“The Bank shall publish a document explaining the steps to be taken by it to implement the decisions of the Monetary Policy Committee, including any changes thereto” [Section 45ZJ(1) of the Reserve Bank of India Act, 1934] 1. Introduction IV.1 The operating procedure of monetary policy1 revolves around the implementation of monetary policy decisions – “the plumbing in its architecture” (Patra et al., 2016). As enjoined by the RBI Act, the decision of the MPC on the policy rate has to be operationalised by the RBI so that it alters the spending behaviour of economic agents and, in turn, achieves the RBI’s mandate on inflation and growth. Since monetary policy is characterised by “inside” and “outside” lags in policy formulationand implementation,2 the challenge for an efficient operating procedure is to (i) minimise the transmission lag from changes in the policy rate to the operating target – a variable that can be controlled by monetary policy actions – rapidly and efficiently; and (ii) ensure that changes in the operating target are transmitted as fully as feasible across the interest rate term structure in the economy. In pursuit of the legislative mandate, details of the changes in operating procedure and their rationale are presented in the bi-annual Monetary Policy Reports. IV.2 The weighted average call rate (WACR) – which represents the unsecured segment of the overnight money market and is best reflective of systemic liquidity mismatches at the margin – was explicitly chosen as the operating target of monetary policy in India. An interest rate corridor – the liquidity adjustment facility (LAF) – has been defined since May 2011 by the interest rate on the marginal standing facility (MSF) as the upper bound (ceiling), the fixed overnight reverse repo rate as the lower bound (floor) and the policy reporate in between (RBI, 2011).3 IV.3 The LAF corridor effectively defines the operating procedure of monetary policy. Once the policy repo rate is announced, liquidity operations are conducted to keep the WACR closely aligned to the repo rate. While the operating target and the LAF corridor framework have remained unchanged during the FIT period, several refinements have been introduced regarding (i) the width of the corridor; (ii) the choice of liquidity management instruments; and (iii) finetuning regular/durable market operations, all intended to anchor the term structure of interest rates to the policy repo rate in order to strengthen transmission. IV.4 Monetary policy transmission constitutes a ‘black box’ (Bernanke and Gertler, 1995). Several channels of transmission have been identified in the literature and the cross-country experience: (i) the interest rate channel described in the foregoing; (ii) the credit or bank lending channel, which assumes importance in a bank-dominated financial system such as India’s; (iii) the exchange rate channel operating through relative prices of tradables and non-tradables; (iv) the asset price channel impacting wealth/income accruing from holdings of financial assets; and (v) the expectations channel encapsulating the perceptions of households and businesses on the state of the economy and its outlook. These conduits of transmission intertwine and operate in conjunction and are difficult to disentangle. There is a loose consensus, however, in great measure associated with the development and growing sophistication of financial markets, that the interest rate channel is dominant (Bernanke and Blinder, 1992). Since the 2000s, this has provided the rationale for the choice of the operating procedure in India. During FIT, this operating procedure has been reinforced by practitioner innovations and communication strategies. In the process, trade-offs have surfaced, which warrant careful evaluation in order to draw lessons for the operationalisation of FIT in India, going forward. IV.5 Given this motivation, this chapter sets out to review the performance of the extant operating framework and its efficacy. The rest of the Chapter is structured in the following manner: Section 2 presents the stylised facts of the operating procedure and the transmission mechanism juxtaposed against the cross-country experience. Section 3 addresses specific tensions stemming from the operating procedure and the monetary transmission mechanism, some aspects of which engaged public discourse over the past four years. This section also recommends steps needed to fine-tune the operating procedure and facilitate better transmission. Finally, Section 4 concludes by laying out the challenges lying ahead. 2. Some Stylised Facts IV.6 Refinements in the operating framework have been undertaken in response to the changing macroeconomic and financial environment to sharpen the role of the repo rate as the single policy rate, to establish the 14-day term repo as the main instrument for providing liquidity over the reserve maintenance period and to enable a flexible framework that could shift seamlessly from a deficit mode in consonance with a tightening stance to a surplus mode in support of an accommodative stance (Table IV.1). IV.7 In February 2020, the culmination of these reforms was placed in the public domain with a view to clearly communicating the objectives and the toolkit for liquidity management (Box IV.1). IV.8 During the period of FIT,4 liquidity management operations underwent severe stress on two occasions. The first test came with the surplus liquidity glut post-demonetisation, which prompted the RBI to impose an unprecedented incremental cash reserve ratio (CRR) of 100 per cent for one fortnight (RBI, 2017). The second shock is the outbreak of COVID-19 when market seizure caused a collapse in trading activity, warranting the use of extraordinary system-wide as well as targeted liquidity measures to restore normalcy (RBI, 2020). | Table IV.1: Reforms in the Operating Framework | | The New Operating Framework of Monetary Policy (May 2011) | Revised Liquidity Management Framework (September 2014) | Modified Liquidity Framework (April 2016) | • Repo Rate - Single policy rate. • Weighted average overnight call money rate (WACR) is the operating target. • Corridor of +/- 100 bps around the Repo Rate. • 100 bps above the repo rate for the Marginal Standing Facility (MSF) and 100 bps below the repo rate for the reverse repo rate. • Full accommodation of liquidity demand at the fixed repo rate, albeit with an indicative comfort zone of +/-1 per cent of net demand and time liabilities (NDTL) of the banking system. • Transmission of the changes in Repo Rate through the WACR to the term structure of interest rates. | • Access to assured liquidity of about 1 per cent of NDTL on an average • Bank-wise overnight fixed rate repos of 0.25 per cent of NDTL, and the balance through 14-day variable rate term repos. • More frequent auctions of 14-day term repos during a fortnight (every Tuesday and Friday of a week). • Introduction of variable rate fine-tuning repo/reverse repo auctions. | • The corridor around the Repo rate narrowed from +/- 100 bps to +/- 50 bps. • Commitment to progressively lower the ex-ante system level liquidity deficit to a position closer to neutrality in the medium run. • Reducing the minimum daily maintenance of the CRR from 95 per cent of the requirement to 90 per cent. |

Box IV.1

Liquidity Management Framework The salient features of the extant framework operationalised on February 14, 2020 are5: The liquidity management corridor is retained and the weighted average call rate (WACR) remains the operating target. The width of the corridor was retained at 50 basis points (bps)6 A 14-day term repo/reverse repo operation at a variable rate and conducted to coincide with the cash reserve ratio (CRR) maintenance cycle is the main liquidity management tool for managing frictional liquidity requirements; the daily fixed rate repo and four 14- day term repos conducted every fortnight earlier stand withdrawn. The main liquidity operation is supported by fine-tuning operations, overnight and/or longer tenor, to tide over any unanticipated liquidity changes during the reserve maintenance period; if required, the RBI will conduct variable rate repo/reverse repo operations of more than 14 days tenor. Liquidity management instruments include fixed and variable rate repo/reverse repo auctions, outright open market operations (OMOs), forex swaps and other instruments. The daily minimum CRR maintenance requirement is retained at 90 per cent7 Standalone Primary Dealers (SPDs) are allowed to participate directly in all overnight liquidity management operations. Transparency in communication is enhanced through (a) dissemination of both flow and stock impact of liquidity operations; and (b) publication of a quantitative assessment of durable liquidity conditions of the banking system with a fortnightly lag. | Operating Framework and Market Microstructure IV.9 The choice of the operating framework and the liquidity management strategy of a central bank is premised on an efficient inter-bank money market which ensures smooth transfer of funds from lenders to borrowers and, in that process, determines the overnight rate (Bindseil, 2014). Reforms to develop the money market in India over the years in the context of the first leg of monetary policy transmission have expanded participation and instruments. There has been a steady migration of market activity to collateralised segments (Table IV.2), in conformity with some advanced economy (AE) experiences viz., the US, the UK, the Euro area and Japan. IV.10 In the uncollateralised segment, the reduced turnover is highly concentrated in the opening and the closing hours of trading, which tends to accentuate volatility in the WACR (Bhattacharyya et al., 2019). The collateralised segments are dominated by non-bank participants such as mutual funds (MFs). Consequently, extraneous developments such as large redemption pressures in the stock market spill over and bring episodes of tightness to overnight market conditions. Likewise, regulatory changes that mandate or incentivise collateralised instruments for investment by these entities – as in September20198 – can ease market conditions unexpectedly. Other aspects of the market microstructure can also influence the WACR. Specifically, special repos – repo transactions in which funds are lent in order to acquire a specific security for meetingobligations in the short sale9 market – often drive market repo rates to unduly low levels, dragging down money market rates out of sync with the Reserve Bank’s operating corridor. Furthermore, a higher proportion of ‘reported deals’ – which are traded over-the-counter (OTC) and reported on the negotiated dealing system (NDS)-Call platform after the deals are completed – exerts adisproportionate influence on the WACR.10 | Table IV.2: Share in Overnight Money Market Volume | | (Per cent) | | Financial Year | Uncollateralised | Collateralised | | Call Money | CBLO/ Tri-party Repo | Market Repo | | Pre-FIT | 2011-12 | 21.2 | 58.9 | 19.9 | | 2012-13 | 21.1 | 54.5 | 24.5 | | 2013-14 | 15.2 | 60.1 | 24.8 | | 2014-15 | 13.0 | 59.2 | 27.8 | | 2015-16 | 12.4 | 59.1 | 28.6 | | 2016-17 (April - September) | 11.5 | 56.2 | 32.3 | | Average (Pre-FIT) | 15.4 | 58.2 | 26.4 | | FIT | 2016-17 (October – March) | 9.8 | 61.4 | 28.8 | | 2017-18 | 8.4 | 63.2 | 28.5 | | 2018-19 | 9.6 | 63.8 | 26.6 | | 2019-20 | 6.9 | 68.0 | 25.1 | | Average (FIT) | 8.4 | 64.8 | 26.8 | Note: Tri-party repo replaced collateralized borrowing and lending obligations (CBLO) effective November 5, 2018; Pre-FIT (April 2011- September 2016).

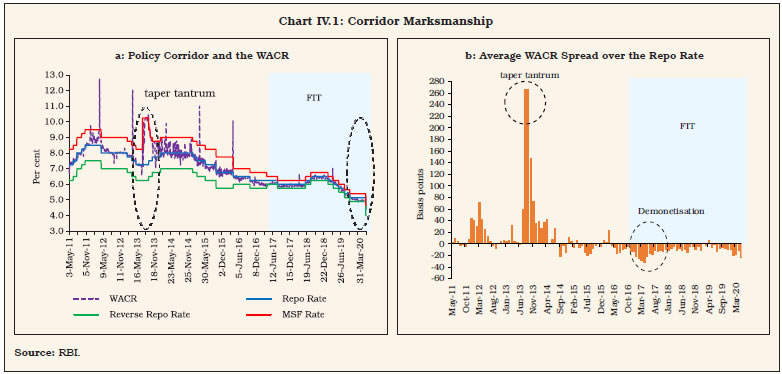

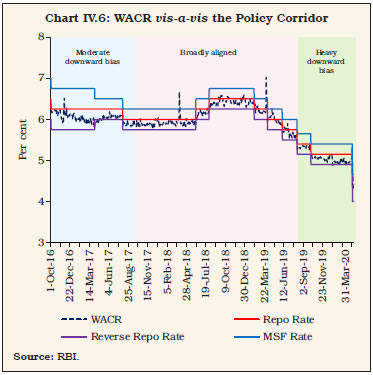

Source: Reserve Bank of India (RBI). | Policy Corridor IV.11 During FIT, liquidity management operations kept the WACR within the policy corridor on 97 per cent of the time (Table IV.3), although it predominantly traded below the repo rate (91 per cent of the time). IV.12 The country experience with regard to a corridor system indicates that the operating target generally lies in the middle, i.e., equidistant from the ceiling and the floor, suggesting efficient liquidity management based on prescient forecasting of systemic liquidity requirements (Sveriges Riksbank, 2014). In India, the WACR was centred in the LAF corridor and aligned tightly with the policy rate ahead of the institution of FIT and through its early months, reflecting monetary marksmanship on the back of a narrowing of the corridor from 200 bps in April 2015 to 50 bps by April 2017. This was honed by active liquidity management – 14-day repo auctions were used in the place of fixed rate repo. From the latter part of 2016-17 and in the first half of 2017-18, the demonetisation-induced liquidity overhang imparted a softening bias to overnight rates, reflected in a negative spread (over the repo rate) of 19 bps over a year. In the wake of the slowdown in economic activity thereafter, the RBI adopted an accommodative stance of monetary policy and allowed systemic liquidity (net LAF) to transit from deficit to surplus from June 2019 and into large liquidity absorption with the onset of the pandemic (Chart IV.1a). Overall, the WACR traded 11 bps below the repo rate under FIT on average, as against 19 bps above the repo rate pre-FIT (Chart IV.1b).

| Table IV.3: Operating Target and Monetary Marksmanship | | (Days) | | Regime | Outside Corridor | Within Corridor | Total | | > MSF | < Reverse Repo | < Repo | = Repo | > Repo | | Pre-FIT | 31 | 0 | 556 | 7 | 710 | 1,304 | | FIT | 4 | 23 | 742 | 2 | 74 | 845 | | Overall | 35 | 23 | 1,298 | 9 | 784 | 2,149 | Note: Pre-FIT: (May 2011 to September 2016); FIT: (October 2016 to March 2020).

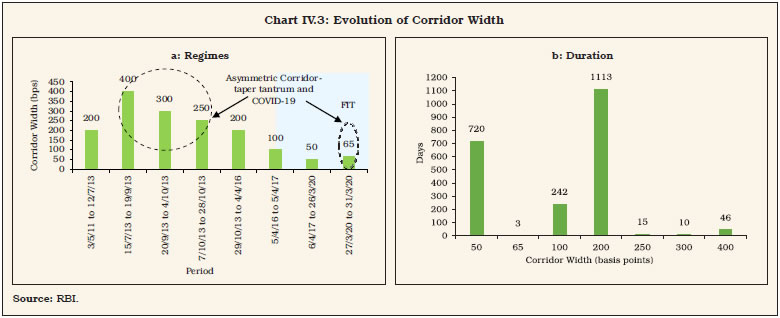

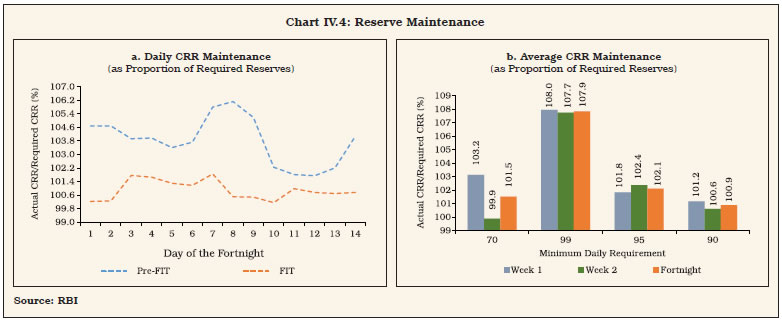

Source: RBI. | IV.13 The country experience suggests that the corridor width usually ranges between 25-200 bps around the policy rate/target (Annex IV.1). The optimal width of the corridor and its impact on liquidity management has been extensively deliberated in the literature. A wider corridor is synonymous with costlier central bank standing facilities and is associated with (i) greater inter-bank turnover; (ii) leaner balance sheet of the central bank; and (iii) greater short-term interest rate volatility (Bindseil and Jablecki, 2011). In contrast, a narrow corridor is associated with (i) shrinking inter-bank market activity; (ii) higher recourse to standing facilities, leading to a sharp increase in the size of the central bank’s balance sheet; and (iii) stable short-term rates in the inter-bank market. In India, the width of the corridor was progressively narrowed in a symmetric manner, which helped in moderating volatility – measured by the exponential weighted moving average(EWMA)11 of the WACR – corroborating the cross-country experience (Chart IV.2). IV.14 An asymmetric corridor has also been proposed in the context of a weak economy and a fragile financial sector (Goodhart, 2010); in practice, it has gained wide acceptability among some AEs after the GFC. In India too, the RBI asymmetrically widened the corridor to 400 bps in mid-July 2013 in response to the taper tantrum. With the return of normalcy, the corridor width was gradually restored to its pre-crisis level of 200 bps by end-October 2013 (Chart IV.3). After the COVID-19 pandemic, the Reserve Bank once again asymmetrically widened the corridor during March-April 2020, operating a de facto floor system as various conventional and unconventional measures flooded liquidity into the system and kept financial conditions ultra-easy to counter the pandemic. Reserve Maintenance and Averaging IV.15 Although the efficacy of the CRR as a policy instrument is limited in a modern financial system, it is a potent tool for stabilising overnight interest rates by creating the demand for reserves. Banks may frontload (backload) their maintenance at the beginning (end) of the reserve maintenance period, depending on the prevailing market interest rate and expectations of future rates. Accordingly, the overwhelming preference across jurisdictions is to stipulate reserve maintenance on an average basis: maintenance periods vary from two weeks (India) to six-eight weeks coinciding with monetary policy meetings (Euro area). The number of central banks stipulating daily minimum reserve maintenance is limited (Annex IV.1).  IV.16 Under Section 42(2) of the RBI Act, 1934, banks are required to maintain a specified proportion of their net demand and time liabilities (NDTL) as CRR balances with the RBI on an average daily basis over a reporting fortnight, with a minimum daily maintenance (stipulated as a proportion of actual requirements) during the fortnight. The daily minimum reserve requirement provides banks with flexibility in optimising their reserve holdings, depending upon intra-fortnight cash flows. Within the reporting fortnight, banks choose their daily maintenance levels – based on a cost-benefit analysis of interest rate expectations vis-à-vis the rates on standing facilities. Significant improvement in liquidity planning and reserve maintenance by banks has been observed in the FIT period (Chart IV.4a). The daily minimum reserve requirement was enhanced from 70 per cent of required CRR (effective since December 2002) to 99 per cent in July 2013 but subsequently reduced to 95 per cent in September 2013 and further to 90 per cent in April 2016. Post the outbreak of COVID-19, the minimum requirement was further reduced to 80 per cent in March 2020. The intra-fortnight variation (across weeks) in reserve maintenance was negligible when the daily minimum was prescribed at 99 per cent after the taper tantrum; in contrast, there has been significant frontloading in the first vis-à-vis the second week when the daily minimum balance was set at 70 per cent (Chart IV.4b).  Volatility of WACR IV.17 The efficacy of monetary policy transmission is contingent upon minimising volatility in the operating target so that policy signals are not blurred. Lower volatility in the overnight inter-bank rate lessens uncertainty about funding costs (Kavediya and Pattanaik, 2016). In fact, longer term rates can be higher than the policy preference due to increased volatility in the operating target (Carpenter et al., 2016); hence, stable and predictable short-term rates can help to improve transmission (Mæhle, 2020). Minimising operating target volatility has accordingly acquired priority in liquidity management objectives of central banks. It is in this context that most central banks resort to fine-tuning operations and provide forward guidance to align the operating target with the policy rate (USA; Euro area; UK, Sweden, Canada, Norway, Australia). Volatility is also minimised by (i) synchronising main refinancing operations with the reserve maintenance periods (ECB); (ii) indexing the overnight rate to the policy rate (UK); and (iii) undertaking discretionary operations alongside regular operations. IV.18 In India, the conditional volatility of the WACR has been found to positively affect the bid-ask spread in the overnight inter-bank market (Ghosh and Bhattacharyya, 2009). The conditional volatility of WACR has generally been subdued especially after the introduction of FIT, but for the usual year-end effects associated with balance sheet adjustment by banks (Chart IV.5). IV.19 An assessment of the key determinants of volatility suggests that calendar effects (annual closing) and reserve maintenance behaviour have had lesser impact under FIT than before, indicating improved liquidity management during this period (Box IV.2). Instruments and Collateral IV.20 In the aftermath of the GFC, discretionary and emergency liquidity facilities have been active across central banks or relevant legislations are in place for their future usage, if required. Besides open market operations (OMOs), other discretionary operations include forex swaps (Australia); term deposits (Australia); compulsory deposits (Mexico); additional loans and deposits (Sweden); and funding for lending (UK). Box IV.2

Volatility of WACR – Key Determinants Based on daily data from January 2009 to March 2020, the estimated volatility of daily changes in WACR, on an average, is found to be lower during the FIT period (Table 1). Moreover, skewness and kurtosis of estimated volatility has also declined during the FIT period, which is partly reflected in the moderation of spikes in WACR around end-March during this period. High frequency variables such as the WACR exhibit volatility clustering – bouts of intense volatility followed by periods of calm. This warrants the use of generalised autoregressive conditional heteroscedasticity (GARCH) [1,1] models or variants, where the sum of the estimated parameters is close to unity. Considering the persistence of volatility in the WACR, the integrated-GARCH (I-GRACH) model is used to model volatility (Engle and Bollerslev, 1986) with the following specification:

| Table 1: Estimated Conditional Volatility of Daily Changes in WACR | | Summary Statistics | Pre-FIT$ | FIT@ | | Mean | 0.050 | 0.003 | | Median | 0.012 | 0.003 | | Maximum | 2.028 | 0.004 | | Minimum | 0.000 | 0.002 | | Std. Dev. | 0.146 | 0.000 | | Skewness | 7.308 | 0.676 | | Kurtosis | 69.882 | 2.669 | $: January 2009 to September 2016;

@: October 2016 to March 2020 |

| Table 2: Volatility of WACR | | Dependent Variable: ∆WACR | | Variables | Pre-FIT | FIT | | Mean Equation | | Constant | -0.01*** | -0.02*** | | ∑∆WACR | -0.12*** | -0.13*** | | ∑∆Repo Rate | 0.78*** | 0.49*** | | Net Liquidity | -0.00** | -0.01*** | | ECM | -0.04*** | -0.22*** | | dum_March | 3.12*** | 0.04 | | Dum_April | -3.08*** | -0.60*** | | Dum_Taper | 0.11*** | | | D3 | 0.05*** | | | D4 | 0.01*** | | | D5 | 0.01*** | | | D6 | 0.00** | | | D7 | 0.01*** | | | D10 | 0.01*** | | | D12 | 0.01*** | | | Volatility Equation | | RESID(-1)^2 | 0.23*** | 0.00* | | GARCH(-1)^2 | 0.77*** | 0.99*** | | DUM_MARCH | 0.21*** | 0.00 | | Diagnostics (p-values) | | T-DIST. DOF | 0.00 | 0.00 | | Q(10) | 0.57 | 0.31 | | Q(20) | 0.51 | 0.69 | | ARCH LM (5) | 0.86 | 0.16 | | Note: *, ** and *** denote significance at 10%, 5% and 1% level, respectively. Demonetisation dummy turned out to be insignificant in both mean and variance equation for FIT period. | A one percentage point increase in the policy repo rate led to an instantaneous increase of 0.8 percentage points in WACR in the pre-FIT period as compared with 0.5 percentage points during FIT. The error correction term, indicating the speed of adjustment for any departure of the WACR from its long-term relationship with the policy repo rate, is about five times higher for the FIT period, reflecting improvement in transmission. Calendar effects are statistically significant during both the periods; however, their impact is much lower during FIT, with the end-March effect turning insignificant. Dummy variables capturing the impact of reserve maintenance behaviour of banks turned out to be statistically significant in the pre-FIT period; however, their impact became insignificant during FIT. Reference: Engle, R.F. and T. Bollerslev, (1986), “Modelling the Persistence of Conditional Variance”, Econometric Reviews, 5, 1-50. | IV.21 For liquidity management purposes, OMOs – more purchases than sales – have been the favoured instrument in India under FIT (TableIV.4).12 USD/INR swaps have also been used since March 2019 to inject/withdraw durable liquidity. In the wake of the pandemic, unconventional monetary policy (UMP) instruments such as long-term repo operations (LTRO) and targeted long-term repo operations (TLTRO) were introduced to reach out to specific sectors, institutions and instruments, which helped in easing market stress and softening financing conditions (RBI, 2020). As a COVID-related exceptional response, refinance / line of credit was provided to All IndiaFinancial Institutions13 [viz., National Bank for Agriculture and Rural Development (NABARD); Small Industries Development Bank of India (SIDBI); National Housing Bank (NHB); and Exim Bank of India] to alleviate sector-specific liquidityconstraints.14 IV.22 Fine-tuning operations through variable rate auctions of varying maturities geared at meeting unanticipated liquidity shocks commenced from 2014-15. During FIT, these operations have increased, both in terms of volume and number of operations conducted (Table IV.5). Although the bulk of such transactions were concentrated in smaller maturities (1-3 days), reverse repo transactions of longer maturity picked up during FIT relative to before, due to phases of prolonged surplus liquidity. As a pre-emptive measure to tide over frictional liquidity requirements caused by dislocations due to COVID-19, longer tenor (16-day maturity) fine-tuning variable rate repo auctions were conducted in March 2020, notwithstanding large surplus liquidity. | Table IV.4: Liquidity Management Instruments | | (₹ Crore) | | Financial Year | Net OMOs Purchases (+) / Sales (-) | Export Credit Refinance | LTROs / TLTROs | USD/INR Swap Auction | | Auction | NDS-OM | Total | Sell/ Buy | Buy/ Sell | | Pre-FIT | 2011-12 | 1,24,724 | 9,361 | 1,34,085 | 23,640 | | | | | 2012-13 | 1,31,708 | 22,892 | 1,54,599 | 18,200 | | | | | 2013-14 | 52,003 | 0 | 52,002 | 28,500 | | | | | 2014-15 | -29,268 | -34,150 | -63,418 | -9,100 | | | | | 2015-16 | 63,139 | -10,815 | 52,324 | - | | | | | 2016-17 (up to Sept. 30, 2016) | 1,00,014 | 490 | 1,00,504 | - | | | | | FIT | 2016-17 (Oct. 01, 2016 onwards) | 10,000 | -10 | 9,990 | - | | | | | 2017-18 | -90,000 | 1,225 | -88,775 | - | | | | | 2018-19 | 2,98,502 | 730 | 2,99,232 | - | | 34,561 | | | 2019-20 | 1,04,224 | 9,345 | 1,13,569 | - | 1,50,126 | 34,874 | - 20,232 | | Source: RBI. |

| Table IV.5: Fine-Tuning Operations | | Year | Tenor (Days) | Average Volume (₹ Crore) | | Repo | Reverse Repo | | Pre-FIT | | 2014-15 | 01-03 | 15,399 (50) | 13,485 (56) | | 04-12 | 12,143 (8) | 11,144 (8) | | 13-27 | - | - | | 28 and above | 9,125 (1) | - | | 2015-16 | 01-03 | 13,051 (57) | 11,449 (104) | | 04-12 | 14,915 (44) | 13,418 (42) | | 13-27 | 21,570 (6) | 4,995 (6) | | 28 and above | 19,803 (8) | - | | 2016-17 (up to Sept. 30, 2016) | 01-03 | 9,247 (8) | 15,341 (47) | | 04-12 | 11,438 (11) | 11,969 (49) | | 13-27 | 15,064 (2) | 4489 (10) | | 28 and above | 20,004 (1) | 560 (3) | | FIT | | | | | 2016-17 (since Oct.1, 2016) | 01-03 | 51,912 (15) | 40,145 (164) | | 04-12 | 6,850 (1) | 21,469 (68) | | 13-27 | - | 17,989 (53) | | 28 and above | - | 10,626 (22) | | 2017-18 | 01-03 | 14,270 (6) | 20,565 (37) | | 04-12 | 21,016 (7) | 15,603 (226) | | 13-27 | 25,005 (1) | 11,775 (180) | | 28 and above | 23,631 (4) | 3,141 (139) | | 2018-19 | 01-03 | 19,988 (11) | 38,945 (65) | | 04-12 | 22,441 (6) | 14,092 (120) | | 13-27 | 22,594 (4) | 4,272 (14) | | 28 and above | 24,377 (8) | - | | 2019-20 | 01-03 | 15,709 (3) | 1,22,451 (222) | | 04-12 | 11,772 (1) | 26,747 (39) | | 13-27 | 38,873 (2) | 9,824 (3) | | 28 and above | - | 16,482 (11) | Note: Figures in parentheses represent number of operations.

Source: RBI. | IV.23 All major central banks consider public sector securities as eligible collateral. Since the GFC, the list of eligible collaterals has expanded in several countries covering (i) financial entity debt (Japan, Mexico, Sweden and UK); (ii) covered bonds (Australia and UK); (iii) other asset backed securities (Australia, Canada, Mexico and UK); (iv) corporate debt and loans and other credit claims (Canada and UK); and (v) cross-border collateral (Australia, Japan, and Mexico). Accordingly, countries follow different practices relating to pricing, margins and haircuts for collateral. IV.24 As per the RBI Act, only government securities are eligible as collateral in India for counterparties availing standing facilities and participating in liquidity operations of the RBI. Consequently, funds under the MSF and the repo facility are availed against pledging of central and state government securities. Drivers and Management of Liquidity15 IV.25 A close examination suggests that although the key drivers of autonomous liquidity have remained unchanged in the FIT period relative to preceding years, their average dimensions have changed (Table IV.6). Liquidity leakage from the banking system through currency in circulation (CiC), on an average, has increased sizably in the FIT period. The size of market intervention by the RBI has been stepped up during FIT, reflecting pressures from surges in capital inflows. Among discretionary measures, the quantum of OMOs has increased, reflecting the preference towards market-based instruments under FIT. USD/INR forex swaps and UMP measures introduced after the outbreak of the pandemic have provided additional leeway in modulating systemic liquidity. Table IV.6: Key Liquidity Indicators

(period averages) | | (₹ Crore) | | | Pre-FIT | FIT | | A. Drivers of Liquidity | | | | 1. Net Purchases from Authorised Dealers (ADs) | 75,764 | 1,23,818 | | 2. Currency in Circulation (- leakage) | -1,47,465 | -2,05,553 | | 3. Government of India Cash Balances (+ decrease/- increase) | -7,307 | -2,460 | | 4. Excess CRR maintained by banks (+ drawdown/- build-up) | 12,055 | -23,831 | | B. Management of Liquidity | | | | 5. Net Liquidity Adjustment Facility (LAF) | -34,326 | -50,322 | | 6. Open Market Purchases | 61,768 | 95,211 | | 7. UMPs (LTROs and TLTROs) | 0 | 68,005 | | 8. Net Forex Swaps | 0 | 14,058 | Note: Pre-FIT (April 2011 – September 2016); FIT: (October 2016 – March 2020).

Source: RBI | Monetary Policy Transmission IV.26 Monetary policy impulses transmitted to the money market work their way through financial markets to the real economy i.e., the second leg of the operating procedure. Since financial markets are typically characterised by asymmetric information, policy signalling is an effective mechanism of bridging the asymmetry and conveying the central banks’ policy stance to the economy (Amato et al., 2002). Transmission of Policy Rate to WACR IV.27 In the pre-FIT period, the policy repo rate was increased (reduced) on eight (nine) occasions, while it remained unchanged on as many as twenty-three instances (Table IV.7). In contrast, it has been increased only twice, reduced on eight occasions and kept unchanged on twelve instances under FIT. While the CRR was not hiked during 2011-20, it was reduced on five occasions in the pre-FIT period. Under FIT, the sole reduction (100 bps) was in March 2020, aimed at easing liquidity constraints in response to COVID-19. IV.28 Empirical findings suggest that the market’s reactions to policy innovations are stronger and faster than the responsiveness of actual cost of funds to system liquidity shifts (Box IV.3). | Table IV.7: Policy Rate Changes | | (number of changes) | | Financial Year | Repo Rate | Cash Reserve Ratio | | ↑ | ↓ | — | Quantum

(in bps) | ↑ | ↓ | Quantum

(in bps) | Primary Liquidity Injected

(₹ crore) | | Pre-FIT | 2011-12 | 5 | - | 3 | 175 | - | 2 | -125 | 80,000 | | 2012-13 | - | 3 | 5 | -100 | - | 3 | -75 | 52,500 | | 2013-14 | 3 | 1 | 3 | 50 | - | - | - | - | | 2014-15 | | 2 | 6 | -50 | - | - | - | - | | 2015-16 | - | 2 | 4 | -75 | - | - | - | - | | 2016-17 (up to Sept. 30, 2016) | - | 1 | 2 | -25 | - | - | - | - | | FIT | 2016-17 (Oct. 01 to Mar 31, 2017) | - | 1 | 2 | -25 | - | - | - | - | | 2017-18 | - | 1 | 5 | -25 | - | - | - | - | | 2018-19 | 2 | 1 | 3 | 25 | - | - | - | - | | 2019-20 | - | 5 | 2 | -185 | - | 1 | -100 | 1,37,000 | Note:↑: Increased; ↓: Decreased; —: Unchanged.

Source: RBI. |

Box IV.3

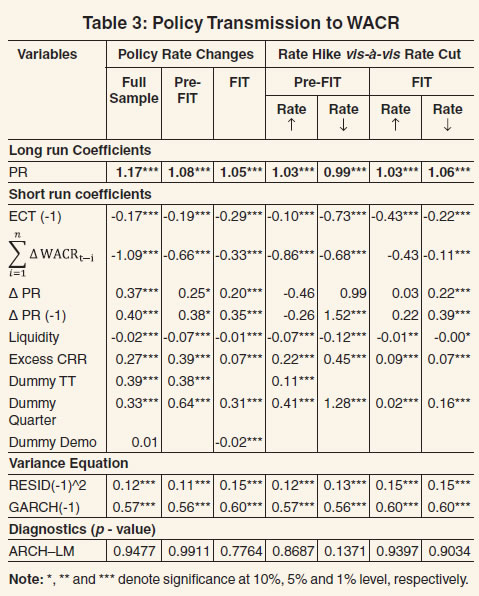

Policy Transmission to the Operating Target Based on daily data spanning May 2011 to March 2020, the WACR and the policy rate (PR) are found to be non-stationary at levels but stationary in first differences (Table 1). | Table 1: ADF Unit Root Test | | Variable | Level | Difference | | WACR | -2.018 | -22.991* | | Policy Rate | 0.986 | -46.729* | | Note: *denote significance at 1%. The optimal lag order is selected based on SIC in the ADF test equation. | The Bound test suggests that the two series are co-integrated in a long run relationship (Table 2). | Table 2: Cointegration of PR and WACR | | Bound test | F = 28.188 | | Critical values at 5 per cent | [ 3.62 4.16] | | Inference | Cointegrated | This supports the application of the autoregressive distributed lag (ARDL) model (Pesaran et al., 2001) for examining the long-run relationship between the two series, as specified below: The short run dynamics, which represent the deviation of the WACR from its long-run relationship with PR, are modelled using the GARCH (1, 1) framework (Bollerslev, 1986), with the mean and variance equation, as below: where the error correction term (ECT) estimated from equation (1) reflects the deviation from the long-term relationship. The short run dynamics also take into account the impact on WACR due to (i) variability in banking system liquidity (net LAF position); (ii) excess CRR maintenance by banks; (iii) a dummy variable capturing the impact of the taper tantrum; (iv) dummies capturing behavioural patterns, viz., banks reducing their lending exposure in the unsecured call market at the end of each quarter; and (v) a dummy variable to capture the impact of demonetisation. The long-run coefficient of the policy repo rate indicates complete pass-through of policy rate impulses to the WACR across the full sample as well as the two sub-periods. The estimated coefficient of liquidity operations (measured by net liquidity injection as proportion of NDTL) indicates the expected inverse relationship between liquidity conditions and the WACR. The high value of the quarter-end dummy coefficient (positive and statistically significant) is indicative of significant pressure on the WACR at quarter ends, although the impact is considerably moderated during the FIT period; similarly, the coefficient of excess CRR is much smaller during FIT vis-à-vis pre-FIT. Both these findings essentially reflect more efficient liquidity management by banks during FIT. Furthermore, the ECT suggests speedier correction of any deviation of the WACR during the FIT period, indicating efficiency gains from higher speed of adjustment in the market clearing mechanism. Finally, high GARCH coefficients from the estimated volatility equation suggests that volatility is persistent during both the periods (Table 3).16 The above equations are re-estimated separately under the tightening and easing phase, for both the pre-FIT and the FIT period. The long run estimates suggest that policy transmission from rate cuts (vis-à-vis rate hikes) is higher during FIT in comparison to the pre-FIT period (Table 3). Similarly, transmission under surplus and deficit liquidity conditions are analysed separately by re-estimating the above equations for the full sample as well as the two sub-periods. The long-run estimates suggest that policy transmission is higher under deficit vis-à-vis surplus liquidity conditions for the full sample (Table 4). While transmission is greater under deficit liquidity conditions in the pre-FIT period, it is stronger in surplus mode during FIT. The dynamics of adjustments are distinctly different for the FIT period and the years preceding it, with the ECT indicating more than three-fold faster rate of convergence in the FIT period under deficit liquidity conditions than under the pre- FIT period. For the full sample as well as the truncated sample periods, excess CRR has a significant effect on the WACR under deficit conditions. Even under surplus liquidity, excess CRR’s impact on the WACR turns out to be significant, with the appropriate sign during FIT. Finally, the impact of quarter-end phenomenon causing spikes in the WACR was stronger under deficit liquidity conditions, both for the full sample and the truncated periods.  The above findings underscore the need for more proactive liquidity management to achieve monetary marksmanship during the FIT period, considering the institutional features, calendar effects, and market dynamics. Nevertheless, the greater impact of policy announcements on the operating target vis-a-vis shifts in systemic liquidity conditions merits closer scrutiny of market microstructure issues. References: Bollerslev, T. (1986), “Generalized Autoregressive Conditional Heteroskedasticity”, Journal of Econometrics, 31(3), 307-327. Pesaran, M., Y. Shin & R. Smith (2001), “Bounds Testing Approaches to the Analysis of Level Relationships”, Journal of Applied Econometrics, 16, 289–326. | Transmission to Broader Market Segments IV.29 During the FIT period prior to COVID-19 outbreak (October 2016 to March 10, 2020), monetary transmission has been full and reasonably swift across the money market, the private corporate bond market and the government securities market. In the money market, interest rates on 3-month certificates of deposit (CDs), 3-month commercial papers (CPs) and 91-day Treasury bills (T-Bills) moved in sync with the policy rate, lowering funding and working capital costs. As against the cumulative reduction of 135 bps in the policy rate during FIT, the yield on 3-month T-Bills declined by 165 bps, while the yield on 3-month CPs issued by non-banking finance companies (NBFCs) declined by 117 bps (Table IV.8). Transmission to the government securities market and the corporate bond market, however, was less than complete. Since February 2019, improved transmission was facilitated by several liquidity augmenting measures (both conventional and unconventional) announced by the RBI. | Table IV.8: Policy Transmission to Financial Market Segments | | | FIT (Per cent) | Variation during FIT

(bps) | | 03-Oct 2016 | 06-Jun 2018 | 06-Feb 2019 | 10-Mar 2020 | | I. Policy Repo Rate | 6.50 | 6.25 | 6.50 | 5.15 | -135 | | II. Money Market | | (i) WACR | 6.39 | 5.88 | 6.42 | 4.96 | -143 | | (ii) Tri-party Repo | 6.19 | 5.71 | 6.34 | 4.86 | -133 | | (iii) Market Repo | 6.38 | 5.78 | 6.33 | 4.86 | -152 | | (iv) 3-month T-bill | 6.45 | 6.51 | 6.56 | 4.80 | -165 | | (v) 3-month CD | 6.61 | 7.54 | 7.17 | 5.23 | -138 | | (vi) 3-month CP (NBFCs) | 7.00 | 8.18 | 7.78 | 5.83 | -117 | | III. Corporate Bond Market | | (i) AAA -5-year | 7.52 | 8.70 | 8.55 | 6.53 | -99 | | (ii) AAA-10-year | 7.62 | 8.74 | 8.67 | 7.13 | -49 | | IV. G-sec Market | | (i) 5-year G-sec | 6.77 | 8.02 | 7.32 | 5.93 | -84 | | (ii) 10-year G-sec | 6.77 | 7.92 | 7.36 | 6.07 | -70 | | Source: RBI; Bloomberg. | IV.30 Empirical evidence suggests differential impact of monetary policy announcements on various market segments (Box IV.4). Box IV.4

Transmission to Other Markets Based on daily data spanning October 2016-March 2020, monetary policy surprises are calculated as the change in the one-month overnight indexed swap (OIS) on the monetary policy announcement days (Kamber and Mohanty 2018, Mathur and Sengupta 2019). The OIS instruments are forward looking and take into account all the anticipated monetary policy changes until the policy announcement date. Any change in the one-month OIS rate on the monetary policy announcement day reflects the unanticipated component or surprise element of monetary policy.18 The transmission of monetary policy surprises and its impact on various markets (10-year G-sec yield, 5-year AAA corporate bond yield, INRUSD exchange rate and Nifty) is examined through the local projection method (Jorda, 2005), which measures the magnitude of monetary policy surprises on financial markets through the following equation  where h = 1, …, 12 days. The coefficient βh represents the average impact of a monetary policy surprise on the variable of interest h days after the shock. Δyt+h is the change in the dependent variable (10-year G-sec yield, 5-year AAA yield, INRUSD exchange rate return and Nifty return) measured over a one-day window at different horizons of h. Equation 1 is estimated separately for each of the markets as the dependent variable and the coefficients of monetary policy surprises are reported as the results of the cumulative impulse response function with 90 per cent confidence interval. A robustness check of the results undertaken through statistical identification methods (Rigobon, 2003) corroborate the findings. The monetary policy surprise is immediately transmitted to G-sec and corporate bond yields with persistent impact. The cumulative impulse response function implies that a one per cent monetary policy surprise (increase) on announcement day hardens 10-year G- sec and AAA 5-year corporate bond yields, cumulatively on average, by about 0.98 per cent and 0.9 per cent, respectively, over the next 12 days (Chart 1). The impact on the forex and stock market, however, is not significant.19 References: Jorda O. (2005), “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, 95, 161-182. Kamber G., and M.S. Mohanty (2018), “Do Interest Rates Play a Major Role in Monetary Policy Transmission in China?”, BIS Working Papers No. 714, Bank for International Settlements. Mathur A., and R. Sengupta (2019), “Analysing Monetary Policy Statements of the Reserve Bank of India,” IHEID Working Papers 08-2019, Economics Section, The Graduate Institute of International Studies. Prabu E. A., and P., Ray (2019), “Monetary Policy Transmission in Financial Markets”, Economic and Political Weekly 54.13, pp. 68–74. Rigobon R. (2003), “Identification Through Heteroskedasticity”, The Review of Economics and Statistics, Vol. 85, pp. 777–792. | Credit Market Transmission IV.31 Following the deregulation of lending rates of scheduled commercial banks (SCBs) in October 1994, the Reserve Bank mandated the benchmarking of rupee loans pricing by banks, beginning with the prime lending rate (PLR) regime. The PLR regime (October 1994 to March 2003) was followed by the benchmark PLR (BPLR) regime (April 2003 to June 2010) and the base rate regime (July 2010 to March 2016).17 These benchmarks – based on internal parameters of balance sheets such as the cost of funds and operating costs – were bank-specific. Although the Reserve Bank had introduced external benchmark-based lending in 2000 to run in parallel, banks almost invariably offered loans based on the internal benchmark, arguing that external benchmarks do not reflect cost of funds (RBI, 2018a). The introduction of the marginal cost of funds-based lending rate (MCLR) regime – the latest internal benchmark introduced by the RBI in April 2016 – almost coincided with the adoption of FIT (Table IV.9). In case of the internal benchmark-based pricing of loans, transmission from the policy rate to bank lending rates is indirect, since lending rates are determined on a cost-plus basis. This creates a wedge in the pricing of bank credit, unlike in the determination of money market rates and bond market yields where transmission is direct (Kavediya and Pattanaik, 2016). In recognition of this asymmetry, the RBI mandated the introduction of an external benchmark system of lending rates for select sectors three years into the FIT regime in October 2019.20 | Table IV.9: Transmission from Repo Rate to Banks’ Deposit and Lending Interest Rates | | (Basis points) | | | Repo rate | Median Term Deposit Rate | WADTDR | WALR - Outstanding Rupee Loans | WALR - Fresh Rupee Loans | | Pre- FIT | Apr 2004 – Sep 2008 | 300 | 229 | 253 | -23 | - | | Oct 2008 – Feb 2010 | -425 | -227 | -174 | -181 | - | | Mar 2010 -June 2010 | 50 | 0 | - | - | - | | July 2010 - Mar 2012 | 325 | 226 | 222 | 203 | - | | Apr 2012 – June 2013 | -125 | -4 | -46 | -44 | - | | July 2013 - Dec 2014 | 75 | 7 | -9 | -28 | 5 | | Jan 2015 – Sep 2016 | -150 | -96 | -123 | -67 | -110 | | FIT | Oct 2016- May 2018 | -50 | -62 | -70 | -92 | -95 | | June 2018 – Jan 2019 | 50 | 16 | 20 | 2 | 57 | | Feb 2019 – Mar 2020 | -135* | -48 | -53 | -27 | -115 | *: The 75-bps policy rate cut on March 27, 2020 is not included.

WALR: Weighted Average Lending Rate; WADTDR: Weighted Average Domestic Term Deposit Rate.

Source: RBI. | Transmission under FIT IV.32 The MCLR system introduced in April 2016 endured only for a brief eight-month period of tight monetary policy (June 2018-January 2019), preceded and followed by easing cycles. Transmission to deposit and lending interest rates remained muted during the initial months of FIT, but it gained traction post-demonetisation (November 2016 to November 2017), resulting from an unprecedented influx of low cost current account and savings account (CASA) deposits into the banking system which, in turn, encouragedbanks to lower their term deposit rates.21 The introduction of external benchmarking of lending rates for retail and micro and small enterprises (MSEs) loans in October 2019 and syncing of liquidity in the financial system with the stance of monetary policy were noteworthy reform measures in support of transmission during the FIT period. IV.33 It is estimated that a policy rate change impacts the weighted average lending rate (WALR) on fresh rupee loans sanctioned by commercial banks with a lag of 2 months and the impact peaks in 3 months - the impact used to peak in 4 monthsin the pre-FIT period.22 IV.34 The pass through to WALR on fresh rupee loans improved in the FIT period vis-à-vis pre-FIT in response to the policy rate tightening (Table IV.9). A reduction in the policy repo rate, however, had noticeable impact on lending rates duringboth regimes.23 IV.35 There is evidence of asymmetry in pass-through of policy repo rate changes to banks’ lending and term deposit rates. Transmission is uneven across bank groups as well as across monetary policy cycles (Singh, 2011; Das, 2015; Khundrakpam, 2017), and usually higher for weighted average outstanding domestic term deposit rates (DR) and weighted average lending rates (WALRs) on fresh rupee loans (LR-F) vis-à-vis WALRs on outstanding rupee loans (LR-O) over different policy cycles (Table IV.10). Sensitivity of Output and Inflation to Monetary Policy IV.36 Since monetary transmission is subject to long, variable and uncertain lags, most IT central banks have adopted a period in the range of 12-24 months as their policy horizon (Bank of England, 1999; European Central Bank, 2010). An analysis of empirical work reported in the literature suggests that the average transmission lag is 29 months, and the maximum reduction in prices is, on average, 0.9 per cent following a one percentage point hike in the policy rate (Havranekand Rusnak, 2013).24 Transmission lags are longer in developed economies (26 to 51 months) than in post-transition economies (11 to 20 months). The difference in the speed of adjustment between developed and post-transition economies has been attributed to the degree of financial development: greater financial development is associated with slower transmission, as developed financial institutions have more opportunities to hedge against surprises in monetary policy actions. In developing countries, however, an underdeveloped financial market impedes transmission (Mishra et al., 2012). It appears that it is not the stage of development of financial markets per se, but it is the choice of an appropriate monetary regime that is more important in determining the strength of monetary transmission (Marques et al., 2020). IV.37 A survey of the empirical literature across countries shows that monetary policy impacts output with a lag of up to 12 months and inflation with a lag of up to 39 months and monetary policy impulses persist up to 60 months and even beyond for some countries. The lagged impact is sensitive to sample period, assumptions and methodology adopted for empirical analysis (Annex IV.2). IV.38 For India, empirical results from estimating New Keynesian models with inflation measured by the WPI indicate that in response to policy tightening, output starts contracting after three quarters and reaches its trough after one more quarter before gradually returning to its baseline. Inflation responds after seven quarters of the shock and the maximum impact is felt after 10 quarters(Patra and Kapur, 2012).25 When data on CPI are used, the transmission of a policy rate increase to headline CPI inflation peaks after 4 years (Kapur, 2018). In the QPM, the peak impact of monetary policy tightening on CPI inflation occurs after 10 quarters (Benes et al., 2016). There is a consensus that the interest rate channel is the strongest conduit of transmission, followed by thecredit channel.26 | Table IV.10: Transmission across Bank Groups – Tightening and Easing Policy Cycles | | (Basis points) | | Policy Cycle | Repo Rate | Public Sector Banks | Private Sector Banks | Foreign Banks | SCBs | | DR | LR-O | LR-F | DR | LR-O | LR-F | DR | LR-O | LR-F | DR | LR-O | LR-F | | Oct 16 - May 18 | -50 | -77 | -95 | -107 | -54 | -91 | -108 | -58 | -74 | -59 | -70 | -92 | -95 | | June 18 – Jan 19 | 50 | 13 | -32 | 37 | 29 | 53 | 78 | 60 | 35 | 75 | 20 | 2 | 57 | | Feb 19 – Mar 20 | -135 | -42 | -35 | -83 | -70 | -11 | -140 | -139 | -89 | -135 | -53 | -27 | -115 | DR: Weighted average domestic rupee term deposit rate; LR-O: Weighted average lending rate on outstanding rupee loans; LR-F: Weighted average lending rate on fresh rupee loans sanctioned by banks.

Source: RBI. | 3. Fine-tuning the Operating Procedure and Transmission Channels IV.39 The lessons from the implementation of monetary policy under FIT juxtaposed with the contemporaneous country experience points to the scope for several refinements in the operating framework and market infrastructure which can potentially improve the efficiency of monetary policy in the transmission of signals across the term structure of interest rates and the spectrum of markets in the economy. It is important to delineate, however, what works and, therefore, need not be fixed. Uncollateralised vis-à-vis collateralised rate as the operating target IV.40 The WACR should continue as the operating target of monetary policy. The gradual shrinkage in the share of the call money market in total money market turnover is mirrored in the experiences of countries across the world and this has not been deemed inimical to the integrity of the call money rate as an operating target by the majority of central banks, although a few viz., Brazil, Canada, Mexico, Switzerland choose the collateralised rate as the operating target (Annex IV.1). Moreover, collateralised segments of the money market are also populated by non-bank and unregulated participants whose actions may not be consistent with the monetary policy stance or amenable to the central bank’s regulatory control. Technically, the Reserve Bank can exert countervailing influence over them by its power to create reserves, but this may prove to be inefficient and costly in terms of the volumes of liquidity that has to be injected or withdrawn and the frictions encountered in the interface with the Reserve Bank’s collateral policy. Corridor Play, Marksmanship and MPC’s Mandate IV.41 As stated earlier, the FIT period was marked by the WACR trading with a pronounced downward bias vis-à-vis the policy repo rate. Moreover, the corridor was made asymmetric on March 27, 2020 by reducing the reverse repo rate by an additional 15 bps over and above the75 bps reduction in the repo and the MSF rate.27 Cumulatively, these two factors have resulted in the WACR getting closely aligned with the reverse repo rate (Chart IV.6). In this context, it has been argued in some section of the media and by a few analysts that by undertaking unilateral reductions in the reverse repo rate not in proportion to the repo rate, the Reserve Bank has solely appropriated for itself the task of monetary policy decision making.  IV.42 The amended RBI Act entails that the MPC shall determine the policy rate required to achieve the inflation target. It also defines the policy rate as the repo rate under the LAF. The operating procedure of monetary policy is guided by the objective of aligning the operating target of monetary policy – the WACR – to the repo rate through active liquidity management, consistent with the stance of monetary policy (RBI, 2015). Day to day liquidity management function is solely in the domain of the Reserve Bank. During normal times, the reverse repo rate and the MSF rate move in sync with repo rate changes as they are pegged to the repo rate in an equidistant manner under a symmetric corridor. In exceptional times, however, the corridor itself becomes an instrument for managing liquidity conditions. As the marginal standing facility and the fixed rate reverse repo windows are essentially instruments of liquidity management, they are in the remit of the Reserve Bank. In its endeavour to achieve the policy rate voted upon by the MPC, decisions involving a change in the reverse repo rate and the MSF rate and announcements thereof may be shifted out of the MPC resolution to the Reserve Bank’s Statement on Developmental and Regulatory Policies. The RBI may also clarify for the purpose of anchoring expectations that in normal times it will work with a symmetrical corridor with the MSF rate and the fixed rate reverse repo rate at pre-specified alignment with the policy repo rate and that it reserves the option of operating with an asymmetric LAF corridor in exceptional times. IV.43 When the MPC decided to adopt an accommodative stance of policy in June 2019, the Reserve Bank, in pursuance, ensured that systemic liquidity migrated from deficit to surplus by injecting large amounts of durable liquidity into the banking system through forex operations and OMO purchases and later through LTROs and TLTROs. In the absence of adequate opportunities for productive deployment of funds, surplus liquidity was parked by banks with the RBI under the reverse repo window. In this milieu, the reduction in the reverse repo rate was aimed at discouraging banks from passively parking surplus liquidity and explore lending opportunities amidst the nation-wide lockdown. The downside risk that emerged was that collateralised money markets traded, on average, 49-58 bps lower than the reverse repo rate. Term premia on instruments such as treasury bills, CPs and CDs moderated sharply – their interest rates trading below the overnight fixed rate reverse repo – posing threats to financial stability. Given this backdrop, it needs to be recognised that the asymmetric corridor is a temporary measure which will be reversed once normalcy is restored and that it would be misleading to interpret a crisis-induced measure as an attempt to weaken the MPC. IV.44 In view of the above, clarity of roles and responsibilities is clearly warranted to preserve the public’s credibility in monetary policy procedures so that expectations are anchored to this goal and intent. Consistency of actions with the publicly communicated stance would preserve and enhance transparency under the FIT framework. Narrow versus Wide Corridor IV.45 At the start of FIT in India, the Reserve Bank indicated a preference for narrowing the LAF corridor in keeping with peer country experiences with a view to honing monetary marksmanship in aligning the WACR closely with the policy repo rate (Patra et. al, 2016; RBI, 2016). While a narrow corridor lowers volatility in the operating target, it dis-incentivises the inter-bank market, resulting in the central bank emerging as the sole counterparty. In contrast, a wide corridor entails costlier central bank liquidity facilities but encourages active inter-bank trading and the development of the market segments, participants and products that continuously price and transfer various kinds of risks, but at the cost of tolerating higher volatility (Bindseil and Jablecki, 2011), which can amplify to a point at which it impedes monetary transmission. Therefore, the trade-off between low volatility and market buoyancy has to be keenly weighed before deciding on the appropriate width of the corridor. It is pertinent to note that ultra-low volatility (a very stable rate) is not particularly helpful for market making as contrasting views are necessary to spur market activity. As the pandemic recedes, exceptional measures are wound down and normalcy is restored, it is envisaged that the pre-pandemic LAF corridor of +/-25 bps may be gradually reinstated. At that stage, it may be appropriate to fully resume the revised liquidityframework laid out in February 202028 (Box IV.1) with 14-day repo/ reverse repo auctions as the main liquidity operation with cut-offs finely aligned with the policy rate to secure marksmanship. Capital flows and Liquidity Management IV.46 Large swings in capital flows can undermine the stance of monetary policy and pose challenges for liquidity management, as Chapter V dwells upon in detail. Forex market intervention by the Reserve Bank is aimed at curbing excessive volatility and discourage disruptive speculative activities in the foreign exchange market: large-scale capital outflows necessitate forex sales to avoid high volatility of the domestic currency on the downside, while a deluge of inflows warrants forex purchases to prevent volatility on the upside. More pressing are the resulting liquidity consequences of these interventions (Raj et al., 2018). Forward interventions may be liquidity neutral but by imparting pressure on the short-term interest rates, they can produce a similar outcome of contravening the policy stance. Forex purchases, by expanding domestic liquidity, exert downward pressure on money market rates which may be at variance with the stated policy stance. Moreover, in situations of exceptional liquidity glut, the traditional instrument viz., OMO sales have limitations in terms of the availability of adequate securities in the Reserve Bank’s portfolio. Furthermore, the reverse repo window, being a short-term instrument whose impact gets quickly reversed, cannot be an effective sterilisation tool for durable liquidity flows. In times of extreme liquidity tightness, an analogous constraint emerges in the form of the finite stock of excess statutory liquidity ratio (SLR) securities held by banks, which can be used as collateral under the LAF. With the MSF acting as a safety valve on the injection side, it is necessary to impart symmetry to the LAF by providing for a special facility on the absorption side. IV.47 In this context, the standing deposit facility (SDF) announced in the Union Budget 2018-19 and notified in April 2018, which is unencumbered and unconstrained regarding availability of securities, can be activated. The design of the SDF in terms of the appropriate interest rate and the conditions under which it is triggered, however, merits closer scrutiny since it would act as an additional floor to interest rates, beside the existing reverse repo rate. If the reverse repo facility has to be kept active or a potent tool of liquidity management, the interest rate on SDF must be lower than the reverse repo rate. Thus, the SDF will ensure that tail events such as a deluge of capital inflows do not threaten financial stability without the need to take recourse to instruments outside the Reserve Bank’s toolkit (eg., MSS). In that sense, the SDF needs to be regarded as a tool for ensuring financial stability in addition to its role in liquidity management (RBI, 2018b). Improving Liquidity Assessment and Communication IV.48 With the introduction of the 14-day variable rate repo as the main liquidity management tool synchronised with the reserve maintenance period, a more accurate assessment of liquidity is critical for both the Reserve Bank and the commercial banks, combining top-down methodologies and bottom-up approaches. From the Reserve Bank’s standpoint, resources have to be invested into availability of information on a more concurrent basis and more precise forecasts of autonomous factors such as currency demand, government cash balances and forex flows for a systematic liquidity assessment over the reserve maintenance fortnight. Illustratively, government cash balances are available to the liquidity forecaster with a lag of one day and currency in circulation with a lag of one week whereas they should be available on the same day and even intra-day for frictional liquidity management operations. As committed to in the revised liquidity management framework announced in February 2020, the Reserve Bank’s assessment of autonomous liquidity in an aggregated manner could be made available in the public domain on an ex ante daily / fortnightly basis as an incentive mechanism for improving the quality of forecasts. IV.49 For commercial banks, refining intra-fortnight cash flow projections remains a major challenge. The incentive structure for commercial banks to improve the quality and precision of bottom-up forecast could take the form of a reporting requirement on a pre-set frequency which the Reserve Bank, in turn, can aggregate and release in public domain along with its own assessment / forecasts. IV.50 Active liquidity management also presages the need for operations as needed in the form of two-way OMOs (both purchases and sales), forex operations (both spot and forward) and repo/ reverse repo of various tenors so that quantity modulation occurs seamlessly and persisting liquidity gaps / overhangs, as under the FIT, are avoided. Such gaps / overhangs often lead to large deviation of the operating target from the policy rate necessitating increased intervention by the central bank in the money market thereby hindering efficient price discovery and market development. Alongside, the frequency of fine-tuning operations should be minimised and confined to short tenors which are easily reversible so as not to overwhelm durable liquidity operations. Overall, the success of liquidity management in terms of its objectives hinges around clear and transparent communication of the central bank’s intentions followed up by credible actions resulting in desirable outcomes that are consistent with the publicly communicated stance. Synchronising Market Timings IV.51 Synchronicity in market timings across all products and funding markets is necessary to ensure that they complement each other by avoiding unanticipated frictions. Asynchronous market closure timings across different money market segments, high trading intensity in early hours and market timings not in sync with settlement timings often impact WACR trading disproportionately towards the end of the day. Specifically, the first hour of trading in the call money market usually accounts for bulk of the day’s volume as most of the market participants are unable to assess their cash-flow position for the day in the absence of a robust liquidity forecasting framework. As a result, late hour demand supply mismatches reflect in volatile call rates. Moreover, the absence of uniform market hours across all money market segments (Table IV.11), which are not in sync with real time gross settlement (RTGS) timings often have a destabilising impact on the WACR towards the market’s closure as cooperative banks enter the market to lend at cheaper rates. Therefore, standardising operational timings across market segments would reinforce the sanctity of the WACR as the operating target. | Table IV.11: Market Timings | | Market | Trading System | Settlement type | Entities | Market Timings | | Open | Close | | Call Money market | NDS-Call | T+0

T+1 (Notice/ Term) | All Entities | 9.00 AM | 5.00 PM | | Tri-party Repo in Government securities | TREPS | T+0 | Entities settling funds at RBI | 9.00 AM | 3.00 PM | | | | | Entities settling funds at Settlement Bank | 9.00 AM | 2.30 PM | | Tri-party Repo in Government securities | TREPS | T+1 | Entities settling funds at RBI | 9.00 AM | 5.00 PM | | | | T+1 | Entities settling funds at Settlement Bank | 9.00 AM | 5.00 PM | | Market Repo in Government Securities | CROMS | T+0 | All Entities | 9.00 AM | 2.30 PM | | Market Repo in Government Securities | CROMS | T+1 | All Entities | 9.00 AM | 5.00 PM | | Repo in Corporate Bond (reporting) | F-TRAC | T+0 | All Entities | 9.00 AM | 6.00 PM | | Repo in Corporate Bond (reporting) | F-TRAC | T+1 | All Entities | 9.00 AM | 6.00 PM | | Government Securities (Central Government Securities, State Development Loans and Treasury Bills) | NDS-OM | T+0 | All Entities | 9.00 AM | 2:30 PM | | Government Securities (Central Government Securities, State Development Loans and Treasury Bills) | NDS-OM | T+1 | All Entities | 9.00 AM | 5.00 PM | Note: In order to minimise the risks of contagion from COVID-19 and to ensure safety of personnel, trading hours for various markets were curtailed effective April 7, 2020.

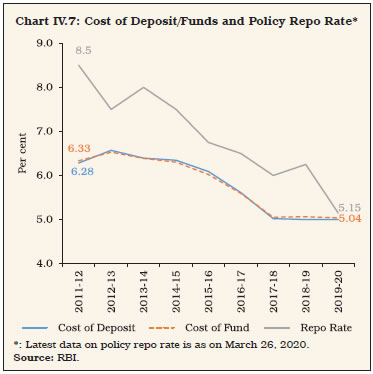

Source: RBI. | IV.52 Among Asian economies, interbank money markets are open till about 4-6:30 pm (local time) in Indonesia, Malaysia, South Korea and Hong Kong. The cut-off timings of payment systems relating to customer transactions is before closure of money markets in many of these jurisdictions; however, retail payment systems remain open post closure of money markets in China, Thailand and Vietnam. IV.53 Synchronous operational timings in the money market is vital so that participants have access to collateralised / uncollateralised funding as per their requirements. It also alleviates pressure on any segment that remains operational after the closure of other segments, as is the case in funding markets. Different settlement mechanisms for collateralised (market repo and TREPS) segments and uncollateralised (call) segment, however, pose challenges in aligning timings. The settlement of transactions in market repo and TREPS takes place along with secondary market transactions in securities segment. Multilateral netting of funds and securities results in high degree of netting benefits for market participants in terms of liquidity requirement. Furthermore, sufficient time is also required to facilitate repayment of intra-day credit lines availed by market participants from banks after completion of securities settlement. Availability of large value payment systems, such as RTGS, facilitates efficient functioning of the collateralised funding markets. IV.54 Finally, synchronised timing is also necessary from the viewpoint of meeting intra-day liquidity challenges due to sequencing of settlements. For instance, primary auctions and OMOs settle at about mid-day while settlement of securities are towards the end of the day. This sequencing of settlements may increase the intraday liquidity needs of the system as some market participants may have payable position in one settlement and receivable in another. Hence, primary auction/OMO settlement may be conducted later in the day. This would not only improve the netting efficiency but also help in reducing the overall liquidity requirement (RBI, 2019). Impediments to Transmission IV.55 Monetary transmission in India is delayed and incomplete. Several factors impeded policy transmission to deposit and lending interest rates of banks during the FIT regime (Box IV.5). Policy Measures Undertaken to Improve Transmission in Credit Market IV.56 Keeping in view the drags on transmission, a few initiatives were taken to facilitate transmission in the FIT period. As the experience with the introduction of MCLR regime coinciding with FIT framework did not prove to be satisfactory, the Reserve Bank mandated introduction of external benchmark linked loans for retail and MSE sectors in October 2019; and for medium enterprises, effective April 1, 2020. IV.57 Notably, a cross country survey of interest rate benchmarks adopted by banks reveals that loans linked to external benchmarks constitute a significant share of balance sheets of banks in many countries (Table IV.12). Box IV.5