During the year, the Reserve Bank adopted innovative means of communication, virtual meetings, web-conferencing and social media in response to the logistical constraints imposed by the pandemic. Economic and statistical policy analysis and research were reoriented, and information management systems were fortified. In the international arena, India took over the Chair of the BRICS, completed the SAARCFINANCE Chair and co-chaired the G-20’s Framework Working Group (FWG). Effective cash management and sound management of foreign exchange reserves in pandemic conditions were concurrent priorities. Several legislative initiatives/ amendments were undertaken to ensure a sound and efficient financial system. X.1 In the wake of the pandemic, the Reserve Bank took recourse to virtual platforms to broaden its reach to the public. In spite of logistical challenges, relations with international organisations and multilateral bodies were further strengthened. With heightened precautionary demand for currency, concerted efforts were made to provide effective cash management services to central and state governments by integrating their systems with that of e-Kuber. Risk management practices for foreign exchange management were strengthened to counter pandemic induced volatility in global financial markets and asset prices. Policy-oriented research was undertaken, and the timely release of the flagship publications was ensured. The information management system was further strengthened through establishment of the Data Science Lab (DSL) and initiation of processes leading up to building a Public Credit Registry (PCR). A number of amendments to/introduction of legislations pertaining to the Reserve Bank of India Act and Banking Regulation Act were undertaken during the year. X.2 Against this backdrop, the rest of the chapter is structured into eight sections. The next section presents major initiatives of the Reserve Bank with regard to its communication strategy and processes. Section 3 discusses the Reserve Bank’s international relations, including with international organisations and multilateral bodies. Section 4 dwells on the activities of the Reserve Bank as a banker to governments and banks. Section 5 reviews the conduct of foreign exchange reserves management. Section 6 sets out research activities, including statutory reports and frontline research publications. Section 7 profiles the activities of the Department of Statistics and Information Management (DSIM). Section 8 presents the activities of the Legal Department. Concluding observations are given in the last section. 2. COMMUNICATION PROCESSES X.3 The functioning of the Department of Communication (DoC) is driven by two-way communication with the public, anchored by the objectives – transparency, clarity, precision, timeliness and credibility in the dissemination of the Reserve Bank policies. The strategic objectives of building the public confidence and anchoring their expectations, guided the dissemination of policy developments/initiatives and their rationale through multiple channels such as the Reserve Bank’s website, media interface, informal workshops, and social media. X.4 In the past, central banks around the world witnessed a significant shift in the nature and medium of their public communication. Since the 2008-09 global financial crisis (GFC), transparency, accountability and timely dissemination had become the hallmark of communication, which were put under test during the COVID-19 pandemic. Communications on financial stability are now an integral part of communications from the central banks both in normal and crisis time and they supplement monetary policy communications contributing to awareness of challenges that the central banks face and the strategy they adopt. Such communications bring in greater engagement of public and make it easier for central banks to achieve their goals. However, in times of crisis, such as the pandemic, these challenges became huge (Box X.1). Box X.1 Central Bank Communication during Pandemic Central banks use communication as an important tool to improve the effectiveness of their policies and regulations. The nature and channels of communication, which have been constantly evolving, underwent a major shift in the wake of the COVID-19 pandemic. Focus Areas As the successive shifts in economic condition were sudden, highly irregular and non-linear, the focus of central bank communication during the pandemic shifted to: (a) reinforcing the intent and rationale for multiple measures taken in the backdrop of pandemic; (b) providing some forward guidance on policy measures, especially when committed for an extended period; (c) giving reassurance on financial stability by providing real-time assessment to dispel any misgivings; (d) management of expectations of economic agents to contain any panic reaction, which may exacerbate the problem; (e) covering the range of markets and activities beyond the specified mandate to assure on coordinated approach by all public authorities; (f) sensitising the common citizens about the safeguards in digital banking as more people shifted to digital transactions; and (g) increased frequency of communication, in the face of heightened uncertainties. Central bank governors generally led from the front during the pandemic in announcing the measures with rationale, giving their assessment of economic conditions and building confidence on financial stability conditions, and simultaneously ensuring that the regular work of improving the resilience of the financial system also continues. In view of the COVID-19 related restrictions, direct communique from the highest level on digital platforms with members of public, market participants and other stakeholders became the mainstay. Almost all central banks communicated their commitment to support the process of economic revival, avoid any premature withdrawal of liquidity and avoid premature tightening of monetary policy. Stakeholders read the actions of the central banks from their communication, action and signals (Shaktikanta Das, 2021) Modes The channels of communication also underwent a change in the pandemic when structured communication was supplemented by informal, unstructured communication using non-traditional modes like social media platforms, layering of messaging customised to specific target groups and use of multimedia to reach out directly to the masses. Transparency, simplicity and proactiveness in communication reinforced trust and paid off during the peak of the crisis. The Reserve Bank took out regular public awareness campaigns through Twitter and Facebook and monitored the feedback on these campaigns. It has also created a Social Media Command Centre (SMCC) for social media monitoring and listening. Amidst the increasing reliance on work from home (WFH) environment, digital modes of communication got a fillip. Speaking engagements of central bank governors were seamlessly disseminated through livestreaming on social media. The trust in direct communication from major central banks on social media was reflected in an increase in their social media account followers. For example, the number of followers of Reserve Bank’s Twitter handle surpassed one million mark during this period. Many central banks joined international organisations in creating focused portals on COVID-19 resources, sharing of experiences, especially about the production and dissemination of regular releases. Checking Frauds and Disinformation As information technology platforms served well for supporting business continuity and smooth functioning during the COVID-19 related social restrictions, central banks impressed upon fortifying public confidence in digital banking to support the financial landscape. Central banks used their social media handles extensively for educating people on safe digital banking practices. These efforts came handy for financial education as mischiefs by certain fraudulent entities engaged in phishing, financial frauds and other cybercrimes surged during the lockdown. Rising episodes of disinformation and rumours on social media platforms about financial entities as well as nature of transactions like the link between banknotes and coronavirus were quelled by central bank’s campaigns. Some of them issued statements in March 2020 focusing on three messages: (i) banknotes do not pose a particular risk of infection, (ii) the cash supply is secure, and (iii) retailers should continue to accept cash. Listening As flow of detailed economic data suffered during the pandemic, a quick and realistic assessment of pressure points was warranted. Subsequently, central banks supplemented their regular information flow by seeking public perception and directly listening to representatives of the public. Direct communication from the central bank struck the right chord with people and helped in upholding trust and ensuring credibility during the pandemic. The Reserve Bank took out regular public awareness campaigns through Twitter and Facebook and monitored the feedback on these campaigns. Key Takeaway Thus, as central banks across countries responded unprecedently to mitigate the impact of the COVID-19 pandemic, direct and more frequent communication paid off and helped in supporting the measures to dampen the adverse impact and stabilise the markets in highly uncertain times. Reference: Shaktikanta Das, Governor, Reserve Bank of India in an interview with the Times of India, March 8, 2021. | X.5 Given the multiple equilibria that prevail in the market, it is not only important to make public aware of the facts but also to guard against any miscommunications that result in self-fulfilling prophecies that lead to inferior equilibriums. Confidence needs to be restored so that expectations stabilise. These considerations guided the overall communication policy of the Reserve Bank during 2020-21, which was characterised by vulnerable, uncertain, complex and ambiguous (VUCA) times. In pursuit of this objective, the Reserve Bank deployed technology and social media to the forefront in the communication strategy. X.6 The Department, therefore, disseminated the Reserve Bank’s policies through website and social media; enhanced awareness about the Reserve Bank’s policies through need-based formal and informal virtual media workshops; and deepened its engagement with the multi-lingual and multi-cultural society. This was facilitated by widening the reach of the public awareness efforts through use of vernacular languages for the social media campaigns; and by remaining connected with the regional media to facilitate informed reporting, with the underlying objective of ensuring greater transparency and building accountability and credibility among the members of public for their better understanding. This in turn, helped in demystifying the rationale for central bank’s mandate, governance, policies, operations and outcomes, thus reducing the uncertainty and facilitating a public dialogue that could anchor expectations and foster better policies. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.7 Last year, the Department had set out the following goals under Utkarsh: -

Conduct workshops/sessions for the media on important regulatory and banking related issues (Para X.8); -

Deepen its engagement with the society through public awareness programmes and social media presence (Para X.9 - X.12); and -

In line with international experience, efforts will be made to create a ‘Social Media Command Centre’ for social media monitoring and listening (Para X.13). Implementation Status of Goals Communication Policy X.8 The Reserve Bank’s communication policy was updated to embrace the technological advancements, changes in modes of communication and other developments. The updated policy includes the objectives, target audience, channels and tools of communication policy and operational practices, and subsumes the guidelines for regional level communication. Though the social distancing norms impacted some activities, the Department resorted to virtual and physical workshops for media during January-February 2021 and conducted informal briefings through the year. Target-specific Communication X.9 Tailored communication was initiated with an objective to reach out to different age / interest groups. For instance, separate tab was created on the home page of the Reserve Bank’s website for ease of access to all COVID-19 related measures undertaken by the Reserve Bank. Tailored communication of public interest was released through social media and placed under the 'RBI Kehta Hai’ page of the Reserve Bank’s website and YouTube channel. RBI Website 2.0 X.10 During the year 2020-21, the work on development of a redesigned Reserve Bank’s website for more effective and engaging communication with all stakeholders through best in class digital experience platform (DXP) was undertaken. Dissemination through Social Media X.11 As organisations moved towards digital communication and online work environment in a big way with the onset of the pandemic, social media became a major mode of communication. Accordingly, the number of followers of the Reserve Bank’s Twitter handle @RBI surpassed the one million mark touching 1.15 million as on March 31, 2021, signifying the largest following among the central banks of the world. The Reserve Bank’s YouTube channel, which was widely used for telecasting live monetary policy announcements, publishing speeches and interviews of the Reserve Bank’s top management, and financial education, had over 76,100 subscribers as on March 31, 2021. Enhancing Public Awareness Outreach using Social Media Platforms X.12 As digital transactions increased manifold in the COVID-19 period, the need for increasing financial literacy and spreading awareness among people on various aspects like digital banking, nomination facility, facilities for senior citizens and cyber security was felt. During the year, the Reserve Bank actively used its second Twitter handle and Facebook page @RBIsays to ensure wider dissemination of public awareness messages in Hindi, English and eleven regional languages. New social media creatives on public awareness were put out at least once every month during 2020-21. The 'RBI Kehta Hai’ microsite is regularly updated with material on public awareness campaigns as and when they are released via television, newspapers, digital and social media platforms (Tables X.1 - X.3). Further, the microsite was revamped to give it an interesting look and structure the content in an easy to access manner. Table X.1: List of Themes for Public Awareness Campaigns | | Period | Campaign | | October - November 2020 | 1. Nomination and settlement facility - newspapers, TV, radio, hoardings, websites, and SMS. | | December 2020 - January 2021 | 2. Safe digital banking (cyber security) - newspapers, TV, radio, hoardings, and websites. | | February 2021 | 3. Release of e-posters and audio-visual spots in TV and radio during the financial literacy week 2021, on three themes, viz., (i) timely repayment and building credit history, (ii) borrowing from formal institutions only, and (iii) responsible borrowing. | | March 2021 | 4. A multi-media campaign on convenience of digital banking - newspapers, TV, radio, hoardings, cinema theatres, websites, and SMS. | | | 5. A campaign on safe digital banking – cyber security during the digital payments awareness week, in print, digital, and hoarding. | | | 6. A campaign on setting limits on cards on TV and radio. |

| Table X.2: Release on Social Media | | Period | Messages/Posts | | July 2020 | 1. Graphics Interchange Formats (GIFs) in 13 languages on safe digital transaction - Identity theft. | | | 2. GIFs in 13 languages on safe digital transaction - Not to respond to unsolicited calls/links. | | | 3. GIFs in 13 languages on safe digital transaction - UPI based payment links. | | | 4. GIFs in 13 languages on safe digital transaction – Prevent Installation of malicious apps. | | August 2020 | 5. GIFs in 13 languages on safe digital transaction – not to share personal details over phone/email/SMS. | | | 6. Post on highlights of bi-monthly monetary policy announcement by the Reserve Bank Governor. | | | 7. Post on celebrating independence by transacting safely from home. | | September 2020 | 8. Caution post regarding safe digital transactions - not to share card credentials. | | | 9. Caution post regarding safe digital transactions - using secure websites for online transactions. | | | 10. Post on customer’s limited liability in case of fraudulent transaction in account. | | | 11. Awareness messages for public on various themes with Shri Amitabh Bachchan, Brand Ambassador. | | October 2020 | 12. Awareness messages on various themes in 13 languages with Shri Amitabh Bachchan. | | November 2020 | 13. Two posters on nomination and settlement facility. | | December 2020 | 14. Social media post on highlights of monetary policy announcement by the Reserve Bank Governor. | | | 15. Social media caution post against unauthorised digital lending platforms/mobile apps. | | | 16. Twitter poll followed by Twitter and Facebook (FB) post in 13 languages on the theme - timely repayment of loan instalments. | | January 2021 | 17. Twitter poll followed by Twitter and FB post in 13 languages on the themes - nomination and settlement facility, fictitious offers, limited liability and setting limits. | | February 2021 | 18. Social media post on highlights of monetary policy announcement by the Reserve Bank Governor. | | | 19. Financial literacy week posters and video links on the themes – credit from formal sources, responsible borrowing, and timely repayment. | | March 2021 | 20. Release of a video on cyber security on Twitter and FB. | | | 21. Twitter poll followed by Twitter and FB post in thirteen languages on each of the three themes - risk vs returns, complaining on Sachet Portal, notifying the bank in case of card getting compromised/stolen, and registering mobile number and email with bank. | | | 22. Post on Twitter and FB about the temporary exhibition on Indian banknotes at the RBI Museum, Kolkata. |

| Table X.3: List of High Impact Programmes | | Channels | Duration | | 1. Doordarshan and All India Radio | October 2020 - March 2021 | | 2. Kaun Banega Crorepati (KBC) 2020 | September 2020 - December 2020 | | 3. Indian Premier League 2020 | September 2020 - November 2020 | | 4. India-Australia Cricket Series 2020 | November 2020 - January 2021 | | 5. India-England Cricket Series 2021 | March 2021 | X.13 The Reserve Bank created a Social Media Command Centre (SMCC) for social media monitoring and listening. Other Initiatives X.14 Extensive efforts were made to collaborate with fact-checking portals, social media handles of the central government, among others, to highlight proper perspective and understanding of topical issues and to obviate any misinformation regarding banking, certain financial entities, the Reserve Bank’s measures and other issues of interest. The RBI Museum X.15 The RBI Museum located at Kolkata tells the stories of money, gold and the genesis of the Reserve Bank through its artefacts, exhibits, technology and games. The Museum was reopened on January 18, 2021 after being closed for visitors during a major part of the year owing to COVID-19 pandemic. Efforts are underway to enable a virtual tour of the Reserve Bank Museum for those who are unable to visit the Museum in person. During the year, the Reserve Bank launched its second Facebook page under the title @therbimuseum to ensure wider dissemination of information related to the Reserve Bank, the Indian economy, the Reserve Bank Museum as well as financial literacy messages to the public. Agenda for 2021-22 X.16 During 2021-22, the Reserve Bank’s communication channels would be further strengthened, and efforts will be made towards the following goals under Utkarsh: -

To open for public a new section of the Reserve Bank Museum, which will be dedicated to the functions and working of the Reserve Bank; -

To revamp the Reserve Bank’s website with improved information architecture; -

To continue to conduct virtual/physical workshops/ sessions for the regional media on important regulatory and banking related issues; and -

To use public awareness programmes, social media presence and other channels of communication to further deepen engagement with the society. 3. INTERNATIONAL RELATIONS X.17 Despite challenges posed by the pandemic during 2020-21, the Reserve Bank further strengthened economic and financial relations, particularly with international organisations (IOs) and multilateral entities. The International Department (ID) engaged in steering several bilateral and multilateral dialogues through virtual means. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.18 The Department had set out the following goals for the year 2020-21: -

Follow up on issues relating to the international financial architecture (IFA), including the 16th General Review of Quotas (GRQ), Bilateral Borrowing Agreements (BBAs) and New Arrangements to Borrow (NAB) of the IMF (Utkarsh) [Para X.19 - X.20]; -

Article IV consultations with the IMF (Utkarsh) [Para X.21]; -

Completion of its activities as the SAARCFINANCE Chair, including swap support, capacity building, and joint research (Utkarsh) [Para X.22 - X.24]; -

Strengthening cooperation amongst the BRICS central banks through the BRICS Bond Fund (BBF), the Contingent Reserve Arrangement (CRA) and other initiatives, with India taking over the BRICS Chair in 2021 (Utkarsh) [Para X.25 - X.26]; -

Intensification of engagement with the G20 in the run-up to taking over the Presidency in 2023 (Para X.27); and -

Providing inputs for activities relating to Governors’ bi-monthly BIS Board and other meetings, meetings of the Committee on the Global Financial System (CGFS), and the Financial Stability Board (FSB) [Para X.28 - X.30]; Implementation Status of Goals IMF and IFA Related Issues X.19 The Department participated in the meetings of the G20 International Financial Architecture Working Group (IFA WG), and provided inputs on capital flows to the emerging markets and developing economies (EMDEs) and on the issues relating to the global financial safety net. X.20 The Department provided inputs to Reserve Bank management during the Annual Fund-Bank meetings held virtually in October 2020 on the early warning exercise; global policy agenda; IMF governance reforms; doubling of NAB; extension of 2016 Note Purchase Agreement (NPA) by one year; and India’s participation in the 2020 NPA. X.21 In view of the pandemic, the Article IV engagement with the IMF was deferred. However, the Department hosted an IMF staff visit held in the virtual format. The IMF Article IV consultations, a surveillance exercise under the IMF’s Articles of Agreement, is now likely to take place in July 2021. Other contributions of the Department included provision of inputs for the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER), and its participation in Macroprudential Policy Survey and other IMF and World Bank surveys. BRICS, SAARC and Bilateral Cooperation X.22 In its capacity as the SAARCFINANCE (SF) Chair, the Reserve Bank undertook various initiatives (Box X.2). The 40th and the 41st SAARCFINANCE Governors’ Group Meetings (SFGGMs) were organised in November 2020 and March 2021, respectively, in a virtual format, with the inauguration of the SAARCFINANCE Sync, a closed user group secure communication portal amongst SAARC central banks. X.23 The Reserve Bank organised two virtual webinars on ‘Artificial Intelligence and Central Banking’, and ‘The Promise of FinTech: Financial Inclusion in the Post COVID-19 Era’. The annual SF database (SFDB) Working Group meeting in July 2020 focused on improving the quality of the database and supporting research. Efforts were made to identify and close data gaps in the SF database during its technical meetings. X.24 Under the capacity building initiative, the SF scholarship for 2021 was offered to four officials, including officials from the Ministry of Finance, Afghanistan; the Bangladesh Bank; the Maldives Monetary Authority and the Nepal Rastra Bank to pursue doctoral studies in India. The Reserve Bank shared technical know-how with officials from central banks of Sri Lanka, Nepal and Bhutan on ‘data compilation and analysis during COVID-19 pandemic’ in January 2021. Papers covering areas of SupTech, retail payments, cyber security, data and consumer protection, prepared by the Reserve Bank, were circulated to SAARC central banks in February 2021. The SF collaborative study on ‘comparison of financial sector regulatory regimes’, co-led by Sri Lanka and India, was presented at the 41st SFGGM in March 2021. Box X.2 SAARCFINANCE and RBI Initiatives The SAARCFINANCE (SF) is a network of central bank Governors of the SAARC region, which was instituted on September 9, 1998, with a view to establishing dialogue on macroeconomic policies of the region and sharing mutual experiences and ideas. The Reserve Bank of India’s SF Chair from October 2019 to October 2020 was extended till March 2021 because of the COVID-19 pandemic. A key deliverable completed during the year was the development of the SAARCFINANCE Sync (SF Sync) with the following features: -

It will track the developments under the various SF initiatives; -

The logistics support, conduct of events, seminars, and meetings will be co-ordinated through this portal; -

The portal will enable researchers to share not only documents but also actively engage in real time dialogues on collaborative studies; and -

The data and document repository section will build the archives in the SF Sync. Two new initiatives were operationalised by the Reserve Bank. First, the ‘Directory of the Retired Resource Persons’ was launched, which offers a pool of experts on 14 central bank activities including monetary policy; macro-economic research; financial inclusion; and payment systems. Second, the financial inclusion platform was created as a repository of information on financial inclusion and literacy initiatives in the SAARC countries, which will develop a knowledge network in the area. A revised Framework of Currency Swap Arrangement for SAARC countries 2019-22 was put in place. Swap support was provided to Bhutan, Maldives and Sri Lanka, amounting to an aggregate of USD 1 billion since February 2020. The Reserve Bank is leading a joint SF collaborative study on FinTech and financial Inclusion. The maiden issue of the annual SF e-Newsletter was released in March 2021. The focus area of the RBI Chair was the use of technology in central banking functions. The Reserve Bank’s SF Chair culminated in the SF Governors’ Symposium on March 2, 2021 with a keynote session on ‘SupTech use in central banks’ and a panel discussion on ‘Cyber security in central banks’ (Chart 1). | X.25 During the period under review, the BRICS central banks successfully conducted the third BRICS CRA test run. This has further enhanced the operational readiness of the CRA. To augment the analytical capacity under the CRA, the BRICS central banks produced the BRICS Economic Bulletin in 2020, an annual document. The operational and governance aspects of the BBF were mapped and efforts were made to take the initiative forward. Co-operation on information security and payment systems among the BRICS members was fostered by the BRICS Rapid Information Security Channel (BRISC) and BRICS Payments Task Force (BPTF), respectively. X.26 India took over the BRICS Chair on January 1, 2021. Under the various BRICS workstreams, 16 meetings of the technical groups were held from January to March 2021. The first BRICS Deputies meeting and the BRICS CRA Standing Committee meeting were held in February and March 2021, respectively. G20 and its Working Groups X.27 Indian G20 Presidency has been postponed to 2023 in agreement with other G20 members. The Department provided inputs for the virtual G20 Finance Ministers and Central Banks' Governors (FMCBG), and Finance and Central Bank Deputies’ (FCBD) meetings. The Reserve Bank also participated in the meetings of G20 Framework Working Group (FWG) and its other focus groups, Infrastructure Working Group (IWG), and Global Partnership on Financial Inclusion (GPFI). The G20 Italian Presidency has converted the earlier Sustainable Finance Study Group into Sustainable Finance Working Group (SFWG) as part of its focus on Green Agenda. The Government of India (GoI) and the Reserve Bank are both represented on the SFWG. BIS Activities X.28 The Department continued to provide support and analytical inputs to top management on a host of cross-cutting thematic issues discussed at the Bank for International Settlements (BIS) bi-monthly meetings, especially on COVID-19 induced policy responses and medium-term challenges for the EMDEs. The Department also made contributions and provided support to top management for various other meetings of BIS committees, especially the CGFS. FSB Initiatives on Global Financial Regulation X.29 The Financial Stability Board (FSB) is responsible for promoting international financial stability through assessment of vulnerabilities affecting the global financial system. The Department provided inputs for formulating India’s stance in the FSB on issues relating to the global financial system and associated risks to financial stability. X.30 The Department organised the second conference of the FSB’s Regional Consultative Group (RCG) for Asia, with India as its co-chair. It acted as a nodal agency for the FSB for sharing of information on policy responses to the pandemic by India. The Department also contributed to the FSB’s ongoing evaluation of the effects of ‘too-big-to-fail’ (TBTF) reforms and coordinated furnishing of data for the FSB’s annual monitoring exercise to assess global trends and risks from non-bank financial intermediation and provided inputs in surveys steered by the FSB on LIBOR transition, crisis preparedness, and implementation of reforms in OTC derivatives. Other Activities X.31 The seventh review of the trade policies and practices of India under the aegis of the WTO was conducted in January 2021. The Department actively participated in the Trade Policy Review (TPR) mechanism of the WTO by providing timely responses to the questions raised by member countries on India’s Secretariat Report (SR) and Government Report (GR). It also worked closely with the World Bank Finance, Competitiveness and Innovation (FCI) Global Practice team. X.32 The Reserve Bank continued its active engagement with the IMF’s South Asia Regional Training and Technical Assistance Centre (SARTTAC) and the South East Asian Central Banks (SEACEN) Centre. Several of its officers participated in the webinars/training courses organised by the SEACEN and the SARTTAC during July 2020 to March 2021. The Reserve Bank was also represented at the Mid-Year Steering Committee meeting of the SARTTAC held virtually on January 19, 2021. The Reserve Bank continued to extend support for the research initiatives of the G24 and G30. X.33 Biannual consultation under the bilateral swap arrangement (BSA) between India and Japan was held in October 2020. The second annual Senior Level Dialogue (SLD) between the Bank of Japan (BoJ) and the Reserve Bank of India was held in November 2020, focusing on economic and financial market conditions as also retail payment services. Agenda for 2021-22 X.34 In 2021-22, the Department will focus on the following: -

Follow up on issues relating to the IFA WG, including the 16th GRQ, Bilateral Borrowing Agreement (BBA) and New Arrangements to Borrow (NAB) of the IMF (Utkarsh); -

Successful completion of the IMF Article IV surveillance by the IMF Mission to India (Utkarsh); -

Continue to support the SAARC countries through the swap facility (Utkarsh); -

Continue to deliver under various initiatives including BBF, CRA and BRISC under the BRICS Chair (Utkarsh); and -

Strengthen its engagement with the G20 in the run-up to taking over the Presidency in 2023. 4. GOVERNMENT AND BANK ACCOUNTS X.35 The Department of Government and Bank Accounts (DGBA) oversees the functions of the Reserve Bank as banker to banks and banker to governments, besides formulating internal accounting policies of the Reserve Bank. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.36 Last year, the Department had set out the following goals under Utkarsh: -

Integrating the central government’s systems with Reserve Bank’s core banking solution – e-Kuber – for direct collection of their e-receipts and making e-payments (Para X.37 - X.38); -

Integrating remaining state governments’ systems with e-Kuber (Para X.39); -

Putting in place an efficient reporting system for Non-GST transactions (Para X.40); -

Putting in place dashboard for government transactions (Para X.41); and -

Integrating remaining state governments for online memorandum of error (MoE) resolution process for reconciliation of GST transactions (Para X.42). Implementation Status of Goals Integrating the Central Government’s Systems with e-Kuber for Direct Collection of their e-Receipts and Making e-Payments X.37 Collection of central government taxes such as customs, integrated goods and services tax (IGST), and compensation cess directly into the government accounts with the Reserve Bank through NEFT/RTGS payment modes was enabled through integration of Indian Customs Electronic Gateway (ICEGATE) system of Central Board of Indirect Taxes and Customs (CBIC) with e-Kuber. This is in addition to the central excise and service tax, which are being collected through this mode since July 1, 2019. X.38 The Treasury Single Account (TSA) system for e-payment by central government autonomous bodies was operationalised for a total of 16 autonomous bodies and their sub-autonomous bodies through leveraging on the existing integration of Public Financial Management System (PFMS) with e-Kuber (Box X.3). The Office of Controller General of Defence Accounts was on-boarded to e-Kuber for making pension payments of defence pensioners using NEFT/RTGS by way of integration of the SPARSH [System of Pension Administration (Raksha)] system with e-Kuber. Box X.3 Treasury Single Account System for e-Payment by Central Government Autonomous Bodies Based on the announcement made in the Union Budget 2014-15, the Government of India (GoI) had set up the Expenditure Management Commission (EMC) to look into various aspects of expenditure reforms to be undertaken by the government. The EMC, headed by Dr. Bimal Jalan, former Governor of the Reserve Bank, recommended inter-alia, that the GoI may gradually bring all autonomous bodies (ABs) under the TSA System in order to minimise the cost of government borrowings and to enhance efficiency in fund flows to ABs. The TSA system for ABs is intended to avoid keeping government funds idle in the bank accounts and to manage the cash flow of the government efficiently. The ‘just-in-time’ principle for release of funds enhances the efficiency of fund flows to ABs under the TSA system, while ensuring better cash management as it facilitates drawdown of funds from government account as and when required, and also helps in avoiding accumulation of unutilised grants with ABs, thereby decreasing the cost on borrowed funds. The TSA framework was operationalised by the GoI, in consultation with the Reserve Bank, leveraging on the integration of Public Financial Management System (PFMS) of Office of Controller General of Accounts and e-Kuber system of the Reserve Bank. The important features under the TSA system are as under: -

The Reserve Bank functions as primary banker to the concerned Ministries/Departments without involvement of any agency bank; -

The ABs and sub-ABs are required to open ‘assignment accounts’ with the Reserve Bank and expenditure from these accounts is incurred subject to the availability of limits; -

These accounts of AB and sub-ABs are treated as government accounts by tagging them to the respective ministry/department of GoI and transactions (debits/ credits) are automatically included in the calculation of GoI cash position; -

All transactions in the accounts of ABs and sub- ABs, including assignment of limits and processing of e-payments to the ultimate beneficiary, are processed through PFMS – e-Kuber integration; -

The limits assigned to ABs and sub-ABs can be changed (added or withdrawn) dynamically. Successful processing of e-payment instructions reduces the available assignment limit and returns, if any, add to the assignment limit to that extent in the books of the Reserve Bank; -

All assignment limits expire at the end of the financial year; and -

All the payments are made only through electronic modes and there are no physical payments from the account of the ABs maintained with the Reserve Bank. Necessary notifications at specified intervals are sent by e-Kuber to PFMS electronically. The Department of Economic Affairs, Ministry of Finance, issued an Office Memorandum dated May 12, 2020 to expand the TSA system in two phases effective from August 1, 2020 and October 1, 2020 to bring more ABs and their sub-ABs under the ambit of TSA. Currently, a total of 16 ABs, along with nearly 900 sub-ABs are onboarded for TSA system. Since the implementation of phase I on August 1, 2020 till March 31, 2021, a net amount of ₹32,325 crore has been assigned as limit by the GoI and ₹31,351 crore has been spent by ABs/sub-ABs. Going forward, considering its benefits, the TSA system may expand in terms of number of entities as well as coverage of various types of payments, including payments from different ministries/departments to a particular AB/sub-AB and its accounting and processing thereof. A TSA Helpdesk has also been put in place by the Reserve Bank with a view to ensure timely redressal of technical and operational issues. Source: RBI. | Integrating Remaining State Governments’ Systems with e-Kuber X.39 During the year, while one state government from the North East and one union territory were newly on-boarded for e-payments, two state governments have taken up testing and are expected to be soon on-boarded to e-Kuber for e-payments. Two other state governments have expressed willingness and are examining the technical requirements for integration. Putting in Place an Efficient Reporting System for Non-GST Transactions X.40 A system of automated dispatch of standardised system generated reports was put in place for the state governments that are already integrated with e-Kuber. Regional offices of the Reserve Bank were provided necessary facility to monitor the status of transactions of respective governments integrated with the Reserve Bank’s e-Kuber. Putting in Place Dashboard for Government Transactions X.41 The process for putting in place a dashboard facility to governments, which are integrated with e-Kuber, was commenced but is yet to be completed due to COVID-19 related lockdown issues. Integrating Remaining State Governments for Online Memorandum of Error (MoE) Resolution Process for Reconciliation of GST Transactions X.42 During the year, the online MoE process was extended to seven state governments for reconciliation of GST transactions. While three state governments have completed the testing and are expected to go live shortly, eleven more state governments are in various stages of testing. Other Initiatives X.43 Several areas were identified to bring in improvements in processing, reconciliation and reporting of government transactions including Application Programming Interface (API) web-based reconciliation system, providing reports and management information system (MIS) in machine consumable formats and enabling reporting by agency banks of electronic receipt collection using new payment modes. X.44 The work related to integration of all stakeholder systems with e-Kuber for facilitating collection of direct taxes through Tax Information Network 2.0; enabling payment of pension to defence pensioners residing in Nepal; provision of account validation; and Aadhaar-based payments were also taken up during the year. X.45 Necessary arrangements were made in the case of newly formed union territory (UT) of Ladakh as well as the merged UTs of Dadra & Nagar Haveli and Daman & Diu to facilitate smooth transition of accounting ownership at government level. Agenda for 2021-22 X.46 For 2021-22, the Department proposes the following agenda under Utkarsh: -

Pursuing the on-going agenda of integration of central and state government systems with e-Kuber for e-payments and e-receipts; -

Providing dashboard facility to governments for self-monitoring of e-receipts and e-payments transactions; -

Automation of daily position processing of government balances in e-Kuber; and -

Putting in place an automated process of agency commission calculation and payment to agency banks. 5. MANAGING FOREIGN EXCHANGE RESERVES X.47 The Department of External Investments and Operations (DEIO) continued with the investment objectives of safety, liquidity and return in that order for managing foreign exchange reserves (FER). On a year-on-year basis FER increased by 20.8 per cent in March 2021 as against an increase of 15.7 per cent in the corresponding period of the previous year. X.48 The negative/low interest rate environment, which is expected to persist in the times to come, is posing challenges to the central banks across the globe, for effectively managing FER without compromising the strategic objectives of deployment of FER (Box X.4). Box X.4 Challenges to Forex Reserves Management in a Low Yield Environment Interest rates in most advanced economies have been on a declining trend over the last four decades and reached their historic low in many countries in 2020 (Chart 1). The 10-year bond yields in USA have fallen from the high of 15.8 per cent in 1981 to below 1 per cent in 2020. Many advanced economies like Euro zone, Japan and Switzerland have had negative policy rates and sovereign bond yields for years now. This ultra-low for long interest rate environment is a reflection of structural changes in the global economy and financial markets, which can be better understood by decomposing nominal rates into two parts - real interest rates and inflation/ expected inflation. While real rates have been declining for the last few decades, low inflation has become a norm over the last decade, despite the efforts of many advanced economies’ central banks to lift inflation to their targets (Charts 2 and 3). The declining trend in real rates can be attributed to factors relating to decline in potential growth rates, demographic factors, income inequality, and demand for safer assets. The structural changes in these factors have led to decline in equilibrium real rates and they are expected to remain low in the medium to long term. Some of the reasons for the historically low inflation environment are: cross border supply-chain integrations, lower commodity prices, low wage growth, declining inflation expectations, and declining velocity of money.

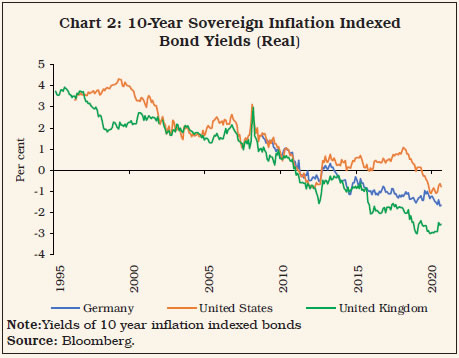

This low yield environment makes it an arduous task for asset managers in general and reserve managers in particular, to generate reasonable returns from their portfolios given their risk appetite. The huge and increasing pile of negative yielding debt across the developed world has accentuated this problem and presented challenges for capital preservation. This situation has been further exacerbated by the COVID-19 pandemic, which has resulted in major losses to the real economies across the world and led to unprecedented expansionary monetary and fiscal policies. The structural low yield environment is expected to persist for a considerable time in the future. Reserve managers, therefore, face the challenge of looking beyond the traditional approaches for the management of reserves to maintain and augment returns, but also evaluate if this could be accomplished by investment in safe assets as that is a necessary characteristic of reserve assets. Subject to safety, they can also explore increasing the duration of their portfolios, adopting asset diversification by investing in new asset classes, new currencies and markets, relaxation of credit quality requirements, and active management of their gold stocks. However, the optimum mix of reserve management strategies would have to consider the risk appetite, investment priorities, skill sets, and overall objectives of the reserve management. References: 1. Kiley, M. T. (2019), ‘The Global Equilibrium Real Interest Rate: Concepts, Estimates, and Challenges’, Finance and Economics Discussion Series, Federal Reserve Board, Washington, D.C. 2. Lane, Philip R. (2019), ‘Determinants of the Real Interest Rate’, Speech at the National Treasury Management Agency, Dublin, November 28. | X.49 The Reserve Bank continued to purchase gold as a diversification strategy while scaling up the forex swap and repo operations and exploring the possibilities of new products. During the COVID-19 pandemic led lockdown, the Department continued its normal activities and also ensured timely implementation of all best practices for FER management and enhancement of systems security as well as furthering existing business continuity arrangements. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.50 Last year, the Department had set out the following goals: -

An enhanced risk management framework (Utkarsh) [Para X.51]; -

Dedicated research inputs (Utkarsh) [Para X.52]; and -

Effective diversification of reserves through gainful deployment without compromising the safety of investments (Para X.53). Implementation Status of Goals X.51 During the year, the Department enhanced the quantitative approach for reviewing risk management framework for reserves management. Further, the existing risk management practices were constantly reviewed, especially in view of the evolving global macro-economic scenario overshadowed by the pandemic. X.52 An internal market research unit was structured for dedicated research input in the Department. X.53 Steps were taken for diversification of reserves by scaling up operations in forex swaps and repo markets, acquisition of gold and exploring new markets/products, while adhering to the safety and liquidity standards. Effective diversification of reserves through gainful deployment in existing currencies and products without compromising the safety of investments was ensured, especially in the low yielding interest environment. Agenda for 2021-22 X.54 For 2021-22, the Department will focus on the following goals: -

Continue to explore new asset classes, new jurisdictions/ markets for deployment of foreign currency assets (FCA) for portfolio diversification and in the process tap advice from external experts, if required; -

Leverage IT in the form of contemporary treasury management solution for FER management (Utkarsh); and -

Roll-out system based daily computation of weighted average cost for assets. 6. ECONOMIC AND POLICY RESEARCH X.55 As the knowledge centre and think-tank of the Reserve Bank, the Department of Economic andPolicy Research (DEPR)1 undertakes professional research with a view to providing analytical inputs and management information system (MIS) services for policy formulation. The Department generates primary data and is also the repository and disseminator of secondary data on the Indian economy. The Department is also responsible for the Reserve Bank’s statutory reports, frontline research publications, collaborative research with external experts and technical support to various operational departments and technical groups/ committees constituted by the Reserve Bank from time to time. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.56 Last year, the Department had set out the following goals: -

Alternative models for improving inflation and growth projections (Utkarsh) [Para X.57]; -

A study on municipal finances (Utkarsh) [Para X.57]; -

Release of data on bilateral trade in services (Utkarsh) [Para X.58]; -

Studies on spillover effects of non-deliverable forward (NDF) market on onshore forex market in India; rural-urban inflation dynamics; determinants of discretionary spending of states; and relationship between volatility index (VIX) and stock index (Para X.59); -

Revival of the Report on Currency and Finance with the theme “Reviewing the Monetary Policy Framework” (Para X.60); -

Release of the History of the Reserve Bank, Volume-5 for the period spanning 1997 to 2008 (Para X.61); -

Enabling public access to the Central Library’s digitised contents (Para X.62); -

Development of a document management software for management of digital records in the Archives (Para X.63); -

Tracking real time economic outlook/ sentiment based on machine learning tools (Utkarsh) [Para X.64]; -

In-depth micro-analysis of the impact of policy reforms, e.g., green finance in India (Utkarsh) [Para X.64]; and -

Deepening collaboration with other operational and research departments within the Reserve Bank as well as with outside scholars [Para X.64]. Implementation Status X.57 New models for forecasting inflation were developed, with one of them titled “An Alternative Measure of Economic Slack to Forecast Core Inflation”, being published in the RBI Occasional Papers. An extensive data collection exercise, based on budgetary data of more than 200 municipal corporations, is currently underway. X.58 Data on India’s bilateral trade in services on ultimate country basis (based on Foreign Exchange Transactions Electronics Reporting System) was shared with the Ministry of Commerce and Industry. X.59 During 2020-21, the Department published 60 research papers/articles, of which 22 were published outside the Reserve Bank in international and domestic journals. In addition, 12 working papers were posted on the website during the year. The published studies covered a wide range of issues, including trend inflation; price discrimination in over-the-counter currency derivatives; bank capital and monetary policy transmission; public debt sustainability; financial stress measurement; and combination of inflation forecasts. X.60 The Report on Currency and Finance with the theme of “Reviewing the Monetary Policy Framework” was released in February 2021. The Report addressed the issues of goals, processes, operating procedures and open economy dynamics under the flexible inflation targeting framework. X.61 The work relating to publication of the History of the Reserve Bank, Volume-5 for the period spanning 1997 to 2008 is nearing completion for its release during 2021-22. X.62 In order to ensure wider dissemination and easy access to the public, the Central Library uploaded digitised publications of the Reserve Bank, including Annual Reports, Bulletins and Staff Studies up to 1997 on the Reserve Bank’s website (www.rbi.org.in). X.63 The work of developing a document management software for storing, searching, retrieval and sharing of digitised documents available in the RBI Archives has been assigned to the Reserve Bank Information Technology Private Ltd. (ReBIT) and the work is in progress. X.64 A nowcasting model for GDP growth using machine learning tools (e.g., neural networks and random forest techniques) was presented in the monetary policy strategy (MPS) meetings of December 2020 and February 2021. An article on green finance in India was published in the Reserve Bank’s monthly bulletin of January 2021. The Department also collaborated both within and outside the Reserve Bank on several research projects, including over-the-counter currency derivatives, fiscal austerity in emerging market economies, and structural transformation of jobs from manufacturing to services. Other Initiatives X.65 During the year, the Department continued compilation and dissemination of primary statistics on monetary aggregates; balance of payments; external debt; effective exchange rates; combined government finances; household financial savings; and flow of funds on established timelines and quality standards. To deal with the post-COVID data gaps, new high frequency indicators of economic activity were combined with conventional indicators to generate alternative aggregate measures that helped assess the impact of the pandemic on the economy and also the pace of normalisation. X.66 The DEPR Study Circle, an in-house discussion forum, and the Central Library organised 44 online seminars / presentations / workshops during the year on diverse research themes. The Department also conducted online interviews for selecting candidates for the Scholarship Scheme for Faculty Members from academic institutions. Agenda for 2021-22 X.67 The Department’s agenda for 2021-22 will focus on the following goals: -

Increase in the number of research studies for publication in the Reserve Bank Occasional Papers and Working Papers (Utkarsh); -

Forward-looking agricultural commodity price sentiment analysis, based on newspaper coverage, through big data applications (Utkarsh); -

Development of an in-house expertise for data compilation under the KLEMS [capital (K), labour (L), energy (E), material (M) and services (S)] project; and -

Conduct of an Itinerant Exhibition on the first floor of the Reserve Bank Museum at Kolkata. 7. STATISTICS AND INFORMATION MANAGEMENT X.68 The Department of Statistics and Information Management (DSIM) aims to compile, analyse and disseminate macro-financial statistics and to provide statistical support and analytical inputs through data management, applied statistical research and forward-looking surveys to the Reserve Bank. In pursuit of these objectives, the DSIM maintains a centralised database for the Reserve Bank at par with international standards, manages the centralised submission of returns through the eXtensible Business Reporting Language (XBRL) platform, undertakes structured surveys relating to enterprises and households as inputs for monetary policy formulation and actively engages in statistical and analytical research. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.69 Last year, the Department had set out the following goals: -

To make Centralised Information Management System (CIMS) fully operational (Utkarsh) [Para X.70- X.71]; -

To set up advanced analytic environments in a Granular Data Access Lab (GDAL) and Data Science Lab (DSL) [Utkarsh] [Para X.70- X.71]; -

To establish an element-based repository in a phased manner following Statistical Data and Metadata eXchange (SDMX) standards, leading to operationalisation of a metadata driven data maintenance and dissemination system (Utkarsh) [Para X.70- X.71]; -

To develop an end-to-end system for a Public Credit Registry (PCR) (Utkarsh) [Para X.72]; -

To operationalise the DSL (Utkarsh) [Para X.73]; -

To undertake policy-related research in the areas of modelling, nowcasting and forecasting of macroeconomic indicators, including the use of web-crawling, artificial intelligence (AI), machine learning (ML), and big data analytics (Utkarsh) [Para X.73]; -

To develop a state-of-the-art single searchable Central Fraud Registry (CFR) portal for SCBs, UCBs and NBFCs to assist them in taking informed decisions on providing credit (Para X.74); and -

To extend the Consumer Confidence Survey (CCS) to all urban centres, analogous to the Inflation Expectations Survey of Households (IESH) (Para X.75). Implementation Status of Goals X.70 Under the Centralised Information Management System (CIMS) project, installation of IT infrastructure at the Reserve Bank’s data centres was completed with a delay due to COVID-19 related restrictions. The control and function specification documents were finalised and testing of system-to-system integration was successfully done with major banks. X.71 Data migration from the existing exploratory Hadoop environment to CIMS Hadoop environment was completed. X.72 Development of the Public Credit Registry (PCR) system was initiated. The draft PCR Bill was peer reviewed. X.73 The Data Science Lab (DSL) started its operations in January 2020 and has commenced working on data analytics projects for the Central Office Departments of the Reserve Bank using statistical and machine learning algorithms. Big data analytical tools were employed to extract relevant information from online print media for research activities relevant to the Bank, viz., media sentiment on macroeconomic parameters. X.74 A state-of-the-art common wireframe (prototype) has been developed for liberalised remittance scheme (LRS), central repository of information on large credit (CRILIC) and central fraud registry (CFR) under CIMS and is being refined. X.75 Pilot rounds of the Consumer Confidence Survey (CCS) are now being conducted in six cities (viz., Bhubaneshwar, Chandigarh, Jammu, Nagpur, Raipur and Ranchi) where the Inflation Expectations Survey of Households (IESH) is conducted. Other Initiatives X.76 Electronic Data Submission Portal (EDSP) was modified with enhanced security features for facilitating International Banking Statistics (IBS) data submission since June 2020. X.77 In view of COVID-19 related disruptions and risks involved in physical surveys, household surveys were conducted telephonically (Box X.5). The results of a forward looking quarterly ‘Bank Lending Survey (BLS)’ and ‘Services and Infrastructure Outlook Survey (SIOS)’ were disseminated under the guidance of the Bank’s Technical Advisory Committee on Surveys (TACS). X.78 Despite COVID-19 related disruptions, the Department brought out its regular publications, viz., Handbook of Statistics on the Indian Economy, 2019-20; Statistical Tables Relating to Banks in India, 2019-20; Basic Statistical Returns of SCBs in India (BSR1, BSR2 and BSR7); Weekly Statistical Supplement (WSS); and the ‘Current Statistics’ portion of the Reserve Bank’s Bulletin in a timely manner during the year. Agenda for 2021-22 X.79 Going ahead, the Department will focus on the following goals: -

Work towards making CIMS an advanced analytic environment fully operational and migrate all databases to the new centralised system (Utkarsh); -

Follow SDMX standards for metadata driven maintenance and dissemination system (Utkarsh); -

Implement a scalable end-to-end system for PCR in a phased manner starting with SCBs (Utkarsh); -

Revise the reporting systems for International Banking Statistics (IBS) as per the revised guidelines of the Bank for International Settlements (BIS); -

Expand the scope of data collection mechanism and analytical work in the domain of Big data for providing supplementary information relevant to the Reserve Bank; and -

Put in place a system to collect monthly data on economic classification of international credit/debit card transactions. Box X.5 Surveys during COVID-19 Pandemic According to a survey conducted by the United Nations Statistics Division (UNSD) and the World Bank, over 95 per cent of National Statistical Offices (NSOs) had partially or fully stopped face-to-face data collection in May 2020 (UN, 2021). Some national agencies witnessed major disruption in their regular surveys on household finance, travel and other domains. Many central banks grappled with these novel challenges by focusing on alternative data sources and tweaking of survey questionnaires during the lockdown period, however, many businesses could not be contacted, and the response rate of the Reserve Bank’s forward-looking enterprise surveys came down drastically (US, 2020). Regular survey rounds were supplemented by follow-up surveys in mid-March 2020. Also, given the unprecedented situation, the survey questionnaires included an additional block to assess the outlook on critical parameters for two more quarters (in addition to the current and the ensuing quarter). The Reserve Bank temporarily substituted its computer-aided personal interview (CAPI) based surveys of households with telephonic surveys to provide continuity and most of its training of reporting entities and investigators were also on online platforms (RBI, 2020). The proportion of interviews verified through audio and telephonic verification were increased to compensate for the inability to conduct on-spot verifications or field visits. After the lockdown related restrictions were eased, the reliance on telephonic channels in household surveys has been gradually reduced. References: 1. UN (2021), ‘Planning and Implementing Household Surveys under COVID-19’, Technical Guidance Note by the Inter-Secretariat Working Group, December 2020. 2. US (2020), ‘Monitoring the State of Statistical Operations under the COVID-19 Pandemic - Survey of National Statistical Offices’, May, July and October. 3. RBI (2020), ‘Results of Forward Looking Surveys’ (Bi-monthly Press Releases). | 8. LEGAL ISSUES X.80 The Legal Department is an advisory department established for examining and advising on legal issues, and for facilitating the management of litigation involving the Reserve Bank. The Department vets circulars, directions, regulations, and agreements for various departments of the Reserve Bank with a view to ensuring that the decisions of the Reserve Bank are legally sound. The Department provides the secretariat to the First Appellate Authority under the Right to Information Act and represents in the hearing of cases before the Central Information Commission, with the assistance of operational departments. The Department also extends legal support and advice to the Deposit Insurance and Credit Guarantee Corporation (DICGC), CAFRAL, and other RBI-owned institutions on legal issues, litigation and court matters. Agenda for 2020-21: Implementation Status Goals Set for 2020-21 X.81 Last year, the Department had set out the following goals for 2020-21: -

Automate its workflow process and function, which in turn will enhance research, e-discovery and data analytics (Utkarsh) [Para X.82]; -

Provide a guidance note for its Central Public Information Officers to discharge their functions more effectively and expeditiously, keeping in view the Department’s responsibilities as a secretariat to the Appellate Authority under the Right to Information Act (RTI Act), 2005 (Utkarsh) [Para X.83]; -

Proactively perform its functions in close coordination with the operational departments of the Reserve Bank [Para X.84 - X.86]; and -

Manage litigation on behalf of the Reserve Bank [Para X.87 - X.96]. Implementation Status of Goals X.82 The work relating to the development of a software package for automating the activities of the Department has been entrusted to the Reserve Bank Information Technology Private Ltd. (ReBIT). The modalities for development of the proposed software package were finalised and the statement of work (SoW) was also signed with ReBIT. Development of the software in this regard is currently under progress. X.83 The preparation of the guidance note for its central public information officers to discharge their functions under RTI Act, 2005 more effectively and expeditiously was completed during the year. X.84 Several important legislations/regulations concerning the financial sector were brought in/ amended during the year. The Banking Regulation (Amendment) Act, 2020 received the assent of the President of India on September 29, 2020. The Amendment Act was deemed to have come into force on June 26, 2020, except section 4, which, in so far as it relates to primary cooperative banks, be deemed to have come into force on June 29, 2020. Further, vide notification dated December 23, 2020, central government has announced April 1, 2021 as the date on which the provisions of section 4 of the Banking Regulation (Amendment) Act, 2020 shall come into force for state cooperative banks and central cooperative banks. X.85 The Bilateral Netting of Qualified Financial Contracts Act, 2020 received the assent of the President of India on September 28, 2020 and was brought into force with effect from October 1, 2020 with an objective to ensure financial stability and promote competitiveness in Indian financial markets, by providing enforceability of bilateral netting of qualified financial contracts and for matters connected therewith or incidental thereto. X.86 International Financial Services Centres Authority Act, 2019 was notified by the Government of India (GoI) vide its notification dated September 29, 2020. The effective date for the provisions of section 13 and section 33 of the said Act was fixed as October 1, 2020. The International Financial Services Centres Authority (IFSCA) notified the International Financial Services Centres Authority (Banking) Regulations, 2020 on November 18, 2020 for banking and investment activities in the International Financial Services Centres and adopted the directions/ circulars/guidelines issued by the Reserve Bank under Banking Regulation (BR) Act,1949; Reserve of India (RBI) Act, 1934 and FEMA, 1999 to be applicable for the banking units concerned. X.87 The Hon’ble Supreme Court vide order dated March 23, 2020 directed to take suomotu cognizance2 of the situation arising out of the challenge faced by the country on account of COVID-19 and the resultant difficulties that are faced by litigants across the country in filing proceedings within the period of limitation prescribed under the general law of limitation or under special laws. The Court also examined the extension of the period of validity of negotiable instruments such as cheques and bank drafts. Subsequently, the Court vide order dated July 10, 2020, observed that the period in respect of such negotiable instruments is prescribed by the Reserve Bank under Section 35A of the Banking Regulation Act,1949 and hence it would not be appropriate to interfere with the period, particularly, since the entire banking system functions on the basis of that period. X.88 A writ petition (Gajendra Sharma v. Union of India & Ors.) was filed under Article 32 of the Constitution of India before the Supreme Court against the Reserve Bank’s circular dated March 27, 2020 stating that it is ultra vires, to the extent it charges interest on the loan amount during the moratorium period. During the pendency of the petition, the central government granted various reliefs for benefit of waiver of interest up to ₹2 crore in eight categories and the Reserve Bank also issued a circular dated October 26, 2020 to all commercial banks, all primary cooperative banks and all-India financial institutions and all non-banking financial companies advising them to follow the scheme dated October 23, 2020 announced by the Government of India. The apex court then disposed of the petition vide order dated November 27, 2020. X.89 In a batch of petitions related to loan moratorium seeking extension of moratorium period and waiver of interest before the Hon’ble Supreme Court challenging the Reserve Bank’s circulars dated March 27, 2020 and August 6, 2020, the apex court vide interim order dated September 3, 2020 held that the accounts, which were not declared non-performing assets (NPA) till August 31, 2020, shall not be declared NPA till further orders. The apex court heard the matter on several dates and vide a final order dated March 23, 2021 disposed the matters stating that it cannot interfere with the economic policy decisions on the ground that either they are not sufficient or efficacious and/or some more reliefs should have been granted. However, with reference to the scheme for grant of ex-gratia payment of difference between compound interest and simple interest, the Court observed that there is no justification shown to restrict the relief of not charging interest on interest with respect to the loans up to ₹2 crore only and that too restricted to the categories specified therein. The Court granted relief in respect of charging of interest on interest/compound interest/penal interest for the period during the moratorium from any of the borrowers. X.90 In the case of Piyush Bokaria v. RBI, a writ petition was filed before the Madras High Court challenging the master circular on Basel III capital regulations issued by the Reserve Bank vide circular dated July 1, 2015. After hearing the submissions of the Reserve Bank, the Court vide its order dated September 30, 2020 upheld the validity of the said circular. X.91 In the matter of reconstruction of Yes Bank and write off of additional tier-1 bonds related cases, several writ petitions were filed before various High Courts challenging the decision of the Administrator of Yes Bank, to write down such bonds issued by the Yes Bank. As Yes Bank has already filed a Transfer Petition before the Supreme Court, the High Courts have adjourned the matters, pending the decision of the Supreme Court. X.92 The ‘Lakshmi Vilas Bank (LVB) Ltd. (Amalgamation with DBS Bank India Ltd.) Scheme, 2020’ issued vide notification dated 25 November 2020, was challenged through several petitions filed across various High Courts by the shareholders. As the Reserve Bank and DBS India Ltd. have filed Transfer Petitions before the Supreme Court, the High Courts have adjourned the matters. X.93 In the matter of Big Kanchipuram Cooperative Town Bank Ltd. v. Union of India & Another; and Vellur Cooperative Urban Bank Ltd. v. Union of India & Another, two writ petitions were filed before the Madras High Court challenging the constitutional validity of certain sections of the Banking Regulation Amendment Act, 2020. The Court vide interim order dated July 20, 2020 refused to stay the Act and the matter is pending for hearing. X.94 The Telangana High Court in its decision dated December 10, 2020 on the matter of Rajesh Agarwal vs RBI & Others held that the compliance with principles of natural justice has to be read into clause 8.9.4 and 8.9.5 of the Master Directions on classification and reporting of fraud by banks and select Financial Institutions (FIs), 2016. The petition was filed, inter alia, challenging the Reserve Bank’s Master Directions on fraud dated July 1, 2016 and also the action classifying the account as ‘fraud’ being violative of principles of natural justice. X.95 In the matter of Jeewan Holdings Private Ltd. & Another v. Union of India & Another, a petition was filed before High Court of Delhi challenging the order of the Appellate Authority (Ministry of Finance, Government of India), which upheld the decision of the Reserve Bank cancelling the Certificate of Registration (CoR) granted to the petitioner company along with the Reserve Bank’s order of cancellation. The Court in its judgement dated October 23, 2020 observed that the statutory framework does not mandate an opportunity of personal hearing. It was also held by the court that the respondents can claim no vested right to carry on business without complying with the condition of license or the directions issued by the Reserve Bank. X.96 In the case of Shakun Holdings Private Ltd. v. Union of India & Others, the High Court of Shimla in its judgement dated July 22, 2020 observed that the cancellation of CoR for non-achievement of net owned fund (NoF) was proper and dismissed the petition of the applicant. Agenda for 2021-22 X.97 In 2021-22, the Department will continue to focus on the following goals: -

Proactively perform its functions in close coordination with the operational departments of the Reserve Bank; and -

Take efforts to automate its workflow process and function, keeping in view the importance of use of technology in legal operations, particularly, in a situation like COVID-19 pandemic. 9. CONCLUSION X.98 During the year gone by with the challenging macroeconomic environment along with severe threat to human lives and livelihood, the Reserve Bank undertook a host of conventional and unconventional policy measures to deal with the pandemic-induced situation, which fostered congenial financing conditions in the economy without jeopardising financial stability. Further, forward guidance gained prominence in the Reserve Bank’s communication strategy to realise cooperative outcomes. Going ahead, the major focus of the Reserve Bank in the functional areas covered in the chapter will be as follows: further strengthening communication channels and economic and financial international relations; automating daily position processing of government balances in e-Kuber; continuing to explore portfolio diversification through new asset classes/markets for forex reserve management; sharpening economic and statistical policy analysis and research; making CIMS fully operational; rolling out PCR in a phased manner; and expanding the scope of data collection mechanism and analytical work in the domain of big data.

|