[Under Section 45ZL of the Reserve Bank of India Act, 1934] The tenth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on April 4 and 5, 2018 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Viral V. Acharya, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:– -

the resolution adopted at the meeting of the Monetary Policy Committee; -

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and -

the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation1 at its meeting today, the Monetary Policy Committee (MPC) decided to: - keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.0 per cent.

Consequently, the reverse repo rate under the LAF remains at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25 per cent. The decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 6. Since the MPC’s last meeting in February 2018, global economic activity has gathered further momentum, both in advanced and emerging market economies, though financial market volatility and potential trade wars pose a threat to the outlook. Among advanced economies (AEs), the US economy, which ended 2017 on a slightly weak note, appeared to have bounced back in Q1:2018; the unemployment rate remains low with hiring around multi-month highs. In the Euro Area, economic activity remained buoyant, although consumer spending and factory activity slowed down due to the strengthening of the euro, but a consistently falling unemployment rate and elevated consumer confidence continued to underpin the strength of the economy. The Japanese economy registered eight straight quarters of growth till Q4:2017; available data for 2018 point to a slower start to the year with weak machinery orders and an easing manufacturing Purchasing Manager’s Index (PMI) in February-March. 7. Economic activity remained robust in emerging market economies (EMEs) in Q1:2018. The Chinese economy started the year on a strong note; retail sales picked up pace indicating robust consumption, while industrial production also registered a strong increase in Q1:2018 on improved mining and manufacturing activity. In Brazil, economic activity is gaining momentum, driven by higher commodity prices. The Russian economy continued to recover in Q1; industrial production expanded in January-February, after two months of contraction, while exports grew at a robust pace. In South Africa, leading indicators, viz., the manufacturing PMI and business confidence, improved in Q1. 8. World trade volume growth is expected to have been robust in Q1, as gauged from the data on container trade throughput, air freight and export orders. Crude oil prices have become volatile in the recent period. After softening in February from multi-year highs on increased production in the US, crude prices hardened in the second half of March, driven by rebalancing of supply by OPEC and Russia, and drawdown of US inventories. Metal prices have come under selling pressure, with copper touching a three-month low in March on uncertainty stemming from global trade protectionism and US monetary policy. Gold prices, which touched a two-month low in March, have recently witnessed some uptick on fears of intensification of a trade war. Inflation remains below target in many key AEs and EMEs. 9. Financial markets turned volatile in February-March, triggered by uncertainty regarding the pace of normalisation of US monetary policy, and concerns surrounding global trade. Equity markets globally have shed most of the gains of the previous quarter in a heavy sell off in February-March, caused by optimistic US job reports and the US imposition of new tariffs on Chinese goods. Yields in the US traded sideways on weaker than expected inflation pressures and the anticipated rate hike by the Fed. Yields in other major AEs have fallen, while among EMEs, they have remained divergent on country-specific factors. In currency markets, the US dollar, which recovered somewhat in early March on an optimistic outlook of the economy, shed most of its gains in the latter part of the month on a less hawkish stance of the Fed and on anxieties surrounding a possible trade war. Among other major currencies, the euro continued to appreciate on an improving growth outlook for the region. Most EME currencies have retreated in the wake of the recent market volatility and the improving US economic outlook, though investors continued to discriminate on country-specific factors. 10. Turning to the domestic economy, the Central Statistics Office (CSO) released its second advance estimates for 2017-18 on February 28, revising India’s real gross domestic product (GDP) growth marginally upward to 6.6 per cent from 6.5 per cent in the first advance estimates released on January 5. GDP growth in 2017-18 at 6.6 per cent was lower than 7.1 per cent in 2016-17 and the deceleration was broad-based, but each component revealed intra-year turning points. Private consumption growth – whose contribution to GDP growth in 2017-18 was 68 per cent – moderated in the second half. Goods and services tax (GST) implementation had an adverse, even if transient, effect on urban consumption through loss of output and employment in the labour-intensive unorganised sector. Government expenditure provided sustained support to aggregate demand, with a pick-up in pace in the second half. Gross fixed capital formation turned around in Q2 and accelerated in the second half – markedly so in Q3 – reflecting the first signs of a sustained expansion in capital goods production and a modest revival of construction activity. Net exports dragged down aggregate demand in 2017-18 due to a surge in imports and deceleration in exports in Q3, the latter being driven in part by GST-related working capital disruptions. 11. For Q4, high frequency indicators point to a further strengthening of demand conditions. Private consumption seems to be improving on the back of strong growth in domestic air passenger traffic and foreign tourist arrivals, rising sales growth of passenger vehicles and a strong upturn in the production of consumer durables. The growth in sales of two-wheelers and tractors reflects buoyant rural consumption. Capital goods production registered a 19-month high growth in January 2018, indicative of the likely traction in investment demand. Housing loans extended by banks have increased significantly, which is a positive for residential investment. External demand remains a weak link. Merchandise import growth has slowed because of gold imports; simultaneously export growth has also weakened. 12. Turning to the supply side at a disaggregated sectoral level, the kharif foodgrains production for 2017-18 has been revised upward by 2.8 per cent in the second advance estimates released in February 2018 as compared with the first advance estimates released in September 2017. Total foodgrains production for 2017-18 is estimated at 277.5 million tonnes, up by 0.9 per cent from the level of 2016-17, with the production of rice, pulses and coarse cereals estimated to reach a record high. Wheat production is estimated to be lower than last year due to a decline in acreage and low soil moisture, but imports of 1.6 million tonnes and comfortable buffer stocks should cushion potential adverse effects. Horticulture production touched a new peak of 305.4 million tonnes in 2017-18, up by 1.6 per cent from last year. 13. For the year 2017-18 as a whole, the CSO estimates that value added in industry decelerated in relation to the previous year; in terms of quarterly performance, however, expansion set in by Q2 and was built upon in Q3 and Q4. This was mainly driven by the rebound in manufacturing. The manufacturing PMI remained in an expansionary mode for the eighth consecutive month in March, although there was some moderation in Q4. Assessment of overall business sentiment for manufacturing also improved in Q4 as reflected in the Reserve Bank’s Industrial Outlook Survey, driven by increasing output and new orders. Growth of value added in the services sector accelerated through the year, driven by trade, hotels, transport and communication and a significant pick-up in construction activity. Other high frequency indicators of services sector activity such as domestic air passenger traffic, international freight traffic, port traffic and commercial vehicles sales also expanded at a fair pace. The services PMI moved out of contraction and stabilised in March on a renewed increase in new business and strengthening expectations. 14. Retail inflation, measured by the year-on-year change in the CPI, fell from a high of 5.1 per cent in January to 4.4 per cent in February due to a decline in inflation in food and fuel. Excluding the estimated impact of an increase in the house rent allowances (HRA) for central government employees under the 7th central pay commission (CPC), the headline inflation for February was at 4.1 per cent. Food inflation declined by 120 bps in February, pulled down by a sharp decline in vegetable prices, especially of onions and tomatoes, along with continuing deflation in pulses. The fall in prices was also observed in other food components such as eggs, sugar, meat and fish, oils, spices, cereals and milk. 15. In the fuel and light group, inflation in respect of liquefied petroleum gas declined in line with international price movements. Furthermore, the rate of increase in prices of firewood and chips, and dung cake moderated. 16. CPI inflation excluding food and fuel remained unchanged at 5.2 per cent for the third consecutive month in February, after rising from its trough in June 2017. Among its constituents, housing group inflation rose significantly, reflecting the HRA increase for central government employees. Excluding the HRA impact, inflation in this group was estimated markedly lower at 4.4 per cent. Inflation in the transport and communication group increased in February on account of the rise in petroleum product prices and transportation fares. Inflation either eased or remained at a low level in February in other major sub-groups such as household goods and services, recreation and amusement, education, and personal care and effects. 17. Households’ inflation expectations, measured by the March 2018 round of the Reserve Bank’s survey of households, edged up for both three-month and one-year ahead horizons. Manufacturing firms covered in the Reserve Bank’s Industrial Outlook Survey reported input price pressures and an increase in selling prices in Q4:2017-18, which are expected to continue in Q1:2018-19. Manufacturing and services firms polled by PMI also showed a rise in input and output prices in Q4. 18. Liquidity in the system moved between surplus and deficit during February-March 2018. From a daily net average surplus of ₹ 272 billion during February 1-11, 2018, liquidity moved into deficit during February 12-March 1, reflecting a slowdown in government spending and large tax collections. After turning into surplus during March 2-15, the system moved into deficit again during March 16-22 mainly on account of quarterly advance tax outflows. Anticipating the seasonal tightening of liquidity at the end of March, the Reserve Bank conducted four additional longer tenor (24-31 days) variable rate repo operations aggregating ₹ 1 trillion, apart from the regular repo operations. In mid-March, additional liquidity of ₹ 1 trillion got released into the system through redemption of Treasury Bills issued under the Market Stabilisation Scheme (MSS) in April and May 2017. On the whole, the Reserve Bank injected ₹ 60 billion and ₹ 213 billion on a net daily average basis in February and March, respectively. The weighted average call rate (WACR) inched closer to the policy repo rate from 12 basis points below the policy rate in January to 7 bps in February, and 5 bps in March. 19. Merchandise export growth decelerated in January and February 2018, pulled down by a slowdown in exports of gems and jewellery, readymade garments and engineering goods. Import growth also moderated in February due to a decline in gold imports, lower growth in non-oil non-gold imports, and contraction in imports of transport equipment, vegetable oils and pulses. As import growth continued to exceed export growth in January-February, the trade deficit widened. The current account deficit increased in Q3:2017-18, primarily on account of the higher trade deficit. Net foreign direct investment moderated in April-January 2017-18 vis-à-vis the level a year ago. Foreign portfolio investors made net purchases in 2017-18, despite net sales in the wake of a global sell-off in February. India’s foreign exchange reserves were at US$ 424.4 billion on March 30, 2018. Outlook 20. The 6th bi-monthly resolution of 2017-18 in February projected CPI inflation at 5.1 per cent in Q4:2017-18; and in the range of 5.1-5.6 per cent in H1:2018-19 and 4.5-4.6 per cent in H2, including the HRA impact, with risks tilted to the upside. Actual inflation outcomes in January-February averaged 4.8 per cent, largely reflecting the sharp decline in vegetable prices and significant moderation in fuel group inflation. The available information suggests that vegetable prices continued to moderate in March as well. Accordingly, inflation in Q4:2017-18 is now projected at 4.5 per cent. 21. Several factors are likely to influence the inflation outlook. First, with the sharp moderation in food prices in February-March, the inflation trajectory in H1:2018-19 is expected to be lower than the projection in the February statement, despite a likely reversal in food prices in H1. Overall food inflation should remain under check on the assumption of a normal monsoon and effective supply management by the Government. Second, international crude oil prices have become volatile in the recent period, with a distinct hardening bias in the second half of March, even as the increase in shale production was more than expected. This has adversely impacted the outlook for crude oil prices. Third, on current assessment, Indian domestic demand is expected to strengthen during the course of the year. Fourth, the statistical impact of an increase in HRA for central government employees under the 7th CPC will continue till mid-2018, and gradually dissipate thereafter. 22. Taking these factors into consideration, projected CPI inflation for 2018-19 is revised to 4.7-5.1 per cent in H1:2018-19 and 4.4 per cent in H2, including the HRA impact for central government employees, with risks tilted to the upside (Chart 1). Excluding the impact of HRA revisions, CPI inflation is projected at 4.4-4.7 per cent in H1:2018-19 and 4.4 per cent in H2. 23. Turning to the growth outlook, several factors are expected to accelerate the pace of economic activity in 2018-19. First, there are now clearer signs of revival in investment activity as reflected in the sustained expansion in capital goods production and still rising imports, albeit at a slower pace than in January. Second, global demand has been improving, which should encourage exports and boost fresh investment. On the whole, GDP growth is projected to strengthen from 6.6 per cent in 2017-18 to 7.4 per cent in 2018-19 – in the range of 7.3-7.4 per cent in H1 and 7.3-7.6 per cent in H2 – with risks evenly balanced (Chart 2).2

24. The MPC notes that there are several uncertainties surrounding the baseline inflation path. First, the revised formula for MSP as announced in the Union Budget 2018-19 for kharif crops may have an impact on inflation, although the exact magnitude will be known only in the coming months. Second, the staggered impact of HRA revisions by various state governments may push headline inflation up. While the statistical impact of the HRA revisions will be looked through, there is a need to watch out for any second round effects. Third, in case there is any further fiscal slippage from the Union Budget estimates for 2018-19 or the medium-term path, it could adversely impact the outlook on inflation. There are also risks to inflation from fiscal slippages at the level of states on account of higher committed revenue expenditure. Fourth, should the monsoon turn deficient temporally and/or spatially, it may have a significant bearing on food inflation. Fifth, firms polled in the Reserve Bank’s Industrial Outlook Survey expect input and output prices to rise, going forward. Sixth, recent volatility in crude prices has imparted considerable uncertainty to the near-term outlook. 25. Against the above backdrop, the MPC decided to keep the policy repo rate on hold and continue with the neutral stance. The MPC reiterates its commitment to achieving the medium-term target for headline inflation of 4 per cent on a durable basis. 26. The MPC notes that growth has been recovering and the output gap is closing. This is also reflected in a pick-up in credit offtake in recent months. The large mobilisation of resources from the primary capital market should support investment activity further. While the domestic cyclical recovery is underway, the long-term growth potential is also expected to be reinforced by various structural reforms introduced in the recent past. On the downside, the deterioration in public finances risks crowding out private financing and investment. Furthermore, even as global growth and trade have been strengthening, rising trade protectionism and financial market volatility could derail the ongoing global recovery. In this unsettling global environment, it is especially important that domestic macroeconomic fundamentals are strengthened, deleveraging of distressed corporates and rebuilding of bank balance sheets persisted with, and the risk-sharing markets deepened. 27. Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Viral V. Acharya and Dr. Urjit R. Patel voted in favour of the monetary policy decision. Dr. Michael Debabrata Patra voted for an increase in the policy rate of 25 basis points. The minutes of the MPC’s meeting will be published by April 19, 2018. 28. The next meeting of the MPC is scheduled on June 5 and 6, 2018. Voting on the Resolution to keep the policy repo rate unchanged at 6.0 per cent | Dr. Chetan Ghate | Yes | | Dr. Pami Dua | Yes | | Dr. Ravindra H. Dholakia | Yes | | Dr. Michael Debabrata Patra | No | | Dr. Viral V. Acharya | Yes | | Dr. Urjit R. Patel | Yes | Statement by Dr. Chetan Ghate 29. My main concern in the last few reviews has been whether the ongoing cyclical recovery in growth will sustain, despite growing discomfort on the upside risks to the 4% inflation target in the medium-term. 30. The broad-based turnaround in growth continues to gather strength, although the turnaround is benefitting from a favourable base. Demand conditions improved in Q3 (2017-2018). Capacity utilization, which tracks investment trends, has started to improve and is at the highest level now (at 74.3%) since Q2 2014-2015. Three-month average IIP growth (Nov 2017-Jan 2018) is 7.8% y-o-y; what is encouraging is that the high IIP growth is due to sequential gains and not base effects. Profitability in non-IT services has turned around. The sequential gains in the manufacturing sector are strong with the PMI-Manufacturing in expansion zone for the past 8 months. Credit growth continues to pick up, after lagging behind nominal GDP growth in the last two years. There is a risk that recent fraud in a public sector bank may make banks risk averse and slow lending. 31. Overall, growth signals are strong. Most indicators of the output gap suggest that it is closing. While consumption continues to be robust, investment is accelerating. 32. Food inflation continues to impart volatility to headline inflation and drive headline inflation momentum. Lower food inflation at 3.4% in February compared to 4.6% in January was the main driver of lower headline inflation (4.4%) in February. Inflation in vegetables is still elevated due to the adverse base in 2016-2017. Fuel inflation (at 6.8%) is much higher than all the other components. There was a marginal uptick in the 1-year ahead inflation expectations compared to the last round of the survey. Elevated and persistent inflation excluding food, fuel, and HRA adjustments is somewhat worrying. There is however a sustained moderation in cereals inflation, which is unusual. The total availability of pulses also appears to be well above demand estimates. 33. More than the cyclical drivers of food inflation, which for most items tends to be mean reverting, what worries me are the upside structural risks to inflation that impinge on the durability of the 4% inflation target in the medium term. In the past few reviews, I have flagged four such risks: (i) increases in minimum support prices (MSP), (ii) staggered implementation of the pay commission award by the States, (iii) slippages in the fiscal deficit in an election year, (iv) a sustaining of the price of oil at a high level. 34. Of these, my main concern at the current juncture is the possible simultaneous occurrence of adverse twin terms of trade shocks: internal (via a substantial upward revision of minimum support prices which would raise the relative prices of agricultural goods) and external (the price of oil sustains at a high level). Such twin terms of trade shocks would complicate inflation management and worsen the growth-inflation trade-off. 35. While details on what form the MSP policy will take are still awaited, my own research with co-authors shows that a one standard deviation net procurement shock not only increases inflation across all sectors, but after inflation rises for two quarters on impact, it remains positive for about six to seven quarters after that. As in an external terms of trade shock, which would push the Phillips curve of the economy upwards, compromising GDP growth and raising inflation in the medium term, an internal terms of trade shock via a rise in the MSP would do the same. The response to changes in the MSP would therefore need to be pursued in a systematic way to maintain durability of the medium-term 4% inflation target. 36. At this juncture, I would prefer to wait and watch as the data evolves. 37. I vote for a pause in the policy repo rate at today’s meeting of the Monetary Policy Committee. Statement by Dr. Pami Dua 38. Headline inflation eased to 4.4% in February after rising to a 17-month high of 5.2% in December, 2017. This fall was largely due to a significant seasonal drop in vegetable prices, along with other components of food. CPI inflation excluding food and fuel remained unchanged in February, having stayed at 5.2% since December, partly due to housing inflation driven by the direct effects of house rent allowance for government employees under the 7th central pay commission. 39. Despite the recent fall in headline inflation, several upside risks prevail. The proposed link between the minimum support prices (MSPs) for kharif crops with 1.5 times the cost of production may drive inflation up. Fiscal deficit slippage and the slower than expected fiscal consolidation, as well as the staggered impact of house rent allowance by state governments, may also exert pressure on inflation. The recent volatility in crude prices has also resulted in uncertainty regarding the inflation scenario. Further, the proposed increase in customs duty is likely to increase inflation. The outlook for inflation as per RBI’s survey of households undertaken in March 2018 signals high inflation expectations for both three-month-ahead and one-year-ahead horizons. Further, the Industrial Outlook Survey (IOS) of the RBI suggests hardening of input prices, which may be passed on to consumers and lead to higher CPI inflation. 40. On the output front, the estimated GDP growth is 6.6% for 2017-18, lower than 7.1% for 2016-17. Nevertheless, some positive signs of economic growth are visible, especially in revival of investment. Implementation of GST is stabilising and the recapitalization of public sector banks, as well as the steps towards NPA resolution under the insolvency and bankruptcy code, are expected to contribute to economic growth. On the other hand, banking sector risks can be an impediment to sustainable growth. Separately, the possibility of an escalating trade war is a growing risk factor. 41. Moreover, the Consumer Confidence Survey conducted by RBI in March 2018 presents a pessimistic outlook for General Economic Situation and Employment Scenario. This is supported by the languishing growth in the Economic Cycle Research Institute’s (ECRI) Indian Leading Index, a harbinger of future economic activity, indicating dull prospects for economic growth. Further, growth in ECRI’s 20-country composite Long Leading Index has eased, suggesting that global growth is likely to slow down. This has impacted growth in ECRI’s Indian Leading Exports Index, a predictor of the direction of exports growth, which is subdued, indicating that Indian export growth outlook remains restrained. Dimming growth prospects at the global level are also indicated in the drop in the composite Purchasing Managers’ Indexes covering services and manufacturing for various economies, including the Euro area, the U.K., China and Japan, since the end of 2017, and more recently in the U.S. 42. Thus, with upside risks to inflation and lacklustre growth prospects, a wait and watch strategy with respect to evolving risks, along with status quo in interest rates, is currently recommended. Statement by Dr. Ravindra H. Dholakia 43. The headline inflation in January and February 2018 showed a sharper decline than what MPC had expected in its previous meeting. It is likely to show a lower print even during March 2018. From April 2018, however, it is expected to increase on account of unfavorable base effect for the next 3-4 months before it again starts declining to reach the level of around 4 per cent by March 2019. Thus, in the baseline scenario, we are likely to be at or around the target rate of headline inflation 12 months down. There are, however, several uncertainties and concerns surrounding this forecast. These are: -

There is a revival of economic growth but not to the level expected by RBI. Although the capacity utilization has improved to around 74 per cent, I feel, it is still far below the threshold required to induce substantial fresh investment. There is hardly any evidence on employment growth picking up to a level that would put upward pressure on the wage growth. Thus, continued existence of a negative output gap has to be considered. -

Fears of a trade war among major global players are turning increasingly realistic with likely adverse impact on our exports and costs of production. It may severely affect our growth recovery over the coming year. -

Oil prices have been fluctuating and both their direction and magnitude are difficult to predict for any possible impact on the headline inflation during the coming year. -

Concerns about the adequacy of monsoon rains and implementation of the revision in minimum support prices of different crops add another dimension to the inflation uncertainties. -

Implementation of the revisions in HRA for employees of different states and related organizations (like universities, research institutes, municipal bodies, etc.) in line with the 7th CPC could raise the headline inflation substantially over time. Although it has to be seen through because it would be only statistical, it does impact CPI as well as CPI excluding food and fuel significantly for about a year. And if the implementation is staggered among states, it would take even longer. In this context, it is argued that the second round effects of such an increase have to be considered. My research shows that inflation dynamics have changed during the current decade making the second round effects less relevant. -

Slippage by the Centre from the fiscal consolidation path and its likely adverse impact on the headline inflation and the cost of borrowing are often raised as a major concern. In this context, as I had pointed out in the last MPC minutes, it is the combined (Centre and all States together) fiscal deficit that matters for the headline inflation. By now, 26 states have presented their budgets and their combined budgeted fiscal deficit is estimated to be 2.6 per cent of GDP. Thus, to a large extent, the fiscal slippage of the Centre is compensated by the fiscal discipline shown by the States. The net impact on the headline inflation on this count, therefore, is likely to be very limited. Moreover, there are expectations about the tax revenues exceeding the revised estimates for the year 2017-18, reducing the estimate of the fiscal slippage by the Centre. If the same buoyancy continues, it can substantially reduce the magnitude of the fiscal slippage next year. On the other hand, the slippage can occur for various reasons including the forthcoming elections in States and the Centre. -

The Business Inflation Expectations Survey (BIES) conducted by the Indian Institute of Management Ahmedabad (IIMA) during February 2018 shows that the expected headline inflation (CPI) 12 months down by the businesses is 4.1 per cent but is increasing of late. Similarly, the RBI survey of household inflation expectations also shows increasing trend. 44. On account of all such uncertainties of impacts on headline inflation in both the directions, it is prudent to wait and watch the events play out before any decisive change in policy stance and/or rate can be considered. I, therefore, vote for maintaining a status quo on the policy rate and neutral stance. Statement by Dr. Michael Debabrata Patra 45. I maintain my vote for a 25 basis points increase in the policy rate. Underlying macroeconomic developments impart some urgency to commencing the withdrawal of accommodation. 46. The ebbing of inflation in January and February will likely extend into the reading for March, given the continuing decline in prices of vegetables. Does it present a persuasive case for an easier/neutral monetary policy stance? In my view, that will be time-inconsistent and will push the achievement of the inflation target farther out in time, given the current assessment that the target is not likely to be achieved during the full course of 2018-19, absent policy action. 47. It is important to recognise that volatility in the prices of vegetables is obscuring a clearer evaluation of underlying inflation pressures. An unseasonal spike in November has given way to a delayed seasonal easing in February and March, which should reverse by April-May. Accordingly, this transient supply shock, however favourable it might be, has to be looked through while setting monetary policy so that the focus is on the real risks to food inflation looming over the horizon from (a) increases in minimum support prices announced in the union budget; and (b) the shortfall in wheat output and the implications for prices of cereals. 48. The main risks to the achievement of the target are festering in the category of CPI excluding food and fuel in which inflation has stubbornly risen above 5 per cent over the past three months. Over the course of 2018-19, inflation in this category is expected to peak close to 6 per cent in June and moderate in the rest of the year to settle at a little above 5 per cent. It is necessary, however, to adjust for the statistical impact of the HRA in assessing this trajectory. After the adjustment, the baseline path of inflation excluding food and fuel is one of monotonical hardening till the end of the year without the June peak. Meanwhile, upside risks in the form of international crude prices, rising raw material and other input prices, the slow return of pricing power among corporates, the spectre of trade wars and embedded tariff increases - which could turn out to be both inflationary and growth retarding – and bouts of global spillovers as markets re-price the normalization of monetary policy by systemic central banks have increased. Should the food situation turn adverse or overwhelm food management strategies, we will have to deal with inflation testing the upper tolerance limit of the inflation band. Households are reflecting these fears in their inflation expectations, and both bond and credit markets have been tightening interest rates well ahead of the MPC. 49. Impulses of growth are strengthening. The turnaround in the pace of investment is the defining feature of 2017-18 in contrast to the consumption-led growth in preceding years. Foodgrains and horticulture production are set to scale new records. Manufacturing is on an accelerating mode and the recovery is broadening and encompassing an increasing number of constituent industries in its ambit. It is supported by rising sales growth, an uptick in seasonally adjusted capacity utilization, drawdown of finished goods inventories and upbeat business confidence even as the regaining of pricing power is helping to shore up profit margins. There are also indications of the capex cycle gradually starting up. It is important that these drivers be nurtured to full strength and traction, and not be frittered away by allowing inflation to get out of hand in an environment of fiscal slippages at the central and state levels, a current account deficit that is modest but on the rise, and balance sheets of banks and corporates still fragile. Statement by Dr. Viral V. Acharya 50. In my minutes of the February 2018 Monetary Policy Committee (MPC) meeting, I had flagged two reasons that had induced me to pause from voting to begin the process of “withdrawal of accommodation”: first, the possibility of US shale gas response softening the oil price outlook, and two, growth recovery in the economy still being nascent. Uncertainty on these fronts has now receded. 51. In spite of the US shale gas response to rising oil prices being robust, inventories have continued to dwindle. The combination of OPEC supply cuts and strengthening global demand appear to be keeping international oil prices at a relatively high level, and the volatility of prices around the high level has been relatively low in the past three to six months. The dwindling stock of inventories implies that a supply side disruption to any one critical source, for instance, due to geopolitical risk, could have a sharp upward impact on prices. On the domestic front, the lack of fiscal space to go easy on fuel cesses implies that prices at the pump will likely mirror movements in international prices. Since global commodity prices as a group are refusing to budge, the overall outlook is not comforting from the standpoint of domestic inflation. 52. On the growth front, while we have not seen another print from the CSO since last policy, most real economic activity indicators, including the Purchasing Manager’s Index (PMI) data released during the week of MPC meeting, point to growing traction in the drivers underlying growth. In fact, RBI’s estimates suggest that output gap is closing; the finance-adjusted measure, which I personally prefer, shows near complete closure of the output gap due to the resilient credit growth over the past two quarters. This is further confirmed by high frequency data on rural and urban consumption, investment activity revival, and improvement in capacity utilisation. In my view, these healthy developments on the economic activity front are likely to remain durable due to steady progress in the time-bound resolution of twin balance-sheet problem affecting our banks and corporates. 53. In view of the above referred developments since the last MPC meeting, I have moved substantially closer to switching from the neutral stance to beginning the process of withdrawal of accommodation. This is in spite of the softening of inflation in recent prints. Let me explain in some detail. 54. An inflation targeting central bank needs to separate “signal” from “noise” in the data: • Recent prints have softened due primarily to easing of vegetable prices (contributing to over 90 per cent of softening of food inflation in February). Digging into specifics does not suggest that this is due to durable supply management in vegetables. Instead, reasonable conclusion is that vegetable prices continue to show seasonality over years, albeit with some variation in months in which the seasonality kicks in. This volatility is largely “noise” from an interest-rate setting perspective; this volatility is also not something amenable to monetary policy actions, and certainly not at short horizon of a few months at which it is likely to, and typically does, revert. • What concerns me is that the more persistent component of headline inflation, which is ex food and fuel, and which one can consider as the “signal” given its persistence, has strengthened steadily from a trough of 3.8 per cent last June to 4.4 per cent in February (excluding the estimated impact of Centre’s House Rent Allowance increase, i.e., ex HRA). This rise has been broad-based, consistent with the durability of a growth pick-up over this period, and also confirmed by input price pressures and selling price increases reported by firms in the Reserve Bank’s Industrial Outlook Survey. • The inflation trajectory over the entire twelve-month period is projected, despite the soft print in February, to remain above the MPC target rate of 4 per cent, on a quarter by quarter basis. Note that this is the case even after excluding the HRA impact. • Professional forecasters surveyed by the Reserve Bank also expect the inflation to stay over 4 per cent for much of 2018-19. • While there is inevitable uncertainty around these inflation projections, I view the risks as tilted significantly to the upside given the continuing rise in the ex-food-and-fuel inflation. Besides oil prices, my another primary concern is the risk of fiscal slippages, at both the Centre and State levels, especially in the form of: -

A shift away from capital expenditures towards revenue expenditures, as is already being seen in state expenditure to accommodate farm loan waivers; and, -

Food price-support measures, on which further clarity is needed, but which clearly induce an upside bias to potential inflation risks (estimates vary widely from 10 basis points to close to 100 basis points depending on what measures are adopted). • Finally, as the Indian economy is economically as well as financially integrated with the global economy, a faster normalisation of interest rates by systemic central banks can also pose a major challenge to the external sector. 55. I feel it is important to let some more hard data come in, especially on growth, and allow some more time to let the early skirmishes on the global trade front play out. I am, however, likely to shift decisively to vote for a beginning of “withdrawal of accommodation” in the next MPC meeting in June. Reinforcement of inflation-targeting credibility that such a shift would signal is crucial in my view for prudent macroeconomic management, on both the domestic and external sector fronts. Statement by Dr. Urjit R. Patel 56. CPI inflation moderated in January-February, led largely by a sharp decline in vegetable prices and continuing deflation in pulses. Fuel group inflation also moderated mainly on the back of a decline in liquefied petroleum gas inflation, reflecting softening in international prices. These developments, combined with the continued softening in vegetable prices in March, are expected to pull down the headline CPI inflation in Q4:2017-18 below the projection made in February. However, it is noteworthy that over the last three months (December-February), the monthly CPI headline inflation (year-on-year) adjusted for house rent allowance (HRA) revision has averaged 4.6 percent. 57. Going forward, the combined effects of the observed moderation in food inflation in January-February and the expected further softening in March are likely to result in lower headline inflation trajectory in the first half of 2018-19 vis-à-vis the February statement. This will be despite the likely seasonal reversal of food prices in the first half. Inflation expectations have firmed up, both for three-month and one-year ahead horizons. Input cost pressures are rising and the corporates are gradually regaining some pricing power. The outlook of inflation also faces several uncertainties emanating from: (i) the increase in minimum support prices for kharif crops; (ii) elevated and volatile crude oil prices, in part due to geo-political factors; (iii) the staggered impact of revision in HRA by various State Governments – the direct impact on inflation will be statistical in nature, which will be looked through; (iv) fiscal slippages by the Centre and the States; and (v) the performance of the monsoon. 58. Economic activity has been recovering, with the GDP growth in 2018-19 projected to be higher at 7.4 per cent (with balanced risks) as compared with 6.6 per cent in the previous year. There are clearer signs of revival of investment activity. The manufacturing sector is strengthening, which is also reflected in higher capacity utilisation. Improving global demand and trade should boost manufacturing and investment activity, going forward. Leading indicators also point to the strengthening of the services sector; purchasing managers’ index (PMI) for services moved into the expansion zone again in March. Credit offtake from the banking sector has continued to improve and it is becoming gradually more broad-based. The flow of funds from non-bank sources to the corporate sector has also been rising. 59. Even as inflation has moderated in recent months, several upside risks to inflation persist. Hence, I would like to wait for more data and watch how various risks to inflation evolve, going forward. I, therefore, vote for holding the policy repo rate at the current level and maintaining the stance as neutral. Jose J. Kattoor

Chief General Manager Press Release : 2017-2018/2783

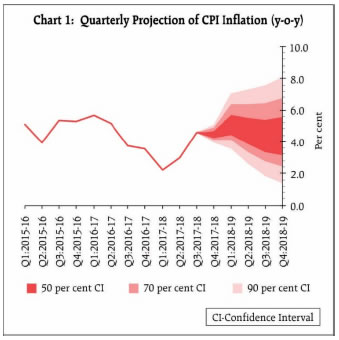

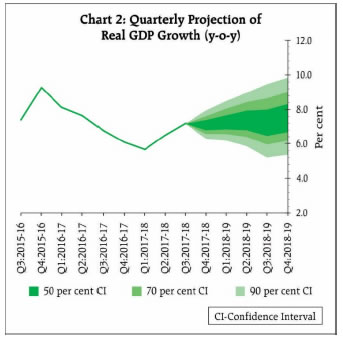

|