On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 4, 2020) decided to:

- keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

- The MPC also decided to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

2. The outlook for Q4 (October-December) of 2020 is overcast with a surge in COVID-19 infections in a second wave across Europe, the US and major emerging market economies (EMEs), with accompanying lockdowns. Progress on vaccine candidates has, however, generated some offsetting optimism. World trade recorded a rebound in Q3 as lockdowns were eased, but it is likely to slow in Q4 as pent-up demand is exhausted, inventory restocking is completed, and trade-related uncertainty is rising with the second wave. CPI inflation has remained muted across major advanced economies (AEs) while it picked up in some EMEs on firming food prices and supply disruptions. Global financial markets remain buoyant, supported by highly accommodative monetary policies and positive news on the vaccine.

Domestic Economy

3. In India, the data release of the National Statistical Office (NSO) on November 27 showed a contraction of 7.5 per cent in real GDP in Q2:2020-21 (July-September). In Q3:2020-21, high frequency indicators point to a recovery gaining traction, with double digit growth in passenger vehicles and motorcycle sales, railway freight traffic, and electricity consumption in October, although there was moderation in some of these indicators in November. Riding on the favourable monsoon, the outlook for agriculture remains bright, with rabi sowing up 4.0 per cent from the acreage covered at this time last year under supportive soil moisture and reservoir conditions.

4. CPI inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October 2020, with some evidence that price pressures are spreading. Food inflation surged to double digits in October across protein-rich items including pulses, edible oils, vegetables and spices on multiple supply shocks. Core inflation, i.e., CPI excluding food and fuel, also picked up from 5.4 per cent in September to 5.8 per cent in October. Both three months and one year ahead inflation expectations of households have eased modestly in anticipation of the seasonal moderation of food prices in the winter and easing of supply chain disruptions.

5. Domestic financial conditions remained easy in October-November and systemic liquidity continued to be in large surplus. Reserve money increased by 15.3 per cent (y-o-y) (as on November 27, 2020), driven by a surge in currency demand. Money supply (M3), on the other hand, grew by only 12.5 per cent as on November 20, 2020. A noteworthy development is that non-food credit growth accelerated and moved into positive territory for the first time in November 2020 on a financial year basis – hitherto, the large inflow of deposits into the banking system was being predominantly deployed in SLR investment. Corporate bond issuances stood at ₹4.4 lakh crore during April-October 2020 as against ₹3.5 lakh crore during the same period last year. India’s foreign exchange reserves were US$ 574.8 billion (as on November 27), up from US$ 545.6 billion on October 2 at the time of the MPC’s last resolution.

Outlook

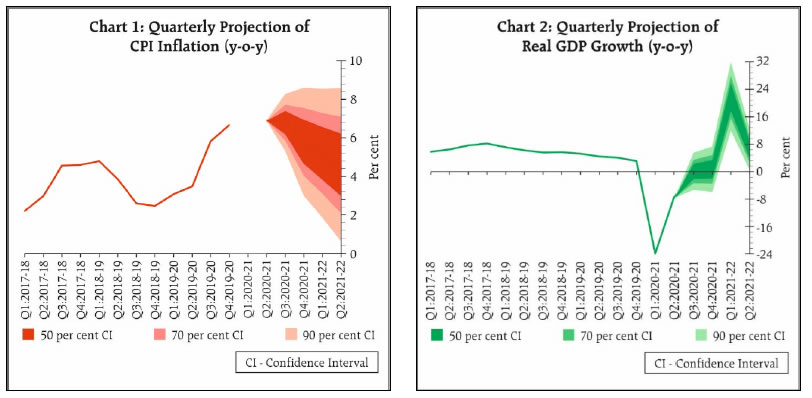

6. The outlook for inflation has turned adverse relative to expectations in the last two months. The substantial wedge between wholesale and retail inflation points to the supply-side bottlenecks and large margins being charged to the consumer. While cereal prices may continue to soften with the bumper kharif harvest arrivals and vegetable prices may ease with the winter crop, other food prices are likely to persist at elevated levels. Crude oil prices have picked up on optimism of demand recovery, continuation of OPEC plus production cuts and are expected to remain volatile in the near-term. Cost-push pressures continue to impinge on core inflation, which has remained sticky and could firm up as economic activity normalises and demand picks up. Taking into consideration all these factors, CPI inflation is projected at 6.8 per cent for Q3:2020-21, 5.8 per cent for Q4:2020-21; and 5.2 per cent to 4.6 per cent in H1:2021-22, with risks broadly balanced (Chart 1).

7. Turning to the growth outlook, the recovery in rural demand is expected to strengthen further, while urban demand is also gaining momentum as unlocking spurs activity and employment, especially of labour displaced by COVID-19. These positive impulses are, however, clouded by a possible rise in infections in some parts of the country, prompting some local containment measures. At the same time, the recovery rate has crossed 94 per cent and there is considerable optimism on successes in vaccine trials. Consumers remain optimistic about the outlook, and business sentiment of manufacturing firms is gradually improving. Fiscal stimulus is increasingly moving beyond being supportive of consumption and liquidity to supporting growth-generating investment. On the other hand, private investment is still slack and capacity utilisation has not fully recovered. While exports are on an uneven recovery, the prospects have brightened with the progress on the vaccines. Demand for contact-intensive services is likely to remain subdued for some time due to social distancing norms and risk aversion. Taking these factors into consideration, real GDP growth is projected at (-)7.5 per cent in 2020-21: (+)0.1 per cent in Q3:2020-21 and (+)0.7 per cent in Q4:2020-21; and (+)21.9 per cent to (+)6.5 per cent in H1:2021-22, with risks broadly balanced (Chart 2).

8. The MPC is of the view that inflation is likely to remain elevated, barring transient relief in the winter months from prices of perishables. This constrains monetary policy at the current juncture from using the space available to act in support of growth. At the same time, the signs of recovery are far from being broad-based and are dependent on sustained policy support. A small window is available for proactive supply management strategies to break the inflation spiral being fuelled by supply chain disruptions, excessive margins and indirect taxes. Further efforts are necessary to mitigate supply-side driven inflation pressures. Monetary policy will monitor closely all threats to price stability to anchor broader macroeconomic and financial stability. Accordingly, the MPC in its meeting today decided to maintain status quo on the policy rate and continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

9. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged. Further, all members of the MPC voted unanimously to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

10. The minutes of the MPC’s meeting will be published by December 18, 2020.

(Yogesh Dayal)

Chief General Manager

Press Release: 2020-2021/720 |