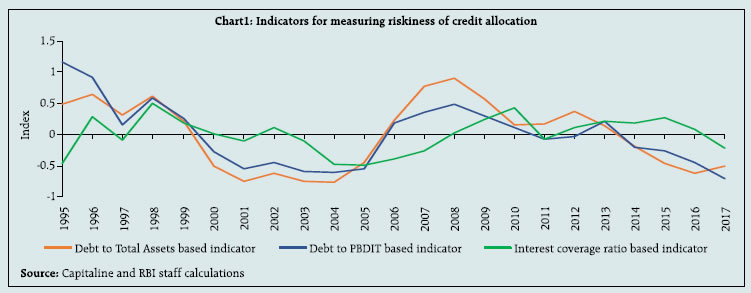

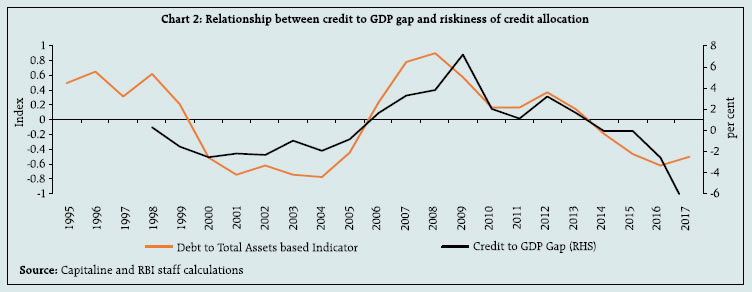

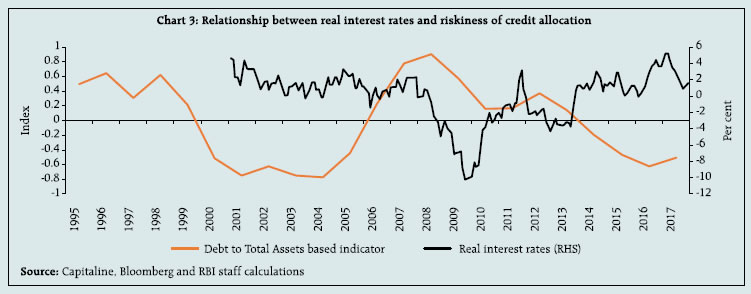

The global regulators have finalised the regulatory ecosystem with the adoption of post crisis reform package. On the domestic front, the regulatory stance is trying to inculcate a better credit culture even as the Insolvency and Bankruptcy Code is leading to a market-based time-bound resolution of corporate insolvencies. Given the escalation of operational risk, a more proactive approach addressing embedded operational risk especially in PSBs as also calibrating risk-taking limits in vulnerable banks will help in reducing systemic risk. RBI has put in place a framework for taking enforcement action in an objective, consistent and non-partisan manner and has initiated enforcement actions on a wide range of contraventions. On the non-banking front, the increasing trend of financial savings in mutual funds continues. Furthering its thrust on reforms, SEBI has permitted liquidity enhancement schemes (LES) in commodity derivative contracts. The recent regulatory initiatives in insurance sector are aimed at broad-basing the investor base in insurance companies as also easing the process of their registration in International Financial Services Centre (IFSC). Initiatives in pension sector are targeted at rationalising requirements for appointment of Retirement Advisors as also easing partial withdrawal requests from pension investors. The overriding shadow of cyber risk in the wake of adoption of innovative technologies like Fintech and data-analytics based financial intermediation have created new frontiers in regulatory and supervisory challenges. Section A International and domestic developments I. Banks a. International regulatory developments Post-crisis reforms 3.1 The final pieces of the regulatory ecosystem culminated in the form of a post-crisis reforms package to Basel III, also frequently referred to as Basel IV, which was endorsed by the Basel Committee on Banking Supervision (BCBS) in December 2017. These reforms streamline the ways in which banks calculate their capital requirements so as to make outcomes comparable across the globe. 3.2 The progress report1 on Basel implementation has noted that at the end of March 2018 all 27 member jurisdictions had risk-based capital rules, liquidity coverage ratio (LCR) regulations and capital conservation buffers in place. Most of the member jurisdictions also had in force the final rules for counter-cyclical capital buffers, domestic systemically important banks (D-SIBs)2 and global systemically important banks (G-SIBs). According to the last updated list published in November 2017, 30 banking groups had been identified as G-SIBs. Accounting standards 3.3 International Financial Reporting Standard 9 (IFRS 9) came into force in January 2018 for European Banks, replacing International Accounting Standard (IAS 39). IFRS 9 introduces a forward looking approach for recognising credit losses in financial accounts viz., the ‘expected credit loss’ (ECL) approach. A survey by Risk Quantum consisting of 36 large banks from 11 European countries found an average decline of Common Equity Tier 1 (CET1) capital (between December 2017 when old accounting system IAS 39 was still in effect and March 2018, the first reporting date of IFRS 9 adoption) by 34 basis points (bps). This decline is computed by excluding banks who have adopted the transitional measures. Early supervisory intervention framework3 3.4 A BCBS report discusses a range-of-practice study on how supervisors have adopted frameworks, processes and various tools to support early supervisory interventions globally. Early supervisory intervention involves supervisors taking action to correct an identified weakness before rules or buffers are materially breached. The report found that early supervisory action taken by the supervisors depends not only on the expert judgement of the supervisors but also to a large extent on organisational infrastructure that sets in place: (i) supervisory reinforcement through both vertical and horizontal risk assessments to maximise the early detection of risks; (ii) a clear framework for when actions should be taken; and (iii) internal governance processes and programmes to support supervisory development and capacity building. Understanding NPAs 3.5 A cross-country survey for identifying and measuring non-performing assets (NPAs) has thrown up interesting nuances across regions (Box 3.1). Box 3.1: Identification and measurement of NPAs: A cross-country comparison4 A cross-country comparison of the identification and measurement of NPAs was published by the Financial Stability Institute (FSI) of the Bank for International Settlement (BIS). The findings reveal considerable differences across jurisdictions in applicable accounting standards which are exacerbated by divergent prudential frameworks that govern NPAs’ identification and measurement: (i) The report highlights that both accounting and prudential requirements affect the identification and measurement of NPAs with practices varying across countries. While International Financial Reporting Standards (IFRS) is the prevailing global standard, a number of jurisdictions do not follow IFRS which can lead to differences in determining both the volume of impaired assets and also their associated provisions. Even in jurisdictions that apply IFRS, the judgmental nature of the collateral valuation process, particularly with respect to estimating collateral values under the Net Present Value (NPV) approach, can lead to vastly different provisioning outcomes across IFRS reporting jurisdictions. For instance, impaired assets under IFRS-9 require a more granular assessment of credit risk in comparison to International Accounting Standards (IAS) 39. Under IFRS-9, applicable entities must now place financial instruments in three distinct stages -- performing, underperforming and non-performing -- rather than the unimpaired and impaired categories under IAS 39. There are subtle differences between the treatment of “forborne” exposures under IFRS and existing US Generally Accepted Accounting Principles (GAAP). Under IFRS-9, a financial asset that has been re-negotiated (forborne) cannot be automatically upgraded to a higher quality status without evidence of demonstrated payment performance under the new terms over a period of time. IFRS-9 requires write-offs if the entity has no reasonable prospects of recovering a financial asset in its entirety or even a portion of it. Under the current US GAAP, the asset is required to be written off in the period in which it is deemed uncollectible. (ii) NPA identification: There are four main reasons for key differences across surveyed jurisdictions. First, there is no uniform definition of an NPA across sampled countries, including both entry (into impairment) and exit (from impairment) criteria. Second, certain asset classes (such as foreclosed collateral) are exempt from the NPA designation in a number of jurisdictions. Third, several respondents explicitly consider collateral in the NPA identification process while others determine the credit quality of an exposure without considering collateral support. Finally, while all jurisdictions have prescribed both quantitative (past due) and qualitative criteria, the extent to which supervisors rely on past-due criteria to place an exposure on the NPA status varies across jurisdictions. (iii) The role of asset classification frameworks in NPA identification: Regulatory asset classification frameworks are commonly used in Latin America and the Caribbean (LAC) regions, the US and some EU-single supervisory mechanism (SSM) jurisdictions. The US and nearly all (10 of the 11) surveyed jurisdictions in Asia require banks to use an asset classification system to classify credit exposures into various risk buckets (with the most common being: normal, special mention (or watch), substandard, doubtful and loss), based on criteria developed by the prudential regulator. In LAC countries, the risk buckets for credit exposure vary substantially across countries ranging from five to 16 (iv) In Asia there is convergence around the use of a five-bucket risk framework with the three most severe asset classification categories (sub-standard, doubtful and loss) considered as NPAs. Therefore, the sub-standard category (or its equivalent) is considered the entry point of the NPA designation, with the over 90-days-past-due threshold typically serving as the quantitative backstop. The qualitative criteria are more forward looking that allow supervisors to place exposures in the sub-standard category even if the loans do not satisfy 90-days-past-due criteria or are not impaired under applicable accounting rules. (v) The US applies a similar five-bucket risk framework but there is no specific link between its regulatory classification system and the designation of an NPA. (vi) In the LAC region some countries use a five-bucket risk framework while others employ a more granular breakdown, both for the performing and the lowest quality asset classification categories. In general, countries employing more than five buckets typically require greater risk differentiation within the severe asset classification categories. Supervisors combine the past-due criterion typically set at 90-days for a commercial loan to be considered non-performing with qualitative information tracking the borrower’s ability to repay based on various indicators. (vii) With regard to the application of cross default clauses, respondents in a majority of Asian jurisdictions as well as half of the LAC countries noted that multiple loans granted to the same borrower with at least one NPA were all treated as NPAs. In the EU-SSM jurisdictions, if 20 per cent of the exposures of a debtor is 90 days or more past due all exposures of this debtor must also be classified as non-performing exposure (NPE). | Shadow banking5 3.6 FSB in its annual Shadow Banking6 Report (2017) observed that other financial intermediaries (OFIs),7 under a broad definition of shadow banking, grew by 8 per cent to USD 99 trillion in 21 jurisdictions and the Euro area; this was faster than the growth rates of banks, insurance corporations and pension funds. OFI assets now represent 30 per cent of total global financial assets, the highest level since 2002. The activity based narrow measure8 of shadow banking grew by 7.6 per cent in 2016 to USD 45.2 trillion for the 29 jurisdictions. Data also shows that pension and insurance funds in countries like Belgium, India, Brazil and Netherlands are investing in shadow banks in search of yields. b. Domestic developments Banks’ supervisory actions and portfolio choices 3.7 The recent capitalisation of domestic public sector banks (PSBs) and the consequent debate on an appropriate governance and control environment in the banking sector in general and for PSBs in particular has re-focussed attention on the evaluation of the overall business strategies and governance frameworks in banks. Clearly, the efficacy of annual supervisory assessments and the consequent risk mitigation plans or more intrusive supervisory interventions like prompt corrective action (PCA) to correct the underlying risk issues is predicated on the underlying control environment prevailing in these institutions. It is possible that inasmuch as the control environment plays a major role in removing information asymmetry between the supervisors and the regulated institutions such mechanisms are also instrumental in the efficient discharge of the monitoring and information processing function of the banks through internalising of the information embedded in borrower/client transactions. In other words, factors beyond an economic downturn can be responsible for the asset quality deterioration in the banking sector (Box 3.2). Conversely, banks’ portfolio choices also determine their susceptibility to the robustness of internal controls. Box 3.2: Issues in lending decisions The financial crisis of 2008-09 is largely blamed for excessive risk taking by banks. Hence, it is worth exploring what prompts banks to start riskier credit allocations. Increased credit availability is a major factor that may induce risky credit allocations by banks. Theory posits that during a credit expansion, loan officers’ screening abilities become low because of a loss of institutional memory about bad credit risks (Berger and Udell, 2004). In addition, during credit booms, financial intermediaries find it less profitable to properly screen borrowers or maintain lending standards (Dell Ariccia and Marquez, 2006). Three indicators of riskiness of firms receiving credit9 based on 3 vulnerability measures – (i) debt to total assets (ii) debt to profit before depreciation, interest and taxes (PBDIT) and (iii) interest coverage ratio (ICR) are constructed taking a sample of Indian listed public limited firms10 for the period 1995-2017. Starting from information on a firm level vulnerability measure, the indicators are built as follows - first, for each year, a firm is assigned the value (from 1 to 10) of its decile in the distribution of the measure. A higher decile represents larger value of vulnerability. Second, firms are similarly sorted by the changes in net debt to lagged total assets in five equal sized bins. Firms in the bin with the largest increase in debt are “top issuers” and with the largest decrease are called “bottom issuers”. Finally, the indicators are computed as the difference between the average vulnerability decile for top issuers and the corresponding average for the bottom issuers (Ref: Global Financial Stability Report, April 2018). A higher value of the indicator implies riskier firms getting more credit as compared to less riskier ones. All three indicators display cyclical patterns in the riskiness of credit allocations (Chart 1). To explore credit cyclicality of the indicators further, Chart 2 plots the debt to total assets based indicator11 with the credit-to-GDP gap12; the relationship appears quite strong. Periods of positive (negative) credit to GDP gap are associated with a higher (lower) riskiness of credit allocations. Theory also points to an increase in the riskiness of credit allocation following a positive macroeconomic shock or when interest rates fall. In the event of a positive macroeconomic shock or a fall in interest rates, there is an improvement in a firm’s short-term prospects and net worth. This allows firms with high leverage easier access to credit markets (Bernanke and Gertler, 1989; Kiyotaki and Moore, 1997). The relationship between the riskiness indicator and real interest rates13 shows an expected inverse relationship (Chart 3).

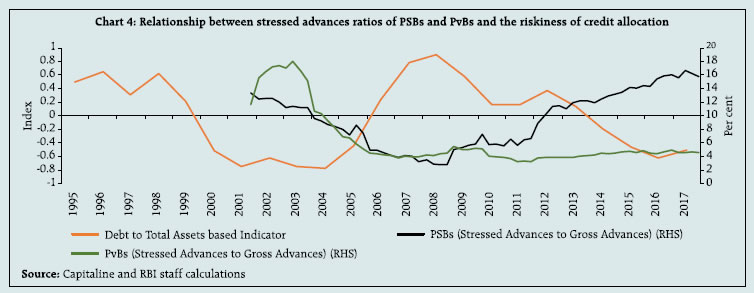

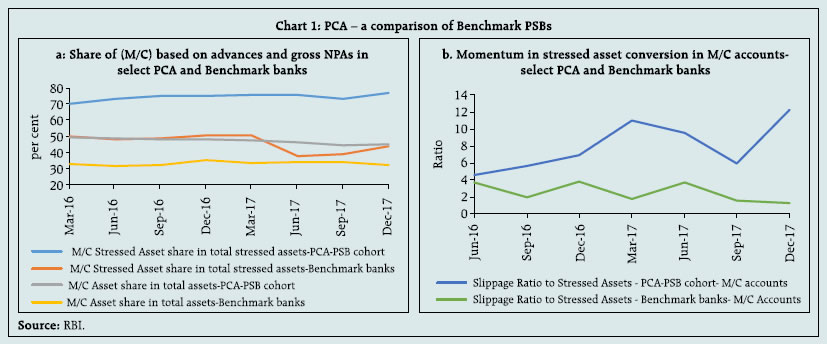

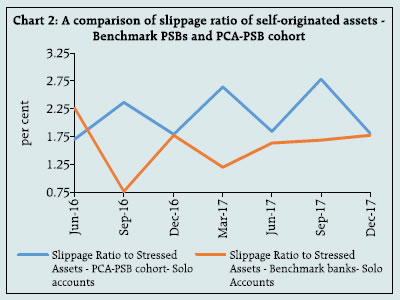

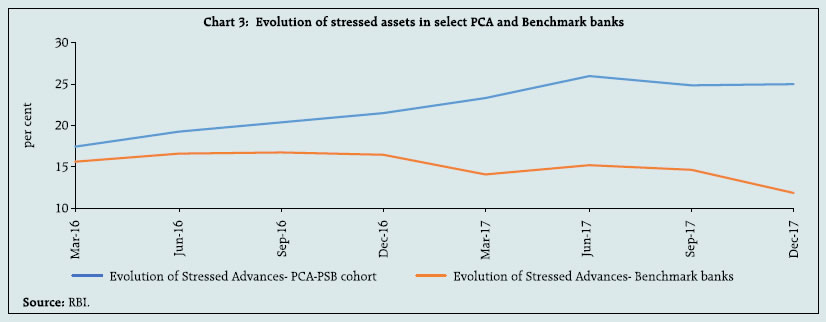

However, in the Indian case, PSBs in particular have been struggling with increased NPAs. Does that mean that PSBs went in for riskier lending whereas private sector banks (PvBs) were risk averse? Chart 4 plots the riskiness of credit allocation with stressed advances ratio for these two bank groups. While the stressed advances ratio of PSBs correlates well with the indicator, that of PvBs appears to be impervious to such allocations. This implies that the riskiness of credit allocation is not only influenced by macroeconomic factors but also by idiosyncratic factors. It also underlines the possible role of governance in limiting the risk appetite as also oversight of the credit portfolio, particularly of PSBs. In literature, it is seen that banks with more effective boards are less likely to lend to risky commercial borrowers (Faleye and Krishnan, 2010). References: 1. Berger, Allen N. and Gregory F. Udell (2004). “The Institutional Memory Hypothesis and the Pro-cyclicality of Bank Lending Behaviour,” Journal of Financial Intermediation, 13 (4): 458–95. 2. Bernanke, Ben S. and Mark Gertler (1989). “Agency Costs, Net Worth and Business Fluctuations,” American Economic Review, 79 (1): 14–31. 3. Dell’Ariccia, Giovanni and Robert Marquez (2006). “Lending Booms and Lending Standards,” Journal of Finance, 61 (5): 2511–46. 4. Faleye, O. and K. Krishnan (2010). Risky lending: does bank corporate governance matter? Available at: http://ssrn.com/abstract=1661837. 5. Kiyotaki, Nobuhiro and John Moore (1997), “Credit Cycles,” Journal of Political Economy, 105 (2): 211–48. | 3.8 Asset quality issues in PSBs and the interplay between internal controls / regulatory regime and realised credit risks are assessed by broadly looking into legacy asset allocation inter-se between select PCA and non-PCA PSBs (benchmark banks). In addition, incremental asset allocation in wholesale banking/ SLR assets (Box 3.3) has been examined to look at the composite impact of supervisory actions / risk aversion on asset yields. Box 3.3 : PSBs’ legacy asset choices and realised credit risks – A comparison between PSBs under PCA and benchmark PSBs Differences in realised credit risk between a sample of PSBs14 placed under PCA and the benchmark PSBs15 is examined here. Charts 1 a & b show the dominance of multiple banking/consortium (M/C) originated assets in stressed assets among PSBs, implying general screening issues with respect to such assets. Such screening issues are pervasive for PCA-PSBs in general, that is, PCA- PSBs with a relatively lower share of M/C assets in aggregate loan portfolios also have impairment issues with regard to M/C assets. However, the superior asset screening ability of benchmark PSBs can be seen from the relative slippage ratios of ‘self originated assets’ to stressed assets in Chart 2. While in general, PCA banks have a higher share of stressed assets to begin with (Chart 3) one favoured hypothesis is that ‘operational risk led credit risk’ for self-originated asset classes particularly affected the aggregate stressed asset load for this chosen cohort of PCA-PSBs (see paragraphs 3.9-3.13). It may however be appropriate in this context to appreciate that M/C arrangements by their construct carry the benefit of risk sharing and that participating banks having agreed to be part of M/C arrangements must be passive. But in the Indian context, in the absence of appropriate institutional mechanisms to deal with information flow across the participating banks inhibit fruitful co-ordination of efforts towards recovery or rehabilitation with other consortium partners.

The implementation of Insolvency and Bankruptcy Code (IBC, 2016) has given the cohort of banks under PCA a significant opportunity to unload legacy assets. A comparison of the relative size of IBC intermediated resolution referrals to gross GNPA for the PCA cohort shows that on aggregate, cohort of PCA banks discussed earlier had referred an amount equivalent to 64 per cent of outstanding gross NPAs (as on March 31, 2018) to the resolution process. The provisions held against such referrals are, on aggregate, about 52 per cent of the referred amount. Three specific advantages of an aggressive asset cleansing strategy can be seen: first, it brings in a lot of transparency to the quality of the asset portfolio thus possibly crowding in potential investors; second, marginal pricing without provisions of legacy assets can be more competitive going forward; and third, to put an end to frittering away opportunity costs in the eternal hope of a miraculous turnaround of stressed assets’ quality when a significant part of the assets owe their current status to operational risks contributing to or amplifying credit risks. In this regard, the current capital adequacy regime is in alignment with global norms while the lingering impact of past forbearance on asset provisioning implies that there are unrecognised credit losses in the books. In the absence of a legally binding resolution framework, there probably was a justification for a forbearing regulatory approach. However with the benefit of hindsight it is clear now that “a regulation susceptible to forbearing instincts carries the concomitant chance of risk inducing behaviour by stakeholders”16. Given that close to 50 per cent of multiple banking assets of the cohort of PCA-PSBs are stressed clearly points towards such behavioural tendencies whereby regulated entities depend on regulatory dispensations and the entire regime of forbearance had been getting institutionalised – blurring the distinction between good and bad forbearance.17 These concerns led to RBI issuing the revised framework for resolution of stressed assets announced on February 12, 2018. While the previous paragraphs outline the impact of legacy choices on asset impairment, whether asset screening in PCA-PSBs have undergone a significant reorientation in the recent past, specifically following the imposition of PCA is an issue of importance. To this end, a broad review of asset choices of PCA PSBs and non-PCA banks (PSBs + PvBs) based on their relative participation in top 210 ‘wholesale banking18’ performing accounts (as on Q3, 2017-18, forming about 30 per cent of the wholesale banking) since March 2016 was undertaken. For the analysis relating to Charts 4 to 6, the entire cohort of PSBs placed under PCA, as on date and having exposure to the top 210 wholesale banking accounts is being considered. For the previous analysis, an additional criteria of 3 clear quarters following imposition of PCA was put as an additional restriction, so as to analyse the performance of PCA-PSBs after the PCA restrictions have been internalised in their operations. They show an unchanged/increased share of both PCA PSBs and PvBs therein, largely at the expense of non PCA-PSBs in respect of advances to lower rungs of the credit spectrum (Chart 4). As regards exposure to sovereign assets, SLR maintained by PSBs in general exceed that of PvBs (Chart 5) and there was no systematic difference between SLR holdings of PSBs between PCA and non PCA banks. Incidentally, the foreign banks given their lack of credit appetite maintain the highest proportion of SLR assets. Given the portfolio choices of different categories of banks, the aggregate impact of such choices on asset yields is outlined in Chart 6. Clearly, a significant proportion of yield enhancement through diversification into lower rungs of credit has been offset by sizeable surplus investments. Given the fact that PCA banks have a significant burden of provision requirement from legacy assets, the trade-off to optimise yield returns with obvious capital constraints requires attention. Investments in relatively poorer rated assets, as observed above for the PCA PSBs require robust internal controls/governance mechanisms for prudential oversight. In this context, it is important to evaluate the relative efficacy of internal controls across different bank groups (please see paragraphs 3.9-3.13).

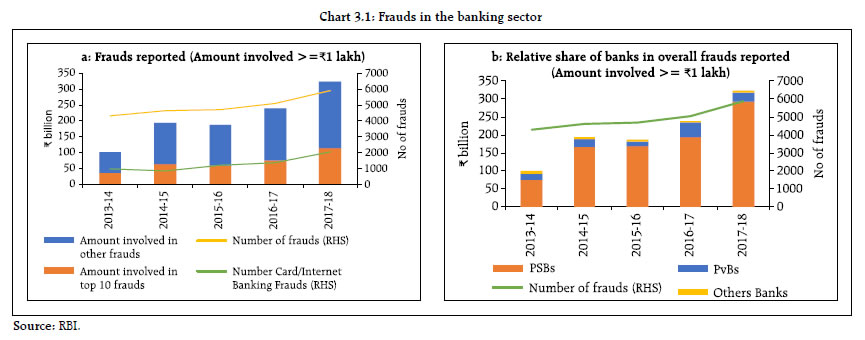

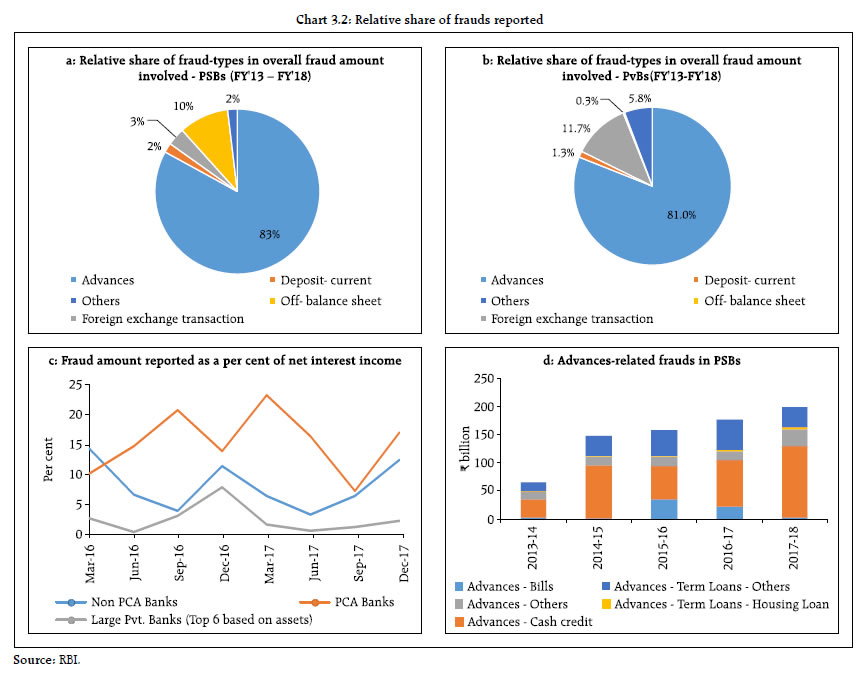

| Operational risks in banks 3.9 Operational risks in banks have implications across the entire spectrum of risks and hence materialisation of operational risk may be symptomatic of the weakness in the underlying risk management framework, internal controls, internal audits and governance mechanism. In recent years, frauds reported( for amount ≥ ₹1 lakh) in the Indian banking sector show an increasing trend both in terms of number and quantum (Chart 3.1 a). In terms of the relative share of frauds, PSBs have a disproportionate share (>85 per cent) (Chart 3.1b) significantly exceeding their relative business share (credit and deposit ≈ 65-75 per cent). A sharper rate of growth observed in total number of frauds in 2017-18, which is driven by a significant jump in card/internet banking related frauds (Chart 3.1a). Banks are increasingly leveraging technology to deliver retail services and the significant buy-in from customers by their adoption of these delivery channels are anecdotally validated. The sharper increase in number of frauds owing to card/internet banking related issues are pointers to the underlying vulnerability of this delivery channel. 3.10 The composition of fraud amount reported is largely dominated by frauds in loans and advances both in PSBs and PvBs (Charts 3.2a and b) although the relative potency of frauds relative to income is sharply different between the two categories of banks (Chart 3.2c). Fraud amount reported in PCA-PSBs is well in excess of their relative share in credit. It could be that somewhat lax internal controls in these bank cohorts have magnified their stressed asset positions relative to non-PCA PSBs. 3.11 The dominance of loans, particularly working capital loans in PSB frauds (Chart 3.2d) points to co-ordination issues in implementing the ‘three lines of defence architecture’.19 Structurally, the operational risk oversight frameworks of PSBs and PvBs is not different. Yet, significant differences realised in operational risk calls for a deeper introspection as to the effectiveness of the oversight of ‘processes’ at the exclusion of ‘outcomes’ in PSBs. A significant deterioration in such assets in the PSB segment possibly owes a lot to poor credit screening, deficiency in oversight of the account by the lead bank and information asymmetry between participating banks in M/C arrangements. In addition, integration of information technology in audit oversight is well thought out in PvBs allowing them to optimise on human resources as compared to PSBs.

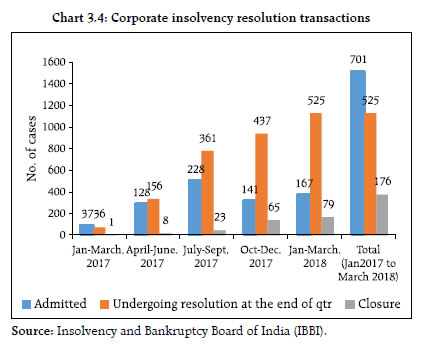

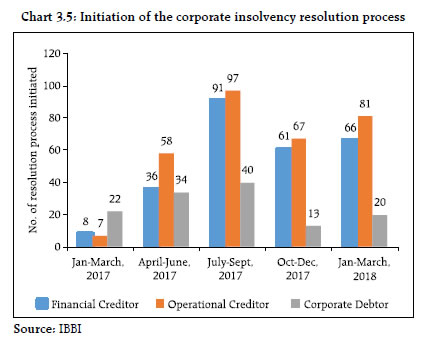

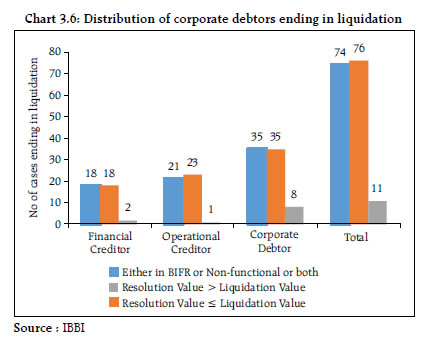

3.12 A critical evaluation of the outcomes of risk management practices also indicates significant scope for understanding and improvements. The issue of incentives for the operating staff is particularly relevant as such incentives are internalised at the PvBs through the performance assessment and rewards framework of the operating staff while they are clearly missing in the PSB space. In addition, for PSBs co-ordination issues between the three pillars of defence imply that verification/ validation of the underlying oversight processes in general and the audit framework in particular is not effectively done. 3.13 Finally, there is significant information asymmetry between external auditors and internal stakeholders and the consequences of this for the quality of internal oversight are important. Recent global reforms aim to put in place institutional structures that incentivise auditors to learn more and internal stakeholders to divulge more about the functioning of the institutions. A previous issue of FSR (December 2017) outlined the role of disclosures of ‘critical audit matters’ in the US (analogous to ‘Key Audit Matters’ in the EU) in the audit report to reduce information asymmetry between internal stakeholders and external auditors. One additional advantage of such disclosures is that they can be validated post-facto with realised risks. Moreover, unlike some jurisdictions, reasons for any omission/ commission on the part of external auditors can be assigned and hence auditor performance can be back-tested. Similarly, the internal audit has undergone a significant evolution globally as banks reorganise themselves from branch-centric delivery of financial services to web-centric delivery. The introduction of IFRS globally has also put governance of internal models in the limelight. This has necessitated internal audits extending to areas involving the overall model governance framework encompassing validation of rating models, applicability of datasets, and an analysis of deviations. A ringside reassessment of efficacy of audit framework (both internal and external), the internal governance framework, specifically with regard to accountability and credit screening / oversight is required to address the issues arising out of “operational risk” embedded in credit risk. Also in this context, the ‘Fugitive Economic Offenders Bill, 2018’ could act as a major deterrence for wilful defaulters. II. The securities market The International Organisation of Securities Commissions (IOSCO) has taken a number of initiatives with regard to emerging issues in securities markets. (A) Framework for supervisory stress testing of central counterparties (CCPs)20 3.14 Post-crisis reforms focussed on ensuring that all standardised OTC derivative contracts were cleared through CCPs to reduce systemic risks. Continued growth in central clearing and the resulting network concentration have further heightened the need for CCPs to have better risk controls. 3.15 The Committee on Payments and Market Infrastructures (CPMI) and IOSCO have released the framework for supervisory stress testing of CCPs. This explains that the supervisory stress-testing framework ‘is intended to serve as a guide for one or more authorities to design and run multi-CCP supervisory stress tests (SSTs) with a macro-prudential orientation.’ The framework sets out six components detailing underlying elements that describe the steps that the authorities will follow while designing and running a multi-CCP SST. The framework is flexible enough to accommodate SSTs that are conducted by a single authority or several authorities from the same jurisdiction or multiple jurisdictions. (B) Mechanism used by trading venues to manage extreme volatility and preserving orderly trading 3.16 Following the recent extreme volatility events, regulatory authorities and trading venues have been reviewing their approaches to managing extreme volatility. In the European Union, for example, the MiFID II21 regime contains detailed provisions and guidelines, while other jurisdictions provide more flexibility to trading venues in determining appropriate volatility control mechanisms. 3.17 In an effort to help trading venues and regulators address extreme volatility and help maintain orderly markets, IOSCO in a recent consultation paper outlined a set of recommendations which stress that differences in liquidity or product types necessitate a tailored approach when it comes to the design and functionality of mechanisms to protect the price discovery process and to avoid significant disruptions to orderly trading. (C) Domestic initiatives 3.18 On the domestic front, the Securities and Exchange Board of India (SEBI) has taken steps to develop the securities market by introducing new products, redesigning existing products, taking up investor awareness initiatives, revising the margin trading facility, permitting stocks as collateral for availing funding from stock brokers and revising the securities lending and borrowing (SLB) mechanism, among others 3.19 With a view to improving market integrity and providing better alignment between the cash and derivatives segments, several measures have also been taken up in connection with eligibility criteria, exit criteria and settlement of stock derivatives. These include mandatory physical settlement of stock derivatives in a calibrated manner. Derivatives on all existing and new stocks which meet the enhanced eligibility criteria are required to be cash settled until further notification. However, if such stocks fail to satisfy any of the enhanced eligibility criteria for a continuous period of three months, they will move from cash settlement to physical settlement. After moving to physical settlement, if such stocks do not meet any of the eligibility criteria for a continuous period of three months then they will exit from the derivatives segment. Stocks currently in the derivatives segment which meet the eligibility criteria but do not meet the enhanced criteria will be physically settled. III. Insurance 3.20 The International Monetary Fund’s (IMF) recent assessment of the insurance sector (IMF-FSAP) observed that public sector insurers continue to command a majority of the market and life insurance predominates with about 75 per cent of the total premia. Non-life insurance is dominated by motor insurance. Risks in life insurance are relatively well spread while in non-life categories they are mainly short-term in nature. The sector is profitable and solvency exceeds minimum requirements but with some exceptions. The report suggests modernisation of the solvency framework, implementing a standardised approach to risk-based capital, insurers developing their own risk and solvency assessment (ORSA) mechanisms and a move to a more risk-based framework for supervision. IV. Pension funds 3.21 A joint report by PFRDA and CRISIL on security for seniors (Opportunities and challenges in creating an inclusive and sustainable pension system in India) was released in February 2018. It brings out key issues and concerns in areas of demographic transition of different states, fiscal space, pension penetration, different pillars of pension provision, creating awareness about pension planning, an information repository and a pay-out design for further discussion. 3.22 The National Pension System (NPS) continued to grow in terms of the number of subscribers and assets under management (AUM). Total Subscribers to NPS increased from 15.44 million in March 2017 to 21.18 million in March 2018. AUM increased from ₹1,746 billion to ₹2,346 billion (Charts 3.3a and b). V. The insolvency and bankruptcy regime 3.23 The Insolvency and Bankruptcy Code 2016 provides for a reorganisation and insolvency resolution of corporate persons, among others, in a time-bound manner for maximising the value of assets of such persons to promote entrepreneurship, credit availability and balancing the interests of all stakeholders. It segregates commercial aspects of insolvency resolution from its judicial aspects and empowers the stakeholders of the corporate debtor (CD) and the Adjudicating Authority (AA) to decide matters expeditiously within their respective domains. It provides an incentive-compliant, market-driven and time-bound process for insolvency resolution of a CD. The code critically depends on choices made by financial creditors for its success. As of March 2018, 525 corporates were undergoing the resolution process (Chart 3.4). 3.24 The number of processes triggered by operational creditors (OCs) is relatively more, though the number of processes initiated by financial creditors (FCs) have started to show an uptrend prompted primarily by the Banking Regulation (Amendment) Act 2017 (Chart 3.5). About 38 per cent of the admitted petitions were filed by FCs, a vast majority of which were banks, indicating their usage of the Corporate Insolvency Resolution Process (CIRP) to clean up their balance sheets. 3.25 Of the 701 corporates admitted to the resolution process during January 2017 to March 2018, 67 were closed on appeal or review, 22 resulted in a resolution and 87 yielded liquidations; this is broadly consistent with the expectation under the code in its initial days of implementation. The distribution of 87 corporate debtors ending with liquidation is given in Chart 3.6. VI. Recent regulatory initiatives and their rationale 3.26 Some of the recent regulatory initiatives, including prudential and consumer protection measures with the rationale thereof, are given in Table 3.1

| Table 3.1: Important regulatory initiatives (November 2017- June 2018) | | Date | Measure | Rationale/purpose | | 1. The Reserve Bank of India | | November 30, 2017 | Banks contribution to Clearing Corporation of India’s (CCIL) settlement guarantee fund (SGF) in the form of government securities should not be reckoned as SLR investments. | Securities contributed by banks to SGF are encumbered. Therefore, securities contributed to SGF should not be reckoned as SLR investments. | | December 06, 2017 | Merchant discount rate (MDR) framework for debit card transactions was revised. The rationalisation of MDR was based on the criteria of merchant’s turnover and mode of transaction. | MDR rationalised to promote debit card acceptance among wider set of merchants. | | December 19, 2017 | All RBI regulated financial creditors advised to adhere to the relevant provisions of Insolvency and Bankruptcy Code (IBC) 2016 and Insolvency and Bankruptcy Board of India (IBBI (IUs) Regulations 2017. Henceforth, a financial creditor has to submit financial information to an information utility (IU) in such a form and manner as may be specified by regulations. | In order to establish authenticity and accuracy of documents/records for resolution process. | | January 04, 2018 | Overseas branches/subsidiaries of Indian banks (Category-I AD banks) permitted to refinance external commercial borrowings (ECBs) of highly rated (AAA) corporates as well as Navratna and Maharatna PSUs, provided the outstanding maturity of the original borrowing was not reduced and the all-in-cost of fresh ECB was lower than the existing ECB. Partial refinance of existing ECBs was also permitted subject to the same conditions. | To bring a level playing field among Indian and foreign banks as refinancers of ECBs. | | February 12, 2018 | A new harmonised and simplified framework for resolution of stressed assets issued. RBI has put in place a strict timeline over which a resolution plan must be implemented, failing which stressed accounts must be referred to IBC. Banks should identify stressed accounts immediately on default, classify these accounts as special mention accounts (SMAs) depending on the period of default, report them to the RBI’s large credit database (CRILC) and begin resolution. Lenders now have to report all SMAs with an aggregate exposure of at least ₹5 crore to the Central Repository of Information on Large Credits (CRILC) on a monthly basis. Additionally, defaults by borrowers having an aggregate exposure of at least ₹5 crore must be reported to CRILC on a weekly basis. Lenders are required to put in place board- approved policies for resolution. | In view of the enactment of the Insolvency and Bankruptcy Code 2016 a need was felt to substitute the existing guidelines with a harmonised and simplified generic framework for resolution of stressed assets. | | February 23, 2018 | An ombudsman scheme for redressal of complaints was operationalised for non-banking finance companies (NBFCs). Initially applicable to deposit accepting NBFCs, it will subsequently be extended to remaining categories of NBFCs. Certain NBFCs like infrastructure finance companies, core investment companies, infrastructure debt funds and NBFCs under liquidation are excluded from the ambit of the ombudsman scheme. | To provide a cost-free and expeditious complaint redressal mechanism relating to deficiency in services by NBFCs covered under the scheme. | | February 26, 2018 | Revised guidelines issued relating to participation of a person resident in India and a foreign portfolio investor (FPI) in the exchange traded currency derivatives (ETCD) market. Persons resident in India and FPIs can now take long (bought) or short (sold) positions without having to establish the existence of underlying exposure, up to a single limit of USD 100 million equivalent across all currency pairs involving INR, put together and combined across all exchanges. | Guidelines issued with a view to facilitating growth in the derivatives segment of the Indian market. | | March 01, 2018 | Revised guidelines for priority sector lending issued. Sub-target of 8 per cent of adjusted net bank credit (ANBC) or the credit equivalent amount of off-balance sheet exposure (CEOBE), whichever is higher, becomes applicable for foreign banks with 20 branches and more for lending to small and marginal farmers from FY 2018-19. Further, the sub-target of 7.50 per cent of ANBC or CEOBE, whichever is higher, for bank lending to micro enterprises also becomes applicable for foreign banks with 20 branches and more from FY 2018-19. All bank loans to MSMEs engaged in providing or rendering services as defined in terms of investments in equipment under the MSMED Act 2006, qualify under the priority sector without any credit cap. | To create a level-playing field within banks and to support the growth of the MSMEs. | | April 06, 2018 | The Reserve Bank of India prohibited entities regulated by the bank to deal in virtual currencies (VCs) or provide services for facilitating any person or entity in dealing with or settling VCs. | To ring-fence the RBI regulated entities from the risk of dealing in virtual currencies. | | June 15, 2018 | Banks permitted to spread provisioning for their mark to market (MTM) losses on all investments held in AFS and HFT for the quarters ended December 31, 2017, March 31, 2018 and June 30, 2018.The provisioning required may be spread equally over up to four quarters, commencing with the quarter in which loss is incurred. Banks that utilise the above option shall make suitable disclosures in their notes to accounts / quarterly results. Banks were also advised to create investment fluctuation reserve (IFR). The reserve shall comprise an amount not less than the lower of the net profit on sale of investments during the year and net profit for the year less mandatory appropriations shall be transferred to the IFR, until the amount of IFR is at least 2 per cent of the HFT and AFS portfolio on a continuing basis. The IFR shall be eligible for inclusion in Tier 2 capital. | To address the systemic impact of sharp increase in the yields on government securities and building up adequate reserves to protect banks against such increase in yields. Creation of IFR restricts the distribution of profits made on account of sale of investment. This increases shock absorbing capacity of banks as also systemic resilience. | | 2. The Securities and Exchange Board of India (SEBI) | | January 03, 2018 | Schemes of Arrangement by Listed Entities and (ii) Relaxation under Sub-rule (7) of Rule 19 of the Securities Contracts (Regulation) Rules 1957: Amendment to Circular No. CFD/DIL3/ CIR/ 2017/21 dated March 10, 2017. | To improve the existing regulatory framework governing scheme of arrangements. | | January 04, 2018 | All Mutual Fund Schemes are to be benchmarked against Total Return Indices. | To enable investors to compare the performance of a scheme vis-a-vis an appropriate benchmark. | | January 05, 2018 | Electronic book mechanism for issuance of securities on private placement basis: Revision of the existing framework. | To further streamline the procedure for private placement of debt securities, allowing private placement of other classes of securities which are in the nature of debt securities and enhancing transparency in issuance, resulting in a better discovery of price.

Electronic platform made mandatory for all private placement issues on a debt basis that have a threshold of Rs.200 crore. | | January 08, 2018 | Margin provisions for intra-day crystallised losses. | The risk of crystallized obligations (profit/loss on trade) incurred due to intra-day trades was not getting fully captured in the margining system and consequently in the clearing corporation’s risk management system for the purpose of providing further exposure to the clearing member. In order to mitigate such risk, SEBI mandated that the intra-day crystallized losses would be monitored and blocked by clearing corporation from the free collateral on a real-time basis only for those transactions which are subject to upfront margining. Crystallized losses can be offset against crystallized profits at a client level, if any. If crystallized losses exceed the free collateral available with the Clearing Corporation, then the entity shall be put into risk reduction mode. | | January 22, 2018 | Role of the Independent Oversight Committee for Product Design: Since commodity derivative exchanges have been adopting varied approaches both in terms of constitution as well as the functioning of such oversight committees, SEBI defined the role of an oversight committee for product design. | The committee will be responsible for overseeing ‘matters related to product design such as introduction of new products/contracts, modifications of existing product/ contract designs etc. and review the design of the already approved and running contracts.’ | | February 02, 2018 | In order to increase penetration of mutual funds in B30 cities (i.e. beyond top 30 cities), the existing provision of charging of additional expenses of 0.30% on daily net assets of the scheme subject to certain conditions was reviewed and it has been decided that the additional expenses of up to 0.30% on daily net assets of the scheme can be charged subject to inflows from B30 cities instead of B15 cities. | To increase penetration of mutual funds in B30 cities (i.e. beyond top 30 cities). | | February 05, 2018 | In order to bring uniformity in disclosure of actual Total Expense Ratio (TER) charged to mutual fund schemes and to enable the investor to take informed decision, it has been decided that AMCs shall prominently disclose on a daily basis, the TER of all schemes under a separate head –“Total Expense Ratio of Mutual Fund Schemes” on their website.

Further, any change in the base TER (i.e. TER excluding additional expenses provided in Regulation 52(6A)(b) and 52(6A)(c) of SEBI (Mutual Funds) Regulations, 1996 in comparison to previous base TER charged to any scheme shall be communicated to investors of the scheme through notice via email or SMS at least three working days prior to effecting such change. | To bring uniformity in disclosure of actual Total Expense Ratio (TER) charged to mutual fund schemes and to enable the investor to take informed decision. | | February 15, 2018 | Compensation to retail individual investors (RIIs) in an IPO. | SEBI put in place a framework to compensate retail investors who fail to get securities in an IPO despite their eligibility on account of situations arising due to certain failures on part of Self Certified Syndicate Banks (SCSBs). | | February 15, 2018 | Easing of access norms for investments by FPIs: Post consultations with stakeholders, SEBI made various changes in the extant regulatory provisions for FPIs. | To ease access norms for investments by FPIs. | | February 22, 2018 | Manner of achieving minimum public shareholding: Additional methods such as open market sale and qualified institution placements are allowed with certain conditions. | To facilitate listed entities to comply with the minimum public shareholding requirements. | | March 13, 2018 | Norms for Shareholding and Governance in Mutual Funds: The provisions would prevent the sponsor or any other shareholder holding substantial shares/ Board Representation in one Mutual Fund, from having major stake or Board representation in AMC or Trustee Company of another Mutual Fund. This would ensure a better governance and shareholding in the Mutual Fund industry. | To avoid conflict of interest amongst shareholders and to ensure a better governance and shareholding in the Mutual Fund industry | | March 21, 2018 | Risk management norms for commodity derivatives. | To align norms related to base minimum capital requirements and liquid net worth for members of clearing corporations in commodity derivatives segment with those applicable for clearing members in equity and currency derivatives segments. | | March 21, 2018 | Due diligence and reporting requirements under the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standards (CRS): SEBI issued a circular on due diligence and reporting requirements under FATCA and CRS, for Foreign Portfolio Investors (FPIs). | To ensure compliance with FATCA. | | 3. The Insurance Regulatory and Development Authority of India | | December 05, 2017 | IRDAI (Investments by Private Equity Funds in Indian insurance companies) Guidelines 2017: In the past Authority allowed private equity funds (PE Funds) and alternative investment funds (AIFs) to invest in insurance companies as investors. However, in the recent past the Authority is in receipt of proposals wherein PE Funds/ venture funds/alternative investments have evinced interest in purchase of stake/promoting an insurance company either as an investor or as promoter. | IRDAI issued these guidelines in addition to Transfer of Equity Shares of Insurance Companies Regulations 2015. These will be applicable to unlisted Indian insurance companies and to private equity funds which have invested in unlisted Indian insurance companies either as investors or as promoters. | | December 18, 2017 | The Prevention of Money-laundering (Maintenance of Records) Seventh Amendment Rules 2017: The central government notified the PML (Maintenance of Record) (Seventh Amendment) Rules 2017 on 12.12.2017 and issued a Gazette Notification on 13.12.2017. Accordingly, the date of submission of the Aadhaar number and the Permanent Account Number or Form 60 by clients to the reporting entity is March 31, 2018 or six months from the date of commencement of the account based relationship. | Amendments made as per the government directives on prevention of money-laundering. | | December 21, 2017 | IRDAI – Registration and Operations of International Financial Service Centre Insurance Offices (IIO) Guidelines 2017: | These guidelines are issued in exercise of powers conferred by Rule 3 of the IRDAI (Regulation of Insurance Business in SEZ) Rules, 2015.

These guidelines aim to put in place the process of registration and operations of Indian / Foreign insurers and reinsurers in IFSC Special Economic Zones i.e. GIFT City, Ahmedabad, Gujarat, in alignment with the objectives of IFSC-SEZ,.

The inter alia rational for issuance of these guidelines is to invite foreign insurance / reinsurance Companies in IFSC-SEZ. This will help us to create a Regional Reinsurance Hub in IFSC-SEZ, India and in turn will help to improve reinsurance capacity and will also attract foreign investments. | | March 20, 2018 | The Prevention of Money-laundering (Maintenance of Records) Second and Seventh Amendment Rules 2017: For existing insurance policies, the date of linking Aadhaar is extended till the matter is finally heard and a judgement pronounced by the Supreme Court of India.

For new insurance policies, a client is allowed six months from DOC. Officially valid documents can also be submitted in the absence of the Aadhaar number. | The Supreme Court in writ petition no. 494/2017 vide order dated 13.03.2018 has extended the deadline for linking Aadhaar till the matter is finally heard and a judgement is pronounced. | | 4. The Pension Fund Regulatory and Development Authority (PFRDA) | | January 09, 2018 | Modification of application fee, registration fee, on boarding fee for RAs and revision in requirement of security deposit after the notification of PFRDA (Retirement Adviser) (Fourth Amendment) Regulations 2017. | The fourth amendment was done to enhance the reach under NPS through retirement advisors. | | January 10, 2018 | Guidelines on the process to be followed by subscribers and nodal office/POP/aggregator for processing of partial withdrawal requests. | Under NPS, subscribers have a provision for partial withdrawal. The norms for partial withdrawal were modified and liberalised for making the product more flexible and adaptable. | | January 25, 2018 | New/upgradation of functionalities by the central recordkeeping agencies (CRAs) for the October-December quarter ended on 31.12.2017. | Various functionalities of CRAs are updated and new ones added from time to time including mobile apps, subscriber registration, FATCA/CRS certification, KYC verification and other operational functions like exit and withdrawal. | | 5. The Insolvency and Bankruptcy Board of India (IBBI) | | December 07, 2017 | The Insolvency and Bankruptcy Board of India (Grievance and Complaint Handling Procedure) Regulations 2017. | The regulations provide for an objective and transparent procedure for disposal of grievances and complaints by IBBI. | | December 13, 2017 | Guidelines for technical standards for the performance of core services by information utilities. | Lay down guidelines for technical standards for performance of core and other services by information utilities. | | December 31, 2017 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations 2016 and the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations 2017. | IBBI amended the regulations to define the ‘dissenting financial creditor’ to mean a financial creditor who voted against the resolution plan or abstained from voting for the resolution plan approved by the Committee of Creditors (CoC). This will discourage financial creditors from dissenting.

It also provides for submission of resolution plan by the resolution applicant within the time given in the invitation made for the purpose. | | January 16, 2018 | Disclosures by insolvency professionals and other professionals appointed by insolvency professionals conducting resolution processes. | Directs IPs to make disclosures to IPAs of which they are professional members within a specified time about their relationships as per the formats. An IP is also required to ensure that relationship disclosures are made by the professionals engaged by him to the IPA. All these disclosures are to be disseminated on their websites by IPAs within three working days of the receipt of the disclosures. | | January 18, 2018 | The Insolvency and Bankruptcy Code (Amendment) Act 2018. | This amendment bars wilful defaulters, defaulters whose dues have been classified as non-performing assets (NPAs) for more than a year and all connected persons of these firms from submitting resolution plans and purchasing assets of corporate debtors in liquidation. There is an enabling provision for CoC to allow a cure for ineligibility conditions and meet CIRP’s timeline. It also empowers the IP with the approval of CoC to lay down qualifying criteria for resolution applicant in tune with the complexity and scale of operations of the corporate debtor. | | February 06 and 07, 2018 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations 2016 and the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations 2017. | IBBI amended the regulations to require the following:

i. The resolution professional to issue an invitation, including the evaluation matrix, to prospective resolution applicants. He may modify the invitation as well as the evaluation matrix. However, the prospective resolution applicant will get at least 30 days from the issue of invitation or modification thereof, whichever is later, to submit resolution plans. Similarly, he will get at least 15 days from the issue of the evaluation matrix or modification thereof, whichever is later, to submit resolution plans. An abridged invitation will be available on the website, if any, of the corporate debtor and on the website, if any, designated by the IBBI for the purpose.

ii. A resolution plan will provide for the measures, as may be necessary, for insolvency resolution of the corporate debtor for maximisation of value of its assets and these may include reduction in the amount payable to the creditors, extension of a maturity date or a change in interest rate or other terms of a debt due from the corporate debtor, change in portfolio of goods or services produced or rendered by the corporate debtor and a change in the technology used by the corporate debtor.

iii. The resolution professional will determine the fair value of the corporate debtor in addition to the liquidation value. The resolution professional and registered valuers shall maintain confidentiality of the fair value and liquidation value.

iv. The resolution professional will submit the information memorandum in electronic form to each member of the committee of creditors within two weeks of his appointment as the resolution professional and to each prospective resolution applicant latest by the date of invitation of the resolution plan, on receiving a confidentiality undertaking.

v. It also provides that a resolution plan identify the specific sources of funds to be used for paying the insolvency resolution process costs and liquidation value to operational creditors and the dissenting financial creditors. | | March 27, 2018 | Amendment to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations 2016. | IBBI amended the regulations to provide for the following:

i. A resolution professional will identify prospective resolution applicants on or before the 105th day from the insolvency commencement date.

ii. The interim resolution professional / resolution professional will disclose item- wise insolvency resolution process costs in such a manner as may be required by the board.

iii. A financial creditor submitting a claim to the interim resolution professional will declare whether it is or is not a related party in relation to the corporate debtor | | March 27, 2018 | Amendment to the IBBI (Liquidation Process) Regulations 2016. | This amendment allows the liquidator to sell the corporate debtor as a going concern. It also provides for including interest on interim finance up to 12 months from the liquidation commencement date till repayment in the liquidation cost. | | March 27, 2018 | Amendments to the IBBI (Insolvency Professionals) Regulations 2016. | According to the amended regulations, norms for registration of IPs have been modified making it compulsory to pass the Limited Insolvency Examination within the last 12 months, undergo a pre-registration course with the Insolvency Professional Agency, and provide for a graduate insolvency programme for those not having requisite experience and requirement of continuous professional education (CPE).

Eligibility conditions for recognition as an insolvency professional entity for a company, a registered partnership firm or a limited liability partnership also changed. | | April 19, 2018 | Annual Compliance Certificate for Insolvency Professional Agencies | In view of the institutional role of the IPAs, and to facilitate monitoring of both their performance and compliance of statutory requirements, and in the interest of transparency and accountability, the IPAs are required to submit the Annual Compliance Certificate as per format to the IBBI and to be displayed on its website within 45 days of the closure of the financial year. | | June 06, 2018 | Insolvency and Bankruptcy Code (Amendment) Ordinance, 2018 | i. It provides relief to home buyers by recognizing their status as financial creditors, entitling them to have due representation in the Committee of Creditors.

ii. For MSME Sector, the Ordinance provides special exemption that it does not disqualify the promoter to bid for his enterprise undergoing Corporate Insolvency Resolution Process (CIRP) unless he is a wilful defaulter or disqualified otherwise. It also empowers the Central Government to allow further exemptions or modifications with respect to the MSME Sector, if required, in public interest.

iii. The Ordinance lays down a strict procedure for withdrawing a case after its admission under IBC 2016. It would be permissible only with the approval of the Committee of Creditors with 90 percent of the voting share, permissible before publication of notice inviting Expressions of Interest (EoI).

iv. The voting threshold has been brought down to 66 percent from 75 percent for all major decisions such as approval of resolution plan, extension of CIRP period, etc. and 51% for routine decisions to ensure that the CD continues as going concern.

v. The Resolution Applicant shall submit an affidavit certifying its eligibility to bid.

vi. Representation through authorised person for creditors in large numbers, exemption to pure play financial entities, grace period for resolution applicants acquiring NPA from being disqualified on account of NPA. The Ordinance provides for a minimum one-year grace period for the successful resolution applicant to fulfill various statutory obligations required under different laws. This would go a long way in enabling the new management to successfully implement the resolution plan.

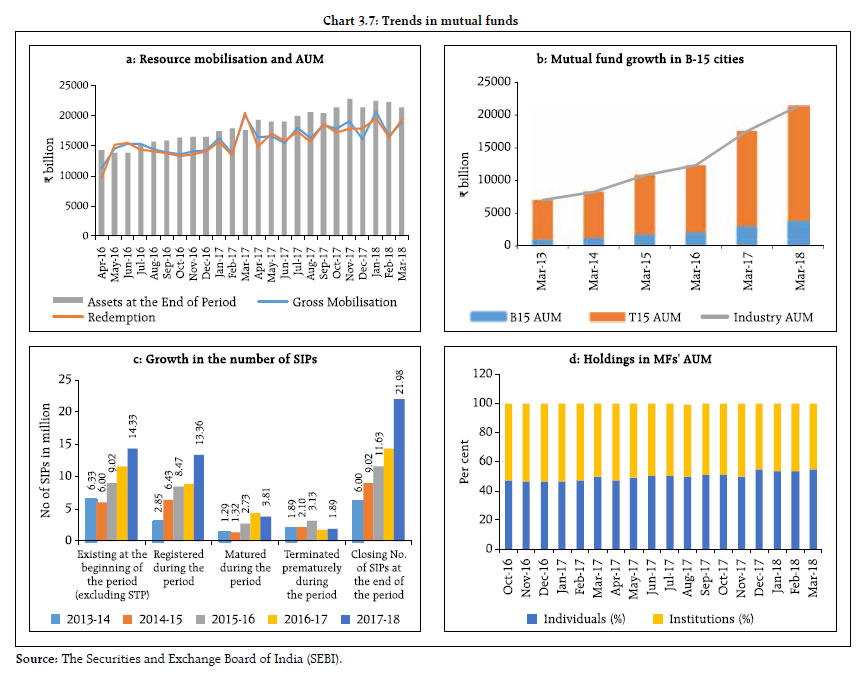

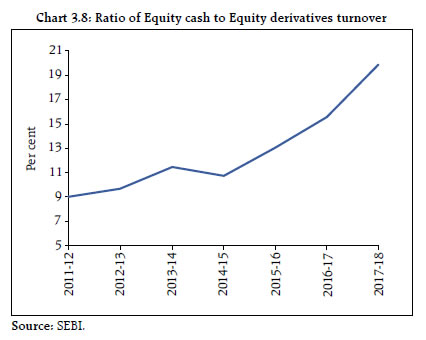

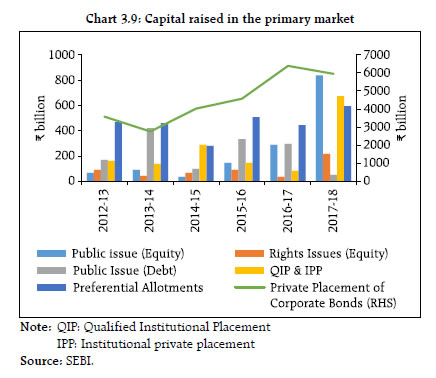

vii. The Ordinance also provides non-applicability of moratorium period to enforcement of guarantee; the requirement of special resolution for corporate debtors to themselves trigger insolvency resolution under the Code; liberalizing terms and conditions of interim finance to facilitate financing of corporate debtor during CIRP period; and giving the IBBI a specific development role along with powers to levy fee in respect of services rendered. | Section B Other developments, market practices and supervisory concerns I. The Financial Stability and Development Council 3.27 Since the publication of the last FSR in December 2017, the Financial Stability and Development Council (FSDC) held its 18th meeting on December 29, 2017 under the chairmanship of the Finance Minister where pre-budget consultations were held with financial sector regulators. The regulators presented their proposals for Union Budget 2018-19 related to the development of their respective sectors. The council deliberated on these proposals and concerned ministries/departments were advised to examine the respective proposals in detail for further appropriate decisions. FSDC was reconstituted by the Government to include the ‘Minister of State responsible for the Department of Economic Affairs (DEA)’, ‘Secretary, Department of Revenue’ and ‘Secretary, Ministry of Electronics and Information Technology’ as new members. II. Fund flows: FPIs and mutual funds Trends in mutual fund (MF) investments 3.28 Resources mobilised by MFs have been on an upswing for the past few years. During 2017-18, MFs’ assets under management (AUM) increased from ₹17.55 trillion in March 2017 to ₹21.36 trillion in March 2018 (Chart 3.7a). AUM from B-15 cities has grown 223 per cent during the 5-year period from 2013-14 (Chart 3.7b). The number of systematic investment plans (SIPs) grew by 53.4 per cent during 2017-18 over the previous financial year while premature termination of SIP accounts was at 9.48 per cent (Chart 3.7c). Investments through SIPs in mutual funds and wider geographical diversity of mutual fund holdings is conducive for both growth and stability of the MF industry.  3.29 Share of individual holdings which includes holdings of retail and High Net-worth Individuals (HNIs) grew from 50 per cent in March 2017 to 55 per cent March 2018 (Chart 3.7d). Increasing individual holdings in mutual funds could potentially provide more diversity to the holding pattern and consequent stability to mutual funds from the point of view of redemption pressures. A. Cash versus derivatives turnover 3.30 Both the equity and derivative markets are important for a well-functioning securities market. Over a period of time the ratio of turnover in equity cash to equity derivatives market has been increasing -- from 14.24 per cent in 2013-14 to 15.59 per cent in 2016-17 and to 19.84 per cent in 2017-18 (Chart 3.8). B. Fund raising activity in the capital market 3.31 Over the years, the aggregate funds raised by the primary market has been on an upswing. There was an increase of more than 10 per cent in the total capital raised during 2017-18 over 2016-17, excluding Alternative Investment Funds (AIFs). However, despite the stable grading of corporate bonds, bond issuance (both public and private) saw a decline during 2017-18 compared to the previous year (Chart 3.9). Capital raised through initial public offerings (IPOs) increased substantially during 2017-18 over the previous year. For the last few years, the share of offer for sale (OFS) has been dominating fresh issuances in IPOs and the trend continued in 2017-18 3.32 SEBI recently initiated several measures to improve the corporate governance of listed firms; Keeping in view the recommendations of the Kotak Committee, along with the public comments thereon, SEBI has taken decisions on several measures to further improve corporate governance in India, including reduction in the maximum number of listed entity directorships from 10 to 8, at least one woman independent director in the top 500 listed entities, separation of CEO/MD and Chairperson, enhanced role of the audit committee, nomination and remuneration committee and risk management committee, enhanced disclosure of related party transactions (RPTs) etc. It also developed a standard operating procedure for dealing with non-compliance by listed entities and fine-tuned guidelines for co-location and algorithmic (Algo) trades (Box 3.4).

Box 3.4: Guidelines for co-location and Algo trades Guidelines for co-location/proximity hosting were initially issued by SEBI on May 13, 2015; on the basis of recommendations of SEBI’s Technical Advisory Committee (TAC). These guidelines cover directions to ensure fair and equitable access to the co-location facility and the integrity and security of the data and trading systems. These guidelines were revised on December 01, 2016 based on TAC’s recommendations and stock exchanges were advised to allow direct connectivity between the co-location facility of one recognised stock exchange and the co-location facilities of other recognised stock exchanges. Stock exchanges were also advised to allow direct connectivity between servers of a stock broker placed in a co-location facility of a recognised stock exchange and servers of the same stock broker placed in a co-location facility of a different recognised stock exchange. It was clarified that co-location services provided by a third party or outsourced from a third party were deemed to be provided by the stock exchange and the stock exchange will remain responsible and accountable for actions of such an outsourced entity with respect to co-location services. To address concerns related to algorithmic trading and the co-location/proximity hosting facility offered by stock exchanges and to provide a level playing field between algorithmic/co-located and manual trading, a discussion paper was also issued on August 05, 2016 to review the existing guidelines. Considering the public comments received and in consultation with TAC and SEBI’s Secondary Market Advisory Committee (SMAC), various measures were introduced in connection with algorithmic trading and the co-location / proximity hosting framework facility offered by stock exchanges. These include facilities such as managed co-location service for medium and small sized members wherein the vendors will provide technical knowhow, hardware and software to trading members, permission to multiple vendors for providing managed co-location services and direction to stock exchanges to publish minimum, maximum and mean latencies and latencies at 50th and 99th percentile and reference latency. To create a more level playing field among the different types of market participants, the stock exchanges were directed to provide tick by tick (TBT) feeds to all the trading members free of cost subject to trading members creating the necessary infrastructure for receiving and processing it. Earlier stock exchanges were advised to put in place effective economic disincentives for high daily order-to-trade ratio (OTR) of Algo orders placed by trading members. However, in the present scenario, to encourage Algo traders to place more orders closer to the last traded price (LTP), it was decided that orders placed within ±0.75 per cent of the LTP (from ±1 per cent earlier) shall be exempted from the framework for imposing penalty for high OTR. It was also decided that orders placed in the cash segment and orders placed under liquidity enhancement schemes will also be brought under the OTR framework. To ensure enhanced surveillance, stock exchanges were directed to allot a unique identifier to each algorithm approved by them. Stock exchanges need to ensure that every algorithm order reaching an exchange platform is tagged with the unique identifier allotted to the respective algorithm and that such unique identifier tags are part of the dataset sent / shared with SEBI for surveillance purposes. | III. The commodity derivatives market (a) Market developments 3.33 The commodity derivatives market witnessed promising trends during October 2017 – March 2018 with all the categories of energy, metals and agriculture indices22 showing positive returns (Chart 3.10). The total turnover at all the commodity derivative exchanges (futures and options combined) increased by 7.9 per cent during the second half of 2017-18 over the previous half year. The total share of the non-agri derivatives in the turnover was 87.2 per cent during the period while the agri-derivatives contributed the remaining 12.8 per cent (Chart 3.11). 3.34 SEBI permitted liquidity enhancement schemes (LES) in commodity derivative contracts, except for sensitive commodities vide revised guidelines for LES. SEBI also issued a circular aligning norms related to the base minimum capital (BMC) and liquid net worth for members of clearing corporations in commodity derivatives with those applicable for clearing members in equity and currency derivatives. SEBI’s circular on ‘Margin provisions for intra-day crystallised losses’ issued to recognised clearing corporations has also been made applicable to commodity derivatives exchanges. Norms for providing margin benefits on spread positions in commodity derivative contracts were revised based on proposals from exchanges and the recommendations of the risk management review committee.