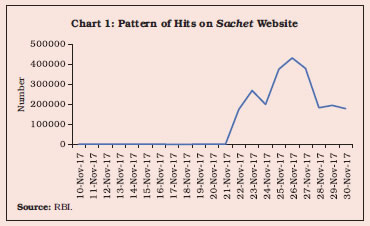

The Reserve Bank, adopting various measures, strengthened its communication efforts further during the year which was also marked by the successful completion of the Financial Sector Assessment Programme (FSAP). Efforts were sustained towards improving research and statistics – both inside and outside the Reserve Bank – as also for providing better banking services to governments. Foreign exchange reserves were managed and guided by the consideration of safety, liquidity and returns. In order to ensure a robust legal framework for the banking and financial sector, a number of financial laws/bills were introduced/amended during the year. X.1 This chapter discusses the developments and implementation status of the annual agenda in the areas of communication, international relations, research, statistics, forex reserves management, banking services to banks and governments, and financial laws during 2017-18 as also the respective agenda set for 2018-19. The channels of communication were strengthened during the year by the launch of ‘Mint Street Memos’, (MSM), i.e., research-based online releases on contemporary economic and financial issues and a public awareness programme through Short Message Service (SMS) followed by a 360 degree campaign. In the area of international relations, successful coordination of the FSAP was a major highlight of the year. X.2 During the year, government banking divisions were opened in seven Regional Offices of the Bank besides integrating state governments with e-Kuber for e-receipts and e-payments. During the year, research activities were sustained by undertaking studies in the area of monetary policy transmission, nowcasting, credit and efficiency in agriculture, rural wage dynamics, macroeconomic impacts of different types of public expenditure besides releasing various statutory and flagship publications. As far as statistics and information management is concerned, the development of an employment index based on Tax Deducted at Source (TDS) data as well as salary account data and improvements in conduct of the surveys relating to monetary policy are underway apart from collection, processing and dissemination of national-level macroeconomic and financial statistics through various publications. The year also witnessed a number of amendments/introduction of several legislations/bills pertaining to the RBI Act, the Banking Regulation Act and the Insolvency and Bankruptcy Code. COMMUNICATION PROCESSES X.3 The Reserve Bank continues to uphold its goal of having a dynamic communication policy to enable timely responses to domestic and international developments. The Department of Communication (DoC) is the nodal department for the Bank’s two-way communication with the public, which is performed mostly through announcements over the Reserve Bank’s website as also by way of emails, speeches, public awareness messages, and tweets of important press releases and circulars. It not only disseminates policy developments and their rationale to various stakeholders in a transparent, timely and credible manner but also strives to obtain continuous feedback on the policies. Agenda for 2017-18: Implementation Status The Website X.4 To make its website (https://www.rbi.org.in) more user-friendly, the Reserve Bank had launched a mobile application (app) version of the Bank’s website with basic features in the previous year. The app has since been modified and more functionalities have been added like ‘notifications’, selective alerts and public awareness messages. The app available for Android as well as iOS platforms from the Play Store/App Store witnessed 1,54,423 downloads on the Play Store and 13,135 downloads on the App Store till June 2018. The Reserve Bank’s Twitter account has the 5th highest number of followers among central banks across the world (over 3,47,000 followers) and its YouTube channel has 18,409 subscribers, as on June 30, 2018. Monetary Policy Communication X.5 Under the new Monetary Policy Framework introduced in October 2016, the Reserve Bank has been communicating the resolutions of the Monetary Policy Committee (MPC) through a press release followed by a press conference. The Governor’s post-policy conference on the bi-monthly statements on monetary policy is disseminated through YouTube along with live streaming on the Reserve Bank’s website and business television channels. Apart from press conference, teleconferences with researchers and analysts are also conducted. The audio and transcripts of the press conferences are uploaded on the Bank’s website. The minutes of MPC meetings are also uploaded on the Bank’s website on the 14th day after every meeting of the MPC as provided under Section 45ZL of the RBI Act, 1934. Mint Street Memos X.6 The Reserve Bank started a new series of online releases on contemporary economic and financial issues called ‘Mint Street Memos’ (MSM) on its website from August 11, 2017 onwards. MSM comprise documents that are in the form of brief reports and analysis, prepared by the staff of the Reserve Bank and the Centre for Advanced Financial Research and Learning (CAFRAL), or drawn from one of the recent publications of the Bank. Relevant citations, including credits and acknowledgements appear in the MSM along with salient facts, data and tables. The endeavour is to present analytical research on a contemporary topic relevant to central banking in a crisp manner that is easy to understand for various stakeholders including common persons. Each issue of MSM is published as a stand-alone release along with a press release. Twelve MSMs were published on the Reserve Bank website from its launch till June 2018 (Box X.1). Workshops for Regional Media X.7 During the year, DoC conducted four workshops for regional media personnel at Kochi, Guwahati, Lucknow and Chandigarh, thus, covering media personnel from various parts of the country. These workshops were structured in the form of interactive sessions on central banking functions of relevance to the media with the aim that they would be better equipped in terms of understanding the functional areas and data reference points while reporting on these topics in future. The range of topics covered in the workshop included monetary policy, regulation and supervision of banks, customer education and protection, currency management, payment and settlement systems, structure of the Reserve Bank’s website, Database on Indian Economy (DBIE), foreign exchange management, press releases and media relations, and local issues of relevance to regional media. The sessions were handled by senior officials/subject experts from the Reserve Bank. Public Awareness Campaign X.8 The DoC undertook a public awareness campaign during the year. The campaign started in November 2017 by way of an SMS cautioning public about fictitious offers purportedly sent out in the name of the Reserve Bank. The SMS campaign also has a missed call element resulting in the service provider calling back to provide more information on the subject of SMS through a pre-recorded Interactive Voice Response System (IVRS). The messages were well received as gauged from the significant increase in the number of complaints received on the Sachet website (Box X.2). X.9 The second segment of the campaign saw the release of a television commercial during the Indian Premier League (IPL) Season 11 in April 2018. The television commercial spoke about opening of the Basic Savings Bank Deposit Accounts (BSBDA) which obviates the requirement of minimum balance in the bank account provided certain limitations on the account operation are acceptable to customers. The television commercial, which featured the Reserve Bank’s six cricketer employees became quite noticeable. The message on BSBDA was also released in other media, viz., print, other television channels, radio, digital and hoardings during May-June 2018. An advertisement with a message on customer’s liability in case of fraudulent transactions in one’s bank account was aired during the FIFA World Cup matches. The advertisements were released in print media and are also being released in other media, viz; other television channels, radio, digital and hoardings. A separate link titled RBI Kehta Hai has been enabled on the RBI website for people who want to know more about the messages being broadcast on various media. Box X.2 Reaching out to the Public through SMS The Public Awareness Campaign of the Reserve Bank through SMS was launched on November 10, 2017. The first SMS regarding fictitious offers was broadcast to approximately 550 million mobile phone subscribers over a period of 12 days (Table 1). The SMS campaign also has a missed call element where the subscriber can give a missed call on the Reserve Bank’s short code number 14440 to receive a call back to get more information on the subject of the SMS. The second SMS had a link to the Sachet website for lodging complaints against the fraudsters and was sent to approximately 590 million mobile phone subscribers, over a period of 12 days starting November 22, 2017. After the SMS about registering complaints against fraudsters was sent, hits on the Reserve Bank’s Sachet website peaked to 4,31,508 on a single day (November 26, 2017) as against a monthly average of approximately 1,000 hits on a regular day before the campaign (Chart 1).  The next three messages were broadcast to dispel rumours regarding ₹10 coins. All these SMS were broadcast in eight regional languages apart from Hindi and English. SMS broadcast from November 2017 to June 2018 SMS 1: Don’t pay fees or charges to get large sums in return. RBI Governor/RBI/Government never sends such email/SMS/call. For more, give missed call to 8691960000. SMS 2: If you receive offer of lottery winnings or cheap funds from RBI/Government body, complain on https://sachet.rbi.org.in/Complaints/Add. | Table 1: SMS Campaign – The Reach | | (in millions) | | Details | SMS 1 | SMS 2 | SMS 3 | SMS 4 | SMS 5 | SMS 6 | SMS 7 | Total | | (November 10, 2017 to November 21, 2017) | (November 22, 2017 to December 3, 2017) | (January 23, 2018 to January 24, 2018) | (January 31, 2018 to February 13, 2018) | (February 14, 2018 to February 27, 2018) | (May 21, 2018 to June 4, 2018) | (June 14, 2018 to June 30, 2018) | | Total Messages Sent | 834.26 | 849.55 | 66.37 | 825.13 | 799.54 | 813.43 | 363.05 | 4551.33 | | Total Messages Delivered | 552.74 | 592.44 | 54.43 | 558.56 | 544.63 | 542.82 | 281.80 | 3127.42 | | Total Missed Calls Received | 8.53 | 1.74 | 0.76 | 4.62 | 3.18 | 5.04 | 3.70 | 27.57 | | Total Successful Call Backs through IVRS | 6.43 | 1.39 | 0.57 | 3.29 | 2.24 | 3.81 | 2.70 | 20.43 | | Source: RBI. | SMS 3: Coins are available in different designs due to their long life. Accept them without fear. Give missed call to 14440 for more information. SMS 4: ₹10 coins have been issued both with rupee symbol and without it. Both are valid. Accept them without fear. To know more, give missed call to RBI at 14440. SMS 5: ₹10 coins have been issued both with 10 and 15 radiating lines. Both are valid. Accept them without fear. Give missed call to 14440 for more information. SMS 6: Don’t want to keep minimum balance in your account and won’t have more than four debits in a month? Open BSBD A/c. To know more, give missed call to 14440. SMS 7: Fraudulent transactions in your bank account? Limit your loss. Notify your bank immediately. For more details, give a missed call to 14440. |

Agenda for 2018-19 X.10 The DoC will continue to hold workshops for regional media on important regulatory and banking related issues. In the ensuing year, such media workshops will be conducted in a few other regional centres which have not been covered in the current year. X.11 Certain features of the Reserve Bank website would be remodelled/modified and some new ones would be added on during the year, to make the website more robust and easy to navigate. X.12 The RBI Museum is coming up at 8, Council House Street, Kolkata, the building from where the Reserve Bank started its journey on April 01, 1935. It is expected to complete the first phase of the Museum comprising ground and mezzanine floors during 2018-19. The Museum will offer visitors an opportunity to learn the fascinating story of money, gold, the Indian financial system and its genesis, and the role and functions of the Reserve Bank, narrated through artefacts and interactive exhibits. X.13 The public awareness campaign is expected to gather steam during 2018-19 with around seven messages already lined up for release. As part of the public awareness campaign, a separate weblink is planned, which will have basic information on the Reserve Bank regulations useful to the common man. STRATEGIC RESEARCH UNIT X.14 Established in February 2016, the Strategic Research Unit (SRU) is a nodal point which is mandated to undertake research and analysis on topical issues that are relevant across various verticals within the Reserve Bank. Broadly, in terms of deliverables, the Unit’s work involves short-term policy and operations, relevant research, and medium to long-term cutting-edge research projects with an aim to publish in top journals. Agenda for 2017-18: Implementation Status X.15 Short-term policy related work mainly involves providing inputs for the MPC meetings. SRU closely monitors different sectors of the economy – both real and financial. In this regard, it has initiated several studies in varied areas including the real sector, financial markets, capital formation, fiscal position and the external sector, which have been regularly presented in the MPC meetings. X.16 Medium-term research involves preparing research-based policy notes and briefs. Besides the regular surveillance and market intelligence related work, SRU also conducted a number of research studies that looked into issues relating to the Union Budget, spending quality of central and state governments, statutory liquidity ratio (SLR) requirements, limiting the exposure of foreign investment in Indian G-Secs, impact of goods and services tax (GST) on working capital constraints of firms, external vulnerability, investment in gold, the impact of minimum support prices on inflation, and impact of demonetisation on automated teller machine (ATM) and point of sale (POS) transactions. These research studies were presented to the top management. X.17 In addition, SRU is involved in long-term research relating to the heterogeneous effects of demonetisation on households, skill development and employment, fiscal austerity, bank recapitalisation in a dynamic stochastic general equilibrium (DSGE) framework, trade and networks, and inflation dynamics. Some of these studies have been presented in research conferences organised by both national and international institutions and published in academic journals. SRU is also currently collaborating with CAFRAL and some external academic experts to build a customised DSGE model for India. X.18 In the vein of future capacity building, SRU collaborates with other departments and CAFRAL for several research projects, inter-departmental research groups, some of which are also presented in the MPC meetings. The unit also organises seminars regularly, jointly with CAFRAL, where eminent economists, professors, and experts in the fields of finance and economics are invited to present their research. In addition, SRU and CAFRAL also organise brown-bag seminars, and lecture series, to encourage research projects. Agenda for 2018-19 X.19 With increasing emphasis on research, the Unit is expanding its domain of work with specialised economics and finance professionals and aims to create a cohort of well-trained employees with PhDs. This will facilitate and encourage research in areas which are now defining the frontiers in economics and finance, with a broad objective of bridging the gap between core academic and policy research. The Unit will broadly continue with the existing structure with an emphasis on research and knowledge dissemination. INTERNATIONAL RELATIONS X.20 During 2017-18, the Reserve Bank intensified its international relations and financial diplomacy with international organisations and multilateral bodies. It was also engaged in several bilateral and multilateral dialogues, focusing on central bank to central bank cooperation. The International Department of the Bank played a key role in these activities including the coordination and completion of the Financial Sector Assessment Programme (FSAP), undertaken once in five years. Agenda 2017-18: Implementation Status G20 and its Working Groups X.21 The department coordinated with the government and participated in the meetings of various working groups of the G20, such as the International Financial Architecture (IFA), the Framework Working Group (FWG) and the Infrastructure Working Group (IWG). It also provided inputs for taking positions on the agenda before the G20 Deputies and the Finance Ministers and Central Bank Governors (FMCBG) meetings. These meetings culminated in the G20 Hamburg Action Plan (HAP) under the German Presidency with a focus on using all policy tools – monetary, fiscal and structural – to achieve the goal of strong, sustainable, balanced and inclusive growth. India’s overall growth strategy, finalised by the government in collaboration with the Reserve Bank, was broadly endorsed in the G20-led International Monetary Fund’s (IMF’s) first pilot report on Strong, Sustainable, and Balanced Growth (SSBG) in October 2017. At the G20 Deputies and FMCBG meetings, the Reserve Bank brought to the fore issues such as completion of the remaining elements of Basel III, unintended consequences of financial sector reforms, cyber security and Financial Technology (FinTech). X.22 Another notable achievement was that the HAP stayed clear of the mandatory adherence to the OECD Code of liberalisation of capital movements. Also, a fruitful reference was made to the IMF’s ‘institutional view’ that allows flexibility in capital account management by the EMEs. With Argentina assuming the G20 Presidency on December 1, 2017, the department continued to work in close coordination with the government in shaping the G20 agenda and its work processes. It also contributed to the survey-based G20 process reform initiative taken by the Argentina Presidency. The G20 IFA is currently working on issues such as capital flows, debt sustainability of low-income countries (LICs), balance sheet optimisation of Multilateral Development Banks (MDBs) and Global Financial Safety Net (GFSN). India through its interventions, also kept the 15th General Review of Quotas (GRQ) of the IMF on the IFA agenda. Notably, India along with some other emerging markets, advocated for greater flexibility in the OECD Code currently under revision at the OECD Advisory Task Force (ATFC) and the IFA meetings. The G20 FWG, for which India is a Co-Chair, focused on ‘Future of Work’ as a new initiative and developed a menu of policy options to reap opportunities from new technologies and address challenges therefrom. The G20 IWG is working on a multi-year roadmap towards developing infrastructure as an asset class by improving cross-country information availability and assessments of project rationale, appraisals, commercial viability, affordability, and deliverability. It also emphasised greater standardisation for financial contracts and products for creating pools of infrastructure assets. X.23 The Reserve Bank also participated in Sustainable Finance Study Group as well as in two sub-groups dealing with Regulation and Standard Setting Body, and Financial Consumer Protection and Financial Literacy, under the Global Partnership for Financial Inclusion. 15th General Review of Quotas (GRQs) and Global Financial Safety Net (GFSN) X.24 In the recent period, adequate progress has not been made on the Quota Formula Review for the 15th GRQ of the IMF. India, however, continued to pitch for progress on the 15th GRQ and its completion within the agreed timeline, including a new quota formula by the spring meetings of 2019 and no later than the annual meetings of 2019. This was strongly articulated in the Governor’s statement at the International Monetary and Financial Committee (IMFC) meeting in April 2018. In order to shoulder its responsibility towards adequate availability of GFSN, the Reserve Bank signed a Note Purchase Agreement (NPA) with the IMF for US$ 10 billion as part of the 2016 borrowing agreements amounting to about SDR 316 billion (US$ 450 billion) from 40 IMF members. This arrangement effectively extends IMF’s access to bilateral borrowed resources until the end of 2019-20. Financial Sector Assessment Programme (FSAP) of the IMF-World Bank X.25 The FSAP for India, conducted jointly by the IMF and the World Bank, was started with a scoping Mission in December 2016 and included two Mission visits - in March 2017 and in June-July 2017. Subsequently, the department coordinated the authorities’ responses to the draft and the final reports. The affirmative nature of the report for India under the FSAP was the highlight of the year (Box X.3). The main report summarising the key findings was released as the Financial System Stability Assessment (FSSA) by the IMF and the Financial Sector Assessment (FSA) by the World Bank in December 2017. Two Detailed Assessment Reports (DARs) relating to (i) the Basel Core Principles (BCP) for Effective Banking Supervision and (ii) the CPMI-IOSCO1 Principles for Financial Market Infrastructures were also released in January 2018 by the IMF and the World Bank, respectively. The latter provides an assessment of the Clearing Corporation of India Limited (CCIL) as a Central Counterparty (CCP) and Trade Repository (TR). Box X.3 India - Financial Sector Assessment Programme (FSAP), 2017 FSAP is a mandatory exercise conducted every five years for 29 jurisdictions, including India, which are identified to have systematically important financial sectors based on two parameters: (i) size of the financial sector and (ii) interconnectedness of the financial sector with the rest of the world. The 2017 FSAP, the second such assessment conducted for India, observed that India has implemented almost all the recommendations of the FSAP 2011, including the oversight of overseas operations of Indian banks and large exposure limits. However, more work needs to be done on the resolution tools and arrangements to deal with a crisis. The 2017 FSAP placed greater emphasis on interconnectedness; expanded the range of coverage; and took into account the potential for price contagion across financial sectors. The assessment of the Basel Core Principles (BCP) was done in terms of the revised BCP that raised the bar for compliance in many ways. The 2017 FSAP, nevertheless, reaffirmed India’s high compliance with the international standards, testifying to a sound and vibrant financial system in India. India was judged as fully or largely compliant with all the BCP principles, except two. The material non-compliance was judged in the area of independence, accountability, resourcing and legal protection for supervisors, and on corporate governance in banks. The former was mainly on account that the regulator does not have full discretion to take supervisory actions against the public sector banks (PSBs), while the latter was due to very limited authority of the Reserve Bank to hold the PSB boards accountable and to replace weak and non-performing senior management and government appointed board members. Policies to address vulnerabilities The FSSA Report recognised the Reserve Bank’s intensified efforts to strengthen bank balance sheets, enhance provisioning coverage, address current fragilities and ultimately improve banking soundness; including (i) setting up of the Central Repository of Information on Large Credits (CRILC) that helps in tracking not just the NPAs, but incipient stress and inadequate recognition of bad loans; (ii) the framework for revitalising distressed assets in the economy with a special focus on addressing coordination problems in large consortium accounts under the Joint Lenders’ Forums (JLFs); and (iii) using the revised prompt corrective framework to work towards needed improvements in weak banks. The government took several legislative measures to facilitate faster recovery and resolution of stressed assets including the Insolvency and Bankruptcy Code, 2016; amendments to the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 and the Recovery of Debts Due to Banks and Financial Institutions Act, among others. The Report recommended the recapitalisation and restructuring, consolidation, divestment and privatisation of the PSBs, and the need to improve their governance and financial operations. The FSAP’s stress tests suggested that capital needs of the PSBs were manageable aggregating between 0.75 per cent of GDP in the baseline and 1.5 per cent in the severe adverse scenario. The findings of the FSAP stress tests were in line with the Reserve Bank’s own stress tests. The authorities have not only been frequently assessing the capital needs but have clearly laid out plans for recapitalisation that are incentive compatible for reforms. The government on October 24, 2017 announced a PSB recapitalisation plan of ₹2.11 trillion (about US$32 billion) to be implemented over the next two years that include budgetary provisions of ₹181.39 billion, recapitalisation bonds of ₹1,350 billion and the balance through raising of capital by banks from the market while diluting government equity. This effectively will address the capital gap assessed in the FSAP exercise. Already, recapitalisation bonds of ₹800 billion have been issued. However, there is pressing need to link the recapitalisation to first putting in place governance reforms, especially for the banks under the prompt corrective action (PCA). Financial sector oversight framework The financial sector oversight framework was assessed in terms of system-wide oversight and macro-prudential policies; supervision and regulation of banking sector, insurance sector and security markets; financial markets infrastructure oversight; crisis management framework; and market integrity. As observed by the FSSA, inter-agency cooperation and information sharing on financial stability matters have improved markedly, since the establishment of the Financial Stability and Development Council (FSDC) in 2010 and the adoption of an inter-agency Memorandum of Understanding among the regulatory authorities in 2013. The Reserve Bank made substantial progress in strengthening banking supervision, especially with the introduction in 2013 of a risk-based supervision through a comprehensive and forward-looking Supervisory Programme for Assessment of Risk and Capital (SPARC). In April 2017, the Reserve Bank established a new Enforcement Department with a view to speeding up regulatory compliance and revised its prompt corrective action framework to incorporate more prudent risk-tolerance thresholds. On the banking sector, the FSAP recommended a review of loan classification and provisioning rules in the context of the International Financial Reporting Standards (IFRS), and with respect to special loan categories. The Reserve Bank is in the process of such a review in conjunction with the IFRS-9, wherein expected loss framework forms the basis for provisions and all loans are covered by provisioning. This framework will capture past loss data and recovery of non-performing loans. At the same time, it needs to be recognised that in the Indian context, special category loans, which comprise loans primarily to agriculture, do not necessarily violate the prudence principles and, instead, reflect the inclusion criteria. Moreover, the Basel Committee on Banking Supervision (BCBS) guidelines issued in 2016 on prudential treatment of problem assets, provide for supervisory deviation from the 90-day norm and prescribe up to a 180-day norm in case of retail and public sector entities exposure if this is considered appropriate for local conditions. To enable the Reserve Bank to be fully effective in exercising its supervisory mandate, the FSAP suggested that the legal framework should be amended to strengthen the Reserve Bank’s powers over PSBs and its de jure independence. The legal provisions to terminate tenures of the top functionaries or to supersede decisions of the Bank are just enabling provisions for extra-ordinary situations. Regarding the recommendation on avoiding duplication of supervisory powers between the Reserve Bank and the Resolution Corporation (RC), the matter is being looked at so that adequacy of inspection/supervisory powers with the RC is appropriately balanced with supervisory powers of the regulator without affecting the ability of RC to adequately prepare to resolve the financial service provider efficiently while at the same time ensuring that the regulator has adequate supervisory powers for the concern, enabling it to turn it around, inter-alia, through prompt corrective action. The FSAP has called for improvement in the frameworks for emergency liquidity assistance (ELA), deposit insurance, and crisis preparedness. While there is no technical obstacle to extending ELA, the Reserve Bank has in place a carefully drafted Board-approved policy on ELA that incorporates constructive ambiguity and flexibility, and as such does not prefer more clarity than is necessary as it could engender moral hazard. The Reserve Bank’s regulation and oversight of the securities and derivatives clearing and settlement systems are broadly effective, according to the FSAP, with the Clearing Corporation of India Limited (CCIL) playing a critical role in all money market segments and acting as a Central Counterparty (CCP) for government securities, repo and secondary markets. As for the Trade Repository (TR), the operating regulations for TR services have since received the Bank’s regulatory approval and the CCIL has notified the regulations, complying with the principle. As for the FSAP view on transfer of ownership of the National Housing Bank to the government and regulation of housing finance companies to the Reserve Bank, it is already under consideration of the government. Market development The FSSA Report has called for progressively reducing the statutory liquidity ratio (SLR) to help deepen markets and encourage lending. The Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework in January 2014 had, inter-alia, recommended that SLR be brought down in consonance with the requirements of the Liquidity Coverage Ratio (LCR) under the Basel III framework. Accordingly, the SLR has been brought down in a consistent but gradual manner, and now stands at 19.5 per cent down from 23 per cent in January 2014. Furthermore, a total carve-out from SLR of 13 per cent of their NDTL is available to banks. However, the authorities’ view is that a pre-announced calendar of reduction would preclude a consideration for market conditions, as is being currently undertaken. On the Priority Sector Lending (PSL) norms, the FSAP has recommended a cost-benefit and gap diagnostic including a plan to reduce its scope and ensure its targets for underserved segments. It is reiterated that the PSL programme plays an important role in providing credit to sectors which do not get easy access to formal finance and so facilitates inclusion, employment and growth. References: 1. IMF (2017), “India’s 2017 Financial System Stability Assessment”, IMF Country Report No. 17/390, December. 2. IMF (2017), “Detailed Assessment Observance of Clearing Corporation of India Limited (CCIL) and Trade Repository (TR)”, October. 3. IMF (2018), “Detailed Assessment of Observance of the Basel Core Principles for Effective Banking Supervision”, IMF Country Report No. 18/4, January. |

OTC Derivatives Reforms X.26 Following the global financial crisis of 2007-08, reform of the Over-the-Counter (OTC) derivatives market has been an important part of the global policy agenda driven by the G20, largely in conjunction with the Financial Stability Board (FSB), which periodically assesses the progress in the implementation of such reforms across countries. In this regard, the department followed up and coordinated the work related to the implementation and impact of reforms in the OTC derivatives market in India. Financial Stability Issues X.27 The department prepared inputs for formulating India’s stance on the issues deliberated in FSB meetings and conference calls which included assessment of macro-financial vulnerabilities, particularly emanating from weak domestic investment demand, shadow banking, cyber-risks and FinTech. The department also contributed to the BCBS task force on financial technology innovations from the perspective of banks’ business models and the role of supervisors. It provided inputs to several FSB surveys that included those on crypto assets and their financial stability implications, cyber security, regulatory and supervisory practices and the ongoing FSB work on reducing misconduct risks in the financial sector. X.28 On the implementation of the Financial Action Task Force (FATF) and BCBS guidance clarifying regulatory expectations around the Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT), it was conveyed that the Reserve Bank’s guidelines were in compliance with the FATF recommendation on correspondent banking. Further, in the context of correspondent banking relationships (CBRs) being under pressure globally, it was conveyed that in India, de-risking issues, leading to a decline in CBR services, were not observed significantly. X.29 The Reserve Bank contributed to the FSB’s annual shadow banking monitoring exercise and provided data/inputs for its 2017 report, in coordination with other regulators. The exercise showed that the Monitoring Universe of Non-Bank Financial Intermediation (MUNFI) grew in 2016 at a marginally faster rate than in 2015 to an aggregate US$160 trillion (i.e., for 21 jurisdictions and the euro area as a whole). MUNFI’s share within the global financial assets increased for the fifth consecutive year to 48 per cent. X.30 The Reserve Bank continued its engagement with the various Bank for International Settlements (BIS) working groups during the year and deliberations were held on a multitude of topical issues such as globalisation, Big Data, central bank digital currency, snapbacks from the unwinding of the Fed balance sheet and risk weight on sovereign assets. The adoption of various Basel III standards has been achieved in India within the BCBS agreed timelines. X.31 The Reserve Bank is also represented on the Committee on the Global Financial System (CGFS), which has set up various working groups on issues such as structural changes in the banking sector post the global financial crisis, implications of a prolonged period of low interest rates and establishing viable capital markets. The Reserve Bank is represented on these working groups as well. BRICS X.32 The BRICS FMCBG meeting at Shanghai in June 2017 and the Xiamen Summit in September 2017, agreed to establish a BRICS Bond Fund (BBF) with the main objective of promoting local currency bond markets in the BRICS countries to improve market infrastructure, reduce barriers to bond investment, provide a low-cost bond portfolio for investors and motivate the participation of international investors in the BRICS local currency bond markets. The department is overseeing the initial preparations for setting up of the BBF. Furthermore, it has been working to keep the BRICS Contingent Reserve Arrangement (CRA) in operational readiness and building upon a system of macroeconomic exchange of information amongst CRA members covering 60 economic and financial indicators that was developed by the Reserve Bank as part of surveillance under the BRICS CRA. South Asian Association for Regional Cooperation (SAARC) X.33 The fourth seminar on SAARCFINANCE database and the second meeting of the working group on SAARCFINANCE database were organised during March 22-23, 2018 at the Jaipur Office of the Reserve Bank, with a view to standardising and enhancing the coverage of data in the SAARCFINANCE database, maintained by the Reserve Bank. Under the SAARCFINANCE roadmap of cooperation, technical support and exposure were provided to member central banks on areas of supervision, monetary policy, currency management, banking regulation, financial markets, financial inclusion and library management. These apart, liquidity support was provided to some central banks under the SAARC swap arrangement. The extension framework of the swap arrangement for the SAARC countries was also finalised during the year with some modifications in order to avoid repeated recourse to swaps in keeping with the spirit of a backstop liquidity to meet temporary balance of payment needs. The scheme is now extended for a period of two years till March 16, 2019. X.34 The Joint Technical Coordination Committee (JTCC) is a forum of the Reserve Bank and the Nepal Rastra Bank to resolve matters of mutual concern. During the year, a major achievement due to the Reserve Bank’s intervention was the decision to remit pension to Nepalese pensioners, residing in Nepal, following the Employees Provident Fund Organisation’s (EPFO) concurrence in consultation with select PSBs that have subsidiaries in Nepal. Other Activities X.35 Six Inter-Departmental Working Groups (IDWGs) were constituted in August 2017 to deal with the regulatory issues under negotiations in various global fora which were coordinated by the department. These groups worked on issues such as: (i) Basel III implementation in India and finalisation of remaining elements thereof; (ii) FinTech and digital innovation and their financial stability implications (including virtual currencies) with special reference to India; (iii) resolution and deposit insurance framework for financial firms in India (as envisaged in terms of the Financial Resolution and Deposit Insurance Bill) with the objective of benchmarking against the FSB’s key Attributes of Effective Resolution Regimes; (iv) effects of the post-crisis global financial regulatory reforms (as implemented by the FSB for more resilient financial system) and their intended and unintended consequences in India; (v) elements of Global OTC Derivative Reforms since the global financial crisis, regulatory compliance and their broader effects on OTC derivative market in India in terms of parameters like legal barriers to reporting and accessing trade data, margining requirements, etc. and (vi) institutionalising macro-prudential framework in India for securing financial stability. The groups have worked on the positions that India may take on these issues with respect to the agenda of the international organisations. X.36 Technical assistance programmes and staff exchange visits were organised for various SAARC central banks in several areas. In addition, during 2017-18, the department organised 41 exposure visits including attachments for capacity building for foreign central banks/regulatory authorities/ ministries and foreign universities of repute. Talks by national and international experts were also organised under Mimamsa - the department’s discussion forum. The Reserve Bank continued its support towards South Asia Regional Training and Technical Assistance Center (SARTTAC) and international groupings such as G24 and G30. Agenda for 2018-19 X.37 The department will continue to follow up and maintain India’s stance on international issues in coordination with the government. It will continue to pitch for completion of the 15th GRQ in a timely manner with realignment of quota shares of the emerging market and developing economies whose under-representation has been increasing. It will also work towards successful completion of the IMF’s Article IV 2018 Mission that visited India during May 2018. X.38 Stabilising and further expansion of the SAARCFINANCE database initiative will be undertaken through the next seminar and meeting of the working group on the SAARCFINANCE database. The agenda under the SAARCFINANCE roadmap will be furthered with capacity building, technical support, collaborative studies and database initiatives. X.39 During the year, the department will be working towards the establishment of the BBF that is expected to be operationalised by 2019. It will also be working towards strengthening the macroeconomic exchange of information to enhance the surveillance capacity of BRICS CRA. Also, BRICS CRA test runs will be conducted during the year to check the operational readiness of the CRA arrangements. The department will continue to provide reliable, thorough and research-based policy briefs, notes and interventions on issues being discussed at various international fora. GOVERNMENT AND BANK ACCOUNTS X.40 The Department of Government and Bank Accounts (DGBA) oversees the functions of the Reserve Bank as banker to banks and banker to government, besides formulating internal accounting policies of the Bank. Agenda for 2017-18: Implementation status X.41 The department monitored the implementation of the GST framework, which was successfully stabilised during the year. Mumbai Regional Office was designated as the nodal office to attend to GST related issues. On the issue of integration of state governments with the Reserve Bank’s e-Kuber, 14 state governments for e-receipts and 11 state governments for e-payments have been integrated so far with e-Kuber. Further, government banking divisions have been opened in seven Regional Offices which will help integrate the state government treasury systems with the Reserve Bank’s e-Kuber for e-receipts and e-payments besides addressing specific needs of the state governments (Box X.4). At the same time, various other state governments are in different levels of technological preparedness. The Bank has been pursuing with the remaining state governments through scheduled meetings, conferences, etc. for integration with e-Kuber, by extending to the state governments necessary technical and non-technical support. With the introduction of Cheque Truncation System (CTS), the need for physical movement of cheques from the presenting bank to the paying bank has been eliminated, as cheques are paid on the basis of cheque images. However, banks are still required to obtain the physical cheque issued by state governments from the presenting bank and submit the same to the concerned state government authorities. The process put in place for such exchange of physical cheques is called P2F (Paper to Follow). In case of central government cheques, the P2F process has been discontinued, effective February 2016. As all state governments are yet to give their consent for discontinuation of P2F arrangement in cheque clearing, efforts are underway to identify technical solution for discontinuation of P2F for specific state governments. Agenda for 2018-19 X.42 During 2018-19, integration of remaining state governments with Reserve Bank’s e-Kuber will be taken up so as to facilitate improved conduct of government business. Discontinuation of P2F arrangements for cheque clearing, in phases for state governments, will be taken up through technological solutions. The department would examine the feasibility of the implementation of the recommendations of the Committee on Cost of Government Banking (Chairman: Shri S. Ganesh Kumar), 2018 and the Working Group on Business Process Re-engineering of Government Banking (Chairman: Shri G. Sreekumar), 2017. Box X.4 Opening of Government Banking Divisions in Seven Regional Offices The Reserve Bank is acting as the principal banker to various state governments as per the provisions of Section 21A of the RBI Act, 1934. Accordingly, Government Banking Divisions (GBDs) at 18 Reserve Bank Offices had been rendering the function as banker to the state governments. In furtherance of this objective and also for providing better service to the needs of state governments at the local level, it was decided to open GBDs at the Reserve Bank Offices in state capitals not having GBDs. These GBDs also facilitate meeting the specific needs of state governments due to proximity by being in the state capitals. Further, these GBDs also play a crucial role in integrating the state government treasury systems with the Reserve Bank’s e-Kuber for e-receipts and e-payments. With this, there are 25 GBDs operational at present. The details of the new GBDs that have commenced operations during 2017-18 are as under: | Sr. No. | New GBDs | Date of Commencement of Operations | Jurisdiction of GBD | | 1 | Ranchi | August 1, 2017 | Jharkhand | | 2 | Shimla | September 15, 2017 | Himachal Pradesh | | 3 | Dehradun | October 3, 2017 | Uttarakhand | | 4 | Raipur | November 13, 2017 | Chhattisgarh | | 5 | Panaji | December 5, 2017 | Goa | | 6 | Shillong | February 2, 2018 | Meghalaya | | 7 | Agartala | March 5, 2018 | Tripura | | Source: RBI. | |

MANAGING FOREIGN EXCHANGE RESERVES X.43 The Department of External Investments and Operations (DEIO) manages the country’s Foreign Exchange Reserves (FER), with focus on safety, liquidity and returns. During the year under review, FER increased by 5.0 per cent by June 2018 over June 2017, as compared to 6.3 per cent witnessed in the corresponding period of the previous year. Agenda for 2017-18: Implementation Status X.44 Diversification of India’s Foreign Currency Assets (FCA) continued during the year with attention being ascribed to risk management, including cyber security risk. The gold portfolio has also been activated. A comprehensive review of the credit risk policy was carried out during the year and the credit risk monitoring mechanism was strengthened. Enhancements to the IT system have been implemented to take care of the new requirements. A number of proactive and preventive measures were taken to ensure the efficacy of the extant IT security system. The backup mechanism was tested periodically and the gaps were suitably fixed. Agenda for 2018-19 X.45 The agenda for 2018-19 includes taking effective steps to further enhance the levels of protection against cyber risks, system development for undertaking interest rate futures transactions and entering into repo transactions to enhance returns. ECONOMIC AND POLICY RESEARCH X.46 A knowledge centre for macroeconomic policy oriented research, the Department of Economic and Policy Research (DEPR) of the Reserve Bank is entrusted with the task of providing research inputs and management information system services for policy-related decision making. The department’s contributions are multi-dimensional. Apart from being a source of important primary national level data, DEPR is also responsible for the Reserve Bank’s statutory reports and frontline research publications, as also the Bank’s collaboration with external experts on policy-oriented research. Agenda for 2017-18: Implementation Status X.47 During the year, the department brought out the flagship publications of the Reserve Bank, viz., the Annual Report, Report on Trend and Progress of Banking in India, Reserve Bank of India Bulletin, and the third edition of the Handbook of Statistics on Indian States. The department also published the RBI Occasional Papers and 4 working papers. The department compiled and disseminated primary statistics on monetary aggregates, balance of payments, external debt, combined government finances, household financial savings and flow of funds. X.48 During 2017-18, thirty one research papers/articles were completed, of which 12 were published outside the Bank in domestic and foreign journals. The research areas included: monetary policy transmission and impact of global spillovers, monetary policy and asset quality, credit potential in Manipur, non-banking financial companies (NBFCs) in India’s financial landscape, credit and efficiency in Indian agriculture, and rural wage dynamics and inflation. Two Development Research Group (DRG) studies, viz., Some Macroeconomic Impacts of Different Types of Public Expenditure in India - Analysis using a Computable General Equilibrium Model; and Role of Financial Frictions in Monetary Policy Transmission in India, were completed during the year. X.49 The department organised a number of events during the year. The 15th L. K. Jha Memorial Lecture was delivered by Professor Vijay Joshi, Emeritus Fellow, Merton College, Oxford on December 11, 2017. Eminent speakers delivered talks during the year including Dr. Maurice Obstfeld, Economic Counsellor and Director of Research, IMF on ‘macrofinancial shocks and the trilemma’; Dr. Hyun Song Shin, Economic Adviser and Head of Research, BIS on ‘global liquidity and monetary policy spillovers’; and Dr. Pravin Krishna, Chung Ju Yung Distinguished Professor of International Economics and Business, Johns Hopkins University, Washington DC on ‘effects of GST on internal and external trade flows in India’. X.50 The DEPR Study Circle, an in-house research discussion forum, organised 40 various seminars and presentations on diverse themes. Besides, external experts, viz., Prof. Sumru Altug, Professor of Economics, Koç University and Research Fellow, CEPR, Istanbul, and Dr. Robert Beyer, Economist, World Bank were invited to make presentations. The annual research conference of the department was held in the College of Agricultural Banking, Pune during May 2018, which included a keynote address by Dr. Rathin Roy, Director, National Institute of Public Finance and Policy (NIPFP) on ‘the political economy of Indian fiscal rules’ and a panel discussion on ‘fiscal risk and monetary policy’ by academic and policy experts (Dr. Ravindra Dholakia, Member, MPC; Dr. Partha Ray, Professor, IIM Calcutta; Dr. Pinaki Chakraborty, Professor, NIPFP; and Dr. Samiran Chakraborty, Managing Director and Chief Economist, Citigroup) apart from staff deliberations on the evolving organisational issues. The third edition of the Handbook of Statistics on Indian States, that provides a wealth of data on the regional economy was also released at the conference. Agenda for 2018-19 X.51 Going forward, apart from the usual statutory and non-statutory publications, and compilation and dissemination of data, some policy-oriented macroeconomic and monetary policy issues have been identified for focused analysis and research during 2018-19. They include: transmission of monetary policy, credit growth and banking sector health, impact of loan loss provisions on bank credit, non-banking financial institution’s financial performance, changing dynamics in monetary aggregates, fiscal policy and financial markets, relationship between implied volatility indices (VIX) and stock price indices, global liquidity and FII flows, impact of farm credit on investment and performance of priority sector lending, big-data study based on night-time luminosity as a supplementary measure of economic activities in India, effectiveness of trade policy measures in managing food inflation in India, minimum support prices and food inflation, impact of demographic changes on the macroeconomic outlook of India, and crypto currency and its challenges for central banks. Furthermore, in keeping with the frequency of release of many other macroeconomic statistics as also the practices in advanced economies, generation of quarterly estimates of household financial savings and flow of funds will be attempted. The department will continue to organise a number of seminars and lectures during 2018-19. The History of the Reserve Bank Volume-V would cover 15 chapters on diverse areas spanning the period of 1997-2008 and will be completed by the History Cell by December 2018. STATISTICS AND INFORMATION MANAGEMENT X.52 The Department of Statistics and Information Management (DSIM) is driven by two overarching goals, viz., to collect, process and disseminate national-level macroeconomic and financial statistics of the highest quality, with a focus on banking, monetary, corporate and external sectors; and to provide statistical and analytical support to all functions of the Reserve Bank through forward looking surveys, data management and applied statistical research. In pursuit of these objectives, DSIM maintains a centralised database for the Reserve Bank, manages the centralised submission of returns through the eXtensible Business Reporting Language (XBRL) system and provides a range of information management related support services. Agenda for 2017-18: Implementation Status X.53 During the year, the department brought out its regular publications, viz., Handbook of Statistics on the Indian Economy, 2016-17; Statistical Tables Relating to Banks in India 2016- 17; Basic Statistical Returns of SCBs in India: March 2017; Composition and Ownership Pattern of Deposits: March 2017; Quarterly BSR-1: Outstanding Credit of SCBs upto December 2017 and Quarterly Statistics on Deposits and Credit of SCBs (BSR-7) upto March 2018. The Weekly Statistical Supplement (WSS) and the ‘Current Statistics’ portion of the RBI Bulletin were generated from the Database on Indian Economy (DBIE), as per the prescribed frequency. Under the guidance of the Technical Advisory Committee on Surveys (TACS), several improvements were considered in the conduct of surveys relating to monetary policy. Important among them were extending the coverage of the Consumer Confidence Survey (CCS) to seven more cities, finalising probability based sampling design for the Inflation Expectation Survey of Households (IESH) and revising the method for estimation of Capacity Utilisation (CU) for the manufacturing sector based on the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) data. Unit level data of the IESH and CCS were released in the public domain to promote research. Besides the payment systems data, data on Tax Deducted at Source (TDS), based on returns filed by the employers to income tax authorities, and salary account data of banks are also being explored for development of an employment index. During the year, the risk profile of the listed non-government non-financial companies was analysed based on suitably chosen stress scenarios. X.54 An Expert Group (Chairman: Prof. G. Sivakumar, IIT, Bombay) was constituted to initiate the project on revamping the data warehouse system. The Group has provided a blue print for the proposed Centralised Information Management System (CIMS). Based on the same, a Technical Advisory Group (TAG) with three sub groups, viz., i) Data Governance Sub-Group (DGS); ii) Subject Matter Expert (SME) Sub-Group; and iii) Data Analytics Sub-Group (DAS) have been formed for preparation of the project. The CIMS will include Big Data platform, centralised analytics with metadata repository and state of the art data visualisation tools. X.55 The Vulnerability Assessment and Penetration Testing (VA-PT) of the Hadoop system for analysing transaction-level payment system data from National Electronic Funds Transfer (NEFT) and National Automated Clearing House (NACH) was carried out during the year. A new web-based, self-validating system for collecting and maintaining information on bank branches with the facility to validate their geographical location with boundaries of the districts has been developed. The web-based banking assets and liabilities (Nostro/Vostro) reporting system went live from the first fortnight of August 2017. Thirty one returns related to various departments including DPSS, FMRD, MPD, DBS, DNBS and FED have been developed under the XBRL system and are expected to go live shortly. The migration of the web and application server of the XBRL system to virtual environment was completed in January 2018. Under the guidance of the Return Governance Group (RGG), an up-to-date list of all the returns prescribed by the Bank, excluding ad hoc/confidential supervisory information sought, along with circulars and formats was placed on the Bank’s website in February 2018. X.56 Definitions for 189 major data elements appearing in various banking returns were harmonised and provided to DBR, which released them in the public domain in two phases on March 30, 2017 and January 4, 2018. The harmonised definitions are expected to minimise data discrepancy issues across returns. X.57 The department provided secretarial support to the High Level Task Force (HTF) on Public Credit Registry (PCR) for India, constituted by the Reserve Bank in October 2017. The HTF engaged actively with all major stakeholders to understand the state of the credit information reporting system in India and identify the gaps in the same. The HTF submitted its report to the Bank on April 04, 2018. The report presents an outline of the proposed PCR in terms of structure, governance and technological framework. The Reserve Bank considered the recommendations of the HTF and decided that a PCR would be set up by the Bank in a modular and phased manner. The report of the HTF was made available for public on the Bank’s website on June 06, 2018. An Implementation Task Force (ITF) has been constituted to help design and undertake logistics for the next steps in setting up of the PCR. X.58 The department provided secretarial support to the Committee on Financial Sector Statistics (Chairman: Prof. Ravindra H. Dholakia), constituted by the National Statistical Commission to review the existing system for collection and processing of Flow of Funds (FoF) statistics; explore the possibility of providing such estimates at the state level; recommend suitable measures to improve timelines; and revamp the system for processing and periodic audit with the aim to disseminate data consistent with international standards. The Committee in its report submitted in May 2018 made wide ranging recommendations for improving the system of FoF compilation in India in line with the prescriptions of the G20 Data Gap Initiatives. Agenda for 2018-19 X.59 Going forward, the PCR will be set up and operationalised in phases under the guidance of the ITF. The work relating to CIMS will be taken forward by floatation of the request for proposal. The Central Information System for Banking Infrastructure (CISBI) for maintaining up-to-date information on all banking units along with their geographical location would be implemented. A prototype for a geographic information system that plots banking units on India’s map will be developed for internal use. A system of detailed monitoring of housing and personal loans on quarterly basis would be established, for regular in-depth internal analysis of various aspects of credit-flow to these critical sectors. An exploratory employment index based on robust data will be constructed. During 2018-19, efforts would be made to disseminate unit level data from other qualitative surveys suppressing respondents’ identities. Further, surveys on start-up companies and payment habits of individuals will be taken up. Towards promoting usage of the SAARCFINANCE database, its scope will be enhanced and web-portal for automated data submission will be developed. Further, automation of data flow pertaining to the annual financial statements of companies from the Ministry of Corporate Affairs to the Bank has been taken up to improve the timeliness, enrich the coverage as well as to enhance the quality of corporate sector analysis. Research and policy analysis in the areas of modelling and forecasting, banking and risk modelling, corporate and external sector assessment and big data analytics will be pursued during 2018-19. Co-ordination with the proposed Data Sciences Lab announced in the Statement on Developmental and Regulatory Policies in April 2018, will be carried out as required. LEGAL ISSUES X.60 The Legal Department is an advisory department established for examining and advising on legal issues and for facilitating the management of litigation on behalf of the Reserve Bank. The Legal Department vets the circulars, directions, regulations and agreements for various departments of the Reserve Bank with a view to ensuring that the decisions of the Reserve Bank are legally sound. The department also extends support and advice to the Deposit Insurance and Credit Guarantee Corporation (DICGC) and other Reserve Bank-owned institutions on legal issues, litigation and court matters. Agenda for 2017-18: Implementation Status X.61 Several important legislations/regulations concerning the financial sector were brought in/ amended during the year. Section 17(1-A) has been inserted in the RBI Act, 1934, authorising the Reserve Bank to accept money as deposits repayable with interest from banks or any other person under the Standing Deposit Facility Scheme for the purpose of liquidity management. The Reserve Bank of India Monetary Policy Committee and Monetary Policy Process Regulations, 2016 were framed to provide for the procedure and conduct of the Monetary Policy Process and a code of conduct for the MPC members. X.62 Two new sections authorising the Reserve Bank to issue directions to banking companies to initiate the insolvency resolution process and to issue directions with regard to stressed assets have been inserted in the Banking Regulation Act, 1949. Sub-section 2 of section 35-AB of the Banking Regulation Act, 1949 empowers the Reserve Bank to specify authorities or committees to advise banks on resolution of stressed assets. These provisions have been made applicable to public sector banks as well. X.63 The Insolvency and Bankruptcy Code, 2016 was amended to make a provision under the code for ‘persons not eligible to be resolution applicant’. The ineligible persons or entities for participation in the resolution process will include undischarged insolvent, wilful defaulter, those whose accounts have been classified as non-performing assets for more than a year, and all related entities of these firms. The amendment ordinance of 2018 aimed towards promoting resolution over liquidation, by lowering the voting thresholds in the committee of creditors, rationalises the conditions of ineligibility for participation in the resolution process. X.64 The Reserve Bank of India has made Credit Information Companies (Amendment) Regulations, 2017 amending the Credit Information Companies Regulations to include an ‘information utility’ and a ‘resolution professional’ appointed under the Insolvency and Bankruptcy Code, 2016 as ‘specified users’. The Bank has introduced ‘The Ombudsman Scheme for Non-Banking Financial Companies, 2018’ from February 23, 2018 for customers of NBFCs under Section 45L of the RBI Act, 1934. X.65 The Negotiable Instruments (Amendment) Bill, 2017 which empowers the court to direct the drawer of the cheque to pay interim compensation to the complainant, subject to certain conditions, has been introduced in the Parliament. X.66 The High Court of Gujarat upheld the exercise of power by the Reserve Bank under the Banking Regulation Act, 1949, relating to directions to banks to initiate the insolvency resolution process. Agenda for 2018-19 X.67 In 2018-19, the department will continue to advise various other departments of the Reserve Bank on legal matters and furnish specific legal opinions whenever sought. It will also continue its efforts at managing litigation on behalf of the Reserve Bank and function as a secretariat to the Appellate Authority under the Right to Information Act. Amendments to various Acts administered by the Reserve Bank will be pursued during the year in pursuance of international commitments and standards and to clarify relevant provisions.

|