List of Abbreviations | ACLF | Additional Collateralised Lending Facility | | BIS | Bank for International Settlements | | CCIL | The Clearing Corporation of India Ltd. | | CiC | Currency in Circulation | | CLF | Collateralised Lending Facility | | CRR | Cash Reserve Ratio | | GDP | Gross Domestic Product | | GoI | Government of India | | Fx | Foreign Exchange | | ILAF | Interim Liquidity Adjustment Facility | | LAF | Liquidity Adjustment Facility | | MMO | Money Market Operations | | MPC | Monetary Policy Committee | | MSF | Marginal Standing Facility | | MSS | Market Stabilisation Scheme | | NDA | Net Domestic Asset | | NDTL | Net Demand and Time Liabilities | | NFA | Net Foreign Assets | | OMOs | Open Market Operations | | PDs | Primary Dealers | | SDF | Standing Deposit Facility | | SDL | State Development Loans | | SF | Standing Facilities | | SLR | Statutory Liquidity Ratio | | SPDs | Stand-Alone Primary Dealers | | WACR | Weighted Average Call Money Rate |

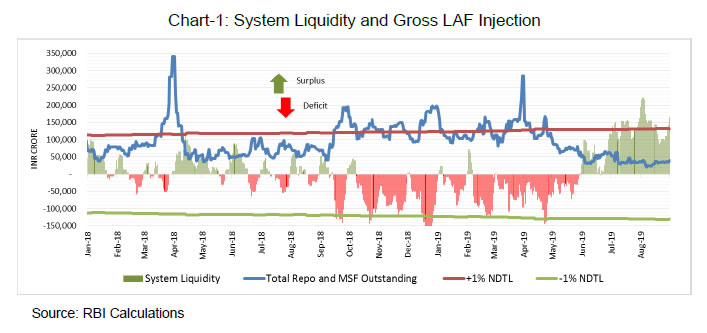

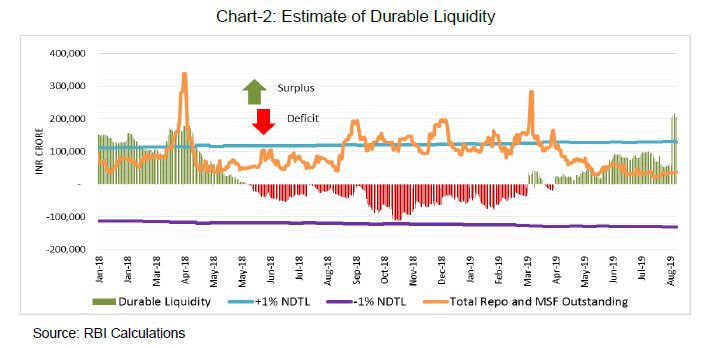

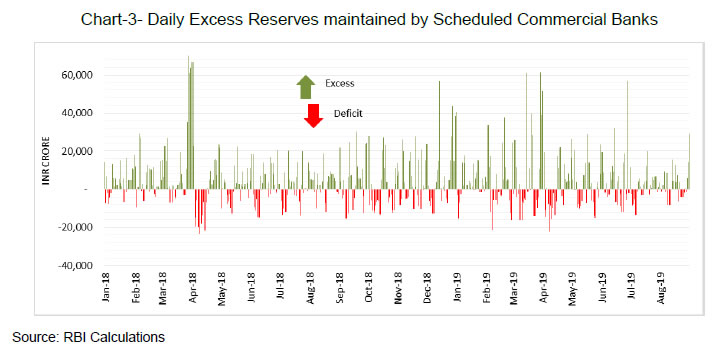

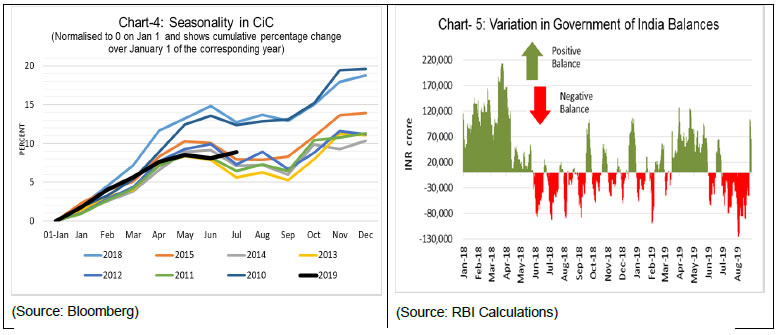

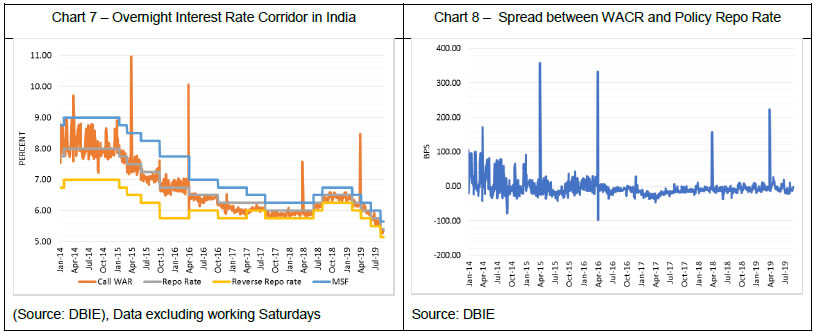

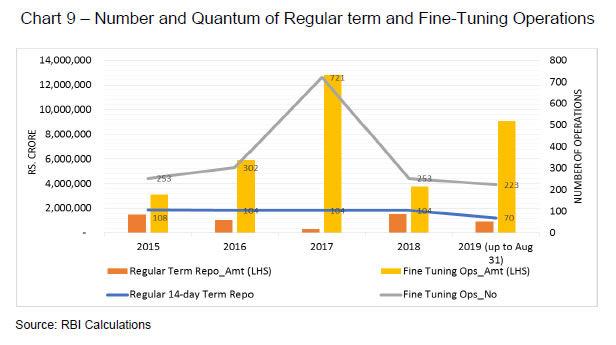

Executive Summary Liquidity management, which is the operating procedure of monetary policy, seeks to ensure adequate liquidity in the system so that sufficient credit is provided to all productive sectors in the economy. The first step in this process is the transmission of changes in the policy rate to the inter-bank call money rate. Subsequently, this impulse gets transmitted to longer term interest rates on financial instruments traded in markets, loans and deposits. This report is focused on the process of transmission of changes in policy rate to the overnight inter-bank rate, or the interest rate in the market for bank reserves1, through the liquidity framework. In this report, the term ‘liquidity’ has been used to mean central bank liquidity. Since successful monetary policy requires effective liquidity operations, the liquidity management framework needs to be carefully designed. The recommendations made in this report are underpinned by five guiding principles, which provide the conceptual basis to assess the efficacy of the Reserve Bank’s liquidity management framework. I. Guiding Principles of Liquidity Management Framework (i) The liquidity management framework should be guided by the objective of maintaining the target rate, i.e., the rate in the inter-bank market for reserves, close to the policy rate. Since the central bank provides reserves through its liquidity management operations to eligible entities (typically banks), the target rate is usually the rate at which reserves are borrowed or lent among banks, viz., the call money market rate in India. Towards this end, the framework should enable the central bank to be equipped with the required tools to inject and absorb liquidity at either fixed or variable rates, on an overnight basis as well as for longer tenors. The central bank should also have the freedom with respect to the instruments to be used as well as the tenor of operation. (ii) Since the determination of the policy rate by the Monetary Policy Committee (MPC) is distinct from the process governing liquidity management operations by the central bank, it is important to ensure that liquidity operations should be consistent with the policy rate set by the MPC. Liquidity management by the central bank should be aimed at achieving the first leg of transmission of monetary policy, which is to align the target rate with the policy rate set by the MPC. (iii) Different liquidity management frameworks are designed for different conditions, though they all aim to achieve the same objective, as set out in (i) above. Specifically, (a) Under a “corridor” system – i.e., with a ceiling and a floor rate – the repo rate, that is, the rate at which central banks inject liquidity, works as the policy rate. Such a system would not be efficient when dealing with surplus liquidity because in surplus liquidity conditions, the inter-bank money market rate tends to gravitate towards the reverse-repo rate, or the rate at which central banks absorb liquidity. Therefore, under a ‘corridor’ system, central banks endeavor to keep the system liquidity in deficit. (b) On the other hand, under a “floor” system, the reverse-repo rate, i.e., the rate at which central banks absorb liquidity, works as the policy rate. Using the same reasoning as in (a) above, central banks endeavor to keep system liquidity in surplus under a ‘floor’ system.2 (iv) It is important that the liquidity management framework does not undermine the price discovery process in the inter-bank money market. Particularly, the framework should incentivise banks to trade among themselves rather than with the central bank because the transmission process crucially depends on market forces working efficiently. (v) The liquidity framework should be robust enough to handle unexpected fluctuations in system liquidity without affecting its ability to adhere to the above guiding principles. Such fluctuations can arise on account of frictional factors like changes in government cash balances as well as durable factors such as the expansion or contraction of Currency in Circulation (CiC) and the impact of a central bank’s Foreign Exchange (Fx) operations on domestic liquidity. II. Operational Implications of the Guiding Principles (i) All liquidity management frameworks should provide the required liquidity to the banking system. Without such an assurance, the objective of maintaining the target rate close to the policy rate would be difficult to achieve. The liquidity management framework should ensure that liquidity available is no more, or no less, than what the banking system needs to meet its reserve requirement. Thus, the banking liquidity being kept in deficit or in surplus mode is a design feature of the liquidity management framework – whether it is the corridor system or the floor system, or, analogously, whether the policy rate is the repo rate or the reverse-repo rate. It does not reflect, or depend upon, the monetary policy stance (neutral, tightening or accommodative), because monetary policy stance, under an inflation targeting framework conducted through changes in interest rate, hinges on the direction of policy rate. The choice between the two systems, therefore, depends on the prevailing liquidity climate. (ii) The liquidity framework should provide the choice for both fixed rate and variable rate operations. While normally liquidity operations should be carried out using fixed rate operations (injecting liquidity at the policy repo rate and absorbing liquidity at the reverse repo rate), unanticipated liquidity developments may necessitate the use of variable rate operations. System liquidity may not always remain in deficit even under a ‘corridor’ system, if we recognise the possibility that certain events – like persistent capital flows – may render it difficult for the central bank to absorb liquidity. In such an eventuality, it may become necessary to absorb surplus liquidity at rates closer to the policy rate for efficient transmission of monetary policy signals. This may require the use of variable rate reverse-repo operations. (iii) The target rate being an overnight rate, liquidity operations should predominantly be of overnight maturity. However, given the overarching requirement of liquidity operations being consistent with the policy rate, and in order to minimise intervention in the inter-bank market so as to enable free play of market forces, it may, at times, be useful to inject or absorb liquidity using longer-term (7 or 14 days, in any case not exceeding a reporting fortnight) operations. For instance, a 14-day operation at the beginning of the fortnight (or a 7-day operation at the beginning of each week) could reduce the system requirement over the fortnight; and consequently, reduce the volume of overnight operations. (iv) The liquidity framework should have an array of instruments to address durable liquidity surplus or deficit. While daily overnight operations (or weekly/fortnightly operations followed by overnight operations) should address the liquidity needs of the banking system, it is nonetheless possible that unanticipated shocks (variations in Government cash balances, fluctuations of CiC, or Fx intervention operations) could lead to liquidity build-up (positive or negative) that could result in actual liquidity being different from the desired level. If the effect of such shocks is expected to be temporary, then flexible use of variable rate operations should suffice. If, however, such liquidity conditions are expected to persist, it would be necessary to bring the liquidity in the system back to the desired level. This could be achieved through outright Open Market Operations (OMOs), or where outright operations are not desirable (e.g., because of their impact on yields), by using alternative tools to achieve the desired impact on durable liquidity. One alternative could be longer-term repo or reverse repo operations (beyond 14 days and up to one year), as they do not have a discernible impact on bond yields. These instruments would, however, work if their interest rates are market determined. Similarly, Fx swaps (buy-sell or sell-buy Rupee-Dollar swaps) can also be used for durable liquidity operations. These instruments – OMOs, longer term variable rate repos or reverse-repos or Fx swaps – should be used to bring the liquidity position in the banking system back to the desired level. (v) Finally, for ensuring activity in the inter-bank money market, banks should have the incentive to trade among themselves rather than only with the central bank, to maintain the efficiency of the price discovery process in the inter-bank money market. This implies that generally banks should be able to borrow in the inter-bank money market at rates not higher than the rate at which they could borrow from a central bank (i.e., the rate at which a central bank injects liquidity). Conversely, banks should be able to lend in the inter-bank money market at rates not below the rate at which they can lend to a central bank (i.e., the rate at which a central bank absorbs liquidity). It follows that, the rate at which a central bank absorbs liquidity and the rate at which it injects liquidity should not materially be the same, as it changes incentives in the market, thereby, affecting price discovery. The above principles lay down the broad contours for the design of an efficient liquidity management framework by the Reserve Bank. Based on the guiding principles for liquidity management framework enunciated above and after considering their implications, the Group makes the following recommendations. III. Recommendations of the Internal Working Group Corridor versus floor system I. As the corridor system affords the desired flexibility to manage situations of liquidity deficit as well as liquidity surplus and given that the repo rate is the policy rate set by the MPC, the Group recommends that the liquidity management framework should continue to be based on the corridor system. Call money rate – the target rate of liquidity operations II. As the call money market is the only money market segment which trades exclusively in reserves, the Group recommends that the call money rate – with Weighted Average Call Rate (WACR) as the measure – should continue as the target rate of the liquidity management framework. The desired level of system liquidity III.1 The Group observes that the design of the corridor system, with repo rate as the policy rate, would generally require the system liquidity to be in a small deficit of about 0.25 per cent - 0.5 per cent of Net Demand and Time Liabilities (NDTL) of the banking system. However, if financial conditions warrant a situation of liquidity surplus, the framework could be used flexibly, with variable rate operations, to ensure that the call money rate remains close to the policy repo rate. III.2 Thus, liquidity operations shall take into consideration prevailing conditions, based on which the required tools will be used to achieve the objective of the liquidity management framework. Managing day-to-day liquidity IV.1 The Group recommends that uncertainty, if any, about the Reserve Bank’s liquidity management (in terms of quantum and rates at which operations are conducted) should be minimised by conducting liquidity management operations at a rate close to the policy repo rate. To this end, the daily primary liquidity management operation should be ideally one single overnight variable rate operation3. The liquidity framework should entirely meet the liquidity needs of the system. Consequently, a separate provision of assured liquidity is no longer necessary. IV.2. Recognising their important role in the primary and secondary market for Government securities, Standalone Primary Dealers (SPDs) should be allowed to participate directly in all overnight liquidity management operations. IV.3 The Group recommends that the Reserve Bank should stand ready to undertake intra-day fine-tuning operations, if necessary; however, such operations should be the exception to address unforeseeable intra-day shocks rather than the rule. Minimising the number of operations should be a goal of efficient liquidity management operations. Managing durable liquidity V.1 The Group recommends that under the corridor system, build-up of liquidity into a large deficit (greater than about 0.25 per cent to 0.5 per cent of NDTL) or surplus, if expected to persist, should be offset through appropriate durable liquidity operations. Deficit in system liquidity should ideally be offset by durable liquidity injection measures (such as OMO purchases or buy-sell Fx swaps); in the same manner, persistent surplus in system liquidity should ideally be neutralised by durable liquidity absorbing operations (such as OMO sales or sell-buy Fx swaps). V.2 The Group recommends that, as an alternative to OMO purchases, longer-term variable rate repos, of more than 14 days and up to one-year tenor, be considered as a new tool for injection if system liquidity is in a large deficit. Similarly, longer-term variable-rate reverse-repos could be used to absorb excess liquidity. As these are possible substitutes for OMOs, these instruments should be operated at market determined rates. The boundaries of the corridor system VI. The Group recommends that the current difference of 25 basis points between the repo rate and the reverse-repo rate, as well as between the repo rate and the Marginal Standing Facility (MSF) rate, be retained. The standing liquidity facilities – Fixed Rate Reverse Repo and MSF – may continue as at present. Margins VII. The Group recommends that margin requirements under the Liquidity Adjustment Facility (LAF) be reviewed on a periodic basis. The Group also recommends that the margin requirement for reverse-repo transactions should continue to be ‘Nil’, as hitherto. Reserve averaging VIII. The Group recognises that the present minimum requirement of maintaining 90 per cent of the prescribed Cash Reserve Ratio (CRR) on a daily basis has helped avoid bunching of reserve requirements of individual banks. Hence, the Group recommends that this minimum requirement be retained at the present level. Standing Deposit Facility IX. The Group recommends that the Standing Deposit Facility (SDF), a tool to absorb liquidity, may be operationalised early. Communication and disclosures X.1 For better dissemination of information on liquidity management operations, the Group recommends that the Press Release detailing the Money Market Operations (MMO) should be modified suitably to show both the daily flow impact as well as the stock impact of the Reserve Bank’s liquidity operations. X.2 The Group also recommends that a quantitative assessment of durable liquidity conditions of the banking system be published on a fortnightly basis with a fortnightly lag. Chapter I: Introduction I.1 Liquidity management, which is the operating procedure of monetary policy, seeks to ensure adequate liquidity in the system so that sufficient credit is provided to all productive sectors in the economy. The first step in this process is the transmission of changes in the policy rate to the inter-bank call money rate. Subsequently, this impulse gets transmitted to longer term interest rates on financial instruments traded in markets, loans and deposits. This report is focused on the process of transmission of changes in policy rate to the overnight inter-bank rate, or the interest rate in the market for bank reserves4, through the liquidity framework. I.2 Liquidity management operations thus constitute an important aspect of the implementation process of monetary policy. These operations are essentially intended to transmit the impulse of monetary policy action to the market for bank reserves (deposits kept by banks with the central bank). Since successful conduct of monetary policy requires effective liquidity operations, the liquidity management framework needs to be carefully designed and deployed. Liquidity management frameworks globally have similarities in terms of design and tools, but several differences also exist as each central bank attempts to accommodate its unique domestic conditions. However, since the Global Financial Crisis (GFC), following the quantitative easing resorted to by many central banks in Advanced Economies (AEs), a clear divergence has emerged between the liquidity management frameworks of AEs and Emerging Market Economies (EMEs). I.3 Since the introduction of an Interim Liquidity Adjustment Facility (ILAF) in April 1999, the liquidity management framework of the Reserve Bank has undergone various refinements during the last two decades in response to changing domestic conditions and global developments. Pursuant to the recommendation of the “Working group on Operating Procedure of Monetary Policy” (Chairman: Deepak Mohanty, RBI, 2011), the repo rate was used to unambiguously signal the stance of monetary policy to achieve macroeconomic objectives of price stability and growth with the WACR as the explicit operating target of liquidity management operations. A corridor around the policy rate with the MSF/Bank Rate as the upper bound (ceiling) and the reverse-repo rate as the lower bound (floor) was set to contain volatility in the operating target. Thereafter, following the recommendation of the Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework (Chairman: Dr. Urjit R. Patel; RBI, 2014), the framework was further modified by eliminating unlimited accommodation on an overnight basis and providing liquidity through term repos. The framework was fine-tuned in April 2016 when it was decided to smoothen the supply of durable liquidity over the year and progressively lower the average ex-ante liquidity deficit in the system to a position closer to neutrality. I.4 The robustness of the current framework, which was put in place in 2014, was tested during November 2016-April 2017, when the banking system was aflush with an unprecedented amount of liquidity following withdrawal of high value notes in November 2016. In order to strengthen the operating system further, the Government has since amended the RBI Act for introduction of a SDF. Recently, the Reserve Bank also added long term Fx swap auctions as a tool for liquidity management. While the liquidity framework has proved to be resilient, multiple fine-tuning operations undertaken by the Reserve Bank have rendered it complex. The assessment of liquidity position by different market participants also varies markedly in the absence of a clear definition of what is meant by the term ‘liquidity’. In view of these developments and based on the experience gained in the conduct of liquidity management operations, it was felt necessary to review the current framework. Accordingly, as announced in the Statement on Developmental and Regulatory Policies of June 06, 2019, an Internal Working Group (IWG) was constituted with a mandate to: i) Conduct a detailed review of the current liquidity management framework with a view to simplifying it; and, ii) Suggest measures to clearly communicate the objectives, quantitative measures and the toolkit of liquidity management by the Reserve Bank. I.5 The Group greatly benefitted from its interactions with economists and bankers. I.6 The Report is organised in three chapters, including this introductory chapter. Chapter II reviews the concepts and drivers of liquidity, the evolution of the liquidity framework in India and spells out the contrasting features of the corridor-based system versus the floor-based system. Chapter III makes an assessment of the key features of the current framework and suggests measures to improve the current operating framework. Chapter II: Current Liquidity Framework – A Review Liquidity management is premised on the principle that banks are required to hold, at the end of the day, a certain level of cash in their accounts with the central bank, called required reserves. As a bank’s cash balances change throughout the day consequent to customer transactions, each bank’s need for reserves at the end of the day is also uncertain. Since the demand for reserves has implications for the overnight inter-bank rate, which in many cases is the operating target of monetary policy, central banks modulate the supply of reserves to achieve the objective of keeping the overnight market rate close to the policy rate. II.1 Liquidity Concepts II.1.1 Liquidity is of paramount importance for a well-functioning and sound financial system. The term ‘liquidity’, however, has many different meanings, and the specific sense in which it is used is determined by the context. Broadly, the term ‘liquidity’ is used in three senses – funding liquidity, market liquidity and central bank liquidity. An effort is made in the ensuing paragraphs to clarify the definition and specific meaning of ‘liquidity’ when used in the context of monetary policy implementation. II.1.2 The Basel Committee on Banking Supervision (BCBS) defines funding liquidity as the ability of banks to meet their liabilities, unwind or settle their positions as they become due. Similarly, the International Monetary Fund (IMF) provides a definition of funding liquidity as the ability of solvent institutions to make agreed upon payments in a timely fashion. Thus, funding liquidity refers to the ability of individual institutions to meet their liabilities and other payments needs. Market liquidity, on the other hand, refers to the ease with which a financial asset can be converted into cash at short notice, without causing a significant movement in its price. In general, market liquidity is measured in terms of bid-ask spread, volume and frequency of transactions per unit of time, turnover ratio and price impact of a trade. While funding liquidity is specific to an institution, market liquidity is specific to a market. II.1.3 The third sense in which the term liquidity is used, central bank liquidity, refers to reserves provided by a central bank to the banking system. Banks are, in many countries, required to maintain a mandated level of balances in their accounts with the central bank. These balances are referred to as required reserves. If the banking system has less money than the required reserve, which it needs to borrow from the central bank, it is said that the system liquidity is in deficit and vice versa. Central bank liquidity operations, accordingly, refer to the injection or absorption of reserves from the banking system. In this report, the term liquidity has been used to mean central bank liquidity. II.2 Measure of Central Bank Liquidity in India II.2.1 Central bank liquidity is the key element in monetary policy implementation process and the focal point for liquidity management operations is the banking system liquidity or system liquidity. Generally, banks would need to borrow funds from the central bank to meet their reserve requirement, if it cannot be met from the inter-bank market and vice-versa, i.e. deposit the excess over the reserve requirement with the central bank. On a given day, if the banking system is a net borrower from the Reserve Bank under LAF, the system liquidity can be said to be in deficit (i.e., system demand for borrowed reserves is positive) and if the banking system is a net lender to the Reserve Bank, the system liquidity can be said to be in surplus (i.e., system demand for borrowed reserves is negative) (Chart-1). In practice, banks maintain a slightly positive margin (excess reserve) over required reserves on a daily basis to meet unanticipated settlement obligations (or precautionary demand for reserves), that needs to be reckoned to arrive at the quantum of liquidity available to the banking system on a given day. Thus, banking system liquidity can be summarised as under: | System liquidity = Net borrowing under LAF - Excess reserves maintained by banks…...(1) Net borrowing under LAF = Total of all Repo/MSF/SLF5 borrowings – Total of all Reverse-repo deposits.……………………………………(2) Excess reserves maintained by banks = Actual reserves maintained by banks – Required reserves ………………………………...……..(3) Note: A positive figure for equation (1) would indicate system liquidity is in deficit and likewise a negative figure would indicate system liquidity is in surplus. | II.2.2 System liquidity or demand for reserves can also be differentiated depending upon whether the source of demand is transient/frictional or durable. Transient/frictional liquidity refers to the liquidity condition which could reverse course overnight, or over a short period of time. Government cash balances, which are held with the Reserve Bank, are a major source of transient/frictional demand for reserves. Durable liquidity or permanent demand for reserves arises from permanent or long-term changes in the liabilities of the Reserve Bank viz., expansion/contraction in CiC and decrease/increase of banking system reserves due to unsterilised Fx intervention operations. An easier derivation of durable liquidity is by adjusting the Government of India (GOI) balance from system liquidity (Chart 2). Thus, if the net borrowing by the banking system from the Reserve Bank is higher than the GOI balance, it indicates that durable liquidity is in deficit and vice-versa.   II.2.3 It needs to be emphasised that the total system demand for reserves on any given day would be met by the Reserve Bank through one or more liquidity operations or windows. Therefore, from the system perspective, the distinction between durable liquidity and frictional liquidity is not very pertinent. The distinction, however, is important for the Reserve Bank from its liquidity planning point of view to minimise the need for fine-tuning operations. Thus, a longer-term or outright operation would be more appropriate to deal with durable liquidity conditions. II.2.4 An attendant issue which merits consideration is whether provision of liquidity through short-term repos, followed by continuous rollovers, can be considered a substitute for durable liquidity. It may not, in view of the attendant roll-over risks. However, it needs to be recognised that there could be leads and lags involved in the supply of and demand for reserves on a durable basis. Hence, a part of the durable demand could also be met through short-term repo operations and then rolling them over till a longer-term/outright operation can be conducted. In the short-term, both outright and repurchase operations are fungible. II.3 Drivers of Liquidity in India II.3.1 The primary demand for reserves by banks arises due to the central bank’s imposition of cash reserve requirement for banks. The demand for reserves also arises on account of movement in Government cash balances, changes in the amount of CiC and Fx operations of the Reserve Bank. All these factors are commonly referred to as autonomous drivers of demand for reserves. In India, CiC is the major driver of liquidity. It is observed that during some years, like 2014-15 and 2017-18, Fx operations of the Reserve Bank also had a significant bearing on liquidity. However, on a day to day basis, movement in Government cash balances is an important factor which drives liquidity (Table 1). | Table 1: Drivers and Management of Liquidity | | (INR Crore) | | {(+) Injection /(-) Absorption of liquidity from banking system} | | | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | | A. Autonomous Drivers of Liquidity (1+2+3+4) | -94,291 | -156,447 | 227,719 | -86,581 | 596,026 | -237,938 | -306,972 | | 1. Net Forex Purchases from Authorised Dealers(ADs) | -15,316 | 58,619 | 343,069 | 63,089 | 82,217 | 222,830 | -111,950 | | 2. Currency in Circulation | -121,702 | -110,099 | -147,238 | -215,151 | 328,197 | -494,082 | -307,422 | | 3. Government of India Cash Balances | -42,452 | -11,837 | -28,842 | -44,121 | 61,311 | -37,205 | 39,863 | | 4. Others* | 85,179 | -93,131 | 60,731 | 109,602 | 124,301 | 70,519 | 72,537 | | | 0 | 0 | 0 | 0 | 0 | 0 | 0 | | B. Management of Liquidity (5+6+7+8) | 121,184 | 112,284 | -118,687 | 122,846 | -553,725 | 259,336 | 343,416 | | 5. Net Liquidity Adjustment Facility(LAF)^ | -45,520 | 94,351 | -24,111 | 105,648 | -613,591 | 371,548 | 90,726 | | 6. Open Market Purchases# | 154,547 | 52,002 | -63,418 | 52,324 | 110,494 | -88,775 | 299,232 | | 7. Standing Liquidity Facilities for Primary Dealers(PDs) | 0 | 0 | 2,410 | 293 | -1,220 | 1,055 | 140 | | 8. CRR Balances$ | 12,157 | -34,069 | -33,568 | -35,419 | -49,408 | -24,492 | -46,682 | | | 0 | 0 | 0 | 0 | 0 | 0 | 0 | | C. Bank Reserves(A+B) | 26,893 | -44,163 | 109,032 | 36,265 | 42,301 | 21,398 | 36,444 | * “Others” include valuation changes, hair cut on operations. etc.; ^ Net LAF represents the liquidity position of fixed rate and variable rate repo and MSF net of reverse-repo operations. # Net OMO purchases include outright as also NDS-OM operations.’ $ On account of increase in NDTL’