[Under Section 45ZL of the Reserve Bank of India Act, 1934] The twenty first meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held during February 4 to 6, 2020 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members – Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, former Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, former Professor, Indian Institute of Management, Ahmedabad; Dr. Janak Raj, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely: -

the resolution adopted at the meeting of the Monetary Policy Committee; -

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and -

the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 6, 2020) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 5.15 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 4.90 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 5.40 per cent. - The MPC also decided to continue with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Since the MPC met last in December 2019, global economic activity has remained slow-paced, but is getting differentiated across geographies. Among the key advanced economies (AEs), the US economy grew by 2.1 per cent in Q4:2019, the same pace as in Q3, with slack in consumer spending offset by government expenditure. In the euro area, economic activity slowed down in Q4 as France and Italy shrank unexpectedly amid waning consumer confidence. Growth momentum in the UK appears to have weakened in Q4 as reflected in a decline in industrial production and tepid retail sales. The Japanese economy was weighed down in Q4 by weak retail sales as reflected in subdued consumer spending in the wake of the sales tax hike in October. Industrial production in Japan was pulled down by muted global demand. 7. Among emerging market economies (EMEs), the Chinese economy slowed down to a 29-year low of 6.1 per cent in 2019, caused by sluggish domestic demand and prolonged trade tensions. In Russia, available indicators point to a loss of momentum in activity in Q4:2019 with industrial production easing, although private consumption may have provided some cushion. In Brazil, activity seems to have slowed down, as reflected in a contraction in industrial production and depressed retail sales. The South African economy recorded a growth of -0.6 per cent in Q3 and is likely to have also contracted in Q4 as industrial production slumped and household spending remained subdued amidst lingering consumer pessimism. 8. Crude oil and gold prices shot up in early January sparked by the US-Iran confrontation, but both softened from mid-January as geo-political tensions eased. By end-January, crude oil prices dipped sharply due to sell-offs triggered by the outbreak of the coronavirus. Gold prices, on the other hand, inched up towards end-January because of safe haven demand. International food prices have been rising on higher demand and supply disruptions from major exporting countries. Reflecting these developments, inflation has edged up in some major AEs and EMEs. 9. Global financial markets remained resilient in December 2019 and for the most part of January 2020 as thawing US-China trade relations and improved prospects of an orderly Brexit buoyed investors’ sentiment. Equity markets rallied across AEs and EMEs, turning bearish towards end-January with the outbreak of the coronavirus as markets braced up for the likely adverse impact on growth prospects, particularly in China. However, equity markets in most economies recovered some of the losses in early February. Bond yields, which had hardened in the US towards the end of 2019 as investors turned to riskier assets, softened in January 2020, especially after the US Fed left the policy rate unchanged and assured the extension of repo operations. In the euro area, bond yields sank further into negative territory in January. Yields also softened across several EMEs. In currency markets, the US dollar strengthened in January against major advanced economies in sympathy with factors impacting US bond markets. EME currencies, which were generally trading with an appreciating bias, have depreciated since the last week of January. Domestic Economy 10. Moving on to the domestic economy, the first advance estimates (FAE) released by the National Statistical Office (NSO) on January 7, 2020 placed India’s real gross domestic product (GDP) growth for 2019-20 at 5.0 per cent. In its January 31 release, the NSO revised real GDP growth for 2018-19 to 6.1 per cent from 6.8 per cent given in the provisional estimates of May 2019. On the supply side, growth of real gross value added (GVA) is estimated at 4.9 per cent in 2019-20 as compared with 6.0 per cent in 2018-19. 11. Turning to more recent indicators, both production and imports of capital goods – two key pointers of investment activity – continued to contract in November/December, though at a moderate pace compared with the previous month. Revenue expenditure of the Centre (excluding interest payments and subsidies) remained robust in Q3, indicative of the counter-cyclical buffer to domestic demand being provided by government final consumption. As per revised estimates given in the Union Budget, growth in revenue expenditure of the Centre (excluding interest payments and subsidies) is estimated to be lower in Q4 compared with Q3. 12. On the supply side, rabi sowing has been higher by 9.5 per cent up to January 31, 2020 compared with a year ago. The north east monsoon rainfall was above normal. Storage in major reservoirs – the main source of irrigation during the rabi season – was 70 per cent of the full reservoir level (as on January 30, 2020) as compared with 45 per cent a year ago. Based on the first advance estimates, horticulture production is estimated to have risen 0.8 per cent to a record level in 2019-20. Production of vegetables is estimated to have increased by 2.6 per cent in 2019-20 due to higher production of onions, potatoes and tomatoes. 13. Industrial activity, measured by the index of industrial production (IIP), improved in November after contracting in the previous three months. The output of core industries returned to positive territory in December after four months of contraction, buoyed by five out of eight of its constituents – coal; refinery products; fertilisers; steel; and cement. Capacity utilisation (CU) in the manufacturing sector, measured by the Reserve Bank’s order books, inventory and capacity utilisation survey (OBICUS), fell to 69.1 per cent in Q2 from 73.6 per cent in Q1; seasonally adjusted CU also eased to 70.3 per cent from 73.4 per cent. The Reserve Bank’s industrial outlook survey points to weak demand conditions facing the manufacturing sector in Q3:2019-20. The Reserve Bank’s business expectations index suggests an improvement in Q4. This is corroborated by the manufacturing purchasing managers’ index (PMI) for January 2020 which picked up sharply to 55.3 from 51.2 in November 2019 on the back of increased output and new orders. 14. Several high frequency indicators of services have turned upwards in the recent period, pointing to a modest revival in momentum, although the outlook is still muted. Amongst indicators of rural demand, while tractor sales grew by 2.4 per cent in December after ten months of a decline, motorcycle sales continued to contract. Domestic air passenger traffic – an indicator of urban demand – posted double digit growth in November, followed by a modest growth in December. Growth in three-wheeler sales and railway freight traffic has accelerated, while port traffic turned around in December. On the other hand, passenger vehicle sales continued to contract. The PMI services index improved to 55.5 in January 2020 from 52.7 in November 2019, boosted by a rise in new business and output. 15. Retail inflation, measured by year-on-year changes in the CPI, surged from 4.6 per cent in October to 5.5 per cent in November and further to 7.4 per cent in December 2019, the highest reading since July 2014. While food group inflation rose to double digits, the fuel group moved out of deflation. Inflation in CPI excluding food and fuel continued to edge up from its October trough. 16. CPI food inflation increased from 6.9 per cent in October to 12.2 per cent in December, primarily caused by a spike in onion prices due to unseasonal rains in October-November. Excluding onions, food inflation would have been lower by 4.7 percentage points and headline inflation by 2.1 percentage points in December. In addition, inflation in several other food sub-groups such as milk, pulses, cereals, edible oils, eggs, meat and fish also firmed up. 17. The CPI fuel group registered inflation of 0.7 per cent in December, reflecting an increase in prices of electricity and firewood and chips; and in administered prices of kerosene. Together they constitute 68 per cent of the CPI fuel basket. LPG inflation remained in negative territory despite a sharp recovery in prices in November-December. 18. CPI inflation excluding food and fuel rose from a low of 3.4 per cent in October to 3.8 per cent by December 2019, driven by an increase in inflation in mobile phone charges, petrol, diesel, transportation fares and clothing. Housing inflation moderated further in December reflecting subdued demand. 19. Households’ inflation expectations eased in the January 2020 round of the Reserve Bank’s survey – after a sharp pick-up in the previous round – with the 3-month ahead and 1-year ahead inflation expectations falling by 60 basis points (bps) and 70 bps, respectively. Based on the Reserve Bank’s consumer confidence survey, consumer spending on non-essential items of consumption contracted from a year ago; however, overall spending is expected to rise, going forward, reflecting an increase in prices. The December 2019 round of the Reserve Bank’s industrial outlook survey suggests that the input and output prices of manufacturing firms remained subdued in Q3:2019-20 and are likely to remain so in Q4. 20. Overall liquidity in the system remained in surplus in December 2019 and January 2020. Average daily net absorption under the liquidity adjustment facility (LAF) amounted to ₹2.61 lakh crore in December 2019. In January 2020, the average daily net absorption of surplus liquidity soared to ₹3.18 lakh crore. The Reserve Bank conducted four auctions involving the simultaneous purchase of long-term and sale of short-term government securities under open market operations (OMOs) for a notified amount of ₹10,000 crore each during December and January (December 23 and 30, 2019 and January 6 and 23, 2020). Reflecting these operations, the 10-year G-sec yield softened cumulatively by 15 bps between December 19, 2019 and January 31, 2020. During the intervening period, however, the yields fell by as much as 25 bps. The weighted average call rate (WACR) traded below the policy repo rate (on an average) by 10 bps in December and by 19 bps in January on easy liquidity conditions. 21. Monetary transmission across various money market segments and the private corporate bond market has been sizable. As against the cumulative reduction in the policy repo rate by 135 bps since February 2019, transmission to various money and corporate debt market segments up to January 31, 2020 ranged from 146 bps (overnight call money market) to 190 bps (3-month CPs of non-banking finance companies). Transmission through the longer end of government securities market was at 73 bps (5-year government securities) and 76 bps (10-year government securities). Transmission to the credit market is gradually improving. The 1-year median marginal cost of funds-based lending rate (MCLR) declined by 55 bps during February 2019 and January 2020. The weighted average lending rate (WALR) on fresh rupee loans sanctioned by banks declined by 69 bps and the WALR on outstanding rupee loans by 13 bps during February-December 2019. 22. After the introduction of the external benchmark system, most banks have linked their lending rates for housing, personal and micro and small enterprises (MSEs) to the policy repo rate of the Reserve Bank. During October-December 2019, the WALRs of domestic (public and private sector) banks on fresh rupee loans declined by 18 bps for housing loans, 87 bps for vehicle loans and 23 bps for loans to micro, small and medium enterprises (MSMEs). 23. Export growth continued to contract in November-December 2019, reflecting the slowdown in global trade. Import growth slumped in November-December 2019, with contraction in both oil and non-oil non-gold imports. While the latter reflected the underlying weakness in domestic demand and was spread across categories such as transport equipment, coal, iron and steel and chemicals, outgoes on account of oil imports were lower due to a cut back in oil import volume. Gold imports also declined in December 2019. On the financing side, net foreign direct investment rose to US$ 24.4 billion in April-November 2019 from US$ 21.2 billion a year ago. Net foreign portfolio investment was of the order of US$ 8.6 billion in 2019-20 (up to February 4) as against net outflows of US$ 14.2 billion in the same period last year. In addition, net investments by FPIs under the voluntary retention route have aggregated US$ 7.8 billion since March 11, 2019. External commercial borrowings were higher at US$ 13.4 billion during April-December 2019 as compared with US$ 2.5 billion during the same period a year ago. India’s foreign exchange reserves were at US$ 471.4 billion on February 4, 2020 – an increase of US$ 58.5 billion over end-March 2019. Outlook 24. In the fifth bi-monthly resolution of December 2019, CPI inflation was projected at 5.1-4.7 per cent for H2:2019-20 and 4.0-3.8 per cent for H1:2020-21, with risks broadly balanced. The actual inflation outcome for Q2 at 5.8 per cent overshot projections by 70 bps, primarily due to the intensification of the onion price shock in December 2019 on account of unseasonal rains in October-November. 25. Going forward, the inflation outlook is likely to be influenced by several factors. First, food inflation is likely to soften from the high levels of December and the decline is expected to become more pronounced during Q4:2019-20 as onion prices fall rapidly in response to arrivals of late kharif and rabi harvests. Higher vegetables production, despite the early loss due to unseasonal rain, is also likely to have a salutary impact on food inflation. On the other hand, the recent pick-up in prices of non-vegetable food items, specifically in milk due to a rise in input costs, and in pulses due to a shortfall in kharif production, are all likely to sustain. These factors could impart some upward bias to overall food prices. Second, crude prices are likely to remain volatile due to unabating geo-political tensions in the Middle East on the one hand, and the uncertain global economic outlook on the other. Third, there has been an increase in input costs for services, in recent months. However, subdued demand conditions, muted pricing power of corporates and the correction in energy prices since the last week of January may limit the pass-through to selling prices. Fourth, domestic financial markets remain volatile reflecting both global and domestic factors, which may have an influence on the inflation outlook. Fifth, base effects would turn favourable during Q3:2020-21. Sixth, the increase in customs duties on items of retail consumption in the budget may result in only a marginal one-time uptick in inflation. Taking into consideration these factors, and under the assumption of a normal south west monsoon in 2020-21, the CPI inflation projection is revised upwards to 6.5 per cent for Q4:2019-20; 5.4-5.0 per cent for H1:2020-21; and 3.2 per cent for Q3:2020-21, with risks broadly balanced (Chart 1). 26. Turning to the growth outlook, real GDP growth for 2019-20 was projected in the December 2019 policy at 5.0 per cent – 4.9-5.5 per cent in H2. GDP growth for H1:2020-21 was projected at 5.9-6.3 per cent. For 2020-21, the growth outlook will be influenced by several factors. First, private consumption, particularly in rural areas, is expected to recover on the back of improved rabi prospects. The recent rise in food prices has shifted the terms of trade in favour of agriculture, which will support rural incomes. Second, the easing of global trade uncertainties should encourage exports and spur investment activity. The breakout of the coronavirus may, however, impact tourist arrivals and global trade. Third, monetary transmission in terms of a reduction in lending rates and financial flows to the commercial sector has progressed vis-à-vis the last policy, and this could spur both consumption and investment demand. Fourth, the rationalisation of personal income tax rates in the Union Budget 2020-21 should support domestic demand along with measures to boost rural and infrastructure spending. Taking into consideration the above factors, GDP growth for 2020-21 is projected at 6.0 per cent – in the range of 5.5-6.0 per cent in H1 and 6.2 per cent in Q3 (Chart 2).

27. The MPC notes that inflation has surged above the upper tolerance band around the target in December 2019, primarily on the back of the unusual spike in onion prices. Over the coming weeks and months, onion prices are likely to ebb as supply conditions improve. The salutary effects on headline inflation are, however, likely to be tempered by hardening of prices of other food items, notably those of pulses and proteins. Meanwhile adjustments to telecom charges are imparting cost-push pressures to CPI inflation excluding food and fuel. Going forward, the trajectory of inflation excluding food and fuel needs to be carefully monitored as the pass-through of remaining revisions in mobile phone charges, the increase in prices of drugs and pharmaceuticals and the impact of new emission norms play out and feed into inflation formation. The MPC anticipates that the combination of these factors may keep headline inflation elevated in the short-run, at least through H1:2020-21. Overall, the inflation outlook remains highly uncertain. Accordingly, the MPC will remain vigilant about the potential generalisation of inflationary pressures as several of the underlying factors cited earlier appear to be operating in concert. 28. At the same time, the MPC observes that the economy continues to be weak and the output gap remains negative. While some high-frequency indicators have turned around and point to a lift in the momentum of economic activity, there is a need to await incoming data to gauge their sustainability. Financial flows to the commercial sector have improved in recent months. The Union Budget 2020-21 has introduced several measures to provide an impetus to growth. While the emphasis on boosting the rural economy and infrastructure should help the growth momentum in the near-term, the corporate tax rate cuts of September 2019 should help boost the growth potential over the medium-term. The fiscal deficit of the Central Government for 2019-20 is placed at 3.8 per cent of GDP in the revised estimates as against 3.3 per cent of GDP in the budget estimates. The higher fiscal deficit in 2019-20 has not resulted in an increase in market borrowings compared to the budget estimates. The fiscal deficit is budgeted to decline to 3.5 per cent of GDP for 2020-21. Fresh gross market borrowings are budgeted to increase by ₹70,000 crore to ₹7.8 lakh crore in 2020-21 from ₹7.1 lakh crore in 2019-20. The MPC notes that while there is a need for adjustment in interest rates on small saving schemes, the external benchmark system introduced from October 1, 2019 has strengthened monetary transmission. These developments should amplify the effects of the cumulative policy rate reductions undertaken by the Reserve Bank since February 2019 and pull up domestic demand going forward. 29. The MPC recognises that there is policy space available for future action. The path of inflation is, however, elevated and on a rising trajectory through Q4:2019-20. The outlook for inflation is highly uncertain at this juncture. On the other hand, economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain status quo. Accordingly, the MPC decided to keep the policy repo rate unchanged and persevere with the accommodative stance as long as necessary to revive growth, while ensuring that inflation remains within the target. 30. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Janak Raj, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted in favour of the decision. 31. The minutes of the MPC’s meeting will be published by February 20, 2020. 32. The next meeting of the MPC is scheduled during March 31, April 1 and 3, 2020. | Voting on the Resolution to keep the policy repo rate unchanged at 5.15 per cent | | Member | Vote | | Dr. Chetan Ghate | Yes | | Dr. Pami Dua | Yes | | Dr. Ravindra H. Dholakia | Yes | | Dr. Janak Raj | Yes | | Dr. Michael Debabrata Patra | Yes | | Shri Shaktikanta Das | Yes | Statement by Dr. Chetan Ghate 33. As in the last several reviews, I continue to track household inflationary expectations carefully. Surprisingly, since the last review, median 3- month ahead inflationary expectations have moderated from 9.2% to 8.6% (60 bps). One year ahead inflationary expectations have also moderated from 9.9% to 9.2% (70 bps). 34. While these drops adaptively reflect the decline in specific perishable food commodities, overall, I am “tentatively encouraged” by the relative stability of both the 3 month and 1 year ahead inflationary expectation series over the longer run. Post implementation of flexible targeting (post 2015), there is suggestive evidence of better anchoring of household inflationary expectations. 35. Post inflation targeting, inflation ex food and fuel has also not converged upwards towards headline CPI inflation as it did in the period prior to that suggesting the lack of second round effects. These factors will improve the short run output-inflation trade-off facing the MPC. 36. Headline CPI inflation in December spiked to 7.35% from 5.5% in November, and 4.6% in October. The sharp uptick in headline inflation was driven by a sharp uptick in food inflation. Onion inflation increased to 328%, which alone accounted for a 210 bps increase in headline inflation despite its small weight (0.64%) in the overall index. This is consistent with the significantly lower mandi arrival of onions in October-November due to unseasonal rains. 37. While some of the increase in the October–December 2019 food inflation (average 9.3%) relative to October–December 2018 inflation (average -1.2%) was due to a strong base effect, the cumulative momentum in food inflation in 2019-2020 so far has tracked the average momentum between 2012-13 and 2016-2017 much more closer than the cumulative momentum in the “outlier” years of 2017-2018 and 2018-2019. While this may be because of the significantly higher build up in vegetable momentum (food inflation ex vegetables however was also elevated at 5% y-o-y in December), it would be prudent to remain watchful of the outsized shocks to food. 38. Inflation ex food and fuel crept up marginally to 3.8% in December from 3.6% in November and 3.4% in October reflecting higher increases in telecom tariffs (which has elevated the transportation and communication sub-group inflation to 4.8% in December). However, all exclusion based measures of inflation (ranging from 3% to 3.8%) lie significantly below headline inflation. 39. In a testament to the success of flexible inflation targeting in India - helped also by good food management by the government - using data for the period January 2015 – December 2019, CPI headline inflation has averaged 4.2% – inflation ex food and fuel has averaged 4.8%, and food inflation has averaged 3.6%. 40. Economic growth is estimated to slow down to 5.0 per cent for 2019-20 by the NSO. The first advance estimate (FAE) for 2019-2020 puts Private Consumption Expenditure growth at a low 5.8% (compared to a 7.55% average growth between 2015-2016 and 2018-2019). Rural demand and rural wage growth continues to be weak. 41. Real sales of 286 listed private manufacturing companies in the manufacturing sector in Q3: 2019-2020 continued to weaken. Capacity utilization was lower at 69.1% in Q2: FY 19-20, consistent with low fixed investment and a negative output gap. Non-food credit growth continued with its declining trend since Q3: 2018-2019. 42. On the prospects for investment, what is disconcerting is that despite the enactment of the September 2019 corporate tax cut, there is no discernible increase in net profits in Q3:2019-20 across several firm types in RBI’s Industrial Outlook Survey (IOS). Profit margin expectations for Q4 also continue to be pessimistic across firm types. While it may still be early, the “impact effect” of the corporate tax cut appears to have been to accelerate the extent of corporate deleveraging rather than increase planned capex in an environment with weak demand. The impact of the corporate tax rate on investment, capital deepening, and wage growth will crucially depend on how the Jorgensonian cost of capital falls in response to the tax cut. 43. On the positive side, broader economic activity is beginning to show preliminary signs of a turn-around. This is encouraging. 44. Eight core industries grew in December (1.3 %) and the full IIP grew in November (+1.8%) after four and three consecutive months of contraction, respectively. Several high frequency indicators have turned and/or strengthened since the last review: PMI Services, PMI Manufacturing, the Manufacturing IIP, Consumer Non-Durables, High Rabi sowing, Vehicle registration, Rail freight, GST Tax collections, and Cement and Steel Production amongst others. Monetary transmission has also gathered pace. Since February 2019, the WALR on fresh rupee loans has fallen by 69 bps, and on outstanding loans by 13bps. 45. The government had an unenviable position of walking a fiscal tightrope in Budget 2020. I see the corporate tax cuts and the personal income tax rationalization in this budget as part of the same combined stimulus. Taking the budget estimates at face value, a rough calculation suggests that this amounts to a tax-stimulus of about 0.9% of GDP (26 USD Billion / 2.9 USD Trillion). The stimulus (in the form of reductions in various rates) from the GST since its implementation in July 2017 probably amounts to an additional 0.3 % of GDP. The combined tax stimulus therefore approximates 1.2 percentage of GDP given the initiatives in the 2020 budget. 46. If growth hasn’t revived with a 135 bps cut in the policy rate, and a tax stimulus amounting to 1.2% of GDP, then the need of the hour is more structural reform. 47. Having said this, fiscal deficit uncertainty may require the MPC to accept tighter than desired monetary conditions to ensure our commitment to the medium-term inflation target. 48. Real GDP growth during March 2015 – September 2019, has averaged 7.2%. This would suggest that the Indian economy has performed like a “7-4” economy (averaging roughly 7% growth and roughly 4% inflation) over the period of flexible inflation targeting. I find the growing chorus challenging the efficacy of flexible inflation targeting in India worrying. For those who advocate targeting an inflation rate higher than 4 per cent, I am sorry: 4-6% inflation is not price stability! 49. In sum, monetary policy continues to be well positioned. While I don’t see space for further cuts going forward, I remain data dependent. While the current spike in headline inflation is likely to lack persistence, the inflation numbers should be carefully watched. 50. Given the above reasons, I vote to pause. I also vote to retain the stance as accommodative. Statement by Dr. Pami Dua 51. Headline inflation, measured by CPI inflation, increased to 7.4% in December 2019 (highest since July 2014) from 5.5% in November and 4.6% in October, primarily due to a sharp rise in food inflation to 12.2% in December. This, in turn, was mainly due to an increase in onion prices, accompanied by a rise in inflation in milk, pulses, cereals, edible oils, eggs, meat and fish. At the same time, CPI inflation excluding food and fuel rose to 3.8% in December from 3.4% in October, driven primarily by an increase in inflation in the transport and communications sub-group. 52. Going forward, both survey data and model-based forecasts indicate a moderation in inflation. According to RBI’s Inflation Expectations Survey of Households, conducted in January 2020, inflation expectations eased by 60 and 70 basis points over three-month and one-year ahead horizons, respectively, possibly due to an expected moderation in food prices. As per the December 2019 round of RBI’s Industrial Outlook Survey, manufacturing firms expect subdued selling prices in Q4:2019-20 as input costs are also expected to remain muted. Further, projections made by RBI indicate that inflation is expected to moderate but remain at elevated levels (5% or above) through Q2:2020-21. 53. The future inflation trajectory is subject to various factors, including downside risks such as sharper than expected moderation in onion prices and larger correction in prices of other vegetables due to higher production. Upside risks include an increase in global food prices, rise in gold prices, fluctuations in oil prices due to geo-political tensions, and an increase in input costs for services. Disruptions in the supply of Chinese imports due to the spread of coronavirus may also exert pressure on prices of goods imported from China. 54. On the output front, industrial production grew by 1.8% y-o-y in November, a sharp turnaround from -4.0% in October. Growth in broad categories under the sectoral classification as well as the use-based classification either increased from the previous month or the extent of contraction eased (with the exception of intermediate goods that grew by double-digits though the pace moderated). Growth turned from negative to positive for the mining and manufacturing sectors, whereas the contraction in growth eased in electricity. The pace of contraction also eased for primary goods, capital goods, infrastructure and construction goods, and consumer durables, while it turned from negative to positive for consumer non- durables. 55. According to the first advance estimates released by the National Statistical Office (NSO), real GDP growth for 2019-20 is pegged at 5%, while GVA growth is estimated at 4.9%. The estimates indicate a deceleration in consumption and investment as well as a contraction in exports, with reduced demand for imports. Industrial growth is also expected to decline, while agricultural growth is expected to edge up – as rabi sowing has been higher than the previous year. 56. Turning to survey data, RBI’s Order Books, Inventory and Capacity Utilisation Survey (OBICUS) shows a drop in capacity utilisation in the manufacturing sector in Q2:2019-20 compared to Q1. The Business Assessment Index (a composite of demand indicator), based on the RBI’s Industrial Outlook Survey for the manufacturing sector, remained in the contractionary zone for Q3:2019-20. At the same time, the Business Expectations Index shows prospects of improvement for Q4. According to RBI’s Consumer Confidence Survey, the Current Situation Index fell to a new low in January 2020 due to weaker sentiment on general economic situation, price level and household income. On the other hand, the Future Expectations Index witnessed a marginal uptick due to improved outlook on employment and prices. Meanwhile, the Manufacturing Purchasing Managers’ Index increased from 51.2 in November to 55.3 in January 2020, reflecting an increase in new orders and output. The PMI Services Index also picked up during this period. A few high frequency indicators are also showing signs of revival, such as tractor sales, three-wheeler sales, railway freight traffic and domestic air passenger traffic. 57. Thus, there are some signs of a modest revival, although overall economic activity continues to remain weak. While the focus of the Union Budget is on sustainable growth within a framework of fiscal consolidation, it may provide some impetus to growth through the incremental rationalisation in personal taxes, focus on infrastructure and rural spending, emphasis on raising competitiveness in manufacturing and enhancing the overall ease of doing business. However, the full impact of these measures may percolate slowly to the economy with possibly only a small effect visible in the short-run. 58. Flow of credit to the commercial sector, that remained tepid till the MPC met last in December, picked up in the last two months. This should nurture growth impulses. The increase in the monetary transmission of the cumulative reduction in the policy repo rate by 135 basis points from February to October 2019 should also help in reviving economic activity. The weighted average lending rate (WALR) on fresh rupee loans sanctioned by banks fell by 69 basis points from February to December 2019 (implying an additional 25 basis points in November and December). Since the introduction of the external benchmarking system, many banks have linked their lending rates for housing, personal and micro and small enterprises (MSEs) to the policy repo rate. From October to December 2019, the WALRs of public and private sector banks on fresh rupee loans fell by 18, 87 and 23 basis points for housing loans, vehicle loans, and loans to MSMEs, respectively. Thus, the external benchmarking system has improved the extent of transmission, although there is still scope for more. 59. Moving on to the international front, some signs of a cyclical upturn in global industrial growth are in sight. On the verge of the coronavirus outbreak, growth in the Economic Cycle Research Institute’s (ECRI’s) 21-Country Long Leading Index, a harbinger of global economic activity, entered a mild cyclical upturn consistent with global growth prospects posting patchy progress. Meanwhile, a nascent upswing in global industrial growth had already begun, following a modest upturn in the growth rate of ECRI’s Global Leading Manufacturing Index. In that context, it is notable that the coronavirus epidemic is not yet tipping global industrial growth into a fresh cyclical downturn. However, this has to be monitored closely to gauge the possible impact of the epidemic on global growth. 60. Aligned with the improvement in global growth prospects, growth in ECRI’s Indian Leading Exports Index, a predictor of Indian exports growth, has increased recently, anticipating a revival in Indian exports growth, which has dropped to a multi-year low. This bodes well for India’s exports, but has to be tracked closely in light of the recent epidemic. Therefore, as of now, it is not clear if economic growth in India can get a boost from global growth. 61. Thus, to address growth in the economy, there is merit in adopting a wait-and-watch approach. This will allow for the pending monetary transmission to be realised in the near future. Further, measures already undertaken by the government to address the growth slowdown are expected to play out, including the fiscal stimulus in the form of a major overhaul in corporate income tax aimed at reducing the overall tax burden on corporates and, in turn, improving India's global competitiveness. Moreover, growth initiatives announced in the Union Budget are also expected to pan out slowly. Additionally, the impact of global growth on the domestic economy would have to be examined in light of the recent epidemic. 62. At the same time, while growth is slowing, headline inflation has increased beyond the upper tolerance band and is expected to remain at elevated levels (5% or above) through Q2:2020-21. At this juncture, it is, therefore, best to monitor incoming data on both inflation and growth, given the evolving inflation-growth dynamics. I, therefore, vote to keep the policy rate unchanged and continue with the accommodative stance. Statement by Dr. Ravindra H. Dholakia 63. Since the last meeting of MPC in December 2019, several major events have occurred and new data is available. Greater clarity has emerged on several uncertainties perceived at that time, though some new uncertainties have arisen and assumed more importance. The latest two readings of monthly headline inflation for November and December 2019 have been significantly above the RBI forecast largely on account of the spikes in onion prices. While this is transitory and in all likelihood would reverse soon, it is most likely to lead to a breach of upper tolerance limit for the headline inflation for a quarter for the first time since the MPC is functioning. Given the high Rabi sowing, record level of water storage in reservoirs, prolonged growth slowdown leading to expanding negative output gap, favourable base effects and some international developments, the headline CPI inflation going forward is expected to show a declining trend for at least a year to come. Some new uncertainties have, however, emerged that could need some policy space for future. Moreover, the Union Budget for 2020-21, in my opinion, has presented a fiscal policy of the Centre that borders on being contractionary rather than expansionary on misplaced concerns about fiscal slippage in the face of a serious growth slow-down. Under such circumstances, in my view, the monetary policy should preserve policy space for any rate action at an appropriate time. I, therefore, vote to maintain status quo on both the policy repo-rate and the accommodative stance in this meeting. More specific reasons for my vote are as follows – -

Uncertainty regarding food and vegetable prices during the last meeting of the MPC has reduced and it is getting clear that these prices would gradually come down to their original level over the next two – three quarters. Fuel prices rising substantially in the short term is hardly a risk given the international developments. Union Budget for 2020-21 has been presented with no major impact on both growth and inflation in my opinion. As a result, there is no risk of output gap closing rapidly in the short to medium term. Global growth slow-down is confirmed by now. -

New uncertainties have emerged from the likely spread of Coronavirus and its impact through trade and fuel prices. It can lead to sharp swings in fuel prices in both the directions over time. Run up to the US Presidential elections and its possible impact on the geopolitics can have substantial impact on the global economic environment. The response of various State Governments to the Union Budget 2020-21 in terms of their own budgets is a major uncertainty deciding almost the other half of the fiscal policy for the country. -

Inflationary expectations of the households for 12 months ahead as revealed in the most recent RBI survey have declined by 70 bps compared to the previous round. This is, however, contradicted by an increase of 40 bps in the headline CPI inflation expectation by the businesses as revealed by the IIMA surveys. Thus, the picture is ambiguous on recent trends in inflationary expectations in the economy. RBI’s own assessment about the inflation forecast four quarters down is 3.2%. Thus, although there is uncertainty, some policy space for the rate action does exist. -

The numbers presented in the Union Budget 2020-21 show that the fiscal slippage of 41 bps in the fiscal deficit to GDP ratio from the budgeted 3.34% in 2019-20 is accounted for by 36 bps due to cyclical factors and by only 5 bps of the genuine fiscal slippage. In a year of a serious growth slow-down, such an adherence to “fiscal discipline” not only shows misplaced emphasis and unjustified concerns but also a contractionary fiscal policy. The budgeted numbers for 2020-21 also continue along the same line and depict a contractionary fiscal policy. It is pro-cyclical rather than counter-cyclical. Moreover, the proportion of revenue deficit in the fiscal deficit in the budget for 2020-21 shows a substantial increase over 2019-20 (RE) that may not help crowding-in of the private investment. Immediate growth recovery may not be aided by the Union budget 2020-21. -

The growth slowdown may, therefore, be prolonged and the real growth may remain below 7.5% of the long-term trend for the next couple of years leading the negative output gap to expand. This is consistent with the capacity utilization rate of less than 70% presently observed in the RBI surveys. Thus, there would be downward pressure on the core inflation in the next few quarters. -

Real rates of interest and policy rates globally are very low and negative in several comparator counties. Our real rates are high. Transmission of the past rate cuts is improving of late, which would continue to provide corrections to the real rates. 64. There is a definite space for policy rate action in the light of the above arguments. The question is – is this the right time? We need to wait for the other half of the fiscal policy given by the budgets of the States. While monetary policy is important for short run revival of aggregate demand, the long-term growth revival depends critically on the fiscal policy and structural reforms. When the long run revival is not seriously attempted, any substantial recovery in the short run is also likely to be elusive and the monetary policy stimulus that works only indirectly and with lags is also likely to be less effective. Under such circumstances, I would like to continue with status quo on both the policy repo-rate and the accommodative stance. Statement by Dr. Janak Raj 65. Headline inflation surged during last three months, driven mainly by an unprecedented spike in onion prices. Non-vegetable food prices such as pulses, milk, eggs, fish and meat also rose significantly, driven mainly by a shortfall in production due to unseasonal rains and a rise in input costs. While onion prices have already started reversing due to late kharif arrivals, the reversal is likely to be more pronounced once the rabi season harvest hits mandis in early March. However, the increase in inflation in non-vegetable food items is more likely to be sustained. Given this broad-based increase in food prices, there is a lot of uncertainty as to the level at which food inflation will stabilise even as onion prices normalise completely. Food inflation, therefore, needs a careful monitoring. 66. Inflation excluding food and fuel accelerated in recent months, driven mainly by cost push shocks such as increase in mobile phone charges. Rising input costs have transmitted to output prices, though weak pricing power of corporates due to deficient demand has limited its pass-through. Global commodity prices, especially of crude oil and metals, also declined sharply towards end-January in anticipation of slowdown in global demand due to the outbreak of coronavirus. This may help mitigate some of the input price pressures witnessed in the recent period. Though inflation expectations of households have moderated in the January 2020 round of the Reserve Bank’s survey, they are still elevated. Headline inflation is projected to remain at or above 5 per cent up to Q2: 2020-21, before moderating to 3.2 per cent in Q3. 67. Domestic economic activity has remained weak with GDP growth estimated at 5.0 per cent for 2019-20 being the lowest in last 11 years. Some of the major factors that have contributed to the growth slowdown are (i) ongoing deleveraging by the private corporate sector; (ii) continuing large inventory overhang in the residential real estate market; (iii) issues facing the auto sector; (iv) decline in income levels in rural areas due to low food prices in previous two years and deceleration in the growth of wages of agriculture and non-agricultural labourers; and (v) global uncertainties, especially trade tensions. All these factors have reduced aggregate demand by impacting investment and private consumption. 68. Some high frequency indicators such as consumer non-durables, tractor sales, port freight traffic, cement production and steel consumption have turned around in recent months. The index of industrial production (IIP) expanded in November 2019 despite contraction in the auto sector as well as eight core industries. Eight core industries, with a weight of 40 per cent in the IIP, also expanded in December. These are positive signs, though more data are needed to assess whether they are sustained. Several other indicators such as sales in commercial vehicles, passenger cars and motor cycles, and international air freight traffic have continued to contract. Credit flows continue to be tepid, though they are improving. 69. Overall, demand conditions remain weak. This is reflected in a variety of indicators such as non-oil non-gold imports, capacity utilisation in the manufacturing sector much below the long-term average even when there is hardly any addition of new capacities, and weak pricing power of corporates. Consumer confidence is also low. 70. Going forward, the recent rise in food prices should boost rural incomes and help strengthen rural demand. The stress in the auto sector seems to be gradually receding. The inventory overhang in the real estate sector remains high and it will take time before it comes to normal levels. The real estate sector has huge forward and backward linkages and it is critical for reviving growth. Though global uncertainties relating to trade tensions and Brexit have abated, a new uncertainty from coronavirus has arisen. It is expected that epidemic of coronavirus will be overcome soon. However, should it prolong and spread, it will have ramifications for the global economy and its net impact on the Indian economy might be negative even if oil and other global commodity prices decline. 71. The impact of monetary easing undertaken since February 2019 continues to unfold. Monetary transmission has strengthened in recent months and it is expected to be reinforced further as existing loans are repriced at reduced interest rates. 72. While current low growth is the outcome of deficient demand, high inflation is an upshot of a supply shock. These conflicting dynamics pose a challenge for monetary policy. Weak demand conditions warrant further monetary policy easing, while elevated inflation and the highly uncertain inflation outlook call for a cautious approach. More data are needed for greater clarity. Hence, I vote for keeping the policy repo rate on hold at the current level and for persevering with the accommodative stance. There is policy space, which could be used once the inflation outlook becomes clear. In a scenario of slowdown in growth, monetary policy has a role to boost aggregate demand consistent with the inflation objective. However, for strengthening the medium-term growth potential of the economy, the need is to step up investment and improve productivity through further structural reforms. In this context, corporate tax cuts announced in September 2019 and higher budgeted capital outlay for 2020-21 compared with the previous year bode well for strengthening India’s medium-term growth potential. Statement by Dr. Michael Debabrata Patra 73. As foretold in December 2019, the MPC has entered what I call the tunnel of testing trade-offs (TTT) and it may be a while before the light at the end of the tunnel is sighted. 74. Economic activity remains weak: there are indications of the momentum of growth stabilising, with sector-specific upticks underlying this guarded optimism, but they are far from gaining economy-wide traction. In some sectors, the slowdown is deep, and activity is stalled by sizable slack in demand. High frequency indicators are not offering definitive evidence yet that the downturn is bottoming out. 75. Global growth remains subdued. What seemed to be a synchronised downturn only a few months ago, is getting decoupled across jurisdictions. Until recently, emerging economies were cushioning the loss of pace in global growth. Now these economies are confronted with a downward slant in the balance of risks either from self-inflicted wounds or global spillovers. This is currently the big cloud on the outlook for the global economy. Overall, headwinds from the global economy continue to blow strongly, darkening the prospects for all economies, including India. The coronavirus outbreak has imparted new and uncertain risks in response to which the world is grappling to fashion a credible response. The implications for India are yet to unravel. 76. As in December, a monetary policy response to the state of the economy is stifled by higher than expected elevation in inflation. The breach in the upper tolerance band of the MPC’s inflation target band in the December print may well recur in the months ahead. 77. The pre-emptive easing of monetary policy since February 2019 is now turning out to be fortuitous. Over the 12 months ahead horizon, the forecasts are indicating some let-up in inflationary pressures, but it is not yet clear as to when and how the current inflation surge will bottom. Monetary policy has headroom to respond to the evolving macroeconomic configuration, but a good fix is needed on the shape of the inflation hump it has chosen to look through. Hardening prices of proteins and pulses and a range of cost pushes to core inflation are new and ominous risks to the inflation outlook if they persist. 78. Incoming data will have to be carefully parsed for this purpose. The endeavour now should be to improve transmission of the cumulative 135 bps rate reduction effected since February 2019 and seize the opportunity when it opens up to act judiciously and effectively to support the economy. 79. It is in this context that I vote for maintaining status quo on the policy rate and to persevere with the accommodative stance of monetary policy until growth revives on a durable basis. 80. The Union Budget has proposed several initiatives to revitalize the economy within the envelope of pragmatic fiscal prudence. These are significant positives for the medium-term growth and stability outlook. Monetary policy will complement the fiscal impulse and boost it going forward. Statement by Shri Shaktikanta Das 81. Since the last policy in December 2019, economic activity has slowed down further with the GDP growth estimated to moderate to 5 per cent for 2019-20. CPI inflation surged in December to its highest reading since July 2014, driven by a spike in food inflation, an uptick in fuel inflation and firming up of inflation excluding food and fuel from its October trough. Global economic activity has also slowed down and the prospects have weakened even further with the outbreak of coronavirus as China is the second largest economy and it is a key player in global supply chain. Central banks in several advanced and emerging market economies have held their policy rates. 82. Headline CPI inflation increased for the fifth consecutive month to 7.4 per cent in December 2019 as food prices, particularly those of vegetables, surged. Inflation in vegetables shot up to 60.5 per cent in December from 36.1 per cent in November largely due to a spike in onion prices, caused by damage to kharif crop from unseasonal rains. Inflation in onion swelled to 328 per cent in December. Excluding onions, CPI inflation was at 5.2 per cent in December and excluding vegetables, inflation was at 4.1 per cent. Inflation in several other items of food such as milk, pulses, cereals, edible oils, egg, meat and fish also edged up. 83. The fuel group moved out of deflation in December with a sharp increase in LPG prices in previous two months and a pick-up in inflation in electricity and firewood and chips. 84. CPI inflation excluding food and fuel edged up to 3.8 per cent in December from 3.6 per cent in the previous month, driven by a rise in inflation in mobile charges, petroleum product prices, transportation fares and clothing. Inflation expectation of households, as polled in the Reserve Bank’s January 2020 round of survey, moderated by 60 bps and 70 bps for 3-month and 1-year ahead horizons, respectively. CPI inflation is projected at 6.5 per cent for Q4:2019-20; 5.4-5.0 per cent for H1:2020-21; and 3.2 per cent for Q3:2020-21. 85. On the growth front, the first advance estimates released by the National Statistics Office (NSO) placed India’s real GDP growth for 2019-20 at 5.0 per cent due to slowdown in private final consumption expenditure and gross fixed capital formation. GDP estimates by the NSO for 2019-20 were in line with the projection set out in the 5th bi-monthly monetary policy. 86. Some green shoots are, however, visible. First, rabi sowing has been higher by 9.5 per cent. Horticulture production has also risen to a record level in 2019-20. This bodes well for farm incomes and boosting rural demand. Second, the index of industrial production (IIP) improved in November after contracting in the previous three months and growth of eight core industries also turned positive in December after four months of contraction. PMI manufacturing increased for January 2020. Business sentiment of manufacturing firms in Q4:2019-20, measured by the Reserve Bank’s business expectations index, also improved. However, capacity utilisation (CU) in the manufacturing sector, measured by the Reserve Bank’s order books, inventory and capacity utilisation survey, deteriorated to 69.1 per cent in Q2:2019-20 from 73.6 per cent in Q1. Third, in the services sector, some high frequency indicators have turned up. Amongst indicators of rural demand, tractor sales emerged out of ten months of contraction in December. Of indicators of urban demand, domestic air passenger traffic posted double digit growth in November. PMI services also rose sharply in January 2020, underpinned by the rise in new business and output. However, durability of such green shoots will be clearer in the coming months. At the same time, some other indicators such as commercial and passenger vehicle sales, and domestic and international air cargo traffic continued to contract. Going forward, real GDP growth is projected at 6.0 per cent for 2020-21 – in the range of 5.5-6.0 per cent for H1 and 6.2 per cent for Q3. 87. As regards credit flows, non-food credit growth of scheduled commercial banks moderated to 7.1 per cent in 2019-20 (up to January 17, 2020) from 14.6 per cent last year. However, it is noteworthy that non-food credit has increased by Rs. 2.77 lakh crore since mid-September 2019 in contrast to a contraction of Rs.0.83 lakh crore between end-March and mid-September. The total flow of credit from both banks and non-banks (domestic and foreign) to the commercial sector increased from Rs. 3.11 lakh crore during the period from end-March to mid-September 2019 to Rs. 8.43 lakh crore in 2019-20 so far (up to January 17, 2020), though they have been lower as compared with the increase of Rs.15.79 lakh crore in the corresponding period of the previous year. 88. The transmission of policy rate reductions has been full across various money and bond market segments; transmission to the longer end of the government securities market, however, has been partial. Transmission to the credit market has improved in the recent period. As against the cumulative reduction in the policy repo rate by 135 bps since February 2019, the 1-year median marginal cost-based lending rate (MCLR) has declined by 55 bps; the weighted average lending rate (WALR) on fresh rupee loans by 69 bps and the WALR on outstanding rupee loans by 13 bps. The external benchmark system has strengthened monetary transmission further. During October-December 2019, the WALR of domestic banks on fresh rupee loans declined by 18 bps for housing loans, 87 bps for vehicle loans and 23 bps for loans to MSMEs. These developments should amplify the effects of policy rate reductions since February 2019. 89. The Union Budget has sought to provide counter-cyclical support to the economy while broadly adhering to fiscal prudence. Monetary transmission and bank credit flows have improved, but they need to become stronger. While the macroeconomy needs further monetary stimulus, the inflation outlook continues to be uncertain. The seasonal winter softening of vegetable prices has been delayed, even as onion prices have begun to soften. Also, the prices of several other food items such as pulses, milk and edible oils have continued to rise. While demand conditions remain weak, there is uncertainty about the likely behaviour of inflation excluding food and fuel, given the recent cost push shocks, especially of mobile charges, prices of automobiles and essential medicines. Overall, the path of headline inflation is expected to moderate, but given the prevailing uncertainty, it is prudent to await more clarity based on incoming data. 90. Considering the overall evolving growth-inflation situation, it would be prudent to continue the focus on growth in the context of the expected moderation in inflation. This would indeed be in sync with the concept of flexible inflation targeting. Financial stability also requires revival of the growth trajectory. Considering all these aspects, I vote for keeping the policy repo rate on hold and for maintaining the accommodative stance as long as necessary to revive growth, while ensuring that inflation remains within the target. Barring the intensification of global risks, there is policy space that needs to be timed optimally and opportunistically to maximise its impact on growth. (Yogesh Dayal)

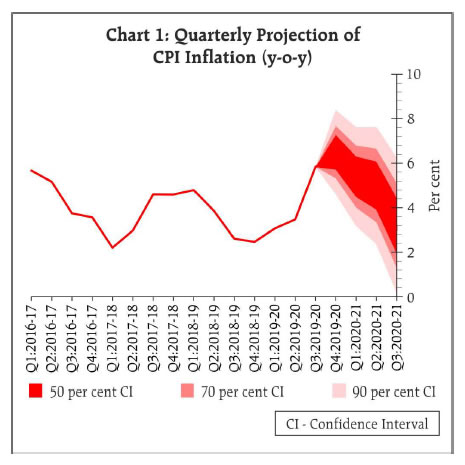

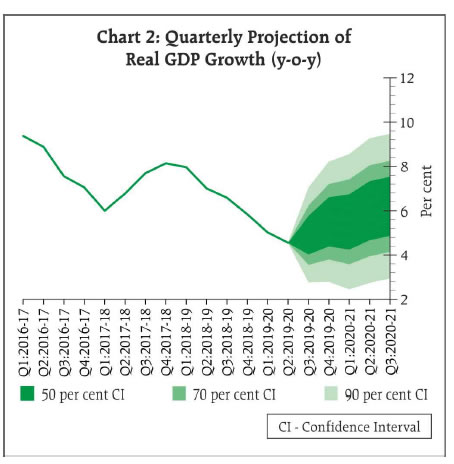

Chief General Manager Press Release: 2019-2020/1972 |