The Reserve Bank developed and strengthened various segments of the financial markets by broadening participation, easing access and transaction norms, improving financial market infrastructure and pursuing rigorous surveillance to maintain market integrity. Management of liquidity conditions, accordingly, became a dominant objective during the year. The Reserve Bank used several unconventional instruments such as forex swaps, long-term repo, targeted long-term repo, short-term forex swaps and variable rate reverse repo. Several measures were undertaken during the year to streamline regulations relating to the foreign exchange markets to align them with the current business and economic environment. V.1 During 2019-20, the Reserve Bank undertook several measures to develop the financial markets further in terms of broadening the participation base in various segments of the markets, easing access and transaction norms, expanding the range of financial products, simplifying procedures and improving financial market infrastructure, while maintaining rigorous surveillance to ensure market integrity. The Reserve Bank’s liquidity management operations, in rupees and forex, were stepped up and unconventional instruments were also deployed to ensure adequate liquidity, the normal functioning of markets and the stability of the financial system in the face of the dislocation caused by COVID-19. V.2 Against this backdrop, section 2 covers the measures undertaken to develop the financial markets. Section 3 presents liquidity management and foreign exchange market operations. Section 4 covers various initiatives undertaken to facilitate trade and payments while promoting orderly development of the foreign exchange market. The agenda for 2020-21 has been covered in each section. The chapter ends with conclusion. 2. FINANCIAL MARKETS REGULATION DEPARTMENT (FMRD) V.3 The FMRD is entrusted with the development, regulation and surveillance of money, government securities (G-secs), foreign exchange and related derivatives markets. The Department undertook several measures in pursuance of this mandate to fulfil the objectives set for 2019-20. Agenda for 2019-20: Implementation Status Goals Set for 2019-20 V.4 The Department had set out the following goals for 2019-20: -

To develop an IT-enabled Integrated Market Surveillance System (IMSS) for augmenting the surveillance capacities (Utkarsh) [Para V.5]; -

To implement international settlement of central government securities through International Central Securities Depositories (ICSDs) to permit non-resident clients of ICSDs to transact in central government securities offshore (Para V.6); and -

Review and implementation of various financial market timings as recommended by the Internal Group set up in August 2018 (Para V.7). Implementation Status of Goals V.5 The Department is in the process of implementation of the Integrated Market Surveillance System. Expression of Interest (EoI) have been obtained from the interested vendors. Based on the evaluation of EoI, the Department shall be issuing the Request for Proposal (RFP) by end of August 2020. V.6 As regards the implementation of international settlement of Indian G-sec through ICSDs, the draft scheme has been finalised in consultation with the government. There are, however, certain tax issues which have been referred to the government. Meanwhile, the operational details of the ICSD scheme are being chalked out, and will be finalised shortly. V.7 As recommended by the Internal Group on market timings and the feedback received from the market participants, the revised market timings for various products have been finalised, and shall be implemented, once COVID-19 related dislocations stabilise. Easing Access, and Broadening Participation in the Foreign Exchange Market V.8 For the domestic foreign exchange market, the initiatives undertaken during the year focused on incentivising access, bridging the segmentation between onshore and offshore trading activity, and simplifying the hedging of foreign exchange risks, while safeguarding the interests of less sophisticated participants (Box V.1) Box V.1

Foreign Exchange Market: Improving Access, Transparency and Pricing During 2019-20, major initiatives were undertaken for improving access and pricing outcomes, especially for retail users in the foreign exchange market. Simplified Regulatory Framework The Regulation1 and Direction2 governing the foreign exchange market have been revised comprehensively. The revised Direction sets out a unified set of rules for accessing the foreign exchange markets for both residents and non-residents. The rules have been made simpler and principle-based. Ease of Access The simplified regulatory framework, inter alia, allows users to enter into deliverable foreign exchange derivative contracts equivalent of US$ 10 million and US$ 100 million in the over-the-counter (OTC) and exchange-traded market, respectively, without the need to establish the underlying exposure. Furthermore, Authorised Dealer (AD) banks have been permitted to offer quotes to their customers, resident and non-resident, at all times, including beyond usual market hours (9 AM - 5 PM). Efficient Hedging The new framework also facilitates booking of anticipated exposures and enables participants to freely cancel and rebook transactions. Gains, if any, on hedging of anticipated transactions will be passed on to the client only when the cash flows are sighted. Removing Segmentation between Onshore and Offshore In order to remove segmentation between the onshore and offshore markets and improve efficiency of price discovery, banks in India which operate International Financial Services Centre (IFSC) International Banking Units (IBUs) were permitted to offer non-deliverable derivative contracts (NDDCs) involving the Rupee, or otherwise, to persons not resident in India. Transparency in Trade Information In order to enhance the transparency in transaction information along with its effective dissemination, all foreign exchange NDDCs (involving Rupee or otherwise) undertaken by banks in India were directed to be reported to CCIL’s reporting platform with effect from June 1, 2020. Similarly, IBUs were directed to report all OTC foreign exchange, interest rate and credit derivative transactions – both inter-bank and client transactions – undertaken by them to CCIL’s reporting platform with effect from June 1, 2020. Consumer Protection A new User Classification Framework has been introduced under which users are classified either as retail or non-retail user. While AD banks are permitted to offer any plain vanilla or structured derivative product to non-retail users (which include, inter alia, regulated financial institutions, corporates with turnover of ₹500 crore and above and non-residents other than individuals), they are permitted to offer only forwards, purchase of European call and put options, purchase of call and put spreads and swaps to retail users. The measure is aimed at protecting the interests of the unsophisticated user while at the same time promoting product innovation for larger market participants/more sophisticated entities. Transparent and Fair Pricing In order to ensure fair pricing and transparency in price discovery for the retail users, the revised Directions stipulate that all transactions with retail users will be executed by AD banks at the ongoing inter-bank/market rates. The time of execution will also be provided to the user. Applicable fees/commissions/service charges related to the contract will be charged/indicated separately and shall not be part of the price. Electronic Trading Platform At the behest of the Reserve Bank, the CCIL has developed an electronic trading platform for retail segment, called FX-Retail. The platform commenced live operations on August 5, 2019. After registering and obtaining limits from their respective ADs, customers can access FX-Retail through internet and place orders which are anonymously matched with orders of other customers or ADs on price-time priority. The platform provides easy and flexible terms of registering, accessing the market, assessing market depth, placing orders, obtaining deal information and getting reports. Charges levied by the ADs are transparently displayed on the portal. Another important feature of this platform is aggregation wherein once the aggregated pending unmatched orders attain the inter-bank segment lot size, they are transferred to the FX-Clear platform, the inter-bank platform of CCIL, thereby ensuring sufficient liquidity. FX-Retail provides cash/tom/spot transactions in USD/INR pair. Forwards and other major currency pairs are to be introduced soon. So far, 1,895 customers have registered on the platform (as on June 30, 2020). Source: RBI. | Non-Resident Investment in Domestic Debt Instruments V.9 A separate route, viz., Fully Accessible Route (FAR) for investment by non-residents in securities issued by the Government of India was introduced on March 30, 2020, in line with an announcement in the Union Budget 2020-213. This will be the third route, in addition to investment under the medium-term framework and the voluntary retention route (VRR) for investment by non-residents in the debt segment. A list of five existing securities have been notified as eligible for investment under the FAR. In addition, all new issuances of government securities of 5-year, 10-year and 30-year tenors from 2020-21 will be eligible for investment under the FAR. While the tenors of new securities to be designated as ‘specified securities’ may be added/amended from time to time, a security, once designated as eligible for investment under the FAR, shall remain eligible till maturity. V.10 Several measures were undertaken to further liberalise/facilitate the Foreign Portfolio Investors’ (FPI) investments in debt instruments: (a) the limit for investment by an FPI in short-term (up to one year) corporate bonds and government securities, including treasury bills and State Development Loans (SDLs), was revised on January 23, 2020, to 30 per cent from the existing 20 per cent of the total investment by that FPI in the respective category; (b) debt instruments issued by Asset Reconstruction Companies (ARC) or by entities under the Corporate Insolvency Resolution Process under the Insolvency and Bankruptcy Code, 2016 were exempted from the short-term investment limit; and (c) the limit for investment by FPIs in corporate bonds was raised to 15 per cent of outstanding stock with effect from April 1, 2020 (from 9 per cent), in line with an announcement in the Union Budget 2020-21. V.11 The investment cap under the VRR was increased to ₹1,50,000 crore from the existing ₹75,000 crore on January 23, 2020 in order to encourage long-term portfolio investment in the Indian debt markets. FPIs, which were allotted investment limits under VRR, were permitted to transfer their investments made under the General Investment Limit to the VRR. Under the VRR scheme, FPIs were also allowed to invest in Exchange-Traded Funds (ETF) that invest only in debt instruments. Units of debt ETF were allowed as eligible securities for repo transactions on November 28, 2019 with a view to expanding the eligible collateral base in repo market and also to improve liquidity. In view of the disruptions caused by COVID-19, FPIs that were allotted limits under VRR between January 24, 2020 (the date of reopening of allotment of investment limits) and April 30, 2020, have been given an additional time of three months to invest 75 per cent of their Committed Portfolio Size (CPS). The retention period for the investments will be reset accordingly. Improving Financial Market Infrastructure V.12 A regulatory framework for financial benchmark administrators was introduced in June 2019 to improve the governance of the benchmark-setting processes in financial markets regulated by the Reserve Bank. Six benchmarks administered by Financial Benchmarks India Pvt. Ltd. (FBIL) were notified by the Reserve Bank as ‘significant benchmarks’ on January 1, 2020. V.13 The Reserve Bank mandated the use of Legal Entity Identifier (LEI) for participation in non-derivative markets in November 2018. In the context of the difficulties expressed by market participants due to COVID-19, and with a view to enabling smoother implementation of the LEI system in non-derivative markets, the timeline for implementation of LEI was extended from March 31 till September 30, 2020. Agenda for 2020-21 V.14 For the year 2020-21, the Department proposes to achieve the following goals: -

As announced in the Reserve Bank’s Statement on Developmental and Regulatory Policies of February 6, 2020, and in line with G-20 recommendations, a framework for exchange of initial and variation margin for non-centrally cleared derivative contracts will be put in place. Such exchange of margin shall be facilitated by the adoption of the legislation for bilateral netting of qualified financial contracts as announced in the Union Budget 2020-21 (Utkarsh); -

Directions on Credit Default Swaps (CDS) will be reviewed with a view to broadening the base of CDS writers and simplifying operational guidelines so as to strengthen the corporate bond market in the light of the proposed legislation on bilateral netting of qualified financial contracts (Utkarsh); and -

Review the Directions on Interest Rate Derivatives with a view to easing access, removing segmentation between onshore and offshore markets and improving transparency. 3. FINANCIAL MARKETS OPERATIONS DEPARTMENT (FMOD) V.15 The Financial Markets Operations Department (FMOD) is entrusted with two primary responsibilities: first, conduct of liquidity management operations for maintaining an appropriate level of liquidity in the financial system for monetary policy transmission; and second, ensuring orderly conditions in the forex market through operations in the spot, forward and futures segments. Agenda for 2019-20: Implementation Status Goals Set for 2019-20 V.16 During the year, the Department had set out the following goals: -

To monitor evolving liquidity conditions closely and to modulate operations to ensure alignment of the WACR with the policy repo rate (Para V.17); -

To conduct foreign exchange operations in an effective manner to curb undue volatility in the exchange rate (Para V.23); and -

To launch a “Public Register” in collaboration with India Foreign Exchange Committee as part of the adoption of principles of “FX Global Code” in the domestic forex market (Utkarsh) [Para V.24]. Implementation Status of Goals Money Market and Liquidity Management V.17 As system liquidity shifted from deficit during April-May 2019 to surplus from June 2019, the Reserve Bank actively managed evolving liquidity conditions through use of fine-tuning instruments under the Liquidity Adjustment Facility (LAF), Open Market Operations (OMOs) and variable rate reverse repo operations of both shorter and longer tenors. V.18 Under the new liquidity management framework announced on February 6, 2020, the Reserve Bank deployed several new instruments tailored to the India-specific situations and drawing from the international experience (Box V.2). V.19 On the basis of an assessment of the existing liquidity conditions, the daily fixed rate repo and four 14-day variable rate repos, being conducted earlier every fortnight, were withdrawn with effect from February 14, 2020. The daily MSF and fixed rate reverse repo were retained. Furthermore, as a part of the revised liquidity management framework, two new instruments, Long-Term Variable Rate Repo (LTR) and Long-Term Variable Rate Reverse Repo (LTRR), with tenors of more than 14 days, were also announced. V.20 In view of the exceptionally high volatility in domestic financial markets which brought in phases of liquidity stress and to provide comfort to the banking system; on March 27, 2020, the borrowing limit of scheduled banks under the Marginal Standing Facility (MSF) scheme, by dipping into the prescribed Statutory Liquidity Ratio (SLR), was increased from 2 per cent to 3 per cent of their Net Demand and Time Liabilities (NDTL) outstanding at the end of the second preceding fortnight. This relaxation which was available up to June 30, 2020 was extended till September 30, 2020 on June 26, 2020. Box V.2:

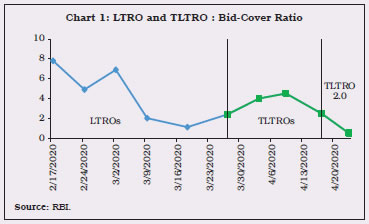

Unconventional Tools of Liquidity Management: The Recent RBI Experience In the post global financial crisis period, several central banks introduced new policy instruments and made changes to their monetary policy frameworks. Often labelled as “unconventional monetary policy tools” (UMPTs), four broad categories are discernible in the cross-country experience: negative interest rate policy; expanded lending operations; asset purchase programmes; and forward guidance (BIS, 2019). Another important element of unconventional monetary policy is provision of liquidity support to the banks on a large scale. For instance, the ECB shifted since October 2008 towards Long-term Refinancing Operations, which are mainly executed on a monthly basis for maturities ranging from six months to twelve months (Pattipeilohy, et al. 2013). The circumstances under which central banks resort to unconventional monetary policy and liquidity management is a key issue. It is argued that when there is little or no room for a reduction in nominal interest rate/policy rate (zero lower bound), unconventional measures are to be taken in order to continue the supply of liquidity in the financial and banking system and various other sectors of the economy (IMF, 2013). In India, the Reserve Bank undertook a bouquet of unconventional liquidity management measures in 2020 to ensure normal flow of finance into the economy, and enable better transmission of monetary policy impulses in the wake of the unprecedented situation created by the COVID-19 pandemic: • From February 17, 2020 and up to March 18, 2020, the Reserve Bank conducted long-term repo operations (LTROs) of one-year and three-year tenors and allotted a total amount of ₹1,25,117 crore at the policy repo rate. • The Reserve Bank introduced another unconventional liquidity management tool - Targeted Long-Term Repo Operations (TLTROs) under which liquidity availed by banks was to be deployed in investment grade corporate bonds, commercial paper and non-convertible debentures over and above the outstanding level of their investments in these bonds as on March 27, 2020. An amount of ₹1,00,050 crore was taken by the banks under TLTRO. • On April 17, 2020, the Reserve Bank introduced Targeted Long-Term Repo Operations (TLTRO) 2.0 at the policy repo rate for tenors up to three years in order to provide liquidity to small and mid-sized corporates, non-bank financial companies (NBFCs) and microfinance institutions (MFIs). An amount of ₹12,850 crore was taken by the banks under TLTRO 2.0. • In order to deal with the liquidity strains on mutual funds (MFs), and potential contagion effects therefrom, the Reserve Bank introduced a special liquidity facility (SLF-MF) of ₹50,000 crore targeted towards MFs for 90 days tenor at the fixed repo rate. Out of the total amount of ₹50,000 crore envisaged, a total amount of ₹2,430 crore was availed under SLF-MF. • The LTRO received an overwhelming response, with average bid-cover ratio of 4.5 for the five auctions. Auctions under the TLTRO also received a positive response from market participants, with average bid-cover ratio of 3.3 over the first four auctions. However, the first tranche of TLTRO 2.0 received lower than anticipated response at just 51 per cent of the notified amount of ₹25,000 crore that was auctioned on April 23, 2020 (Chart 1). The total amount injected through LTRO, TLTRO and TLTRO 2.0 stood at ₹2,38,017 crore.  • Public sector banks, followed by private sector banks, were the major groups of participants in the LTRO auctions, altogether accounting for an average share of 89 per cent of the total allotted amount. Barring the last auction of March 18, 2020, foreign banks and cooperative banks also had a fair share in the total allotted amount of LTRO (Chart 2). In case of TLTROs, the average percentage share of public sector banks and private sector banks hovered around 99 per cent, with the former remaining the major group of borrowers (Chart 3). The Reserve Bank has thus used an armoury of unconventional tools to manage liquidity in the banking and financial system.

References: 1. BIS (2019), ‘Unconventional Monetary Policy Tools: A Cross-country Analysis’, CGFS Papers No 63, Committee on the Global Financial System, BIS, October 2019. 2. International Monetary Fund (2013), ‘Unconventional Monetary Policies - Recent Experiences and Prospects’. IMF Policy Paper. Washington, DC: International Monetary Fund. 3. Pattipeilohy, Christiaan, Jan Willem van den End, Mostafa Tabbae, Jon Frost and Jakob de Haan (2013), ‘Unconventional Monetary Policy of the ECB during the Financial Crisis: An Assessment and New Evidence’, DNB WP No. 381, De Nederlandsche Bank, The Netherlands. | V.21 With regard to durable liquidity, the frequency and quantum of OMOs were increased during H2:2019-20. For the year as a whole (April-March 2019-20), the Reserve Bank conducted OMO purchases (including NDS-OM) to the tune of ₹1,45,690 crore, and OMO sales (including NDS-OM) to the tune of ₹32,121 crore, of which, ₹92,385 crore of OMO purchases and ₹32,111 crore of OMO sales were conducted in H2 alone. This included five simultaneous purchase of long-term and sale of short-term government securities under OMOs (December 23 and 30, 2019, January 6 and 23, 2020, and April 27, 2020). During April-May 2020, OMO purchases and sales (including NDS-OM) to the tune of ₹1,30,474 crore and ₹10,000 crore were conducted respectively. Subsequently, on July 2, 2020, the Reserve Bank conducted another simultaneous purchase of long-term and sale of short-term government securities under OMOs. Reflecting these operations, the 10-year G-sec generic yield softened cumulatively by 15 basis points (bps) between December 19, 2019 and January 31, 2020. V.22 FX swap auctions were actively used as an instrument to manage liquidity in the foreign exchange market in 2019-20. The first USD/INR sell/buy swap auction, amounting USD 2 billion for a period of 6 months, was conducted on March 16, 2020. The Reserve Bank also conducted another 6-month USD/INR sell/buy swap auction of amount USD 2 billion on March 23, 2020 to provide liquidity in the foreign exchange market. Further, in May 2020, the Reserve Bank decided to extend a line of credit of ₹15,000 crore to the Export Import (EXIM) Bank for a period of 90 days from the date of availment with rollover up to a maximum period of one year so as to enable it to avail a US dollar swap facility to meet its foreign exchange requirements in the backdrop of the COVID-19 pandemic. Foreign Exchange Market V.23 Orderly conditions were maintained in the forex market during the year through operations in the OTC and Exchange Traded Currency Derivatives (ETCD) segments. V.24 As part of the Reserve Bank’s commitment for adoption of the principles of ‘FX Global Code’ in the domestic forex market, the Department [in coordination with India Foreign Exchange Committee (IFXC)] launched a “Public Register”, hosted on the website of the Foreign Exchange Dealers Association of India (FEDAI). It provides the Statement of Commitment of all AD Category-I banks operating in the Indian forex market as well as corporates demonstrating their recognition of, and commitment to adopt the good practices set forth in the FX Global Code. The register is already linked with the global public register hosted by Global Foreign Exchange Committee (GFXC). The “Public Register” acts as a repository of information to facilitate market participants to publicise their Statements of Commitment to the FX Global Code and also to assist interested parties in identifying market participants. The Reserve Bank has hosted its own Statement of Commitment in the Central Bank Public Registry maintained by the Bank for International Settlements (BIS). Agenda for 2020-21 V.25 During the year, the Department plans to focus on the following: -

To carry out liquidity management operations effectively, including through additional liquidity management tools, in line with the stance of monetary policy (Utkarsh); -

To monitor evolving liquidity conditions closely and to modulate operations to ensure alignment of the WACR with the policy repo rate; -

To conduct foreign exchange operations in an effective manner to curb undue volatility in the exchange rate; and -

To continue policy-oriented research on financial markets. 4. FOREIGN EXCHANGE DEPARTMENT (FED) V.26 During the year, the Department engaged in carrying forward rationalisation of regulations with a view to moving towards a more principles-based regulatory framework. The Department also undertook several steps for enhancing ease of doing business, including aligning the regulatory framework to respond to needs of the current business and economic environment, in order to facilitate external trade and payments. Agenda for 2019-20: Implementation Status Goals Set for 2019-20 V.27 The Department had set out specific deliverables for 2019-20 in pursuit of its mission: -

Creation of a detailed framework for enhancing FEMA awareness (Utkarsh) [Para V.28]; -

Developing internal frameworks for granting approvals (Utkarsh) [Para V.29]; -

Building a fee structure for minor violations of FEMA (Utkarsh) [Para V.30]; -

Review and rationalisation of entry norms for being licensed as Full-Fledged Money Changers (FFMCs) [Para V.31]; -

Rationalisation of guidelines relating to merchanting trade transactions (Para V.36); -

Enhancing the scope of Special Non-Resident Rupee (SNRR) Account (Para V.39); -

Relaxing the end-use of external commercial borrowings (ECBs) [Para V.40]; and -

Notification of Non-Debt Rules under the FEMA (Para V.42). Implementation Status of Goals V.28 Alongside efforts to simplify regulations, regional offices (ROs) of the Foreign Exchange Department have also been active in disseminating information by organising various conferences, seminars, exhibitions and financial literacy programmes for different target groups. ROs have also been an important channel of securing constructive feedback from the actual users of foreign exchange, viz., Authorised Persons (APs) and Exporters/Importers. With the objective of streamlining various FEMA related events, a detailed framework was issued to the ROs for conducting such events. V.29 The Department developed internal frameworks for granting approvals in areas such as Liberalised Remittance Scheme (LRS) and Overseas Direct Investment (ODI)-Foreign Direct Investment (FDI) structures. V.30 Late Submission Fee (LSF) was introduced, in lieu of compounding process, for certain reporting violations under FEMA in respect of ECBs. The fees can be collected and remitted by Authorised Dealers (ADs) for regularising such violations. Authorised Persons and Remittances V.31 The guidelines on money changing and merchanting activities were rationalised. Definitions of categories of authorised persons licensed by the Reserve Bank under FEMA were incorporated in the guidelines. The prescription on age of directors of FFMCs was aligned with the provisions of the Companies Act, 2013. Companies registered under the Registration of Companies (Sikkim) Act, 1961 were made eligible to apply for FFMC license. V.32 A comprehensive review was undertaken for simplification of reporting requirements of regulated entities and enhancing the role of APs, with a view to reducing transaction costs. An online package for FFMCs/upgraded FFMCs (AD Category II) relating to licensing, renewal, reporting, cancellation and inspection is being developed by the Reserve Bank Information Technology Pvt. Ltd. (ReBIT) which will rationalise reporting and reduce manual handling of other work processes. Trade Guidelines - Liberalisation and Rationalisation V.33 An auto-emailing feature was developed in the Import Data Processing and Monitoring System (IDPMS) and the Export Data Processing and Monitoring System (EDPMS), with a view to enabling self-monitoring by importer/exporter of import/export transactions pending reconciliation. System-generated e-mails are sent to all importers/exporters at regular intervals, giving details of their shipping bills, bills of entry and outward/inward remittances remaining outstanding beyond prescribed due dates. V.34 With effect from November 22, 2019, the guidelines on re-export of unsold rough diamonds from Special Notified Zone of Customs were modified. In terms of revised instructions, the Bill of Entry shall be filed by the buyer for the lot(s) of imported rough diamonds meant to be traded by diamond mining companies. These are to be cleared at the centre(s), which are duly notified under Customs Act, 1962/specified by the Central Board of Indirect Taxes & Customs, Department of Revenue, Ministry of Finance, Government of India. AD banks may permit such import payments after being satisfied with the bonafides of the transaction. AD banks are also required to maintain a record of such transactions. V.35 In order to smoothen the process of obtaining permission of the Reserve Bank for re-exporting of leased aircraft/helicopter and/or engines/auxiliary power units (APUs) re-possessed by the overseas lessor, they were exempted from submission of Export Declaration Form (EDF). V.36 In January 2020, a comprehensive review of the Merchanting Trade Transactions (MTT) was undertaken and revised guidelines were issued. The key highlights are: (i) allowing transformation of ‘state of goods’; (ii) online verification of documents on the website of the International Maritime Bureau or respective airlines; (iii) write-off of export leg receivables in certain circumstances, which are beyond the control of merchanting trader; (iv) payment of agency commission under certain conditions, which might necessitate payment of agency commission after the MTT has been initiated; (v) enhancement in limit of the import advance without Stand-by Letter of Credit (SBLC)/bank guarantee to USD 5 lakh; (vi) specifically prohibiting third party payments; (vii) prohibiting issue of Letters of Undertaking (LoU)/ Letters of Credit (LoC) for supplier’s/ buyer’s credit; (viii) earmarking the export advance received for the purpose of import leg payment; and (ix) clarification on parking of export proceeds in exchange earners’ foreign currency (EEFC) account. V.37 The Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2016 were amended in March 2020 to include Japanese Yen as a currency of settlement under Asian Clearing Union (ACU) mechanism. V.38 In view of the outbreak of COVID-19, the period of realisation and repatriation to India of the amount representing the full export value of goods or software or services exported up to July 31, 2020 was increased from nine months to fifteen months from the date of export. Similarly, the time period for completion of remittances against normal imports (i.e., excluding import of gold/diamonds and precious stones/jewellery) was extended from six months to twelve months from the date of shipment for such imports made on or before July 31, 2020 (except in cases where amounts are withheld towards guarantee of performance). Non-Resident Rupee Account - A Review of Policy V.39 The scope of Special Non-Resident Rupee (SNRR) Account was enhanced by permitting persons resident outside India to open non-interest-bearing SNRR accounts for transactions in INR pertaining to ECBs, trade/trade credits and business-related transactions by International Financial Service Centre (IFSC) Units at Gujarat International Finance Tec (GIFT) City. Restriction on the tenure of SNRR Account - 7 years at present - was also removed for the aforesaid purposes. External Commercial Borrowings Framework - Policy and System Changes V.40 The Reserve Bank, in consultation with the Government of India, relaxed the end-use restrictions relating to ECBs for working capital requirements, general corporate purposes and repayment of rupee loans. Eligible borrowers are now allowed to raise ECBs for the afore-mentioned purposes from recognised lenders, except foreign branches/overseas subsidiaries of Indian banks, subject to maintaining the defined average maturity period. Relaxations also include permitting eligible borrowers to avail ECBs for repayment/assignment of rupee loans, classified as SMA-2 or NPA, subject to meeting certain conditions. V.41 Work on implementing a Software Platform for External Commercial Borrowings and Trade Credits Reporting and Approval (SPECTRA) encompassing the whole lifecycle from receipt of application to communication of decision and reporting of transactions is underway with NSEIT Limited being awarded the work order in November 2019. Notification of Non-Debt Instrument Rules V.42 Amendments were made to the FEMA, 1999 through the Finance Act, 2015. In terms of the amended provisions of the Act, the Government of India has been given the powers to frame rules for any class or classes of capital account transactions not involving debt instruments, while the powers to regulate capital account transactions involving debt instruments will continue to be with the Reserve Bank. Furthermore, the government will make rules which lay down the instruments to be determined as debt instruments. Central government notified the amendments vide notification dated October 15, 2019. Non-Debt Instrument (NDI) rules were notified with effect from October 17, 2019. FEMA Related Events – Dissemination of Information and Feedback V.43 The Department is continuously striving to upgrade skills and disseminate knowledge by organising meetings/conferences with in-charges of the ROs with a view to resolving their queries and also gauging the grassroots requirement in the area of foreign exchange management in order to address their issues promptly. The Department has also conducted various knowledge-sharing sessions for the benefit of staff attached to the Central Office and across all the ROs. The various guidelines/instructions are also disseminated by way of regular updation of master directions, training modules and frequently asked questions (FAQs). Agenda for 2020-21 V.44 The Department’s strategy for 2020-21 is to focus on consolidating and carrying forward all the initiatives which were undertaken in the previous year. The emphasis will remain on ensuring that the FEMA operating framework is in sync with the needs of the evolving macroeconomic environment. Accordingly, the Department has formulated the following strategic action plan for 2020-21: -

Undertaking a complete review of the reporting requirements under various regulations in order to make the reporting aligned with specific requirements and make the process simple and efficient (Utkarsh); -

Introduction of late submission fee for delayed reporting of Overseas Direct Investment (ODI) by Indian Parties/ Resident Indians (Utkarsh); -

Rationalisation of ODI regulations to make them simpler and more principles-based (Utkarsh); -

Conducting awareness programmes and creation of digital content on an ongoing basis (Utkarsh); and -

Rationalisation of various provisions on foreign exchange and currency under Foreign Exchange Management Regulations, 2015, such as export and import of currency; realisation, repatriation and surrender of foreign exchange; possession; and retention of foreign currency. These provisions, which are currently covered in four different notifications under the FEMA, would be unified under a single regulation. 5. Conclusion V.45 In sum, during the year, the Reserve Bank has taken several steps to develop the financial markets in terms of broadening the participation base, easing access and transaction costs, diversifying the array of products, and instruments, simplifying of procedures, and improving financial market infrastructure and also augmented its liquidity management framework. The broad policy approach has been re-oriented towards a principle-based regulatory framework with emphasis on market surveillance and intelligence to ensure that financial markets operate in fair, efficient and transparent manner. In the wake of the COVID-19, the Reserve Bank went beyond its conventional policies and introduced unconventional monetary policy tools in terms of LTRO, TLTRO, TLTRO 2.0; opening lines of credit to all-India financial institutions to ensure sufficient liquidity in the system and in the specific sector arising because of the pandemic, in addition to both kinds of FX swaps to inject rupee and forex liquidity to contain volatility. In the process of rationalisation of FEMA and to make them user friendly for monitoring and reporting purposes, the scope of SNRR account has been enhanced, auto emailing features in IDPMS and EDPMS has been added. The endeavour of the Reserve Bank has been to build a principle-based regulatory framework and ensuring mandate under FEMA along with orderly conditions in the financial markets with international best practices and market infrastructure.

|