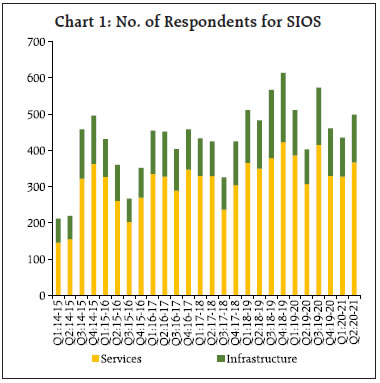

The Reserve Bank’s quarterly Services and Infrastructure Outlook Survey (SIOS), being conducted since Q1:2014-15, provides the perceptions of the services and infrastructure sector companies about their own performance and prospects in the near term. Its response rate is lower than that of other forward looking surveys of the Reserve Bank, but the aggregate responses on major parameters have broad internal consistency. This article presents details of the survey and the movements in major parameters since its inception. After severe contraction in Q1:2020-21 due to the lockdown in the wake of COVID-19 pandemic, business sentiments have moved to recovery path but are yet to reach the pre-pandemic levels. Introduction Business tendency surveys seek opinion of business managers about the prevailing business conditions and their plans and expectations for the near future. These surveys, which are also christened as business outlook/expectation/opinion/climate surveys, aim to provide lead information on macroeconomic and sectoral outlook to economic policymakers, analysts and business planners. The information set from such surveys are also of value in anticipating cyclical turning points in the economy. Surveys of business conditions often go beyond measurable conventional statistics and, inter alia, collect perceptions on economic conditions (e.g., overall business situation, investment climate, production constraints). Organised businesses usually function in several economic sectors (viz., industry, infrastructure, retail trade, services) having different focus areas and parameters. Sector-specific business surveys are, therefore, often relied upon, where relevant questions are designed for a relatively homogeneous group of business entities. The rest of this article is structured as follows. Section II presents the cross-country experience on business outlook surveys relating to services sector. An overview of the quarterly Services and Infrastructure Outlook Survey conducted by the Reserve Bank is given in Section III and its findings are summarised in Section IV. Section V concludes with some key takeaways. II. Cross-Country Practices Business tendency surveys are conducted regularly in developed economies as well as in many emerging market economies and have proved to be an effective means of generating timely information on short-term economic developments. The European Commission co-ordinates the harmonised monthly surveys for different sectors (i.e., industry, services, retail trade and construction) in the European economies. In addition to the common questions, the national authorities often add country-specific questions in their questionnaires. A summary of major business surveys, conducted by major central banks covering services sector firms is presented in Annex Table 1. III. RBI’s Services and Infrastructure Outlook Survey The Reserve Bank’s Internal Working Group on Surveys (2009) had noted that gauging the developments in services sector is vital for understanding the effectiveness of overall policies as services have the largest share in India’s national income and have been recording high employment growth, especially in the retail sector. The Group suggested that a business outlook survey for services sector may be conducted with a focus on trading and other sub-components of services like, IT services, hospitality services, health care services, etc. Accordingly, after some pilot work, the SIOS is being conducted on quarterly basis since Q1:2014-15, with some refinement in the survey questionnaire over the period under the guidance of the Bank’s Technical Advisory Committee on Surveys (TACS) where external experts participate. The survey provides insights on the prevailing business conditions in the services and infrastructure sector and also the expectations in the near term. Target Group and Responses The survey questionnaire is canvassed among a panel of services and infrastructure sector companies. The sample frame is selected so as to get a reasonable representation of size and industry. The frame is updated on annual basis and kept fixed for the survey rounds conducted during a year. The frame has been expanded gradually from nearly 800 companies in the initial rounds to around 3,500 companies. Participation in the survey is voluntary. It is recognised that the number of services sector companies is very large, where small firms dominate in terms of number and their churn rate is high. Accordingly, the response rate is generally lower than that of the other business surveys of the Reserve Bank {e.g., Industrial Outlook Survey (IOS), Order Book, Inventory and Capacity Utilisation Survey (OBICUS), Bank Lending Survey (BLS)}. The actual number of responses for all the survey rounds since inception is presented in Chart 1. The Survey Questionnaire Senior management officials or heads of finance in services and infrastructure companies are solicited to provide their perception on select business parameters along with some basic information on their business profile in a structured questionnaire.1 It assesses the business situation for the prevailing quarter and expectations for the ensuing quarter on overall business situation, demand indicators, employment conditions, price situation, financial situation and profit margin, which provide useful forward looking inputs for policy analysis and research.  The survey responses are collected on a three-point scale (viz., increase, decrease and no change). Feedback about the factors influencing the business favourably and adversely is collected in an additional block of the questionnaire. Respondents can also provide their sentiments on different macroeconomic parameters (e.g., annual inflation rate, annual growth in overall economic output, investment in the economy, Rupee-US dollar exchange rate and business constraints) as well as any other comments/suggestions on sector-specific issues in the survey questionnaire. Methodology: Analysis of Survey Data Each round of the survey has three shares of respondents (viz., percentage of respondents reporting increase, decrease and no change) for each business parameter for both assessment and expectation quarters. These are summarised into a single comprehensive number for each parameter/period in terms of ‘Net Responses (NR)’ or ‘Diffusion Indices (DI)’.2 NR can range from -100 to +100 with the ‘zero’ value separating optimism/expansion from pessimism/contraction. On the other hand, DI ranges from 0 to 100 with 50 as the mid-point (OECD, 2003). The two summary indices move in tandem over time as the difference is essentially that of scale. In the subsequent sections, NR is used to analyse the SIOS results. IV. Survey Findings The movements in the SIOS parameters from the first round (April-June 2014) up to the July-September 2020 round of the survey are set out below.3 Overall Business Situation The overall sentiment of services and infrastructure companies remained in optimistic zone despite gradual moderation during the six year period ending Q4:2019-20 before the severe impact of COVID-19 pandemic. The situation recorded turnaround in the latest quarter for the services sector though the overall perception of respondents was that the infrastructure companies would remain in a contraction zone (Chart 2). As most of the responses for January-March 2020 survey round were received by early-March 2020, it did not foretell the collapse of activities in the subsequent quarter. This is true for all major parameters of the survey.

It is also interesting to note that assessments for all quarters are lower than the expectations expressed in the previous quarter. This is true for most of the other parameters too. A similar phenomenon is observed in the Bank’s quarterly IOS for the manufacturing sector and it indicates optimism bias in business expectations (RBI, 2020). Turnover/Sales This question seeks feedback on the gross revenue generated by companies through selling of goods or providing services.4 The sentiments on turnover show optimism till the end of FY 2019-20 but a dip during Q1:2020-21 as in the case of overall business situation due to the pandemic (Chart 3). The sentiments improved in the subsequent quarter, though the assessment remained in the contraction zone. The respondents expect further improvement in the ensuing quarter (i.e., Q3:2020-21). Full-time Employees Corporate perspective on full-time employees (e.g., whether they are going to increase the regular workforce, cut jobs or retain their strength of full-time employees) are being collected since the 14th round (i.e., Q2:2017-18) of the survey. While the sentiments for the services sector were in an expansion zone before the outbreak of the pandemic, the infrastructure companies were witnesssing a decline in full-time employees since Q2:2018-19 (Chart 4). The latest round of the survey shows that the sentiments are yet to return to the pre-pandemic level. Part-time Employees Due to quicker changes in volume of activities, firms in services and infrastructure sector often use part-time/ contract employees more flexibly than manufacturing companies to cater to the changes in the demand conditions. On net basis, the respondents were positive on engagement of part-time employees till Q2:2019-20, especially in the services sector, but the sentiments turned adverse since Q3:2019-20 (Chart 5). The latest round of the survey shows some improvement though the sentiments still remain in a negative zone. Inventories The question on inventories (goods/materials that a business holds for the ultimate purpose of resale or use to render services) was introduced in the survey questionnaire in Q2:2017-18. The sentiments on inventories for the services sector were in expansion zone but started moderating since Q4:2018-19 and collapsed into contraction zone in Q1:2020-21 due to pandemic situation (Chart 6). The sentiments for the infrastructure sector, however, continued in the expansion zone albeit with lower optimism.

Availability of Finance and Cost of Finance Corporate views on availability and cost of finance (CoF) for supporting their business operations is an important input for financial planning.5 Since increase in CoF is adverse for business (unlike for majority of business parameters where increase indicates positive sentiments), NR for CoF represents the proportion of respondents expecting decline (D) in CoF less the proportion that expect its increase (I). NR on CoF declined continuously from Q3:2017-18 for one year before the perceptions started to improve in Q4:2018-19, though it remained in the negative terrain (Chart 7). The availability of finance (AoF) for services sector companies (from both internal and external sources) was in optimistic zone till the outbreak of the pandemic, although infrastructure companies were reporting pessimistic sentiments much earlier (since Q3:2017-18). Salary/Wages This parameter was included in the survey questionnaire during Q2:2017-18 round to capture sentiments on the cost borne by the companies towards staff salary. Here too, NR is computed as D-I. Both services and infrastructure companies felt continued salary pressures till the outbreak of the pandemic. Subsequently, salary outgo was assessed to have declined as corporates perceived lower engagement of employees over one quarter, before the salary pressure started to increase again (Chart 8). Selling Price and Cost of Inputs The selling price (SP) parameter, which was added to the survey questionnaire during Q2:2017-18, captures the price of the services / goods sold. Perception on the cost of inputs (CoI), which is being collected from the first round of the survey, covers the prices paid by the company for carrying out business. Respondents reported large input cost pressures (with maximum NR scale among all parameters) and low pricing power till 2019-20, which reflected the constraints in raising selling prices over a prolonged period (Chart 9). Sentiments on SP, which generally share an inverse relationship with CoI on a net basis, showed a declining trend with some moderation in input cost pressure from 2019-20.

Technical / Service Capacity The maximum capacity to produce goods or services by companies is assessed through corporate feedback on technical/service capacity. Most of the companies remained positive about their capacity to meet their business requirements throughout the survey period before the outbreak of the pandemic (Chart 10). Unlike many other parameters, the realised assessment of companies was not systematically below their anticipation in the previous quarter and business capacity was generally seen as sufficient in the short run.

Physical Investment Infrastructure sector companies, hotels, hospitals, education institutes, software firms and other service sector companies make physical investment in acquiring building, equipments and other fixed assets. The sentiments on physical investment were largely akin to those for technical and service capacity, which reflected consistent internal planning and confidence among the respondent firms (Charts 10 and 11). Profit Margin Up to 2019-20, on a net basis, service companies were generally optimistic about profit margins for the next quarter though the subsequent assessment were not so positive; infrastructure companies expressed lesser optimism than service sector companies with expectations hovering around zero (Chart 12). During 2020-21, both groups of companies expressed negative outlook on profit margins, though there was decline in pessimistic sentiments during the third quarter of the year from the sharp drop observed in first quarter. V. Conclusion SIOS provides business sentiments of the services and infrastructure sectors ahead of corporate results and official statistics. Its response rate is lower than that of other forward looking surveys of the Reserve Bank for the manufacturing sector and banks but the responses on major parameters have broad internal consistency. Similar to manufacturing companies, the outcome assessment of companies in the services and infrastructure sectors has been lower than their initial expectations. Most of the business parameters in the services and infrastructure sector were severely hit in Q1:2020-21 due to the lockdown and economic slowdown related to the pandemic. Business sentiments have moved to a recovery path in the subsequent survey rounds but are yet to reach the pre-pandemic levels across all parameters. References Banca di Italia (2017), “Survey on Industrial and Service Firms – Methods and Sources”https://www.bancaditalia.it/pubblicazioni/metodi-e-fonti-note/metodi-note-2017/en_survey_methodology_invind.pdf Bank of England (2017), Definitions for the Agents’ scores https://www.bankofengland.co.uk/-/media/boe/files/agents-summary/definitions.pdf?la=en&hash=73F78FCEFBE9B8FA55F11C42F39EBE1306039165 Bank of Japan (2020), TANKAN (Short-Term Economic Survey of Enterprises in Japan), May https://www.boj.or.jp/en/statistics/outline/exp/tk/data/extk04a.pdf Banque de France, http://www.banque-france.fr/en/economics-statistics/business-and-survey/businesssurveys.html Bloom, Nick, Philip Bunn, Paul Mizen, Pawel Smietanka, Greg Thwaites, Garry Young (2017), “Tracking the views of British businesses: Evidence from the Decision Maker Panel”, Bank of England Quarterly Bulletin 2017 Q2. Organisation for Economic Co-operation and Development (OECD) (2003), “Business Tendency Surveys - A Handbook”. Reserve Bank of India (2009), “Report of the Working Group on Surveys”, Reserve Bank of India Bulletin, September. Reserve Bank of India (2020), “Sentiments of Indian Manufacturers in 2018-19”, Reserve Bank of India Bulletin, February. European Commission (2020), “The Joint Harmonised EU Programme of Business and Consumer Surveys – User Guide”, Directorate-General For Economic and Financial Affairs (updated in February 2020). https://ec.europa.eu/info/business-economy-euro/indicators-statistics/economic-databases/businessand-consumer-surveys/methodology-business-andconsumer-surveys_en Federal Reserve Bank of Dallas, “About the Texas Service Sector Outlook Survey”. https://www.dallasfed.org/research/surveys/tssos/about.aspx Waddell, Sonya Ravindranath (2015), “Predicting Economic Activity through Richmond Fed Surveys” Econ Focus, Federal Reserve Bank of Richmond.

| Annex Table 1: Surveys on Business Condition in Services: Country Practices (Contd.) | | Institution | Frequency | Participating firms | Sample size | Coverage of items | | Banque de France | Monthly | Manufacturing, services, construction and retail trade | 10000 | Assessment of economic conditions in the month preceding the publication, together with a GDP growth forecast for the quarter is collected. | | Federal Reserve Bank of Dallas | Monthly | Service firms | 230 | Changes in business conditions for major indicators (e.g., revenue, employment, prices and company outlook) and perception on broader economic conditions (general business activity). Answers cover changes over the previous month and expectations for activity six months into the future. | | Federal Reserve Bank of Richmond | Monthly | Retailers and service firms | Around 100 | Retailers provide information on sales revenues, big-ticket sales, inventories, and shopper traffic, whereas services firms report on their revenues. Both sets of respondents also provide information on employment and wages, prices, and expectations for customer demand during the next six months. | | Bank of Japan | Quarterly | Firms | 10000 | Business trends of enterprises, overall corporate activity by combining with a judgment survey, which covers the responding enterprises' views on the current state of and outlook on business conditions and economic developments, and a quantitative survey covering the actual results and forecasts for the responding enterprises' business plans, including figures for sales, profits, and fixed investment. | | Bank of Italy | Annual | Industrial and service firms | 5000 | Employment, investment (both actual and planned), turnover, capacity utilisation, debt and trade receivables. It also collects information on other economic questions, which are of particular interest for economic research and vary from year to year (e.g., corporate strategies and governance, firm size, physical, human and organisational capital, and electric power). | | Bank of England | Quarterly | Firms | 700 | Agents' quantitative assessments of business conditions (on a scale of -5 to +5), reflecting discussions with businesses from all economic sectors. The scores indicate how different aspects of the economy are behaving. | | European Commission | Quarterly/ Monthly (in most cases monthly surveys include quarterly surveys) | Industry, services, retail trade and building through common or separate schedules, depending on the economy | Different for the economies covered | Harmonised surveys for different sectors in 33 European economies. Quarterly questions on 1) main factors are currently limiting your business and 2) could you increase your volume of activity with your present resources If the demand expanded? If yes, by how much (per cent)? Monthly questions on developments in business situation, demand (turnover) and employment during the last three months and expectations on demand (turnover), employment and prices over the next three months. Economies often put additional questions based on their other requirements. | | Source: Websites of central banks (details in reference list). |

|