The Reserve Bank successfully managed the market borrowing requirements of the central and state governments

during 2016-17 in an orderly manner in the face of multiple challenges such as glide path for reduction in

Held to Maturity(HTM) category and Statutory Liquidity Ratio(SLR), supply concerns over increased state

government issuances, issuances of UDAY bonds and global uncertainties. The borrowing programme was

conducted in line with the debt management strategy of low cost, risk mitigation and market development

while factoring in domestic as well as global economic and financial conditions. The maturity profile of dated

securities was elongated to contain rollover risk while lowering overall borrowing cost, keeping risk at prudent

levels. Despite volatility triggered by both domestic and global factors during the year, G-sec yields witnessed

significant softening, particularly after demonetisation in November 2016 and the consequent surplus liquidity

of the banking system. However, the yields hardened in February 2017 in response to shift in the monetary policy

stance from accommodative to neutral. The agenda for 2017-18 includes elongation of maturity profile of

government debt and widening the bouquet of products for diverse investors.

VII.1 The Internal Debt Management

Department of the Reserve Bank manages

the domestic debt of the central government by

statute vide Sections 20 and 21 of the RBI Act,

1934 and that of 29 state governments and the

Union Territory of Puducherry in accordance with

bilateral agreements, as provided in Section 21A

of the said Act. The Reserve Bank also provides

short-term credit up to three months to both

central and state governments in the form of Ways

and Means Advances (WMA) to bridge temporary

mismatches in their cash flows in terms of Section

17(5) of the Act.

Agenda for 2016-17: Implementation Status

VII.2 During the year, the Reserve Bank

successfully managed the borrowing programme

of the central government and state governments,

notwithstanding multiple challenges in the form of

the glide path for reduction in HTM category of

banks’ investment portfolio and SLR requirements

and supply concerns over increased issuances by state governments, including Ujwal DISCOM

Assurance Yojana (UDAY) bonds. The borrowing

programme of the central government in 2016-17,

was conducted in accordance with the overall debt

management strategy of low cost, risk mitigation

and market development, while factoring in

domestic and global economic and financial

conditions. In line with the above objectives, a

strategy of active consolidation through buyback/

switches was adopted and debt to the extent of

₹641.33 billion and ₹405.10 billion was bought back

and switched, respectively. This had a salutary

effect on the weighted average maturity of central

government debt. To widen retail investments,

access was given to individuals under the non-competitive

bidding in the primary auction of

Treasury Bills (T-Bills). Following the deliberations

by the Cash Co-ordination Committee comprising

officials of the Reserve Bank and the Government

of India (GoI), GoI issued guidelines towards better

information sharing and cash flow forecasting.

VII.3 With a view to increasing acceptability

of the Sovereign Gold Bond (SGB) scheme and

widening the investor base of SGBs, the scheme

was modified suitably. The minimum subscription

amount was reduced to one gram of gold, a

discount of ₹50 offered on the face value of the

security and the number of receiving agencies

increased to include stock exchanges.

VII.4 As part of the ongoing endeavour to

consolidate the debt in State Development Loans

(SDLs) through buyback, the state of Maharashtra

repurchased its high cost debt. Further, the

states that do not maintain reserves in the form

of consolidated sinking fund (CSF) and guarantee

redemption fund (GRF) were encouraged to do so

as a prudent risk management measure.

VII.5 Government securities (G-sec) yields

witnessed significant softening during the

year, particularly after demonetisation and the

consequent surplus liquidity in the banking system.

The yields, however, hardened in February 2017

in response to the shift in monetary policy stance

from accommodative to neutral. The benchmark

yield softened thereafter on lower inflation data,

FPI buying and expectations of normal monsoon.

Debt Management of the Central Government

VII.6 The Reserve Bank in consultation with GoI

followed a strategy of front loading of issuances,

but modulated its market borrowings from the

budget estimates during the fourth quarter,

reducing thereby, the supply of sovereign paper in

the market. As against gross market borrowings of

₹6,000 billion through dated securities proposed

in the Union Budget 2016-17, the actual amount

mobilised was modulated to ₹5,820 billion on

the back of higher surplus cash balances of

the central government. Net market borrowings

through dated securities amounted to ₹4,082

billion in 2016-17, registering a decline of 7.4 per cent and financing 76.4 per cent of the gross

fiscal deficit (GFD), as against 82.0 per cent in

the previous year. On the other hand, net short

term market borrowings through T-Bills increased

to ₹186 billion during 2016-17 from ₹152 billion in

2015-16 mainly due to higher issuances in H1 of

2016-17. In the aggregate, however, net market

borrowing through dated securities and T-Bills

declined by ₹291 billion to ₹4,268 billion in

2016-17 (Table VII.1).

| Table VII.1: Net Market Borrowings of the

Central Government |

| (₹ billion) |

| Item |

2014-15 |

2015-16 |

2016-17 |

2017-18* |

| 1 |

2 |

3 |

4 |

5 |

| Net Borrowings |

4635 |

4559 |

4268 |

2517 |

| (i) Dated Securities |

4,532 |

4,406 |

4,082 |

1312 |

| (ii) 91-day T-Bills |

32 |

39 |

245 |

885 |

| (iii) 182-day T-Bills |

9 |

5 |

57 |

26 |

| (iv) 364-day T-Bills |

62 |

109 |

-115 |

5 |

| *: Up to June 30, 2017. |

Debt Management Operations

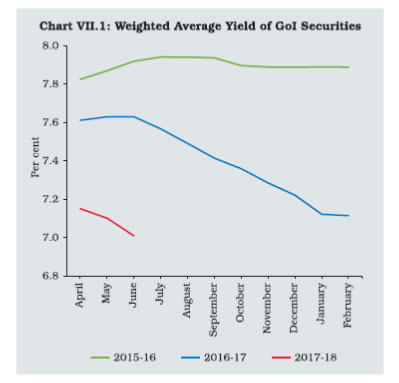

VII.7 The weighted average yield (WAY) of

dated securities of central government issued

during the year declined by 73 bps to 7.16 per

cent in 2016-17 while the weighted average

coupon (WAC) on the outstanding stock of

dated securities declined by 9 bps to 7.99 per

cent as on March 31, 2017. The declining trend

in yield continued in 2017-18 so far (upto June

30) reflecting benign market conditions and

increased liquidity (Chart VII.1).

VII.8 The weighted average maturity (WAM)

of the outstanding stock increased marginally to

10.65 years as at end-March 2017 (Table VII.2).

However, the WAM of issuances during 2016-17

declined by 1.27 years to 14.76 years, reflecting

relatively larger issuances in the maturity buckets

below 19 years. The Reserve Bank continued

its policy of passive consolidation by way of

reissuances and active consolidation through buyback/switches. Out of 164 auctions, 156

were reissuances during the year. Buyback/

switches amounted to ₹1,046 billion in 2016-17

as compared to ₹611 billion in the previous year.

Furthermore, the share of issuances in the two

long maturity buckets declined from 38 per cent

in 2015-16 to 29 per cent in 2016-17, mirroring

the relatively muted demand for long bonds.

VII.9 During 2016-17, the residual maturity of 59

per cent of the market borrowings through dated

securities was 10 years and beyond, as compared with 66 per cent during the previous year, mirroring

an increase in the share of maturities less than 10

years (Table VII.3). With the objective of catering

to the demand for long term investors such as

insurance companies and pension funds, 30 and

35-year tenor bonds were issued during the year.

Primary Dealers and Devolvement

VII.10 The elevated supply of SDLs, including

UDAY bonds during 2016-17 resulted in

devolvement of central government securities on

Primary Dealers (PDs) on four instances for an

aggregate amount of ₹53 billion, as compared with

devolvement of ₹110 billion during the previous

year. The share of the PDs in the subscription to

primary auctions of central government securities

stood at 47.6 per cent in 2016-17, down from 54.2

per cent in 2015-16. The underwriting commission

paid to PDs during 2016-17 declined to ₹0.357

billion from ₹0.471 billion during 2015-16, mainly

on account of ample liquidity conditions. There was

only a single instance of devolvement amounting

to ₹32 billion in Q1 of 2017-18. All the standalone

PDs complied with their target commitments

in auction bidding, secondary market turnover

targets and continued to maintain capital to risk

weighted assets ratio (CRAR) above the minimum

requirement of 15 per cent.

| Table VII.2: Market Loans of Central Government – A Profile* |

| (Yield in per cent /Maturity in years) |

| Years |

Range of YTMs at Primary Issues |

Issued during the Year |

Outstanding stock |

| Under 5 years |

5-10 years |

Over 10 years |

Weighted

Average

Yield |

Range of

Maturities of

New Loans |

Weighted

Average

Maturity |

Weighted

Average

Maturity |

Weighted

Average

Coupon |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

| 2012-13 |

8.21-8.82 |

7.86-8.76 |

7.91-8.06 |

8.36 |

5-30 |

13.50 |

9.66 |

7.97 |

| 2013-14 |

7.22-9.00 |

7.16-9.40 |

7.36-9.40 |

8.41 |

6-30 |

14.23 |

10.00 |

7.98 |

| 2014-15 |

- |

7.66-9.28 |

7.65-9.42 |

8.51 |

6-30 |

14.66 |

10.23 |

8.08 |

| 2015-16 |

- |

7.54-8.10 |

7.59-8.27 |

7.89 |

6-40 |

16.03 |

10.50 |

8.08 |

| 2016-17 |

- |

6.13-7.61 |

6.46-7.87 |

7.16 |

5-40 |

14.76 |

10.65 |

7.99 |

| 2017-18# |

- |

6.52-6.95 |

6.74-7.53 |

7.01 |

6-39 |

14.99 |

10.67 |

7.95 |

| Note: YTM: Yield to Maturity; #: Up to June 30, 2017; -: No issues; *: excluding buyback/switch in GoI securities and special securities. |

| Table VII.3: Issuance of Government of India Dated Securities – Maturity Pattern |

| (Amount in ₹ billion) |

| Residual Maturity |

2014-15 |

2015-16 |

2016-17 |

2017-18* |

| Amount

raised |

Percentage

to total |

Amount

raised |

Percentage

to total |

Amount

raised |

Percentage

to total |

Amount

raised |

Percentage

to total |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

| Less than 5 years |

- |

- |

- |

- |

180 |

3.1 |

- |

- |

| 5 -9.99 years |

2,350 |

39.7 |

2,000 |

34.2 |

2,220 |

38.1 |

880 |

44.7 |

| 10-15.99 years |

1,510 |

25.5 |

1,600 |

27.4 |

1,710 |

29.4 |

519 |

26.4 |

| 16 -19.99 years |

960 |

16.2 |

1,120 |

19.1 |

820 |

14.1 |

250 |

12.7 |

| 20 years & above |

1,100 |

18.6 |

1,130 |

19.3 |

890 |

15.3 |

320 |

16.3 |

| Total |

5,920 |

100.0 |

5,850 |

100.0 |

5,820 |

100.0 |

1,969 |

100.0 |

| *: As on June 30, 2017; -: No Issues. |

Ownership of Securities

VII.11 The outstanding dated securities of central

government registered 8.4 per cent year-on-year

growth in 2016-17. Commercial banks, including

the PD segment remained the largest holder with

40 per cent share as at end-March 2017, followed

by insurance companies with a share of 22.9 per

cent. The Reserve Bank held 14.7 per cent while

provident funds held 6.3 per cent.

Sovereign Gold Bond Scheme

VII.12 The Reserve Bank successfully managed

the issuances of SGBs during 2016-17.

Four tranches of SGBs for an aggregate amount

of ₹34.69 billion (11.44 ton) were issued during

the year. Since the inception of the scheme in

November 2015, a total of ₹60.29 billion (20.73

ton) has been mobilised and SGBs have been

allotted to approximately 1.4 million retail investors

including the issuances of two tranches in (May

and July) 2017-18.

Medium Term Debt Management Strategy (MTDS)

VII.13 The MTDS was formulated as a debt

management framework in 2015, in consultation

with the Government of India, for a period of three

years and rolled over each year. It is premised on three broad pillars: low cost, risk mitigation and

market development. The MTDS, which is in line

with international best practices, calibrates certain

benchmarks on the composition of debt in terms

of short and long term, floating and fixed rate, and

maturity of debt. It also stipulates stress tests and

scenario analysis in relation to costs, maturity and

potential risks. The debt of the central government

has been reviewed against the MTDS benchmarks

and found to be stable and sustainable.

Treasury Bills

VII.14 With a view to encouraging wider

participation and retail holding of T-Bills and in

line with the first bi-monthly monetary policy

statement of 2015-16, the central government in

consultation with the Reserve Bank, extended

the non-competitive bidding facility in T-Bills to

retail investors up to a ceiling of 5 per cent of the

notified amount. As mentioned earlier, net market

borrowings through T-Bills increased during 2016-17. The yields on T-Bills largely mimicked the

declining trend in the yields of dated securities

in 2016-17. Reflecting the increase in appetite

for T-Bills from market participants, the Primary

Dealers’ share in T-Bills auctions declined to 74.4

per cent from 75.4 per cent during 2015-16. The

PDs individually achieved the stipulated minimum success ratio of 40 per cent in bidding while the

success ratio of the PD system as a whole was

58.8 per cent and 60.0 per cent during H1 and H2,

respectively, of 2016-17.

Market Stabilisation Scheme (MSS)

VII.15 With a view to absorbing excess liquidity

in the banking system following demonetisation

in November 2016, the limit for the MSS was

increased. Under MSS, the total amount of cash

management bills (CMBs) issued, for tenors

ranging from 14 to 63 days, amounted to ₹10,115

billion, with associated interest outgo of ₹57

billion. During 2017-18 (up to June 30), T-Bills

issued under MSS for tenors ranging from 312 to

329 days amounted to ₹1,000 billion.

Pradhan Mantri Garib Kalyan Deposit Scheme

(PMGKDS)

VII.16 In the wake of demonetisation, the central

government launched the PMGKDS on December

17, 2016, as a tax amnesty scheme available from

December 17, 2016 to March 31, 2017. Under

this scheme, the deposits are held at the credit of

the declarant of tax in the bonds ledger account

(BLA) maintained with the Reserve Bank and a

certificate of holding is issued to the declarant.

Deposits mobilised under this scheme amounted

to ₹12.4 billion.

Cash Management of the Central Government

VII.17 The WMA limits for the central government

for the first and the second halves of 2016-17

were increased each by ₹50 billion to ₹500 billion

and ₹250 billion, respectively. The government

was in WMA for 26 days during 2016-17

vis-à-vis 15 days during the previous year.

The accommodation to the central government

under WMA was ₹1,567 billion during 2016-17

as compared with ₹838 billion in 2015-16. The

government resorted to overdraft (amounting to

₹68 billion) only once during the year on July 5, 2016. The government’s cash position improved

subsequently, mainly on account of increased

tax flows and higher investments in intermediate/

auction treasury bills (ITBs/ATBs) by state

governments (Chart VII.2).

VII.18 With the advancement of budget

presentation this year, the government units have

started to frontload expenditure, unlike in the

previous years. This combined with low net tax

receipts and large redemption pressure in the first

quarter of 2017-18, caused the cash balances of

the central government to move into prolonged

periods of deficit, warranting issue of CMBs of

₹1,300 billion during the Q1 of 2017-18. The switch

operations undertaken in January, March and

June 2017 helped in easing the stress in the cash

balances to a certain extent. The WMA limit for

the first quarter of 2017-18 was set at ₹600 billion

while the same for the second quarter would be

₹700 billion.

Debt Management of State Governments

VII.19 The gross market borrowings of the

state governments amounted to ₹3,820 billion in 2016-17 as compared with ₹2,946 billion in the

previous year (Table VII.4).

| Table VII.4: Market Borrowings of States through SDLs |

| (₹ billion) |

| Item |

2014-15 |

2015-16 |

2016-17 |

2017-18* |

| 1 |

2 |

3 |

4 |

5 |

| Maturities during the year |

334 |

352 |

393 |

74 |

| Gross sanction under article 293(3) |

2,435 |

3,060 |

4,000 |

2,980 |

| Gross amount raised during the year |

2,408 |

2,946 |

3,820 |

650 |

| Net amount raised during the year |

2,075 |

2,594 |

3,427 |

576 |

| Amount raised during the year to total sanctions (per cent) |

99 |

96 |

96 |

22 |

| Outstanding liabilities (at the end period)# |

12,757 |

16,389 |

20,896 |

21,472 |

| # Including UDAY and other special securities; *: Up to June 30, 2017. |

VII.20 The WAY of state government securities

issued during 2016-17 stood lower at 7.48 per

cent than that of 8.28 per cent in the previous year.

Despite softening of yield across securities, the

weighted average spread of SDL issuances over

the comparable central government securities

increased to 60 bps from 50 bps in 2015-16.

The inter-state spread which was on an average

in the range of 7 bps in 2016-17 same as in the

previous year though higher than 4 bps in 2014-15, however, does not reflect the fiscal strength of

the states in the pricing of SDLs.

VII.21 During 2016-17, thirteen states issued

UDAY bonds for ₹1,091 billion as against ₹990

billion raised by eight states in the previous year.

The spreads of UDAY bonds during 2016-17

declined to 35-75 bps over the corresponding

tenor/10-year FIMMDA G-Sec yield as compared

with a fixed spread of 75 bps in 2015-16.

Approximately 45 per cent of the total UDAY bond

issuances in 2016-17 were concentrated in Q4.

The large volume of SDL issuances including

UDAY, was one of the major factors that resulted

in weighted average spread to widen from 54 bps

in Q1 to 83 bps in Q4 of 2016-17.

VII.22 In 2016-17, five states including

Puducherry issued SDLs with tenors above 10

years and many states issued non-standard

securities of tenors ranging from 2 to 20 years. As

a strategic response to higher spreads, four states

rejected all the bids in some auctions. Furthermore,

the Reserve Bank has been working closely with

state governments to facilitate efficient cash and

liability management operations of states, with the

objective of consolidation through elongation of

debt, reissuances and buyback of high cost debt,

while keeping an eye on redemption capacities

of states. As part of the ongoing endeavour to

consolidate the debt in SDLs through buybacks,

the state of Maharashtra repurchased ₹10.83

billion of its debt.

Cash Management of State Governments

VII.23 The aggregate WMA limit for 28 states

and the Union Territory of Puducherry was

revised from ₹154 billion to ₹322 billion with effect

from February 1, 2016. Eleven states resorted

to WMA in 2016-17, the same number as in the

previous year. Consequent to the increase in

WMA limits, only 4 states resorted to overdrafts in

2016-17 as against 9 states in 2015-16.

VII.24 Outstanding investment of states in ITBs

increased further to ₹1,561 billion as at end-March

2017, while that in ATBs declined for the third year in succession to ₹366 billion (Table VII.5). With

the objective of dynamically aligning the interest

rate on ITBs with market levels, effective January

30, 2017, the discount rate on 14 days ITBs was

re-fixed at the reverse repo rate minus 200 bps,

subject to an upper ceiling of 5 per cent. The

rediscount rate has, consequently, also been re-fixed

at reverse repo rate minus 150 bps, subject

to an upper ceiling of 5.5 per cent.

| Table VII.5: Investments in ITBs and ATBs by

State Governments/UT |

| (₹ billion) |

| Item |

Outstanding as on March 31 |

| 2013 |

2014 |

2015 |

2016 |

2017 |

As on

June 30,

2017 |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

| 14-Day (ITBs) |

1,181 |

862 |

842 |

1,206 |

1,561 |

1,179 |

| ATBs |

286 |

463 |

394 |

383 |

366 |

1,025 |

| Total |

1,466 |

1,325 |

1,236 |

1,589 |

1,927 |

2,204 |

Investments in Consolidated Sinking Fund (CSF)/

Guarantee Redemption Fund (GRF)

VII.25 Outstanding investment by states in the

CSF and the GRF as at end-March 2017 stood at

₹884 billion and ₹49 billion, respectively. During

the year, total investment in CSF and GRF was

₹176 billion (including fresh investment of ₹57

billion and reinvestments of ₹119 billion) as

compared to ₹134 billion during 2015-16.

Agenda for 2017-18

VII.26 The Union Budget 2017-18 projected

gross market borrowings of ₹5,800 billion through

dated securities, a marginal decline of ₹20 billion

from that in the previous year. Net short term

borrowings (i.e., through T-Bills) is budgeted at

₹20 billion, substantially lower than that of ₹186

billion in the previous year. Net market borrowings

via dated securities and T-Bills would finance 77.8 per cent of the GFD in 2017-18 as compared

with 79.6 per cent in 2016-17. In line with the

policy of front-loading of issuances, 64 per cent

(i.e., ₹3,720 billion) of the gross market

borrowings is slated to be raised in the first half of

2017-18. This, in turn, would also help to

manage the redemption pressure during H1 of

2017-18 when 90 per cent (i.e., ₹1,566 billion) of

the total redemptions would fall due. The borrowing

programme of the centre and state governments

would continue to be guided by the pillars of low

cost, risk mitigation and market development by

adopting the following strategic measures :

i. Issuance/re-issuance of longer tenor bonds to

help elongate the weighted average maturity

of debt.

ii. Host a single web link on the Reserve Bank

website for public debt through consolidation

of various links pertaining to internal and

external public debt information.

iii. Preparation of draft compendium for state

governments on best practices in cash

management and a model cash flow

statement on pilot basis.

iv. Capacity building programmes for

Finance Departments/AG Offices of state

governments/other central banks.

v. Keeping in view the fiduciary risk for state

governments, a Working Group on Monitoring

and Reporting of Contingent Liabilities at

the state level has been constituted under

the aegis of 29th State Finance Secretaries

Conference. The thrust of the Working Group

is towards identifying contingent liabilities

and standardising risk management and

mitigation measures, while bringing in

uniformity in disclosure across states for

better peer group analysis. The Working

Group is expected to submit its report shortly. |