| VII.1 Ensuring

adequate availability of good quality banknotes and coins is one of the core functions

of the Reserve Bank. Towards this objective, the Reserve Bank continued to take

measures during 2006-07 to meet the public's demand for banknotes and coins while

simultaneously improving the quality of banknotes. The demand for banknotes was

met almost in full. There was a marked improvement in the quality of Rs.10 denomination

banknotes due to sustained effor ts. The mechanisation of note processing activities

at currency chests was carried forward by equipping the currency chests with the

sorting machines. The disposal capacity of soiled notes has been augmented by

putting in place six Currency Verification and Processing Systems (CVPS) at a

new sub-office in Lucknow. With this, the Reserve Bank now has a total of 54 CVPS

and 28 Shredding and Briquetting Systems (SBS) at its 19 offices.

VII.2

In this backdrop, this Chapter details the currency management operations of the

Reserve Bank during 2006-07. A multi-pronged approach was followed by the Reserve

Bank with the objective of meeting the public's demand for good quality

banknotes and coins. The approach comprised regular supply of fresh notes, speedier

disposal of soiled banknotes, improvements in inventory management and mechanisation

of cash processing activity. Total supplies of banknotes, both in volume and value

terms, from the printing presses were almost close to the indents. The growth

in the volume of banknotes remained substantially lower than that in value terms,

reflecting the ongoing compositional shift in favour of higher denomination banknotes.

Star series banknotes were issued for the first time in 2006-07 with the objective

of streamlining the procedures and reducing manpower deployed in the replacement

activity at the printing presses. Operations aimed at computerisation and networking

of the currency chests with the Reserve Bank's offices were pursued during 2006-07

to reap efficiency gains in reporting and accounting transactions.

BANKNOTES

IN CIRCULATION

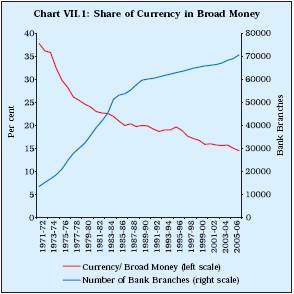

VII.3 During 2006-07, the value of banknotes

in circulation rose by 17.5 per cent (16.8 per cent during 2005-06). The ratio

of currency with the public to GDP has risen steadily over the years from 9.5

per cent of GDP at end-March 1990 to 11.6 per cent at end-March 2006 and further

to 11.7 per cent at end-March 2007. The ratio of currency with the public to broad

money (M3) declined from 15.1 per cent at end- March 2006 to 14.6 per cent at

end-March 2007 continuing with its declining trajectory over the past few years

(Chart VII.1).

VII.4 The volume of banknotes rose

by 5.2 per cent during 2006-07 (2.3 per cent a year ago). The growth in the volume

of banknotes, thus, continued to be substantially lower than that in value terms,

mainly on account of the gradual compositional shift towards higher denomination

banknotes, particularly Rs.1000 and Rs.500 denominations. While the volume of

Rs.500 denomination notes increased by 23.6 per cent during 2006-07 (19.4 per

cent a year ago), that of Rs.1000 denomination notes rose by 45.7 per cent (52.7

per cent a year ago). The volume of Rs.10 banknotes increased by 14 per cent due

to sustained efforts to pump in more fresh banknotes into circulation to bring

about an improvement in the quality of these banknotes. On the other hand, the

volume of banknotes of denominations Rs.2 and Rs.5 declined during the year, while

that of Rs.20, Rs.50 and Rs.100 remained at almost the same level as in 2005-06

(Table 7.1).

Table

7.1: Banknotes in Circulation | Denomination | Volume

(Million pieces) | Value

(Rupees crore) | | End-March | End-

March | End-March | End-March | End-March | End-March |

| 2005 | 2006 | 2007 | 2005 | 2006 | 2007 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Rs.2 & Rs.5 | 6,484 | 6,217 | 6,008 | 2,548 | 2,431 | 2,334 |

Rs.10 | 6,770 | 6,274 | 7,155 | 6,770 | 6,274 | 7,155 |

Rs.20 | 1,938 | 2,038 | 2,089 | 3,876 | 4,076 | 4,178 |

Rs.50 | 5,988 | 5,568 | 5,590 | 29,941 | 27,840 | 27,951 |

Rs.100 | 12,328 | 13,464 | 13,544 | 1,23,282 | 1,34,640 | 1,35,444 |

Rs.500 | 3,055 | 3,647 | 4,508 | 1,52,728 | 1,82,350 | 2,25,400 |

Rs.1000 | 421 | 643 | 937 | 42,082 | 64,300 | 93,676 |

Total | 36,984 | 37,851 | 39,831 | 3,61,227 | 4,21,911 | 4,96,138 |

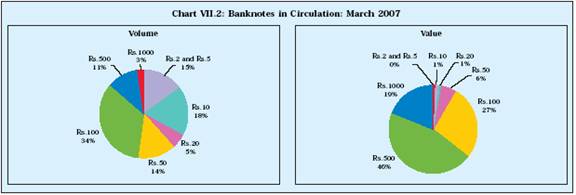

VII.5 In volume terms, Rs.100 denomination notes had the

largest share (34 per cent of the total pieces in circulation) at end-March 2007.

In terms of value, Rs.500 denomination notes had the largest share (over 45 per

cent of the total value of banknotes in circulation) at end-March 2007 (Chart

VII.2). VII.6 In the year 2004-05, the Reserve Bank had to contend with

the reverse flow of coins. The overall stock of coins with the Reserve Bank, as

a result, increased considerably causing strain on storage and distribution of

coins. The trend continued for almost two years. In view of the comfortable stock

of coins at the currency chests/small coin depots and the Reserve Bank, the Reserve

Bank did not place any indent for coins for 2005-06 and 2006-07. There was a reversal

in this trend from October 2006 onwards as there was a sudden spurt in the demand

for Rs.2 coins. In view of the reported melting of Rs.2 cupro-nickel coins due

to rising metal prices, the Government of India, in consultation with the Reserve

Bank, decided to mint all denomination coins in ferritic stainless steel (FSS).

An indent of 700 million pieces was placed in December 2006 for Rs.2 FSS coins

and these coins have already been issued. For the year 2007-08, the Reserve

Bank placed an indent of 300 million pieces, subsequently raised to 500 million

pieces for Re.1 coins, 1,500 million pieces for Rs.2 coins and 300 million pieces

for Rs.5 coins. The total value of coins (including small coins in circulation)

increased by 11.2 per cent during 2006-07 (2.3 per cent in 2005-06). In volume

terms, the increase was 6.5 per cent in 2006-07 (1.4 per cent in 2005-06) (Table

7.2). The value of coins, relative to the value of the banknotes, remains

fairly small and has declined in recent years (from 1.7 per cent at end-March

2006 to 1.6 per cent at end-March 2007).

Table

7.2: Coins in Circulation | Denomination | Volume

(Million pieces) | Value

(Rupees crore) | | End-March | End-

March | End-March | End-March | End-March | End-March |

| 2005 | 2006 | 2007 | 2005 | 2006 | 2007 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Small Coins | 54,051 | 54,115 | 54,277 | 1,353 | 1,357 | 1,364 |

Re.1 coin | 17,896 | 18,730 | 22,878 | 1,790 | 1,873 | 2,288 |

Rs.2 coin | 6,449 | 6,684 | 7,441 | 1,290 | 1,337 | 1,488 |

Rs.5 coin | 5,238 | 5,289 | 5,761 | 2,619 | 2,645 | 2,881 |

Total | 83,631 | 84,818 | 90,357 | 7,052 | 7,212 | 8,021 |

Currency operations

VII.7 The Reserve

Bank continued with its initiatives to provide the public with good quality banknotes.

Towards this objective, a multi-pronged approach is pursued involving regular

supply of fresh notes, speedier disposal of soiled banknotes, improvement in inventory

management and mechanisation of cash processing activity. In the recent period,

the discontinuance of the practice of stapling banknotes has also contributed

to improvement in quality of banknotes. Banks have been advised to issue only

clean notes to the public and to remit the soiled notes in unstapled condition

to the Reserve Bank through currency chests. Efforts are being made to increase

the life of the banknotes and the Reserve Bank is examining various options in

this regard.

Currency Chests

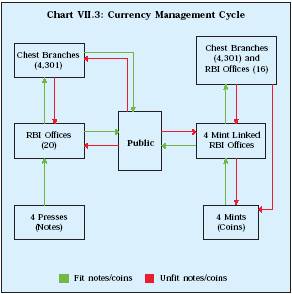

VII.8 The core central

banking function of note issue and currency management is performed by the Reserve

Bank through its 18 Issue Offices, the sub-office of the Issue Department at Lucknow,

a currency chest at Kochi and a wide network of 4,301 currency chests and 4,027

small coin depots. The Reserve Bank has agency arrangements, mainly with scheduled

commercial banks, under which a currency chest facility is granted to them. The

currency chest branch is an extended arm of the Reserve Bank's Issue Department

and carries out the same functions of issue of fresh banknotes/coins, retrieval

of soiled banknotes, exchange of banknotes and coins including mutilated banknotes

(Chart VII.3). The total number of currency chests declined

further during 2006-07 reflecting the impact of the on-going policy to progressively

convert and/or close currency chests held with the State Treasuries as well as

rationalisation of currency chests mainly by State Bank of India (Table 7.3).

VII.9

Out of the 4,301 currency chests maintained by various banks, 4,027 chests have

so far been equipped with note sorting machines. The progress made in respect

of installation of note sorting machines in the remaining currency chests of the

various banks is being closely monitored.

Table

7.3: Currency Chests | Category | Number

of Currency Chests | | June | June | June |

| 30,

2005 | 30,

2006 | 30,

2007 | 1 | 2 | 3 | 4 |

| | | |

Treasuries | 149 | 116 | 26 |

State Bank of India | 2,198 | 2,182 | 2,127 |

SBI Associate Banks | 1,008 | 994 | 988 |

Nationalised Banks | 983 | 1,028 | 1,061 |

Private Sector Banks | 72 | 83 | 94 |

Co-operative Banks | 1 | 1 | 1 |

Foreign Banks | 4 | 4 | 4 |

Reserve Bank | 20 | 20 | 20 |

Total | 4,435 | 4,428 | 4,321 |

Table

7.4: Volume of Banknotes Indented and Supplied |

(Million

pieces) | | 2004-05 | 2005-06 | 2006-07 | 2007-08 |

Denomination | Indent | Supply | %

of | Indent | Supply | %

of | Indent | Supply | %

of | Indent |

| | Supply | to | | | Supply

to | | | Supply

to | |

| | | Indent | | | Indent | | | Indent | |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Rs.5 | 160 | 179 | 112 | – | 50 | – | – | 50 | – | – |

Rs.10 | 4,700 | 4,332 | 92 | 3,300 | 1,183 | 36 | 3,500 | 3,480 | 99 | 4,200 |

Rs.20 | 1,000 | 755 | 76 | 1,200 | 706 | 59 | 500 | 438 | 88 | 600 |

Rs.50 | 2,040 | 1,862 | 91 | 2,700 | 1,063 | 39 | 1,400 | 1,458 | 104 | 1,200 |

Rs.100 | 5,030 | 3,956 | 79 | 5,550 | 3,208 | 58 | 4,000 | 4,034 | 101 | 4,200 |

Rs.500 | 1,625 | 1,252 | 77 | 1,800 | 661 | 37 | 1,500 | 1,473 | 98 | 1,800 |

Rs.1000 | 300 | 257 | 86 | 450 | 130 | 29 | 600 | 589 | 98 | 700 |

Total | 14,855 | 12,593 | 85 | 15,000 | 7,001 | 47 | 11,500 | 11,472 | 99.8 | 12,700 |

Printing of Fresh Banknotes

VII.10 The supply of

banknotes, both in volume and value terms, from the printing presses recovered

during 2006-07 from the sharp decline in the preceding year. Total supplies in

volume terms rose by 64 per cent during 2006-07 while those in value terms increased

by almost 115 per cent during the year. Total supplies during 2006-07 were 99.8

per cent in terms of volume and 99.0 per cent in terms of value of the indent

(Tables 7.4 and 7.5). The relatively

lower supply of Rs.20 denomination banknotes vis-à-vis the indent

was due to the reason that printing of these denominations with new/ additional

security features commenced late during 2006-07.

VII.11 As part of its

ongoing efforts to reduce the expenditure for printing of banknotes, the Reserve

Bank continued with its efforts to source banknotes from the lowest cost producer

(Box VII.1).

VII.12 The position of indent and

supply of coins during 2004-05 to 2006-07 is set out in Table 7.6.

Disposal

of Soiled Notes

VII.13 During 2006-07, 7,325 million pieces of soiled

banknotes (18.3 per cent of banknotes in circulation) were disposed off. Notes

of Rs.100 denomination constituted the largest share of soiled notes, followed

by Rs.10 denomination notes (Table 7.7). As against a disposal

of 7,325 million pieces during the year, 10,214 million pieces of fresh banknotes

were supplied to members of public and to currency chests (9,485 million pieces

supplied in 2005-06). The number of notes withdrawn from circulation and eventually

disposed off in the Reserve Bank offices has, therefore, decreased due to

improvement in the quality of notes in circulation as part of the Reserve Bank's

Clean Note Policy.

Table

7.5: Value of Banknotes Indented and Supplied |

(Rupees crore) |

| 2004-05 | 2005-06 | 2006-07 | 2007-08 |

Denomination | Indent | Supply | %

of | Indent | Supply | %

of | Indent | Supply | %

of | Indent |

| | | Supply

to | | | Supply

to | | | Supply

to | |

| | | Indent | | | Indent | | | Indent | |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Rs.5 | 80 | 90 | 113 | – | – | – | – | – | – | – |

Rs.10 | 4,700 | 4,332 | 92 | 3,300 | 1,183 | 36 | 3,500 | 3,480 | 99 | 4,200 |

Rs.20 | 2,000 | 1,510 | 76 | 2,400 | 1,412 | 59 | 1,000 | 876 | 88 | 1,200 |

Rs.50 | 10,200 | 9,310 | 91 | 13,500 | 5,316 | 39 | 7,000 | 7,292 | 104 | 6,000 |

Rs.100 | 50,300 | 39,560 | 79 | 55,500 | 32,084 | 58 | 40,000 | 40,348 | 101 | 42,000 |

Rs.500 | 81,250 | 62,600 | 77 | 90,000 | 33,065 | 37 | 75,000 | 73,655 | 98 | 90,000 |

Rs.1000 | 30,000 | 25,700 | 86 | 45,000 | 12,960 | 29 | 60,000 | 58,910 | 98 | 70,000 |

Total | 1,78,530 | 1,43,102 | 80 | 2,09,700 | 86,020 | 41 | 1,86,500 | 1,84,561 | 99 | 2,13,400 |

Box VII.1

Printing

Cost of Banknotes The Reserve Bank has been sourcing banknotes

from the two presses of the Security Printing and Minting Corporation of India

(SPMCIL), and the two presses of its wholly owned subsidiary, Bharatiya Reserve

Bank Note Mudran Pvt. Ltd. (BRBNMPL). The cost of printing banknotes during the

year ended March 2007 was Rs.2,020.20 crore. Of this, Rs.1041.95 crore was paid

to the SPMCIL presses in respect of 4,642 million banknotes supplied by them and

Rs.978.25 crore to BRBNMPL for 6,830 million notes procured from its presses.

It has been the Reserve Bank's endeavour to consistently bring down the cost of

banknotes by encouraging the note presses to bring about greater efficiency in

their operations while maintaining the quality of printed notes. The cost of banknotes

paid to the SPMCIL and BRBNMPL presses in the last five years is set out in the

Table.

Table:

Supply and Cost of Banknotes | Year(April-March) | SPMCIL | BRBNMPL | |

| Supply | Cost | Supply | Cost |

| (Million

pieces) | (Rupees

crore) | (Million

pieces) | (Rupees

crore) | 2002-03 | 5,198 | 750.10 | 6,172 | 682.99 |

2003-04 | 5,065 | 894.23 | 8,101 | 815.33 |

2004-05 | 4,622 | 783.25 | 7,971 | 660.32 |

2005-06 | 2,694 | 405.90 | 4,307 | 628.96 |

2006-07 | 4,642 | 1,041.95 | 6,830 | 978.25 |

Mechanisation

VII.14 Mechanisation of cash processing

activity and disposal of soiled banknotes has been one of the major thrust areas

of the Reserve Bank in currency management. With the opening of Lucknow

sub-office in October 2006 and resultant capacity augmentation, the Reserve Bank

has now in place 54 Currency Verification and Processing Systems (CVPS) and 28

Shredding and Briquetting Systems (SBS) at its 19 Offices. During 2006-07, 4,532

million pieces of banknotes were processed on these machines. The remaining notes

were disposed off under other modes including manual system. Counterfeit

Banknotes

VII.15 During 2006-07, the number of counterfeit banknotes

detected at the Reserve Bank offices and bank branches declined by 15.5 per cent.

However, in value terms, the counterfeit banknotes increased by 31.2 per cent

on account of rise in detections in the banknotes of higher denominations, viz.,

Rs.1000 and Rs.500 banknotes (Table 7.8). All banks have

been advised to install note sorting machines at their currency chest branches

to facilitate careful

Table

7.6 : Indent and Supply of Coins | (Million

pieces) | | 2004-05 | 2005-06 | 2006-07 |

Denomination | Indent | Supply | Indent | Supply | Indent | Supply |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

25 paise | 0 | 0 | 0 | 0 | 0 | 0 |

50 paise | 0 | 0 | 0 | 0 | 0 | 0 |

Re. 1 | 1,250 | 463 | 0 | 12.7 | 0 | 45

* | Rs.2 | 500 | 232 | 0 | 21.5 | 700 | 686 |

Rs.5 | 750 | 201 | 0 | 7.2 | 0 | 11 |

Total | 2,500

| 896 | 0 | 41.4 | 700 | 742 |

* : Includes mainly commemorative

coins. |

Table

7.7: Denomination-wise Disposal of | Soiled

Notes | Denomination | Volume

in million pieces | | 2004-05 | 2005-06 | 2006-07 |

1 | 2 | 3 | 4 |

Rs.1000 | 5 | 5 | 7 |

Rs.500 | 257 | 242 | 276 |

Rs.100 | 4,324 | 3,250 | 2,360 |

Rs.50 | 2,490 | 2,160 | 1,456 |

Rs.20 | 485 | 532 | 489 |

Rs.10 | 3,716 | 2,593 | 2,243 |

Up to Rs.5 | 475 | 522 | 494 |

Total | 11,752 | 9,304 | 7,325 |

Memo: | | | |

Total Banknotes in Circulation | 36,984 | 37,851 | 39,831 |

examination and detection of counterfeit banknotes at the

currency chest level as also to ensure efficient sorting of banknotes.

New/Additional Security Features of Banknotes

VII.16

In order to maintain the confidence of the public in the banknotes, the Reserve

Bank, in consultation with the Government of India, reviews the security features

of banknotes periodically. As a part of this process, the Reserve Bank had started

from 2005-06, the introduction of banknotes with several new/additional security

features in denominations of Rs.10, Rs.50, Rs.100, Rs.500 and Rs.1000. These include

(a) demetallised, magnetic and machine readable windowed security thread with

a colour shift from green to blue in Rs.100, Rs.500 and Rs.1000 denominations;

(b) improved intaglio printing; (c) improved see-through feature incorporating

the denominational numeral instead of the floral design; and (d) electrotype watermark

featuring the denominational numeral alongside Mahatma Gandhi portrait in the

watermark window. The process of issuance of all the denominations of the banknotes

in the Mahatma Gandhi Series 2005 with additional/new security features was completed

during 2006-07 with the issuance of Rs.20 denomination banknotes with additional/new

security features in August 2006. Posters containing the pictorial details of

additional/new security features on banknotes have been provided to all the banks

for public dissemination. The Regional Offices of the Reserve Bank have been advised

to facilitate public awareness of these security features at the local levels

through organisations such as the railways and police authorities as well as through

posters printed in vernacular. The details regarding the security features of

the new banknotes have been posted on the Reserve Bank's website.

Introduction

of Star Series Banknotes

VII.17 The Reserve Bank commenced the

issuance of Star series banknotes in the denomination of Rs.10, Rs.20 and Rs.50

during 2006-07. The Star series banknotes look exactly like the earlier banknotes

in the Mahatma Gandhi series but have an additional character, viz.,

* (Star) in the number panel between the prefix and the serial number. The packets

with Star series notes contain, as usual, 100 pieces, though not in serial order.

The Star series system helps in streamlining the procedures at the printing presses

and reducing manpower deployed in replacement activity. The bands of the fresh

note packets containing the Star series numbered note/s clearly indicate the presence

of such banknotes in the packets.

Table

7.8: Counterfeit Banknotes Detected | | Number

of pieces | Value

(Rupees) | Denomination | 2004-05 | 2005-06 | 2006-07 | 2004-05 | 2005-06 | 2006-07 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Rs.10 | 79 | 80 | 110 | 790 | 800 | 1,100 |

Rs.20 | 156 | 340 | 305 | 3,120 | 6,800 | 6,100 |

Rs.50 | 4,737 | 5,991 | 6,800 | 2,36,850 | 2,99,550 | 3,40,000 |

Rs.100 | 1,61,797 | 1,04,590 | 68,741 | 1,61,79,700 | 1,04,59,000 | 68,74,100 |

Rs.500 | 14,400 | 12,014 | 25,636 | 72,00,000 | 60,07,000 | 1,28,18,000 |

Rs.1000 | 759 | 902 | 3,151 | 7,59,000 | 9,02,000 | 31,51,000 |

Total | 1,81,928 | 1,23,917 | 1,04,743 | 2,43,79,460 | 1,76,75,150 | 2,31,90,300 |

Note: Data

are exclusive of the counterfeit notes seized by police and other enforcement

agencies. | Computerisation of Currency

Management

VII.18 The Reserve Bank has taken up the task of

putting in place an Integrated Computerised Currency Operations and Management

System (ICCOMS) in the Issue Departments in regional offices and in the central

office. The project also includes computerisation and networking of the currency

chests with the Reserve Bank's offices to facilitate prompt, efficient and error-free

reporting and accounting of the currency chest transactions and seamless flow

of information between Issue Departments and the Central Office in a secure manner

with proactive monitoring. All offices of the Reserve Bank commenced 'live-run'

on the Currency Chest Reporting System (CCRS) and the Chest Accounting Module

(CAM) of ICCOMS-ID component. Once these two components are completed, the Currency

Management Information System (CMIS) Module at the Department of Currency Management

(DCM) at the Central Office of the Reserve Bank will be taken up for implementation,

the testing for which has already begun.

Customer Service

VII.19 As a part of its efforts to improve customer service in matters

relating to issue/acceptance of coins from public and exchange of soiled and mutilated

banknotes, the Reserve Bank reiterated its directions to all scheduled commercial

banks to issue/ accept coins and soiled banknotes in transactions or for exchange

without any restriction. Offices where demand for coins has picked up were advised

to arrange for coin camps at identified locations in consultation with banks.

Efforts were continued to provide timely and efficient customer service not only

at the Reserve Bank offices but also at the bank branches.

ISO 9001:2000

Certification

VII.20 Apart from DCM, the two Issue offices at Kolkata

and Hyderabad were ISO (9001:2000) Certified in May 2006. Four more Issue offices,

viz., New Delhi, Jaipur, Chennai and Bangalore have been taken up for

ISO Certification.

Bharatiya Reserve Bank Note Mudran Pvt. Ltd.

VII.21 The Bharatiya Reserve Bank Note Mudran Pvt. Ltd. (BRBNMPL), incorporated

as a wholly owned subsidiary of the Reserve Bank, was set up in 1996 to take over

the work of the New Note Press project. The BRBNMPL prints Bank Note Forms at

its two note presses at Mysore (Karnataka) and Salboni (West Bengal). The total

supply of banknotes by BRBNMPL during 2006-07 was 6,830 million pieces.

Outlook

VII.22 The Reserve Bank would continue

to conduct its currency management operations with a view to ensuring efficient

customer service through an adequate supply of good quality banknotes and coins

in the country. The Reserve Bank will continue with its efforts to explore various

options for increasing the circulation life of banknotes. Rationalisation of systems

and procedures with a view to increasing the efficiency of operations and to strive

towards setting international benchmarks in currency management would also be

pursued. |