has since been dispensed with, with effect from September 4. 2014. Fresh photographs will be required to be obtained from a minor customer on becoming a major. Banks have been advised that only ‘mandatory’ information required for KYC purpose which the customer is obliged to furnish while opening an account should be obtained at the time of account opening/during periodic updation. Other ‘optional’ customer details/additional information, if required may be obtained separately after the account has been opened and only with the explicit consent of the customer. In view of the difficulties faced by migrant workers, transferred employees, etc. in submitting a proof of current/permanent address while opening a bank account, the RBI simplified the requirement of submission of ‘proof of address’ specifying that henceforth, customers may submit only one documentary proof of address (either current or permanent) while opening a bank account or while undergoing periodic updation. In case, the address mentioned as per ‘proof of address’ undergoes a change, fresh proof of address may be submitted to the branch within a period of six months. In case, the proof of address furnished by the customer is not the local address or address where the customer is currently residing, the bank may take a declaration of the local address on which all correspondence will be made by the bank with the customer. No proof is required to be submitted for such address for correspondence/local address. This address may be verified by the bank through ‘positive confirmation. In the event of change in this address due to relocation or any other reason, customers may intimate the new address for correspondence to the bank within two weeks of such a change. 1.4 ATM transactions – Enhancement of customer service: Banks were advised to display message regarding non-availability of cash in ATMs before the transaction is initiated either on screen or in some other way, display the ATM ID clearly in the ATM premises, make available forms for lodging ATM complaints within the ATM premises and also display the name and phone number of the officials with whom the complaint can be lodged. Banks were also instructed to make available sufficient toll-free phone numbers for lodging complaints / reporting and blocking lost cards to avoid delays and also attend the requests on priority, proactively register the mobile numbers / e-mail IDs of their customers for sending alerts and enable time out sessions for all screens / stages of ATM transaction 1.5 Charges Levied by Banks for Sending SMS Alerts: As announced in the second quarter review of Annual Monetary Policy Statement 2013-14, banks were advised to leverage the technology available with them and the telecom service providers to ensure that such charges are levied on all customers on actual usage basis. 1.6 Levy of penal charges on non-maintenance of minimum balances in inoperative Accounts: Banks were prohibited from levying penal charges for non-maintenance of minimum balances in any inoperative account. This was in compliance with the announcement made in first Bi-monthly Monetary Policy Statement released on April 1, 2014. 1.7 Opening of Bank Accounts in the Names of Minors: With a view to promote the objective of financial inclusion and also to bring uniformity among banks in opening and operating minors’ accounts, banks have been advised that a savings /fixed / recurring bank deposit account can be opened by a minor of any age through his/her natural or legally appointed guardian. Minors above the age of 10 years can open and operate savings bank accounts independently, if they so desire. 1.8 Levy of foreclosure charges/pre-payment penalty on Floating Rate Term Loans: In compliance with the announcement made in the first Bi-monthly Monetary Policy Statement released on April 1, 2014, regulatory instructions were issued restricting banks from levying foreclosure charges/ pre-payment penalties on all floating rate term loans sanctioned to individual borrowers. 1.9 Timely Issue of Tax Deducted at Source (TDS) Certificate to Customers: To ensure that TDS Certificate in Form 16A are issued by banks to their customers in time, banks were advised to provide to their customers, from whose account TDS was being deducted, a TDS Certificate in Form 16A, within the time-frame prescribed under the Income Tax Rules. 1.10 Periodicity of Payment of Interest on Savings/Term Deposits: On review of instructions on payment of interest on savings and term deposits at quarterly or longer rests, banks have been given the option to pay interest on rupee savings and term deposits at intervals shorter than quarterly intervals. 1.11 Easy access to bank Branches / ATMs to persons with disabilities: Banks have been directed to take necessary steps to provide all existing ATMs / future ATMs with ramps so that wheel chair users / persons with disabilities can easily access them. Banks are also to take appropriate steps, including provision of ramps at the entrance of the bank branches, wherever feasible. Further, banks should make all new ATMs installed from July 1, 2014 as talking ATMs with Braille keypads. In addition, magnifying glasses should also be provided in all bank branches for the use of persons with low vision. The branches should display at a prominent place notice about the availability of magnifying glasses and other facilities available for persons with visual and other disabilities. 1.12 The Depositor Education and Awareness Fund Scheme, 2014: In terms of powers conferred under section 26A of the Banking Regulation Act, 1949 the RBI has set up the Depositor Education and Awareness Fund. The RBI shall by notification in the official gazette specify an authority or Committee with such members as the RBI may appoint to administer the Fund and to maintain separate accounts and other relevant records in relation to the Fund in such forms as may be specified by the RBI. It shall be for the Competent Authority to spend money out of the Fund for carrying out the objects for which the fund has been established. The amount to the credit of any account in India with any bank, which has not been operated upon for a period of ten years or any deposit or any amount remaining unclaimed for more than ten years shall be credited to the Fund, within a period of three months from the expiry of the said period of ten years. The Fund shall be utilized for promotion of depositors’ interest and for such other purposes which may be necessary for the promotion of depositors’ interests as specified by RBI from time to time. The depositor would, however, be entitled to claim his deposit or unclaimed amount or operate his/her account after the expiry of ten years, even after such amount has been transferred to the Fund at such rate of interest as the RBI may specify. The bank would be liable to pay the amount to the depositor/claimant and claim refund of such amount from the Fund. The Depositor Education and Awareness Fund Scheme, 2014 was notified in the official gazette on May 24, 2014. 1.13 Master Circular on Customer Service in Banks: The Master Circular on Customer Service which incorporates RBI instructions/ guidelines issued to banks on various customer service related issues such as operations of deposit accounts, levy of service charges, disclosure of information, remittances, collection of instruments, dishonor of cheques, safe deposit lockers, nomination facility, dealing with complaints etc., has been updated covering instructions/guidelines issued till June 30, 2014 and placed on the website of the RBI. Profile of customer complaints handled by the OBOs | Particulars | 2011-12 | 2012-13 | 2013-14 | | Complaints brought forward from the previous year | 4617 | 4642 | 5479 | | Complaints received | 72889 | 70541 | 76573 | | TotalNo of complaints handled | 77506 | 75183 | 82052 | | Complaints disposed | 72864 | 69704 | 78745 | | Complaints pending at the end of the year | 4642

(6.0%) | 5479

(7%) | 3307

(4%) | | Complaints Pending for less than one month | 2681

(3.0%) | 3281

(4.36%) | 2432

(3%) | | Complaints Pending for one to two months | 1655

(2.14%) | 1675

(2%) | 838

(1%) | | Complaints Pending for two to three months | 277

(0.35) | 492

(0.6%) | 36

(0.04%) | | Complaints Pending for more than three months | 9

(0.01%) | 31

(0.04%) | 1

(0.001%) | | Appeals pending at beginning of the year | 0 | 13 | 0 | | Appeals Received | 47 | 52 | 107 | | Total no. of Appeals | 47 | 65 | 107 | | Appeal Disposed | 34 | 65 | 77 | | Appeals pending at the end of the year | 13 | Nil | 30 | | Representations to review the decision of BOs | 304 | 308 | 531 | 2. The Banking Ombudsman Scheme 2006 2.1 The Banking Ombudsman Scheme (BOS) introduced by the RBI in the year 1995 continues to remain a credible, cost-free alternative consumer dispute redressal mechanism in the banking industry. Its credibility is evident in the number of complaints handled by the offices of Banking Ombudsmen (OBOs) across the country. On average, OBOs receive annually 70000 plus complaints. The major category of complainants is individual bank customers. The objective of the Scheme is to provide a cost free avenue to common bank customers for resolution of their complaints on deficiency of banking services. The Scheme is oriented towards this vulnerable group of bank customers for whom approaching other fora is difficult and cost-prohibitive. The Scheme is applicable to Scheduled Commercial Banks, Regional Rural Banks and Scheduled Urban Cooperative Banks. The Scheme is implemented through 15 offices of Banking Ombudsmen situated across the country. 2.2 The complaint resolution mechanism under the BOS is simple and hassle-free. There are no multiple forms, no fees to be paid. Complaint can be lodged on a plain paper and sent through post/Fax/courier. For net-savvy bank customers the complaint can be sent through e-mail or lodged through online complaint form kept on the web site of the RBI. 2.3 As bank-branch is the first nodal point for the customer for resolution of grievance, the Scheme requires that the complainant first approaches his bank for resolution of his grievance. If he is not satisfied with bank’s resolution or there is no response from the bank within one month from the date of his complaint, he can approach the BO. 2.4 The Scheme specifies 27 grounds of complaint under which a complaint can be lodged with the BO. These grounds cover deficiencies in almost any banking service including credit cards, ATM and internet banking, non-adherence to the provisions of the Fair Practices Code for lenders or the Code of Bank’s commitment to Customers issued by the Banking Codes and Standards Board of India (BCSBI). (See Annex IV –Grounds of Complaints) 2.5 The thrust of the Scheme is on resolution by mediation and conciliation between banks and complainant. The Banking Ombudsmen try to arrive at a solution, which is acceptable to both the parties. Only in such cases where a mutually acceptable solution is not possible, the BO issues an Award. While resolving complaints, BOs take into account the principles of natural justice, banking law and practices and regulatory guidelines. 2.6 The Scheme provides a mechanism for filing appeals. Both the parties have the option of filing an appeal against the decision of BO. The Deputy Governor of RBI who is in charge of the department administering the Scheme (Consumer Education and Protection Department), is designated as the Appellate Authority under the Scheme. The Consumer Education and Protection Department functions as the Secretariat for the Appellate Authority. 2.7 Over the years, the awareness about the Scheme among bank customers has remained restricted mainly to Metro and Urban areas. These areas accounted for about 71% of the total complaints received during the year 2013-14. Some of the reasons attributed to the greater share of complaints from metro and urban areas are increased availability of banking services, financial literacy and expectation level of bank customers and greater awareness about the Scheme among residents of these areas as compared to their counterparts in semi-urban and rural areas. The Scheme is yet to catch up in rural and semi-urban areas. 2.8 Another disturbing fact is that the proportion of non-maintainable complaints received at the OBOs is very high. These are the complaints where the complainant has not followed the procedure laid down in the Scheme for filing the complaint (See Box II) or those complaints which are not covered under the grounds of complaints laid down in the Scheme. One of the reasons attributed to this feature is lack of awareness about the applicability and provisions of the Scheme among bank customers. 2.9 OBOs are trying to enhance visibility and awareness about the Scheme through awareness campaigns, Town Hall events, publicity through print and electronic media etc. However, these efforts need be supplemented at branch level by banks as branches are well placed to spread awareness among customers at the grass-root level. 2.10 The following chapters contain a detailed analysis of complaints handled by 15 BOs during the year 2013-14. Box II. Procedure for filing complaint with Banking Ombudsman –

Clause 9 of Banking Ombudsman Scheme (1) Any person who has a grievance against a bank on any one or more of the grounds mentioned in Clause 8 of the Scheme may, himself or through his authorised representative (other than an advocate), make a complaint to the Banking Ombudsman within whose jurisdiction the branch or office of the bank complained against is located. Provided that a complaint arising out of the operations of credit cards and other types of services with centralized operations, shall be filed before the Banking Ombudsman within whose territorial jurisdiction the billing address of the customer is located. (2) (a) The complaint in writing shall be duly signed by the complainant or his authorized representative and shall be, as far as possible, in the form specified in the Scheme or as near as thereto as circumstances admit, stating clearly: (i) the name and the address of the complainant,

(ii) the name and address of the branch or office of the bank against which the complaint is made,

(iii) the facts giving rise to the complaint,

(iv) the nature and extent of the loss caused to the complainant, and

(v) the relief sought for. (b) The complainant shall file along with the complaint, copies of the documents, if any, which he proposes to rely upon and a declaration that the complaint is maintainable under sub-clause (3) of this clause. (c) A complaint made through electronic means shall also be accepted by the Banking Ombudsman and a print out of such complaint shall be taken on the record of the Banking Ombudsman. (d) The Banking Ombudsman shall also entertain complaints covered by this Scheme received by Central Government or Reserve Bank and forwarded to him for disposal. (3) No complaint to the Banking Ombudsman shall lie unless:- (a) the complainant had, before making a complaint to the Banking Ombudsman, made a written representation to the bank and the bank had rejected the complaint or the complainant had not received any reply within a period of one month after the bank received his representation or the complainant is not satisfied with the reply given to him by the bank; (b) the complaint is made not later than one year after the complainant has received the reply of the bank to his representation or, where no reply is received, not later than one year and one month after the date of the representation to the bank; (c) the complaint is not in respect of the same cause of action which was settled or dealt with on merits by the Banking Ombudsman in any previous proceedings whether or not received from the same complainant or along with one or more complainants or one or more of the parties concerned with the cause of action ; (d) the complaint does not pertain to the same cause of action, for which any proceedings before any court, tribunal or arbitrator or any other forum is pending or a decree or Award or order has been passed by any such court, tribunal, arbitrator or forum; (e) the complaint is not frivolous or vexatious in nature; and (f) the complaint is made before the expiry of the period of limitation prescribed under the Indian Limitation Act, 1963 for such claims. 3. Receipt of Complaints 3.1 Fifteen OBOs covering 29 States and 7 Union Territories, handle the complaints received from bank customers regarding deficiency in banking services under the various grounds of complaints specified in the BOS. During the year 2013-14, OBOs received 76573 complaints. Comparative position of complaints received during the last three years in given in Table 1 and Chart 1. | Table 1 - Number of complaints received by the OBOs | | | 2011-12 | 2012-13 | 2013-14 | | No. of OBOs | 15 | 15 | 15 | | Complaints received during the year | 72889 | 70541 | 76573 |

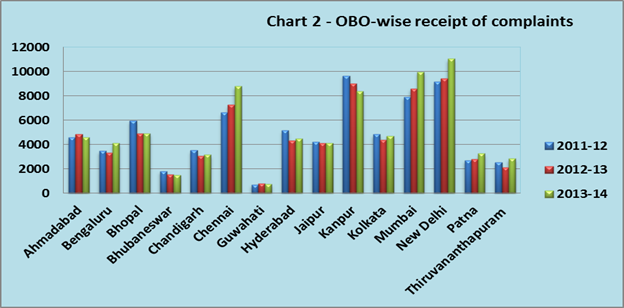

During the year 2013-14 there has been an increase of 8.55% in the number of complaints received over the previous year. Introduction of variety of banking products and services, increasing customer base coupled with rise in awareness about the grievance redress mechanism under the BOS 2006 are some of the reasons for the increase in number of complaints received at the OBOs. OBO-wise receipt of complaints 3.2 OBO-wise position of complaints received during the last three years is given the Table 2 and Chart 2. | Table 2- OBO-wise receipt of complaints | | OBO | No. of complaints received during | % change in 2013-14 over 2012-13 | % to total complaints | | 2011-12 | 2012-13 | 2013-14 | | Ahmadabad | 4590 | 4838 | 4588 | -5.17 | 5.99 | | Bengaluru | 3486 | 3318 | 4101 | 23.60 | 5.36 | | Bhopal | 5953 | 4920 | 4907 | -0.26 | 6.41 | | Bhubaneswar | 1826 | 1523 | 1498 | -1.64 | 1.96 | | Chandigarh | 3521 | 3094 | 3162 | 2.20 | 4.13 | | Chennai | 6614 | 7255 | 8775 | 20.95 | 11.46 | | Guwahati | 708 | 807 | 770 | -4.58 | 1 | | Hyderabad | 5167 | 4303 | 4477 | 4.04 | 5.85 | | Jaipur | 4209 | 4099 | 4104 | 0.12 | 5.36 | | Kanpur | 9633 | 9012 | 8389 | -6.91 | 10.96 | | Kolkata | 4838 | 4388 | 4698 | 7.06 | 6.13 | | Mumbai | 7905 | 8607 | 9965 | 15.78 | 13.01 | | New Delhi | 9180 | 9444 | 11045 | 16.95 | 14.42 | | Patna | 2718 | 2785 | 3253 | 16.80 | 4.25 | | Thiruvananthapuram | 2541 | 2148 | 2841 | 32.26 | 3.71 | | Total | 72889 | 70541 | 76573 | 8.55 | 100% |

With 11045 complaints New Delhi OBO tops the list in number of complaints received. Four metro centres OBOs viz. New Delhi, Chennai, Kolkata, Mumbai and one non-metro centre OBO Kanpur put together, accounted for 56% of the total complaints received at OBOs. Zone-wise, complaints increased by 18.6% in southern zone 7.5% in eastern zone followed by 5.9 % in western zone and 4.0% in northern zone. 10 OBOs at Bengaluru, Chandigarh, Chennai, Hyderabad, Jaipur, Kolkata, Mumbai, New Delhi, Patna and Thiruvananthapuram recorded increase in the number of complaints received whereas the other five OBOs at Ahmedabad, Bhopal, Bhubaneswar, Guwahati and Kanpur recorded a decline in receipt of complaints over the previous year. Population group-wise distribution of complaints received 3.3 Comparative position of last three years’ Population group-wise distribution of complaints is given in Table 3 and Chart 3. | Table 3- Population group-wise distribution of complaints received | | Population Group | No of complaints received during | % increase decrease

(+ / -) | | 2011-12 | 2012-13 | 2013-14 | | Rural | 8190

(11%) | 8598

(12%) | 9927

(13%) | (1%) | | Semi Urban | 11982

(16%) | 10868

(16%) | 12314

(16%) | (0) | | Urban | 24565

(34%) | 24246

(34%) | 25448

(33%) | (-1%) | | Metropolitan | 28152

(39%) | 26829

(38%) | 28884

(38%) | (0%) | | Total | 72889 | 70541 | 76573 | | | (Figures in bracket indicate %age to total complaints of respective years.) | The source of complaints remained heavily skewed towards customers from metro / urban areas. This trend for the current year is same as the previous year. Complaints from urban and metro areas accounted for about 71% of the total complaints received. This shows that the spread of the BOS is still confined to urban and metro areas. Year-on year basis, there is a marginal increase of 1% in number of complaints received from rural areas. The continued thrust on Consumer Awareness would help in improving the position in the future. Receipt of complaints Mode-wise 3.4 OBOs receive complaints through diverse modes such as online, e-mails, fax, couriers, registered / ordinary posts and hand delivery. Comparative position of complaints received through different modes during the last three years is indicated in Table 4 and Chart 4. | Table 4 – Receipt of complaints Mode-wise | | Mode | No. of Complaints received during | | 2011-12 | 2012-13 | 2013-14 | | e-mail | 9499

(13%) | 11381

(16%) | 15181

(20%) | | On line | 10026

(14%) | 8160

(12%) | 9785

(13%) | | Post/Fax/Courier/hand delivery | 53364

(73%) | 51000

(72%) | 51607

(67%) | | Total | 72889 | 70541 | 76573 | | (*Figures in bracket indicate %age to total complaints of respective years.) |

Though physical mode of lodging complaint (Post/Fax/Courier/hand delivery) still remains popular among bank customers, the electronic mode of lodging complaints (e-mail, Online) is also slowly gaining acceptability. Compared to previous year there was 28% increase in complaints lodged through electronic mode (Online and e-mail). Complainant group-wise classification 3.5 Individual bank customers constitute the largest segment of complainants under the BOS, which is the target group of the scheme. 93% of the complaints were received from this segment. Break-up of complaints received from various segments of society is given in Table 5 and Chart 5. | Table 5 – Complainant group-wise classification | | | Complaints Received | | 2011-12 | 2012-13 | 2013-14 | | Individual | 66279

(91%) | 65808

(93%) | 70913

(92.6%) | | Individual- Business | 2635

(4%) | 2245

(3%) | 2163

(2.87%) | | Proprietorship/Partnership | 253

(0.3%) | 227

(0.3%) | 151

(0.2%) | | Limited Company | 690

(1%) | 628

(1%) | 510

(0.7%) | | Trust | 150

(0.2%) | 213

(0.3%) | 184

(0.2%) | | Association | 461

(0.6%) | 325

(0.6%) | 297

(0.4%) | | Government Department | 521

(0.7%) | 390

(0.5%) | 287

(0.4%) | | PSU | 80

(0.1%) | 222

(0.6%) | 266

(0.3%) | | Others | 1820

(2%) | 483

(0.7%) | 1802

(2.4%) | | TOTAL | 72889 | 70541 | 76573 | | (*Figures in bracket indicate %age to total complaints of respective years.) |

Bank group-wise classification 3.6 Classification of complaints received by OBOs based on bank group is indicated in the Table 6 and Chart 6. | Table 6 - Bank group-wise classification | | Bank Group | No of Complaints Received During | | 2011-12 | 2012-13 | 2013-14 | | Nationalized Banks | 22326

(31%) | 21609

(31%) | 24391

(32%) | | SBI & Associates | 25848

(35%) | 23134

(33%) | 24367

(32%) | | Private Sector Banks | 15090

(21%) | 15653

(22%) | 17030

(22%) | | Foreign Banks | 5068

(7%) | 4859

(7%) | 5016

(6.5%) | | RRBs/ Scheduled Primary Urban Co-op. Banks | 1439

(2%) | 1489

(2%) | 1590

(2%) | | Others | 3118

(4%) | 3797

(5%) | 4179

(5.5%) | | Total | 72889 | 70541 | 76573 |

It may be seen that Public Sector Banks accounted for 64% of the total complaints received shared equally between SBI & its Associates and other nationalized banks. Private Sector Banks accounted for 22% whereas Foreign Banks received 6.5% of total complaints received. Regional Rural Banks and Scheduled Urban Co-operative Banks received 2% of the complaints received. 5.5% of the complaints were against other non-bank entities not covered under the BOS. The detailed bank-wise (Scheduled Commercial Banks) and complaint category-wise break-up of complaints received during the year 2013-14 is given in the Annex V. 4. Nature of Complaints Handled 4.1 There are 27 grounds of complaints regarding deficiency in banking services specified under Clause 8 of BOS 2006 for which complaints can be lodged with the OBO. Complaints received under these grounds are broadly categorized into major heads indicated in the Table 7 and Chart 7. | Table 7 – Category-wise distribution of complaints | | | No of complaints received | | 2011-12 | 2012-13 | 2013-14 | | Deposit accounts | 8713

(12%) | 3913

(6%) | 4032

(5.3%) | | Remittances | 3928

(5%) | 2664

(4%) | 2659

(3.5%) | Card Related

(ATM/ Debit / Credit Card) | 14492

(21%) | 17867

(25%) | 18474

(24.1%) | | Loans and advances | 6016

(8%) | 5996

(9%) | 5655

(7.4%) | | Levy of Charges without prior notice | 3806

(5%) | 3817

(5%) | 4547

(5.9%) | | Pension Payments | 5944

(8%) | 5740

(8%) | 6555

(8.5%) | | Failure to meet commitments /Non observance of fair practices code/BCSBI Codes | 18365

(25%) | 18130

(26%) | 20368

(26.6%) | | DSAs and recovery agents | 459

(1%) | 351

(0.8%) | 295

(0.4%) | | Notes and coins | 165

(0.2) | 56

(0.2%) | 63

(0.1%) | | Others | 7327

(10%) | 8635

(12%) | 9861

(12.9%) | | Out of Subject | 3674

(5%) | 3372

(5%) | 4064

(5.3%) | | Total | 72889 | 70541 | 76573 | | (Figures in bracket indicate %age to total complaints of respective years.) |

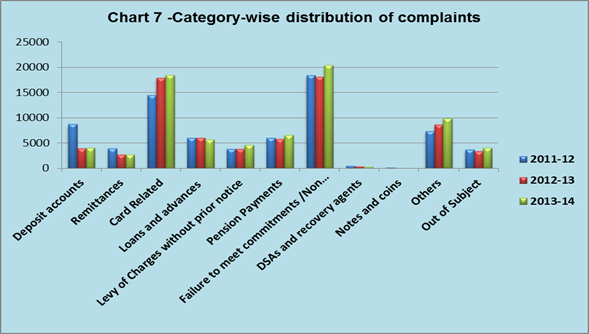

4.2 Complaints pertaining to failure to meet commitments, non-observance of fair practices code, BCSBI Codes taken together constituted largest category of complaints with 26.6% of the complaints received. A large number of complaints in this category indicate the lack of awareness about these Codes amongst bank staff as also the customers. It also reveals the lack of bank’s commitment to adhere to agreed terms & conditions. There is a need for the banks to devote special attention to this aspect and provide appropriate training to their front level staff regarding these Codes. 4.3 Card related complaints comprised 24.1% of the total complaints and formed the second largest category of complaints. There was a marginal decline of 0.9% in card related complaints over the previous year. Out of total 18474 card related complaints 10714 complaints were pertaining to ATM/Debit Cards. Broadly, the reasons for these card-related complaints are issue of unsolicited cards, sale of unsolicited insurance policies and recovery of premium, charging of annual fees in spite of being offered as 'free' card, authorization of loans over phone, wrong billing, settlement offers conveyed telephonically, non-settlement of insurance claims after the demise of the card holder, exorbitant charges, wrong debits to account, non-dispensation/short dispensation of cash from ATM, skimming of cards, fraudulent withdrawals using debit/credit cards etc. 4.4 Pension related complaints which stood at 8.5% of the total complaints received, recorded a marginal increase of 0.5% over the last year. These complaints were mainly regarding delayed payments, errors in calculations and difficulties in switching over to family pension. 4.5 Complaints on ‘loans and advances’ accounted for 7.4 % of the total complaints received during the year. These complaints mainly pertained to non-sanction/delay in sanction of loans, charging of excessive rate of interest, non-return of title deeds, non-issuance of no due certificate, wrong reporting to CIBIL etc. 4.6 5.9% of the complaints received pertained to the category of ‘levy of charges without prior notice’. These were mainly regarding charges for non-maintenance of minimum balance, processing fees, pre-payment penalties in loan accounts, cheque collection charges, etc. 4.7 Complaints in the category of ‘Deposit Accounts’ constituted 5.3 % of complaints received. Delays in credit, non-credit of proceeds to parties accounts, non-payment of deposit or non-observance of the Reserve Bank directives, if any, applicable to rate of interest on deposits in savings, current or other account maintained with a bank were the major reasons for complaints in this category. 4.8 Non-payment or delay in payment of inward remittances, Non-payment or inordinate delay in the payment or collection of cheques, drafts, bills etc were some of the reasons for 3.5% complaints received under the category of ‘Remittances’ 4.9 12.9% complaints received under ‘Others’ category include complaints relating to other grounds of complaints under the BOS such as, those related to non-adherence to prescribed working hours, delay in providing banking facilities, refusal or delay in accepting payment towards taxes as required by RBI/Government, refusal or delay in issuing/servicing or redemption of government securities, non-adherence to RBI directives, etc. 4.10 Complaints received under the category of ‘Out of Subject’ are those which are not under the grounds of complaints specified under the BOS. 5.3% of the complaints received during the year were under this category. Lack of awareness about applicability of the BOS is the major reason for receipt of such complaints. 5. Disposal of Complaints 5.1 Table 8 and Chart 8 below indicate a comparative position of disposal of complaints by OBOs. During the year 2013-14, OBOs handled 82052 complaints. This, comprised of 5479 complaints brought forward from the previous year and 76573 complaints received during the year under review. OBOs disposed 96% of the complaints handled during the year. | Table 8- Comparative position of disposal of complaints by OBOs | | Number of complaints | Year | | 2011-12 | 2012-13 | 2013-14 | | Received during the year | 72889 | 70541 | 76573 | | Brought forward from previous year | 4618 | 4642 | 5479 | | Handled during the year | 77507 | 75183 | 82052 | | Disposed of during the year | 72865 | 69704 | 78745 | | Rate of Disposal (%) | 94% | 93% | 96% | | Carried forward to the next year | 4642 | 5479 | 3307 |

BO office wise position of complaints disposed during the year 2013-14 is indicated in Table 9 below: | Table 9 - BO office wise position of complaints disposed during 2013-14: | | OBO | Complaints pending at the beginning of the Year | Complaints Received during the Year | Complaints handled | Complaints Disposed | Pending at the end of the year | Rate of Disposal (%) | | Ahmedabad | 72 | 4588 | 4660 | 4606 | 54 | 99% | | Bengaluru | 97 | 4101 | 4198 | 4040 | 158 | 96% | | Bhopal | 283 | 4907 | 5190 | 4947 | 243 | 95% | | Bhubaneswar | 68 | 1498 | 1566 | 1552 | 14 | 99% | | Chandigarh | 373 | 3162 | 3535 | 3315 | 220 | 94% | | Chennai | 653 | 8775 | 9428 | 9187 | 241 | 97% | | Guwahati | 82 | 770 | 852 | 813 | 39 | 95% | | Hyderabad | 568 | 4477 | 5045 | 4803 | 242 | 95% | | Jaipur | 80 | 4104 | 4184 | 4134 | 50 | 99% | | Kanpur | 771 | 8389 | 9160 | 8711 | 449 | 95% | | Kolkata | 465 | 4698 | 5163 | 5005 | 158 | 97% | | Mumbai | 655 | 9965 | 10620 | 10045 | 575 | 95% | | New Delhi | 1091 | 11045 | 12136 | 11480 | 656 | 95% | | Patna | 97 | 3253 | 3350 | 3275 | 75 | 98% | | Thiruvananthapuram | 124 | 2841 | 2965 | 2832 | 133 | 95% | | Total | 5479 | 76573 | 82052 | 78745 | 3307 | 96% | Classification of complaints- Maintainable/Non Maintainable 5.2 The complaints which do not pertain to grounds of complaint specified in Clause 8 of the BOS and those complaints where procedure for filing the complaint laid down in Clause 9 of the BOS is not followed are classified as ‘non-maintainable’. All other complaints are classified as ‘maintainable’ and dealt with as per the provisions of the BOS 2006. Table 10 and Chart 9 indicate classification of maintainable and non-maintainable complaints disposed by all the OBOs during the last three years. Of the 78745 complaints disposed during the year 2013-14, 57% complaints were maintainable. | Table-10 Classification of complaints disposed-Maintainable/Non-maintainable | | | 2011-12 | 2012-13 | 2013-14 | | Complaints Disposed | 72885 | 69704 | 78745 | | Maintainable | 37455

(51%) | 39400

(56%) | 44822

(57%) | | Non-maintainable | 35430

(49%) | 30304

(44%) | 33923

(43%) |

Over the period of last three years, percentage of maintainable complaints has increased gradually from 51% in 2011-12 to 57% in 2013-14 which indicates that the BO Scheme is becoming visible and accessible to the customers. The increasing number of maintainable complaints is indicative of effectiveness of efforts of OBOs to spread awareness about applicability of BOS among the bank customers. Mode of disposal of maintainable complaints 5.3 In terms of Clause 7 (2) of the BOS, the BO shall facilitate resolution of complaints by settlement, by agreement or through conciliation and mediation between the bank and the aggrieved parties or by passing an Award in accordance with the Scheme. The BOs accord first priority to resolution of complaint by mutual agreement by mediation and conciliation. Issuing Award is the last resort when mutual agreement is not possible. Over the last three years the percentage of disposal by mutual agreement is witnessing declining trend. Table 11 and Chart 10 below indicate the mode of disposal of Maintainable complaints. | Table 11 - Mode of disposal of maintainable complaints | | Disposal of Maintainable Complaints | 2011-12 | 2012-13 | 2013-14 | | By Mutual Settlement/agreement | 20092

(54%) | 19883

(50%) | 19469

(43.5%) | | Disposal by Award | 327

(1%) | 312

(1%) | 207

(0.5%) | | Maintainable Complaints rejected / withdrawn | 16946

(45%) | 19205

(49%) | 25146

(56%) | | Total maintainable complaints disposed | 37365 | 39400 | 44822 |

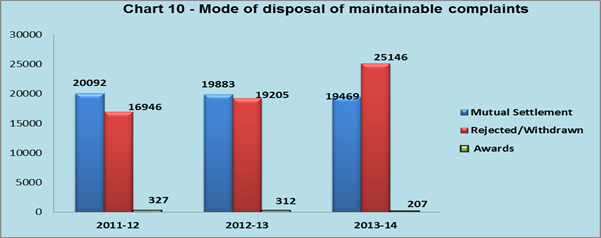

43.5% of the maintainable complaints received during the year were resolved by mutual settlement. Awards were passed in less than 1% of the cases, whereas 56% of the complaints were rejected / withdrawn. Major reasons for rejection of maintainable complaints were, amount of compensation claimed out of pecuniary jurisdiction of the BO, complaints requiring consideration of elaborate documentary and oral evidence and the proceedings before the Banking Ombudsman are not appropriate for adjudication of such complaints, complaints without sufficient cause, complaints where no loss or damage or inconvenience is caused to the complainant. Awards Issued 5.4 During the year BOs issued 207 Awards. OBO-wise position of Awards issued during the year 2013-14 is indicated in Table 12 below: | Table 12 - BO office wise position of Awards issued during the year 2013-14 | | OBO | Awards Issued | | Ahmedabad | 0 | | Bengaluru | 1 | | Bhopal | 0 | | Bhubaneswar | 30 | | Chandigarh | 3 | | Chennai | 2 | | Guwahati | 3 | | Hyderabad | 19 | | Jaipur | 64 | | Kanpur | 32 | | Kolkata | 20 | | Mumbai | 8 | | New Delhi | 23 | | Patna | 0 | | Thiruvananthapuram | 2 | | Total | 207 | Non-Maintainable complaints 5.5 Non-maintainable complaints include first resort complaints, subject matter of the complaint outside the ambit of the scheme, complaints outside the BO’s jurisdiction, complaints against entities other than banks, time-barred complaints, pending in Courts/other fora, frivolous complaints etc. In all such cases the complainant is advised about the reason for his complaint being not processed under the BOS. During the year 2013-14, 43% of the complaints received were non-maintainable. However, over the last three years, this percentage has come down from 49% to 43%. Reasons for rejection of complaints 5.6 Table 13 and Chart 11 indicate reasons for rejection of complaints. | Table 13 - Complaints rejected | | Reasons | 2011-12 | 2012-13 | 2013-14 | | First resort complaints | 14352

(19.69%) | 8660

(12.28%) | 8007

(10.46%) | | Time barred complaints | 778

(1.07%) | 683

(0.97%) | 753

(0.98%) | | Complaints dealt earlier | 2771

(3.80%) | 2634

(3.73%) | 3009

(3.93%) | | Complaints pending in other fora | 705

(0.97%) | 955

(1.35%) | 1117

(1.46%) | | Frivolous complaints | 32

(0.04%) | 31

(0.04%) | 55

(0.07%) | | Incomplete address, beyond pecuniary jurisdiction, pertaining to other institutions/ departments, miscellaneous unrelated complaints, etc | 3144

(4.31%) | 3039

(4.31%) | 3020

(3.94%) | | Complaints without sufficient cause | 5268

(7.23%) | 4705

(6.67%) | 7861

(10.27%) | | Not pursued by the complainants | 62

(0.09%) | 55

(0.08%) | 218

(0.28%) | | Complicated requiring elaborate evidence | 4328

(5.94%) | 5340

(7.57%) | 5588

(7.30%) | | No loss to the complainants | 43

(0.06%) | 44

(0.06) | 93

(0.12%) | | Not on Grounds of Complaints (Clause 8 or sub-clause (3) of clause 9 of the Scheme | 17867

(24.51%) | 19217

(27.24%) | 24090

(31.46%) | | Outside territorial limits of BO | 3026

(4.15%) | 4028

(5.71%) | 5072

(6.62%) | | Total Rejected Complaints (Maintainable & Non-maintainable) | 52376 | 49391 | 58883 | | Total Complaints Received | 72889 | 70541 | 76573 | | (Figures in bracket indicate %age to total complaints received of respective years.) |

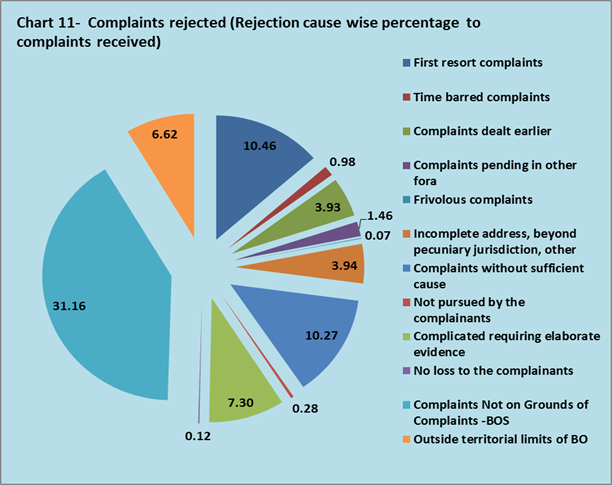

5.6. i Complaints Not on Grounds of Complaints : These are complaints, which do not cover the grounds of complaints specified under Clause 8 of the BOS and also those complaints which violate Clause 9 (3) of the BOS. During the year 31.46% of the complaints received were rejected for these reasons. High percentage of rejection on these grounds highlights an imperative need for educating bank customers about applicability of the provisions of the BOS. 5.6. ii First resort complaints: In terms of Clause 9 (3) (a) of the BOS the complainant should first approach the respective bank for redress of the grievance. If no reply is received from the bank within one month or the complainant is not satisfied with bank's reply, then he/she can approach the BO. Such complaints, where the complainants directly approach the BO are treated as First Resort Complaints (FRC) and rejected. The complainant is advised accordingly and the complaint is forwarded to the concerned bank for suitable action. 10.46% of the complaints received during the year 2013-14 were First Resort Complaints and hence rejected. FRCs are also received through online complaint form placed on the website of the RBI. Such FRCs are forwarded to the concerned bank online. During the year 2013-14, 8385 FRCs received through online complaint form were diverted directly to concerned banks. OBOs also have option to send the FRCs received physically in their offices to concerned banks through this module, which provides for uploading of scanned documents. During the year OBOs forwarded 5038 FRCs to concerned banks using this module. 5.6.iii Complaints without sufficient cause : 10.27% of the complaints received were rejected, as in the opinion of the BOs there was no sufficient cause for complaint. Clause 13 (d) of the BOS empowers the BOs to reject the complaint at any stage if it appears to him that the complaint is made without sufficient cause. 5.6.iv Complicated, requiring elaborate evidence : In terms of Clause 13 (c) of the BOS the BO may reject the complaint at any stage if he is of the opinion that the complaint requires consideration of elaborate documentary and oral evidence and the OBO is not an appropriate forum for adjudication of such complaint. 7.30% of the complaints received during the year were rejected for this reason. 5.6.v Outside territorial limits of BO : Territorial jurisdiction of the BO has been specified by RBI in terms of Clause 7(1) of the BOS. The authority of each BO extends to their respective territorial jurisdiction. In terms of Clause 9 (1) the complainant has to approach the BO within whose jurisdiction the branch or office of the bank complained against is located. During the year 6.62% of the complaints were rejected as these were not pertaining to the jurisdiction of respective BOs. However, such complaints are generally forwarded to the BO office to which the complaint pertains. 5.6.vi Rejection of complaints due to other reasons : Time barred complaints, dealt earlier, complaints pending in other fora, frivolous complaints, incomplete address, beyond pecuniary jurisdiction, pertaining to other institutions/ departments, miscellaneous unrelated complaints etc. not pursued by the complainants, complaints involving no loss to the complainants, were other reasons for rejection of complaints. Age –wise classification of pending complaints 5.7 Table 14 and Chart 12 below indicate age-wise classification of pending complaints. | Table 14- Age-wise classification of pending complaints | | Pending up to | June 30, 2012 | June 30, 2013 | June 30, 2014 | | 1 Month | 2701

(3.42%) | 3281

(4.36%) | 2432

(3%) | | 1-2 Months | 1655

(2.13%) | 1675

2% | 838

(1%) | | 2-3 Months | 277

(0.35%) | 492

0.60% | 36

(0.04%) | | More than 3 Months | 9

(0.1%) | 31

0.04% | 1

(0.001%) | | Total Pending | 4642

(6%) | 5479

(7%) | 3307

(4%) | | Complaints handled | 77507 | 75183 | 82052 | | (Figures in bracket indicate %age to complaints handled during respective years.) | OBOs disposed 96% of the complaints handled during the year 2013-14. At the end of the year 3307 (4%) complaints were pending at all OBOs. Out of these, 3% of the complaints were pending for a period of less than one month, 1% complaints were pending for a period between one to two months, 0.04% complaints were pending for a period between two to three months and only 0.001% complaints were pending beyond three months. Though BOS does not specify time limit for resolution of complaints, OBOs endeavor to resolve the complaints within a minimum possible time. Priority is not to spill over the resolution beyond two months. However, in some cases resolution gets delayed beyond this desirable period due to reasons such as insufficient information/documents submitted, delays in getting information from parties etc. Complaints per officer 5.8 Table 15 and Chart 13 below indicate complaints 'per officer' in respective OBOs. | Table 15 – Complaints per officer | | Office | 2011-12 | 2012-13 | 2013-14 | | No. of complaints received | No. of officers | No. of complaints per officer | No. of complaints received | No. of officers | No. of complaints per officer | No. of complaints received | No. of officers | No. of complaints per officer | | Ahmedabad | 4624 | 11 | 420 | 4838 | 13 | 372 | 4588 | 13 | 353 | | Bengaluru | 3562 | 12 | 297 | 3318 | 13 | 255 | 4101 | 11 | 372 | | Bhopal | 5874 | 9 | 653 | 4920 | 9 | 547 | 4907 | 7 | 701 | | Bhubaneswar | 1819 | 5 | 364 | 1523 | 4 | 381 | 1498 | 4 | 374 | | Chandigarh | 3534 | 10 | 353 | 3094 | 6 | 516 | 3162 | 8 | 395 | | Chennai | 6458 | 13 | 497 | 7255 | 14 | 518 | 8775 | 13 | 675 | | Guwahati | 722 | 4 | 181 | 807 | 3 | 269 | 770 | 2 | 385 | | Hyderabad | 5107 | 11 | 464 | 4303 | 6 | 717 | 4477 | 9 | 497 | | Jaipur | 4444 | 7 | 635 | 4099 | 12 | 342 | 4104 | 9 | 456 | | Kanpur | 9713 | 17 | 571 | 9012 | 17 | 530 | 8389 | 20 | 419 | | Kolkata | 4606 | 15 | 307 | 4388 | 17 | 258 | 4698 | 18 | 261 | | Mumbai | 7650 | 14 | 546 | 8607 | 15 | 574 | 9965 | 19 | 524 | | New Delhi | 9583 | 22 | 436 | 9444 | 17 | 556 | 11045 | 22 | 502 | | Patna | 2718 | 4 | 680 | 2785 | 4 | 696 | 3253 | 4 | 813 | | Thiruvananthapuram | 2471 | 6 | 412 | 2148 | 7 | 307 | 2841 | 8 | 355 | | All India | 72889 | 160 | 454 | 70541 | 157 | 449 | 76573 | 167 | 459 |

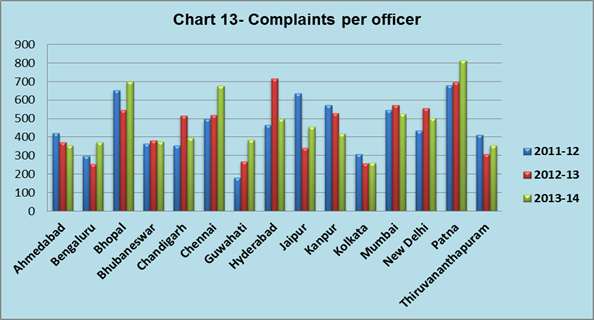

On an average each officer in the OBOs received 459 complaints this year. 6. Cost of Running the Scheme 6.1 The total expenditure incurred for running the BOS is fully borne by the RBI. The expenditure includes the revenue expenditure and capital expenditure incurred on administration of the BOS. The revenue expenditure includes establishment items like salary and allowances of the staff attached to OBOs and non-establishment items such as rent, taxes, insurance, law charges, postage and telegram charges, printing and stationery expenses, publicity expenses, depreciation and other miscellaneous items. The capital expenditure items include furniture, electrical installations, computers/related equipment, telecommunication equipment and motor vehicle. Average cost incurred for handling a complaint under the BOS 2006 is indicated in Table 16 and Chart 14. | Table 16- Cost of handling complaints at OBOs | | | 2011-12 | 2012-13 | 2013-14 | | Total Cost (` Million) | 281 | 315 | 369 | | Complaints Received | 72889 | 70541 | 76573 | | Average Cost of handling a Complaint (`) | 3858 | 4468 | 4824 | During the last three years the aggregate cost of running the BOS has increased from ` 281 million in 2011-12 to ` 369 million in 2013-14. Average cost of handling a complaint has increased from ` 3858 (in 2011-12) to ` 4824 per complaint during this period. BO Office wise 'Per-Complaint Cost’ for the year 2013-14 is given in Table 17: | Table 17 - OBO wise 'Per-Complaint Cost’ for the year 2013-14 | | OBO | Per Complaint Cost (`) | | Ahmedabad | 6503 | | Bengaluru | 4779 | | Bhopal | 4671 | | Bhubaneswar | 11015 | | Chandigarh | 4607 | | Chennai | 3854 | | Guwahati | 17201 | | Hyderabad | 3307 | | Jaipur | 6121 | | Kanpur | 4298 | | Kolkata | 6093 | | Mumbai | 4596 | | New Delhi | 2720 | | Patna | 5537 | | Thiruvananthapuram | 7194 | 7. Appeals against the Decisions of the BOs 7.1 In terms of Clause 14 of the BOS 2006, any person aggrieved by an Award issued by the BO under clause 12 or rejection of a complaint for the reasons referred to in sub clauses (d) to (f) of clause 13, can prefer an appeal before the Appellate Authority designated under the Scheme within 30 days of the date of receipt of communication of Award or rejection of complaint. The Deputy Governor in charge of the department of RBI administering the Scheme (Consumer Education and Protection Department) is the designated Appellate Authority under the BOS 2006. The secretarial assistance to the Appellate Authority is provided by the Consumer Education and Protection Department. Position of appeal handled by the Appellate Authority during the year 2013-14 is given in the Table 18 below. | Table 18- Position of appeals | | Particulars | No of Appeals | | Appeals received during the year from Complainants | 87 | | Appeals received during the year from Banks | 20 | | Total appeals handled during the year | 107 | | Appeal disposed during the year | 77 | | Pending at the end of the year | 30 | | Mode of Disposal | | | Appeals remanded to the BO for review | 1 | | Appeals withdrawn / settled | 3 | | Appeals rejected | 61 | | Appeals allowed | 12 | | Appeals Disposed during the year | 77 | | In favour of customers | 60 | | In favour of banks | 13 | 7.2 During the year 107 appeals were received against the decisions of BOs. Out of these 77 appeals were disposed during the year. In 60 cases the Appellate Authority’s decision was in favour of customers whereas in 13 cases it was in favour of banks. The OBO wise position of appeals received during the year 2013-14 is given in the Table 19. | Table 19 - OBO wise position of appeals received during the year 2013-14 | | OBO | No of Appeals | | Ahmedabad | 0 | | Bengaluru | 12 | | Bhopal | 0 | | Bhubaneswar | 40 | | Chandigarh | 8 | | Chennai | 3 | | Guwahati | 7 | | Hyderabad | 3 | | Jaipur | 12 | | Kanpur | 1 | | Kolkata | 1 | | Mumbai | 14 | | New Delhi | 0 | | Patna | 5 | | Thiruvananthapuram | 1 | | Total | 107 | Representations to review the complaints closed under non-appealable clauses of the BOS 2006 7.3 In terms of Clause 14 (1) of BOS 2006 complaints rejected under Clause 13 a, b & c of the Scheme, the decision given by the BO is non-appealable. Still, representations from the complainants to reopen complaints rejected under these non-appealable Clauses from complainants are received in the Consumer Education and Protection Department, the Secretariat of the Appellate Authority. During the year 531 such representations were received out of which 503 representations were disposed leaving 28 representations pending at the end of the year. In respect of 503 representations disposed, there was no ground calling for re-opening the case. 8. Complaints received through Centralised Public Grievance Redress and Monitoring System (CPGRAMS) CPGRAMS is a web based application developed by the Department of Administrative Reforms and Public Grievances of Government of India empowering the citizens to lodge their complaints online and also enabling redress action within a prescribed time limit. Government Departments, banks are sub-ordinate offices under this system to receive and redress complaints forwarded through this portal. The Consumer Education and Protection Department, RBI is the Nodal Office for RBI. Fifteen OBOs and some of the Central Office Departments of RBI are sub-ordinate offices. Position of complaints received by OBOs during the year 2013-14 is given in Table 20 below. | Table 20 - Position of Complaints received through CPGRAMS | | OBO | Complaints received | Complaints Disposed | Pending | | Ahmedabad | 12 | 11 | 1 | | Bengaluru | 14 | 14 | 0 | | Bhopal | 5 | 5 | 0 | | Bhubaneswar | 3 | 3 | 0 | | Chandigarh | 9 | 8 | 1 | | Chennai | 29 | 28 | 1 | | Guwahati | 2 | 2 | 0 | | Hyderabad | 13 | 11 | 2 | | Jaipur | 2 | 2 | 0 | | Kanpur | 24 | 24 | 0 | | Kolkata | 22 | 22 | 0 | | Mumbai | 40 | 39 | 1 | | New Delhi | 72 | 71 | 1 | | Patna | 8 | 8 | 0 | | Thiruvananthapuram | 6 | 6 | 0 | | Total | 261 | 254 | 7 | 9. Applications received under Right to Information Act, 2005 The Banking Ombudsmen have been designated as the Central Public Information Officers under the Right to Information Act 2005 to receive applications and furnish information relating to complaints handled by the OBOs. During the year OBOs received 596 applications under RTI Act. The OBO wise position is indicated in the Table 21 | Table 21 - Applications received by OBOs under RTI Act (2013-14) | | OBO | Applications received | | Ahmedabad | 11 | | Bengaluru | 11 | | Bhopal | 13 | | Bhubaneswar | 4 | | Chandigarh | 21 | | Chennai | 81 | | Guwahati | 9 | | Hyderabad | 40 | | Jaipur | 51 | | Kanpur | 131 | | Kolkata | 28 | | Mumbai | 62 | | New Delhi | 90 | | Patna | 31 | | Thiruvananthapuram | 13 | | Total | 596 | 10. Other Important Developments Annual Conference of Banking Ombudsmen 2014 10.1 The Annual Conference of Banking Ombudsmen was held in the Reserve Bank of India, Mumbai on January 30, 2014. The Conference was inaugurated by Dr. Raghuram G. Rajan Governor, Reserve Bank of India who also released the Annual Report of Banking Ombudsman Scheme for year 2012-2013 in ‘soft copy’. The Governor appreciated the ‘go green’ effort. In his inaugural remarks, Governor stated that customer protection was at the forefront of RBI’s attention and its regulatory initiatives. Dr. K.C. Chakrabarty, Deputy Governor, RBI chaired the Conference. Dr. (Smt.) Deepali Pant Joshi, Executive Director, RBI welcomed the participants. Dr. K.C. Chakrabarty addressed the Banking Ombudsmen and also held structured interactions with those present. Dr. Nachiket Mor, Director, Central Board of RBI, a Guest Speaker discussed the idea of suitability of products and services and other recommendations of the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households chaired by him. Ms Monika Halan, Editor Livemint, another Guest Speaker, spoke on the need for protecting the rights of small and vulnerable customers. All fifteen Banking Ombudsmen, CMDs/CEOs of major public/ private sector banks, representatives of major foreign banks, Chief Executive of Indian Banks’ Association, Chairman of BCSBI, MD & CEO of NPCI, MD of CIBIL, Member SEBI, Director, CAFRAL attended the Conference. Action points for IBA and banks which emanated from the discussions with the Governor are given in the Box III. Box-III Action Points of Annual BO Conference 2014 for IBA-Banks for improving Customer Protection 1. Banks and IBA to work together on rolling out a wide impact media campaign for improving financial literacy, creating awareness of products and commitment of banks to Fair Practices Codes. The Depositors’ Education and Awareness Fund and banks’ own advertisement budget may be used for the purpose. 2. IBA may issue instructions at the earliest to banks to discontinue levy of pre-payment penalty on all floating rate loans and ensure that fixed rate loans are truly fixed and are not referenced to any floating rate benchmark. (Implemented – RBI has issued instructions prohibiting banks from levying foreclosure charges/pre-payment penalties on all floating rate term loans sanctioned to individual borrowers.) 3. Banks may discontinue the practice of levying penalty for non-maintenance of minimum balance in ordinary savings bank accounts and instead consider converting such accounts to Basic Savings Bank Deposit accounts. IBA/RBI may issue the necessary operational instructions to banks in this regard. 4. Interest rates charged on credit card overdue were inordinately high and out of alignment with other products with similar risk profiles. There should be reasonableness of such charges. Banks to revisit the charges levied to ensure reasonableness, fairness and transparency in pricing. IBA to issue detailed operational guidelines to banks in this regard. 5. Banks and IBA to formulate policy on zero liability of customer in electronic banking transactions, where the bank is unable to establish customer level negligence. The onus of proving customer level negligence would be on the bank and when such negligence is not established beyond doubt, the benefit of such doubt may be given to the customer. IBA and banks should strive to put in place policies, systems and processes to secure electronic banking systems, protect customer’s interest to bring it ‘at par’ with traditional delivery channels. 6. Banks and IBA to revisit the ‘reasonableness’ of the proposed levy of charge for transactions done by customers at banks’ own ATMs. Principal Nodal Officers Conference 10.2 A meeting with Principal Nodal Officers of banks was held on September 30, 2013. The meeting commenced with an interactive session with Dr. K C Chakrabarty, Deputy Governor and Dr. (Smt.) Deepali Pant Joshi, Executive Director. ED (Dr. DPJ) in her opening remarks emphasized the need for empathetic handling of customers by the frontline staff of banks. Dr. K C Chakrabarty while setting the pace of the meeting urged the banks to focus on inculcating an enterprise-wide culture of ‘treating customers fairly’ and protecting their interest. He directed that in case of electronic banking frauds, the onus of proving that the customer was at fault would be on the bank, failing which, banks would be required to compensate the customer promptly. In this regard, he advised that banks may take all action required to strengthen the security of the delivery channel, capping the value of such transactions, seeking insurance against losses / expenses arising out of unauthorized electronic banking transactions, etc. In a bid to maintain timeliness of disposal, he advised banks to promptly furnish clarification/comments to all BOs/CEPD and also stressed that in case no comment /clarification was received within 15 days, the case would be disposed on available evidence / information. Visit by Delegation from Taiwan Financial Ombudsman Institution 10.3 A delegation from Taiwan Financial Ombudsman Institution visited CEPD to study the Banking Ombudsman Scheme and grievance redress mechanism in RBI. The delegation had a fruitful discussion on Banking Ombudsman Scheme and customer care and customer service in Indian banking sector. A visit to BCSBI and SEBI was also organized for the delegates. Regional BO Conferences 10.4 The nodal OBO of every zone organizes half yearly regional conferences of Banking Ombudsmen in its zone. The interaction in these conferences ensures uniformity in decisions and exchange of views on important systemic issues. During the year all nodal offices organized such conferences in their zone. On sidelines of these conferences, meetings are held with the Zonal Heads of major banks of the region to discuss customer service related issues of topical interest and sharing of regulatory concerns and expectations with banks, besides discussing practical issues, problems & obstacles impeding prompt resolution of customer grievances. Formation of new State of Telangana 10.5 29th State of the Union of India viz., the State of Telangana has been carved out of the State of Andhra Pradesh. Consequently, the jurisdiction of Banking Ombudsman for Andhra Pradesh has been bifurcated into the State of Andhra Pradesh and Telangana from June 2, 2014 onwards. The territorial jurisdiction of the Banking Ombudsman for Andhra Pradesh situated at Hyderabad also extends to the newly formed State of Telangana Awareness Campaigns and other initiatives 10.6 OBOs continued with their efforts to reach out to the members of public with the objective of increasing awareness about the grievance redress mechanism available under the BOS. This was done through advertisements in electronic media as also direct interactions with members of public in outreach programs, Banker Customer meets, exhibitions, fairs, etc. Advertisement campaigns in vernacular languages were organised designed to reach maximum number of people, especially in rural areas. 10.6.i Town Hall Events: OBOs organized Town Hall Events aimed at creating awareness among the public about BOS, security aspects of banking especially using ATM card, net banking, fund transfers, avenues for redressal of grievances, education loans security features of currency notes, etc. These events were conducted in local language and Hindi. 10.6.ii Awareness Campaigns: OBOs organised awareness campaigns in the area of their jurisdiction. A large number of villagers, school, college students, bank customers, bank officials of public and private sector banks, representatives from Pensioners’ Association, Depositors’ Association are involved in these awareness programmes. The salient features of BOS, its applicability are explained to participants. These events are mainly arranged in rural and semi urban areas. BOs also conducted on-site resolution of complaints during these campaigns. 10.6.iii Participation in Melas/Trade Fairs /Exhibitions: OBOs participated in various Melas, Trade Fairs, and Exhibitions by setting up stalls and displaying documentaries, informative brochures etc. about the Banking Ombudsman Scheme. The staff of the OBOs answered queries and accepted complaints from members of visiting public on deficiency in banking services. 10.6.iv Inclusion of lesson on BOS in school syllabus: Financial Literacy Lessons including Banking Ombudsman Scheme have been included in Andhra Pradesh & Telangana State schools syllabus for 8th and 9th classes from academic year 2013-14 and for X class from academic year 2014-15. The textbooks are also printed in Oriya, Tamil, Marathi, Telugu and English to cater to the needs of border districts. 10.6.v Press Conferences: OBOs organized Press Meets with local print media highlighting the activities undertaken by them during the year. Information shared included key statistics on the number and nature of complaints handled / resolved and significant / exemplary cases handled during the year. This initiative, which started in 2011, is well appreciated by the Press and extensively covered in several newspapers, including Hindi and vernacular dailies. The publicity generated through these meets has helped in enhancing visibility of the BOS mechanism. 10.6.vi Meetings with Nodal Officers of Banks: OBOs organised meetings with Nodal Officers of banks in the region. During those meetings, issues relating to the customer service in banks were discussed. Systemic issues emanating from the complaints were brought to the notice of the Nodal Officers and they were advised to do root-cause analysis of these issues and take corrective action so that recurrence of such complaints is avoided. Importance of giving prompt and correct information to OBOs was also highlighted in those meetings. 10.6.vii Skill building of staff: With introduction of several new banking products and services, the nature of complaints coming to OBOs is also changing. With a view to build the skill set required to handle these complaints OBOs arranged various training programmes in-house as well as with other institutions for staff of OBOs. These programmes mainly related to ATM operations, Internet Banking, issues related to Credit Information Companies, Pension etc. Industry experts were called for these programmes to share the latest developments in the field with the staff.

Annex - I

Name, Address and Area of Operation of Banking Ombudsmen | Centre | Name & Address of the Office of Banking Ombudsman | Area of Operation | | Ahmedabad | Shri Sunil T. S. Nair

C/o Reserve Bank of India

La Gajjar Chambers, Ashram Road,

Ahmedabad-380 009

STD Code: 079

Tel.No.26582357/26586718

Fax No.26583325

e-mail | Gujarat, Union Territories of Dadra and Nagar Haveli, Daman and Diu | | Bengaluru | Ms. C R Samyuktha

C/o Reserve Bank of India

10/3/8, Nrupathunga Road

Bengaluru -560 001

STD Code: 080

Tel.No.22210771/22275629

Fax No.22244047

e-mail | Karnataka | | Bhopal | Shri A. F. Naqvi

C/o Reserve Bank of India

Hoshangabad Road,

Post Box No.32, Bhopal-462 011

STD Code: 0755

Tel.No.2573772/2573776

Fax No.2573779

e-mail | Madhya Pradesh and Chhattisgarh | | Bhubaneswar | Shri B.K. Mishra

C/o Reserve Bank of India

Pt. Jawaharlal Nehru Marg

Bhubaneswar-751 001

STD Code: 0674

Tel.No.2396207/2396008

Fax No. 2393906

e-mail | Odisha | | Chandigarh | Shri Sanjay Bhatia

C/o Reserve Bank of India

New Office Building

Sector-17, Central Vista

Chandigarh-160 017

STD Code: 0172

Tel.No.2721109/2721011

Fax No. 2721880

e-mail | Himachal Pradesh, Punjab, Union Territory of Chandigarh and Panchkula, Yamuna Nagar and Ambala Districts of Haryana. | | Chennai | Shri K Chandrachoodan

C/o Reserve Bank of India

Fort Glacis, Chennai 600 001

STD Code: 044

Tel No.25399170/25395963/

25399159

Fax No. 25395488

e-mail | Tamil Nadu, Union Territories of Puducherry (except Mahe Region) and Andaman and Nicobar Islands | | Guwahati | Shri Anand Prakash

C/o Reserve Bank of India

Station Road, Pan Bazar

Guwahati-781 001

STD Code: 0361

Tel.No.2542556/2540445

Fax No. 2540445

e-mail | Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura | | Hyderabad | Dr. N. Krishna Mohan

C/o Reserve Bank of India

6-1-56, Secretariat Road

Saifabad,Hyderabad-500 004

STD Code: 040

Tel.No.23210013/23243970

Fax No.23210014

e-mail | Andhra Pradesh and Telangana | | Jaipur | Shri R. Giridharan

C/o Reserve Bank of India,

Ram Bagh Circle,

Tonk Road, Post Box No.12,

Jaipur-302 004

STD Code: 0141

Tel.No.5107973/5101331

Fax No.0141-2562220

e-mail | Rajasthan | | Kanpur | Shri A. K. Naskar

C/o Reserve Bank of India

M.G. Road, Post Box No.82

Kanpur-208 001

STD Code: 0512

Tel.No.2306278/2303004

Fax No.2305938

e-mail | Uttar Pradesh (excluding Districts of Ghaziabad and Gautam Buddha Nagar) and Uttarakhand | | Kolkata | Dr. Smt. S. Chattopadhyay

C/o Reserve Bank of India

15, Netaji Subhash Road

Kolkata-700 001

STD Code: 033

Tel.No.22306222/22305580

Fax No.22305899

e-mail | West Bengal and Sikkim | | Mumbai | Smt. R. Sebastian

C/o Reserve Bank of India

Garment House, Third Floor,

Dr. Annie Besant Road,

Worli, Mumbai-400 018

STD Code: 022

Tel.No.24924607/24960893

Fax No. 24960912

e-mail | Maharashtra and Goa | | New Delhi | C/o Reserve Bank of India,

Sansad Marg,New Delhi

STD Code: 011

Tel.No.23725445/23710882

Fax No.23725218

e-mail | Delhi, Jammu and Kashmir and Ghaziabad and Gautam Budh Nagar districts of Uttar Pradesh,Haryana (except Panchkula, Yamuna Nagar and Ambala Districts) | | Patna | Shri Patric Barla

C/o Reserve Bank of India,

Patna-800 001

STD Code: 0612

Tel.No.2322569/2323734

Fax No.2320407

e-mail | Bihar and Jharkhand | | Thiruvananthapuram | Shri A. Madasamy

C/o Reserve Bank of India

Bakery Junction

Thiruvananthapuram-695 033

STD Code: 0471

Tel.No.2332723/2323959

Fax No.2321625

e-mail | Kerala, Union Territory of Lakshadweep and Union Territory of Puducherry (only Mahe Region). |

Annex - II