While global banks have strengthened their resilience in terms of capital and liquidity, their activity moderated in terms of cross-border lending. On the domestic front, regulations on resolution have ultimately evolved into the bankruptcy framework and stakeholders have to maintain a fine balance among various options available to them for the most optimum resolution. The new insolvency and bankruptcy regime, which came into existence in May 2016 has enabled the introduction of a market-determined and time-bound mechanism to handle insolvencies. As corporate governance in banks is key to ensuring the success of the recapitalisation of banks, the Government has explicitly committed to the compatibility of governance issues of PSBs while committing funds for capitalisation. Financial savings in the form of mutual funds (MF) investments and pension schemes not only continued to grow but have also got broad-based in terms of the spatial distribution and investor profile. Fintech is expanding its relevance to banking and is testing the technological capabilities of traditional banks. With a fast changing operating environment and the attendant risks on the cyber front for banks, a number of steps have been taken by the government and the financial sector regulators to ensure cyber resilience. SEBI has taken a number of steps to further deepen commodity derivatives market, which include a principle based methodology to fix open position limits for agricultural commodities vis-à-vis ‘deliverable supply’. On the supervisory front, IRDAI and PFRDA have taken initiatives towards introduction of risk-based supervision (RBS) for their regulated entities. The Reserve Bank has reviewed its instructions on customer liabilities in unauthorised/fraudulent electronic transactions and facilities for senior citizens and differently abled customers. Similarly, SEBI, PFRDA and IRDAI have strengthened their customer protection frameworks. ’History doesn’t repeat itself, but it often rhymes’ – Mark Twain Section A International and domestic regulatory developments I. Banks a. International regulatory developments 3.1 Globally, banks’ resilience continued to strengthen in terms of capital and liquidity1. However, international banking activity moderated in 2017:Q2 (Chart 3.1) following a rebound in 2017:Q1.2 Consequently, cross-border bank credit in 2017:Q2 contracted by $91 billion from the previous quarter. 3.2 Reducing the systemic risk from over-the-counter (OTC) derivatives market was one of the important aspects of the post-crisis reforms initiated by the Basel Committee on Banking Supervision (BCBS) and the International Organisation of Securities Commissions (IOSCO). Notwithstanding the delayed implementation of the ‘margin requirements for non-centrally cleared derivatives’ standard issued in May 2015 jointly by BCBS and IOSCO, globally there has been significant decline in OTC derivatives’ volume in terms of their gross market value3 (Chart 3.2).  3.3 The recent standards and guidelines issued by the BCBS include guidelines on ‘Identification and management of step-in risks’ (October 2017). These are part of the G20 initiative to strengthen the oversight and regulation of the shadow banking system to mitigate risks arising from banks’ interactions with shadow banking entities. The guidelines define ‘step-in risk’ as a risk that a bank faces when it decides to provide financial support to an unconsolidated entity that is facing stress, in the absence of, or in excess of, any contractual obligations4 to provide such support. 3.4 In the meantime, corporates’ high debt and interest expense have triggered a debate on the justification for allowing interest payment as a tax deductible expense in the context of an emerging view that such tax benefits might be incentivising excessive leverage. This may potentially have a significant impact on governance by altering incentive structures (Box 3.1). Box 3.1: Capital structure – debt and equity The tax reforms currently being debated in the US legislature aim to promote neutrality to the means of financing by limiting tax deductibility of interest expenses. By removing incentives to lever financing, such a measure will raise revenue and also enhance financial stability. An October 2016 IMF paper states that risks to macroeconomic stability posed by excessive private leverage are significantly amplified by tax distortions. But apart from the obvious welfare enhancing feature of reduced leverage, are there other reasons to worry about firms’ financial structures? This concern is particularly appropriate in view of Modigliani and Miller’s (1958, 1963) (MM) remarkable results that under an Arrow-Debreu environment (complete markets, no transaction costs, no taxes, no bankruptcy costs) the value of a firm is unaffected by financing structures or the dividend policy. The tax benefits of debt is supposed to increase the value of the firm, while decreasing the effective cost of debt capital. Miller (1977), however, counters this proposition by stating that firms pass out the tax benefits of debt to creditors through high interest rates to compensate them for the personal tax disadvantage of debt. This negates the tax deductibility advantage of debt and hence Miller holds the MM proposition to be still valid with tax deductibility of interest on debt. Others (DeAngelo and Masulis, 1980) propose that the financial distress costs of debt offset at least some of the tax benefits. However, at a level of abstraction, the impact of the withdrawal of interest rate deductibility on monetary policy operations and credit intermediation in the context of a developing economy will allow an examination of the specific distortions that tax deductibility of interest rates introduces. Since interest expense increases in a non-linear manner with leverage, equilibrium leverage in the absence of interest rate deductibility will be lower for a firm at any given level of expected EBIT. This relative predominance of equity in the financing structure will imply that the asset price channel has a more prominent role to play in the transmission mechanism. If the Wicksellian neutral interest rate is a function of the savings-investment gap, clearly withdrawal of tax deductibility of interest rates being positive for the fiscal is likely to bring down the natural rate of interest too.5 The MM propositions that the total cost of financing is invariant to a mix of debt and equity is only useful at a level of abstraction in the real world. Agency problems at various levels (managerial team, specific claim holders) also imply that the value of the firm is not exogenously given (Jensen and Meckling, 1976; Myers, 1977; Ross, 1977), but the financial structures also matter in determining the value. Research effort has also focused on the role of debt as a governance mechanism, within limits. Yet, the fundamental MM insight that higher equity reduces the riskiness of both debt and equity and therefore reduces the required rate of return gives a better approximation of the real world trade-offs in financing structures. Hence, the proposed US legislative reform on tax policy which aims at the neutrality of taxation in financing arrangements is expected to enhance financial stability. References: 1. DeAngelo, H. and R.W. Masulis (1980), ‘Optimal capital structure under corporate and personal taxation’, Journal of Financial Economics, 8: 3-27. 2. IMF Policy Paper (2016), ‘Tax Policy, Leverage and Macroeconomic Stability’, October 2016, 3. Jensen, M. and W. R. Meckling (1976), ‘Theory of the firm, managerial behaviour, agency costs and ownership structure’, Journal of Financial Economics, 3:305–360. 4. Modigliani, F. and M. Miller (1958), ‘The cost of capital, corporate finance, and the theory of investment’, American Economic Review, 48:261–297. 5. Modigliani, F. and M. Miller (1963), ‘Corporate income taxes and the cost of capital: a correction’, American Economic Review, 53:433–443. 6. Miller, M. (1977), ‘Debt and Taxes’, Journal of Finance, 32: 261-275. 7. Myers, S. (1977), ‘The determinants of corporate borrowing’, Journal of Financial Economics, 5:147–175. 8. Ross, S. (1977), ‘The determination of financial structure: the incentive signalling approach’, Bell Journal of Economics, 8: 23–40. 9. Ruud de Mooij and Shafik Hebous. ‘Curbing corporate debt bias: do limitations to interest deductibility work?’ IMF Working Paper, WP 17/22. | b. Domestic banking – preparing for take-off 3.5 In 1932, in a book way ahead of its time, Berle and Means6 documented that dispersed ownership confers significant managerial discretion which can be potentially abused. This initiated subsequent academic thinking on corporate governance and corporate finance. The recent global financial crisis and the twin balance sheet7 crisis closer home affirm that the risks arising out of managerial discretion are not merely academic. The recent announcement of recapitalisation of PSBs has justifiably initiated a debate as to whether it will be another episode of throwing good money after bad. Most of the commentaries also focus on the deficiencies of board oversight and consequential remedies. Boards in fact operate under a regulatory framework drawn up by the assigned regulators and are supposed to take critical decisions based on available information. They also reappraise the adequacy of internal controls and governance mechanisms based on internal audit reports, while external audits provide an independent third party appraisal of the performance. The scale of the recent crisis throws up valuable lessons on the effectiveness of each of these layers that interface with bank performance. The broad contours of this reform to help this cause can be divided into: -

Improving quality and availability of data for effective oversight -

Strengthening resolution mechanisms -

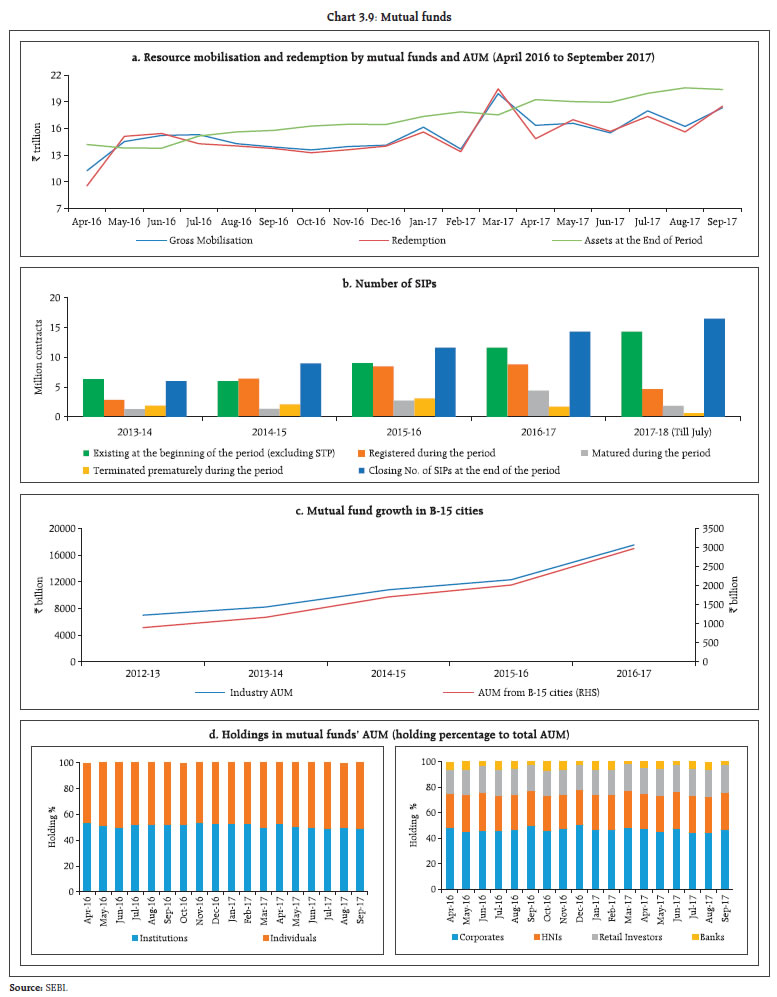

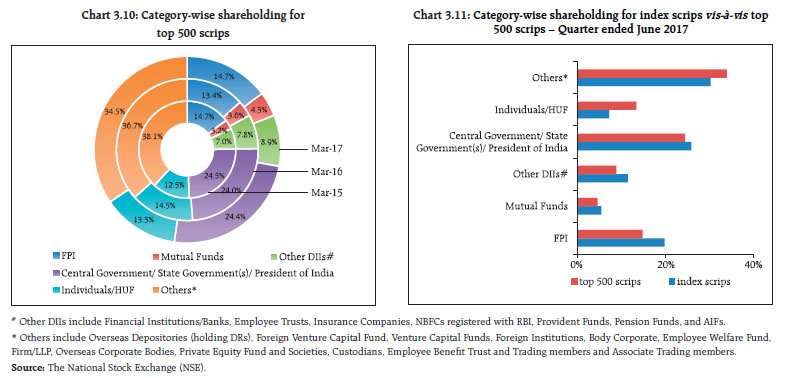

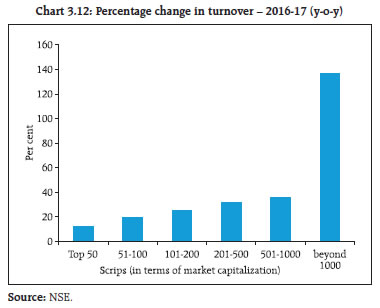

Addressing capital and governance needs for a reformed banking sector Improving data quality and availability for effective oversight 3.6 Economic theory has long emphasised the role of information in credit markets. Jaffe and Russell (1976) and Stiglitz and Weiss (1981) demonstrated that asymmetric information between the borrower and lender poses problems of adverse selection and moral hazards and makes it impossible to price the loan, i.e., information asymmetry prevents the interest rate to play a market-clearing function. Information asymmetry is considerably reduced if borrowers’ credit history is made available to lenders. In this context, having put in place the Central Repository of Information on Large Credits (CRILC) to facilitate exchange of information among critical stakeholders, India has taken the initial steps towards the setting up of a public credit registry. 3.7 Legal Entity Identifier (LEI) Code, which has been conceived as a key measure for improving the quality and accuracy of financial data systems for better risk management post the global financial crisis, is being introduced in a gradual manner. The LEI system was initially introduced for all participants in the over-the-counter (OTC) markets. Subsequently, the phased introduction of LEI for large corporate borrowers (total exposure of ₹500 million and above) has been announced, which will be extended to smaller corporate borrowers. Strengthening resolution mechanisms 3.8 Recognition of impairments and resolution of stressed assets in the banking industry are two aspects attracting a lot of attention currently (Box 3.2). Box 3.2: Regulations for resolutions While the prime concern of the Reserve Bank is to safeguard the depositors’ interest by ensuring that banks’ activities are run in the most prudent way, facilitating borrowers to carry out their business activities on a sustainable basis by availability of timely and adequate credit has also been its focus. The health of the real sector’s balance sheet ensures the health of the banks’ balance sheets and vice-versa. Therefore, any extension of forbearance to banks with a view to facilitating them to nurture their stressed assets should be viewed as a larger responsibility of the regulator to dovetail the interests of both the lenders and borrowers. The Reserve Bank has been prudent enough to adopt a ‘carrot and stick’ approach while devising these regulations which has also ensured that the borrowers have maintained their ‘skin in the game.’ Accordingly, Reserve Bank’s regulatory approach regarding restructuring and resolution of stressed assets has evolved over time. The earliest prudential measure taken by the Reserve Bank regarding asset classification of loans and advances was the introduction of the ‘Health Code System’ for borrowal accounts in November 1985. However, asset classification of restructured accounts was explicitly prescribed for the first time in April 1992 with the introduction of objectively defined asset classification norms.8 An asset, where the terms of the loan agreement regarding interest and principal have been renegotiated or rescheduled after commencement of production, should be classified as sub-standard and should remain in that category for at least two years of satisfactory performance under the renegotiated or rescheduled terms. This was subsequently reduced to one year in May 1999. The Corporate Debt Restructuring (CDR) Cell was established in 2001 as a need was felt for an institutional mechanism to resolve the large accounts under consortium and multiple banking arrangements. While during the initial period, the Reserve Bank retained the authority to approve CDR proposals on specific recommendations of the CDR core group, these powers were subsequently delegated to the CDR Empowered Group and the CDR Standing Forum, both high level bodies of participating banks’ top managements. Prudential norms on restructuring of advances were comprehensively revised in August 2008 and asset classification benefit was allowed on restructuring, subject to strict covenants and conditions to ensure that only viable accounts got restructured with asset classification benefits. However, the fact that this comprehensive review coincided with the aftermath of the global financial crisis (GFC) led the banks to restructure their loan portfolios on a large scale both on a bilateral and multilateral (CDR) basis. A working group formed in January 2012 comprehensively examined the moral hazard of forbearance. On its recommendations the asset classification benefit on restructuring was withdrawn from April 1, 2015. To remove information asymmetry among creditors, the Reserve Bank issued the ‘Framework to Revitalise the Distressed Assets in the Economy’ in January 2014. This led to the establishment of the Central Repository of Information on Large Credits (CRILC) and the requirement of the mandatory formation of the Joint Lenders’ Forum (JLF), when a large borrowal account emitted early warning signals. The framework also suggested regulations for sale of non-performing assets (NPAs), penal action for not sharing information, better credit management, introduction of the ‘non-cooperative’ borrower category and disincentives for them. The JLF framework was supplemented with specific loan structuring tools for project loans, beginning with the scheme popularly known as the 5/25 Scheme in July 2014. As accretion to the impaired loan portfolios of banks from failed restructuring continued unabated, the Reserve Bank introduced the Strategic Debt Restructuring (SDR) Scheme with a view to facilitating the exit of inefficient managements. However, this did not bring expected results as there were very few stakeholders to subsequently take over such companies from banks. SDR was followed by the Scheme for Sustainable Structuring of Stressed Assets (S4A) as a deep restructuring scheme for over-leveraged stressed accounts where the value of the firm could be unlocked if the debt was brought down to a sustainable level. Notwithstanding these measures, the absence of a comprehensive bankruptcy mechanism was proving to be a major hindrance in the efforts towards restoring the health of banks’ loan portfolios. This lacuna was addressed with the government notifying the Insolvency and Bankruptcy Code (IBC) in May 2016 and establishing the regulatory framework in the form of the National Company Law Tribunal (NCLT) in June 2016 and the Insolvency and Bankruptcy Board of India (IBBI) in October 2016. The government also empowered the Reserve Bank to issue directions to any banking company or banking companies to initiate the insolvency resolution process with respect to a default, under the provisions of IBC by amending the Banking Regulation Act, 1949. The Reserve Bank also took proactive steps and constituted an Internal Advisory Committee (IAC), comprising majorly of its independent board members, to advise it in an objective and non-discretionary way. | 3.9 The promulgation of the IBC Code in May 2016 is a watershed event – it has allowed valuation of aged impaired assets to be put in perspective. While the transfer of such assets to various asset reconstruction intermediaries was not effective owing to valuation issues, IBC, through its auction mechanism allows such assets specifically to have executable bids. Such a mechanism also points to the possible recovery values embedded in assets of similar ageing profiles. The government recently tightened IBC to prevent wilful defaulters and other unscrupulous promoters from taking over a company under resolution. 3.10 The impairment crisis in domestic banks has also highlighted certain basic deficiencies with regard to the appraisal of long term projects with a significant gestation time. A significant part of such projects undertaken were consortium lending with appraisals being carried out by professional merchant bankers with built-in conflict of interest (since they were paid by the borrowers). Public-private partnership (PPP) projects were also undertaken in project financing mode with high leverage. The exact implications of such risky projects implemented through the Special Purpose Vehicle (SPV) route were sometimes not clear to bankers. Further, PPP contracts of long term duration are complex in nature due to involvement of multiple stakeholders and there is a need to align their objectives for mutual benefit. Successful implementation of PPP projects calls for more due diligence by all stakeholders including the public sector contracting agencies, the private concessionaires, the bankers, etc. Addressing capital and governance needs for a reformed banking sector 3.11 Committees/working groups set up over the years (Box 3.3) to bring improvements in the banking sector also have a touch of sameness implying that there are structural factors at work which make the PSBs particularly vulnerable. Yet, the delayed or partial implementation of recommendations imply that the basic vulnerabilities have not been adequately addressed. This has had significant fiscal implications. Recently, the Government of India announced a larger recapitalisation plan amounting to ₹2.11 trillion. However, it may be noted that this time as the owner, Government has explicitly committed to the compatibility of governance issues of PSBs while committing funds for capitalisation. Box 3.3: Governance in PSBs – views of previous committees (i) Working Group9 on Restructuring Weak Public Sector Banks In 1999, a working group (WG) setup with the objective of suggesting a strategic plan of financial, organsational and operational restructuring for weak public sector bank, identified Indian Bank, United Bank of India and UCO Bank as weak10 banks. The WG observed that the weaknesses of these PSBs related to three areas -- operations, human resources and management which led to inadequate management planning, inefficient decisions and poor staff productivity. Importantly, the WG noted that, ‘Even after infusion of ₹6,740 crore in the three banks over the last seven years, their basic weaknesses persist. Unconditional recapitalisation from the Government of India has proved to be a moral hazard as no worthwhile attempt has been made by the banks to gain adequate good business or to reduce costs.’ The WG explored three broad options -- merger, closure and privatisation -- but concluded that all the three options were not suitable under the then prevailing environment. Therefore, it recommended comprehensive operational and financial restructuring with conditional recapitalisation as also a systemic restructuring providing for, inter alia, legal changes and institution building for supporting the restructuring process. (ii) Committee11 to Review Governance of Boards of Banks in India More recently, the Reserve Bank constituted a Committee to Review Governance of Boards of Banks in India in January 2014. The committee provided detailed diagnostics of how the PSBs had weakened and pointed to how they might continue to worsen unless there was an overhaul of their governance. The committee, inter alia, observed that if the governance of PSBs continued at its then prevailing level of lower productivity, eroding asset quality and demonstrated uncompetitiveness, the recapitalisation of these banks will impose continuing fiscal costs which may impede fiscal consolidation, affect fiscal stability and eventually impinge on the government’s solvency. The committee explored two options: privatisation (including privatisation through mergers) or PSBs’ operations under a radically different market oriented governance structure. The main recommendations of the committee were targeted at: (i) improving the quality of the boards through their selection by an independent Banks Board Bureau (BBB) and (ii) improved decision making through removal of risk of government interference through passive management of ownership claims. Some of the recommendations like constutition of BBB and appointment of top management of PSBs through have been implemented. The committee also estimated additional Tier-I capital requirement for PSBs up to FY 2018 as ₹2.10 trillion, ₹3.19 trillion and ₹5.87 trillion under three different scenarios. | 3.12 Governance also has a regulatory dimension. ‘... A regulatory regime susceptible to forbearing instincts carries the concomitant chance of risk inducing behaviour from the stakeholders…’12 In this regard, the regulators’ commitment to not condone the consequences of bank specific action should be seen as a hard constraint. Incidentally, such hard constraint on lending practices and prudential accounting treatment does not take away lenders’ discretion for prudential measures aimed at rehabilitating borrowers. Rather, such hard constraints strive to place such rehabilitation measures as exceptions and aim not to institutionalise them. The emerging NPA recognition norms from continental Europe reinforce such mechanisms. 3.13 There is significant information asymmetry between external auditors and internal stakeholders. The recent reforms globally aim to put in place institutional structures that incentivise auditors to learn more and internal stakeholders to divulge more about the functioning of the institutions. Disclosure of ‘Critical Audit Matters’ in the US (‘Key Audit Matters’ in the EU) in the audit report allows information asymmetry between internal stakeholders and external auditors to be put in perspective since such disclosures can be validated post facto with realised risks. Moreover, unlike some jurisdictions, reasons for any omission / commission on the part of external auditors can be assigned and hence auditor performance can be back-tested13. Similarly, internal audit has undergone a significant evolution globally as banks reorganise from branch-centric delivery of financial services to web-centric delivery. The introduction of IFRS globally has also put governance of internal models in the limelight. This has necessitated internal audit extending to areas involving the overall model governance framework encompassing validation of rating models, applicability of datasets and an analysis of deviations. An institutionalised structure of sharing of best practices may allow some of the laggards in governance and control to leapfrog the intermediate steps. 3.14 Globally, supervision is increasingly taking a forward looking approach. In other words, it is providing an assessment of medium term risks. In this regard, issues of standardisation of subjective assessments, developing yardsticks for materiality tests of exceptions and back-testing model predictions with realised risks require particular emphasis. 3.15 The recent referrals under IBC for resolution have implications for the capitalisation requirement too. A record of recovery based impairment assessments, however, has inevitable elements such as the time lag between such assessments and underlying resolutions which can lead to a significant recovery risk associated with ageing impaired assets. However, the recent substantial recapitalisation announced by the government will help banks with requisite capital cushions to tackle the issue and repair their balance sheets. 3.16 The worsening of the negative association between CRAR and asset quality has been documented in Chapter 2. It stands to reason that it is asset quality that is driving the poor capitalisation on the face of a muted balance sheet growth. In this regard, PSBs’ capital plans in particular need to take into account the somewhat elevated levels of slippage from uncontaminated standard assets (standard assets less restructured standard assets) and recovery risks embedded in assets referred to NCLT as outlined earlier. II. The securities market 3.17 The International Organisation of Securities Commissions (IOSCO) had published a report in 2014 regarding the Protection of Client Assets. The report had prescribed eight principles pertaining to the Protection of Client Assets. A thematic review14 was carried out by the Assessment Committee of IOSCO to review the progress made by the jurisdictions15 in adopting the principles. The findings of the thematic review was published in July 2017. In general, the review observed that as on the reporting date, a majority of the participating jurisdictions had adopted a client asset protection regime. India was observed to be compliant with the principles except Principle 316. With reference to Principle 3, the report noted that the intermediaries in India are not required to take additional steps other than using the approved custodians. 3.18 Public transparency and accessibility to information are key components of robust capital markets. Transparency is generally considered to be ‘the degree to which information about trading (both pre-trade and post-trade information) is made publicly available.’ In this regard, in August 2017 the IOSCO board published a consultation report on regulatory reporting and public transparency in the secondary corporate bond markets. The report, inter alia, recommends regulatory authorities to enhance the public availability of appropriate pre-trade information relating to corporate bonds. Such transparency becomes important in the Indian context where the corporate bond market is recording increased activity (Chart 3.3). 3.19 An analysis of the ratings of listed companies by major credit rating agencies (CRAs) (Table 3.1) shows that the upgrades picked up during 2017:Q2 suggesting a turnaround in corporate performance. | Table 3.1: Ratings of listed companies by major Credit Rating Agencies (CRAs) in India | | Rating Action | Number of Debt Issues of listed companies in terms of rating action | Per cent of Debt Issues of listed companies in terms of rating action | | Dec-16 | Mar-17 | Jun-17 | Sep-17 | Dec-16 | Mar-17 | Jun-17 | Sep-17 | | ICRA | | Upgraded + Reaffirmed | 64 | 63 | 19 | 37 | 92.75 | 90.00 | 82.61 | 97.37 | | Downgraded + Suspended | 5 | 7 | 4 | 1 | 7.25 | 10.00 | 17.39 | 2.63 | | Total | 69 | 70 | 23 | 38 | 100.00 | 100.00 | 100.00 | 100.00 | | CRISIL | | Upgraded + Reaffirmed | 914 | 705 | 884 | 1423 | 94.91 | 98.33 | 90.02 | 97.27 | | Downgraded + Suspended | 49 | 12 | 98 | 40 | 5.09 | 1.67 | 9.98 | 2.73 | | Total | 963 | 717 | 982 | 1463 | 100.00 | 100.00 | 100.00 | 100.00 | | CARE Ratings | | Upgraded + Reaffirmed | 547 | 178 | 231 | 506 | 96.81 | 93.19 | 90.94 | 90.04 | | Downgraded + Suspended | 18 | 13 | 23 | 56 | 3.19 | 6.81 | 9.06 | 9.96 | | Total | 565 | 191 | 254 | 562 | 100.00 | 100.00 | 100.00 | 100.00 | | Source: SEBI. | 3.20 Various committees17 constituted by the government and the Securities and Exchange Board of India (SEBI) have been instrumental in improving corporate governance practices in India. Corporate governance, however, is an evolving area which requires periodic reviews. Accordingly, SEBI constituted a Committee on Corporate Governance in June 2017 with a view to enhancing the standards of corporate governance of listed entities in India. The recommendations of the committee, cover a wide-range of areas including aspects relating to board composition, board of directors, independent directors, role of auditors, ratings and disclosures and information sharing with promoters and other stakeholders. Further, as per the committee all listed entities, government or private, should be at par with governance standards. The committee’s recommendations, along with the public comments received are presently under SEBI’s consideration. 3.21 SEBI prescribed a framework categorising commodities as Sensitive, Broad and Narrow with an objective of outlining a principle based methodology for revising the commodity-wise numerical values at the overall client level open position limits for agricultural commodities vis-à-vis ‘deliverable supply’ of such commodities available in the country during any specific year. Accordingly, the position limit for each commodity is to be fixed as a per cent of their deliverable supply, which is the combination of production and imports for the particular commodity. Other regulatory developments pertaining to the capital market are given in Table 3.2. III. Insurance 3.22 The contribution of insurance to financial stability was comprehensively discussed in a report18 of the International Association of Insurance Supervisors (IAIS). The business model of insurers exposes them to unique risks like mortality, morbidity, property and liability risks, which are not typically found in banking. Although interconnected with other financial market entities, a majority of the insurers withstood the global financial crisis of 2008-09 better than other financial institutions due to their inverted production cycle business model. The report, inter alia, cautions that insurance groups and conglomerates that engage in non-traditional or non-insurance activities are more vulnerable to financial market developments and importantly more likely to amplify, or contribute to, systemic risk. It also adds that just as the insurance business model is different from the banking model, the impact of insurance failures on other financial institutions and the real economy are different. Accordingly, it suggests that loss absorbency and resolution regimes for insurers should be different as there are differences between insurers and banks in the impact of failures. 3.23 The insurance sector in India has shown a robust growth so far during 2017-18. For the period ended October 2017, the general insurance industry grew at 18.63 per cent in gross direct premium and life insurance grew by 21.29 per cent in new business premium. Going forward, increasing life expectancy, favourable savings trends and greater employment in the private sector are expected to fuel demand for pension plans and protection plans. Likewise, strong growth in the automotive industry over the next decade will be a key driver for the motor insurance market. Health Insurance is an emerging area and includes indemnity based, critical illness based, benefit based, personal accident, domestic travel and overseas travel products. Health Insurance Products are offered by General, Health and Life insurers in the market. During the FY 2016-17, the total amount of premium collected under health insurance segment by all insurers in the industry was ₹35,430 crore. Further, the opening of branches of foreign reinsurers is a step towards developing the country as a reinsurance hub. 3.24 The Indian insurance sector has recently seen a lot of activity in terms of going public and consolidation; five19 insurance companies have already been listed on the stock exchanges and two more are in the process of being listed. This has been facilitated by the regulatory initiatives of the Insurance Regulatory and Development Authority of India (IRDAI) and the government’s decision to bring down its stake in public sector insurers and increase foreign investments in the sector. 3.25 IRDAI had earlier decided to implement the Ind AS in the insurance sector from the year 2018-19. However, due to replacement of IFRS 4 (on insurance contracts) with IFRS 17 by the International Accounting Standards Board (IASB), the authority has reviewed its position. To avoid a mismatch in the valuation of assets and liabilities and multiple compliance costs, the date of implementation of Ind AS has been deferred by two years, i.e., from FY 2020-21. IV. Pension funds 3.26 The National Pension System (NPS) continued to grow in terms of the number of subscribers and assets under management (AUM). NPS’ total subscribers increased from 13.82 million in October 2016 to 18.05 million in October 2017. At the same time, AUM increased from ₹1,539 billion to ₹2,120 billion during the same period (Charts 3.4 and 3.5). Atal Pension Yojana (APY) and NPS Lite subscribers formed 63 per cent of the total subscribers, while AUM of state governments and central government subscribers formed 88 per cent of the total. However, in terms of AUM per subscriber, the central government was highest at ₹0.41 million, followed by state governments and corporates, the all citizen model, NPS Lite and APY in that order (Chart 3.6).

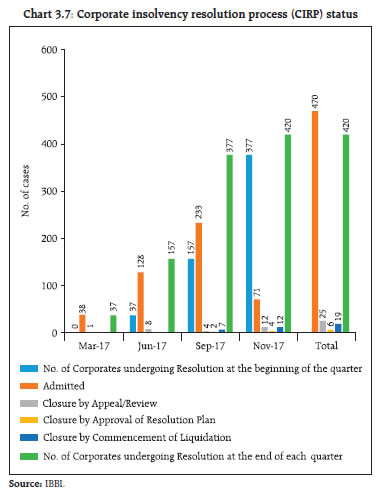

V. Insolvency and Bankruptcy Regime 3.27 The new insolvency and bankruptcy regime, came into existence with the enactment of the Insolvency and Bankruptcy Code (IBC) in May 2016 followed by establishment of the Insolvency and Bankruptcy Board of India (IBBI) as the regulator on 1st October, 2017. An important pillar of ecosystem, the National Company Law Tribunal (NCLT) as the adjudicating authority for Corporate Insolvency Resolution Process (CIRP) was already in place. Since then, there has been a significant amount of progress. A large number of corporate debtors have entered the insolvency process, and a few have even exited the process. As on November 2017, over 4300 applications under CIRP were filed in the various benches of NCLT. Since the majority of these are the cases where the insolvent firm has been previously admitted under the then prevalent laws like Companies Act, Sick Industrial Companies Act (SICA) etc., many cases were not pursued and became time-barred. Out of these, more than 500 applications for admission have been rejected, dismissed or withdrawn. 470 cases admitted by NCLT are at various stages of the insolvency process. So far in 25 CIRP transactions, NCLTs have approved the resolution plans or liquidation orders, whereas admission of cases have been set aside by the orders of appellate authorities i.e. NCLAT/the Supreme Court in 25 CIRPs admitted by the adjudicating authority. The details of transactions under CIRP are given in Chart 3.7.  3.28 Apart from the speed of resolution, another notable feature is that operational creditors, such as trade suppliers, employees, or workmen, have been empowered. Such creditors were served neither by previous restructuring mechanisms (such as SICA) nor the existing recovery mechanisms (SARFAESI, RDDBFI). The distribution of admitted applications based on the applicant for initiating the CIRP is given in Chart 3.8. 3.29 This market-determined and time-bound mechanism to handle insolvencies has been recognised in the World Bank Group’s “Doing Business 2018: Reforming to Create Jobs” report issued in October 2017. India’s ranking on ease of doing business has jumped from 130 to 100. The ranking under the Insolvency head, taken alone, also improved sharply from 136 to 103. VI. Recent regulatory initiatives and their rationale 3.30 Some of the recent regulatory initiatives, including prudential and consumer protection measures and the rationale thereof are given in Table 3.2. | Table 3.2: Important prudential and consumer protection measures and the rationale thereof June-November 2017 | | Date | Measure | Rationale/Purpose | | 1. Reserve Bank of India | | June 13, 2017 | Banks were permitted to use the ratings of the INFOMERICS Valuation and Rating Private Limited (INFOMERICS) for the purpose of risk weighting their claims for capital adequacy purposes, in addition to the existing six domestic credit rating agencies (CARE, CRISIL, FITCH India, ICRA, Brickwork Ratings and SMERA). | On scrutiny of an application from INFOMERICS for accreditation to provide bank loan ratings in terms of requirements prescribed under the Basel III Framework, it was decided that banks may use the ratings assigned by INFOMERICS for the purpose of risk weighting their claims for capital adequacy purposes. | | June 22, 2017 | Banks were advised to provide adequate relevant details of transactions in the passbooks and/or statements of accounts and also incorporate information about the ‘deposit insurance cover’ along with the limit of coverage upfront in the passbooks. | The instructions were issued with a view to helping customers as well as investigative agencies. | | July 6, 2017 | A revised framework for limiting customer liabilities in unauthorised/fraudulent electronic transactions was issued. According to the framework, a customer need not bear any loss if the deficiency is on the part of the bank and in cases where the fault lies neither with the bank nor with the customer but lies elsewhere in the system and the customer notifies the bank within three working days of the unauthorised transaction. Where the loss is due to a customer’s negligence, the customer has to bear the entire loss until he reports the unauthorised transaction to the bank; and where the fault lies neither with the customer nor with the bank and lies elsewhere in the system and the customer reports the unauthorised transaction between four to seven working days, the maximum liability of the customer ranges from ₹5,000 to ₹25,000, depending on the type of account/ instrument. If the unauthorised transaction is reported after seven working days, customer liability is determined as per the bank’s board approved policy. | The guidelines were revised in view of the widespread use of electronic banking and increase in complaints relating to unauthorised/ fraudulent transactions. A need was felt to have a comprehensive policy to limit customers’ liability particularly those who are not at fault. | | July 13, 2017 | UCBs were advised to provide details about the remitter (or beneficiary) and/or the source of credit (or debit) in the passbooks/pass sheets/account statements, in brief and in an intelligible manner to enable the account holders to cross-check them. | Since it had come to the Reserve Bank’s notice that many UCBs still did not provide adequate details of the transactions in the passbooks and / or statements of account, the instructions were re-issued. | | July 28, 2017 | An operating framework, wherein, non-bank entities may obtain approval from the Reserve Bank of India for remittances comprising small value, not exceeding USD 5000 per transaction by resident individuals, subject to the overall limit prescribed under the Liberalised Remittance Scheme (LRS), has been issued on June 16, 2017, as amendment to FED Master Direction No. 19/ 2015-16. The arrangement shall be restricted to current account transactions, in the nature of personal remittances. The AD banks concerned will be responsible for compliance with provisions governing regulations in India and KYC/AML standards/CFT issued by Reserve Bank of India. | This arrangement has been made with a view to facilitate outward remittance services by non-bank entities through Authorised Dealer (Category I) banks in India. | | September 15, 2017 | AD Category-I banks were directed to update the Export Data Processing and Monitoring System (EDPMS) with data of export proceeds on an ‘as and when realised basis’ with effect from October 16, 2017 and generate Electronic Bank Realisation Certificates (eBRCs) only from the data available in EDPMS. | These instructions were issued to have a uniform practice across the board for generating eBRC and to sync the data in EDPMS with consolidated eBRC data at DGFT. Integration of EDPMS with eBRC will make export regularisation and disbursement of duty drawback and incentive process online. | | September 22, 2017 | It was decided, in consultation with the Government of India, to exclude issuance of rupee denominated bonds (RDBs) from the Combined Corporate Debt Limit (CCDL) for investments by foreign portfolio investors in corporate bonds. Consequently, email reporting requirement of RDB transactions for onward reporting to depositories has been dispensed with. However, reporting of RDBs will continue as per the extant ECB norms. | These instructions were issued with a view to harmonising the norms for RDBs’ (masala bonds) issuance with ECB guidelines. | | September 22, 2017 | On a review, it was decided that with effect from October 3, 2017, masala bonds will no longer form a part of the limit for foreign portfolio investors’ (FPIs) investments in corporate bonds. They will form a part of the ECBs and will be monitored accordingly. | The review was carried out with a view to further harmonising norms for masala bonds’ issuance with ECB guidelines. | | September 25, 2017 | Banks were allowed to invest up to 10 per cent of the unit capital of a Category-II Alternative Investment Funds (AIFs) beyond which they will require prior approval from the Reserve Bank. | Category-II AIFs are mostly PE funds which invest in unlisted securities but do not employ leverage for such investment strategies. Under the venture capital funds (VCF) regime, banks have already invested in many such funds. Further, it was felt that the guidelines for AIF-I and AIF-II need alignment. | | September 25, 2017 | Investments by banks in Category-III AIFs were specifically prohibited. Further, a ceiling on investments by banks’ subsidiaries in AIF-III up to the regulatory minima prescribed by SEBI on sponsor/manager commitment has been prescribed. | As Category-III AIFs employ leverage and diverse/risky trading strategies in listed/unlisted derivatives, banks were prohibited from investing in these funds. While launching of Category-III AIFs by banks’ subsidiaries has not been barred, with a view to restricting indirect exposure of a bank a ceiling on the investments by such subsidiaries was kept up to the regulatory minima prescribed by SEBI on sponsor’s/manager’s commitment. | | September 25, 2017 | The minimum CRAR requirement for banks’ investments in financial services companies was aligned with minimum prescribed capital stipulations (including the capital conservation buffer). | The total capital requirements were increased due to the capital conservation buffer’s (CCB) prescriptions. Hence, the Reserve Bank aligned minimum CRAR requirements with minimum prescribed capital stipulations (including CCB). This will also obviate the need for future changes in the minimum CRAR requirements | | October 4, 2017 | The Reserve Bank issued directions for NBFC-peer to peer lending (P2P) platforms which inter alia cover directions related to their registration and operations. | Directions were issued with a view to regulating the provision of loan facilitation by P2P platforms. | | October 4, 2017 | The statutory liquidity ratio (SLR) of commercial banks, primary (urban) cooperative banks (UCBs), state cooperative banks and central cooperative banks was reduced from 20 per cent of their net demand and time liabilities (NDTL) to 19.50 per cent from the fortnight commencing October 14, 2017. | The Reserve Bank has been gradually reducing the SLR with a view to facilitating SCBs to maintain the minimum required liquidity coverage ratio (LCR) which was phased in at 60 per cent from January 1, 2015 to reach 100 per cent on January 1, 2019 with an annual increase of 10 per cent. | | November 2, 2017 | It was decided to introduce the LEI Code for large corporate borrowers in a phased manner. | The LEI Code is conceived as a key measure for improving the quality and accuracy of financial data systems for better risk management post the global financial crisis. LEI is a 20-digit unique code to identify parties to financial transactions worldwide. Accordingly, it was decided to adopt LEI for large corporate borrowers in a phased manner. | | November 9, 2017 | Guidelines on ‘Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs’ were issued so that an NBFC outsourcing its activities ensures sound and responsive risk management practices for effective oversight, due diligence and management of risks arising from such outsourced activities. | NBFCs have been outsourcing various activities and are hence exposed to various risks such as strategic risks, reputation risks, compliance risks, operational risks, legal risks, exit strategy risks, counterparty risks, country risks, contractual risks, access risks and concentration and systemic risks. | | November 9, 2017 | Banks were advised to put in place appropriate mechanisms to provide certain specific services to senior citizens and differently abled customers, for example, provision of dedicated counters for senior citizens, ease of submitting life certificates, free cheque book facility (with certain limits), ease of filing form 15G/H and door step banking. | It was observed that there are occasions when banks discourage or turn away senior citizens and differently abled persons from availing banking facilities in branches. With the objective of meeting the needs of such customers and to ensure that they are able to avail of a bank’s services without difficulty, these instructions were issued. | | 2. Securities and Exchange Board of India (SEBI) | | June 13, 2017 | Comprehensive guidelines for the Investor Protection Fund and the Investor Service Fund and its related matters. | Towards replication of investors’ protection mechanism in the capital market to the commodity derivatives market. | | June 13, 2017 | Options on Commodity Futures – Product Design and Risk Management Framework. | For further deepening the commodity derivatives market in India. | | June 13, 2017 & August 01, 2017 | Circular on a Comprehensive Review of the Margin Trading Facility. | To enable greater participation in the margin trading facility. | | June 14, 2017 | Recording of a non-disposal undertaking (NDU) in the depository system. NDUs are typically undertakings given by a shareholder not to transfer or otherwise alienate the securities and are in the nature of negative liens given in favour of another party, usually a lender. | SEBI’s policy measure was intended to provide a framework to capture the details of NDU in the depository system as these happen outside the depository system and are not captured and reflected in the records of the depositories. | | June 21, 2017 | Participation of Category-III AIFs in the commodity derivatives market. | Towards further deepening of the commodity derivatives market through the participation of institutional investors. | | June 28, 2017 | Participation of NRIs in the exchange traded currency derivatives (ETCD) segment. | To enable NRIs to hedge the currency risks arising out of their investments in India. | | June 30, 2017 | Acceptance of e-PAN card for KYC purposes. | This measure was taken pursuant to CBDT’s introduction of the E-PAN facility and to simplify registration procedures for FPIs. | | June 30, 2017 | Specifications related to the international securities identification numbers (ISINs) for debt securities. | To put in place a framework for consolidation in debt securities as part of the efforts to deepen the corporate bond market. | | June 30, 2017 | Clarification on monitoring of interest/ principal repayment and sharing of such information with CRAs by debenture trustees. | To ascertain the status of payment of interest/ principal by issuer companies to debenture holders on due dates in a timely manner and efficiently share such information with the CRAs. | | June 30, 2017 | Monitoring and review of ratings by credit rating agencies (CRAs). | To ensure that CRAs take cognisance of information regarding delays in servicing debt obligations by the issuer. | | July 07, 2017 | Guidelines for issuance of Offshore Derivative Instruments (ODIs), with derivatives as underlying, by the ODI issuing FPIs. | To further streamline the FPI segment and as a continuing measure for risk containment. | | July 11, 2017 | Amendment to the Investor Grievance Redressal System and Arbitration Mechanism. | To enhance the effectiveness of the grievance redressal mechanism at market infrastructure institutions (MIIs). | | July 25, 2017 | Position limits for agricultural commodity derivatives. | To outline a principle based methodology for revising the commodity-wise overall client level open position limits for agricultural commodities with reference to the ‘deliverable supply’ of such commodities available in the country during any specific year. | | September 08, 2017 | Cyber security and cyber resilience framework for registrars to an issue / share transfer agents (RTAs). | RTAs perform the critical function of providing services to holders of securities. Therefore, RTAs should have a robust cyber security and cyber resilience framework to provide uninterrupted services. | | September 13, 2017 | Outsourcing of activities by stock exchanges and clearing corporations. | These guidelines were prescribed to address the risks/ concerns arising from the outsourcing of activities by stock exchanges and clearing corporations. | | September 21, 2017 | Integration of broking activities in equity and commodity derivatives markets under a single entity. | To integrate the equity and commodity derivatives markets’ broking activities and to facilitate ease of doing business. | | May 17, May 23, August 31, September 26, 2017 | SEBI issued various guidelines/ circulars on position limits for cross-currency futures and option contracts (not involving Indian rupee) in IFSC; permissible investments by portfolio managers, alternate investment funds and mutual funds operating in IFSC; issuance, listing and trading of debt securities in IFSC; Participation of Foreign Portfolio Investors (FPIs) in Commodity Derivatives in IFSC, etc. | Towards orderly and smooth functioning of stock exchanges and clearing corporations in the International Financial Services Centre (IFSC). | | September 27, 2017 | Review of norms for participation in derivatives by mutual funds. | To enable mutual funds to hedge their debt portfolios from interest rate volatility. | | October 06, 2017 | Categorisation and Rationalisation of Mutual Fund Schemes into broad groups such as: Equity Schemes, Debt Schemes, Hybrid Schemes, Solution Oriented Schemes and Other Schemes | In order to bring the desired uniformity in practice across Mutual Funds and to standardise the scheme categories and characteristics of each category and to ensure that an investor in mutual fund schemes is able to evaluate different available options. | | October 16, 2017 | Criteria for settlement mode of commodity derivatives contracts with the first preference of settlement type by the way of physical delivery. | In order to streamline the settlement process and facilitate hedging function of commodity derivative contracts by anchoring them to their respective underlying physical markets. | | October 26, 2017 | Framework for block deals by providing two block deal windows

– Morning and Afternoon Block Deal Window | In order to further facilitate execution of large size trades through a single transaction. | | November 17, 2017 | Review of Securities Lending and Borrowing (SLB) Framework | To further facilitate SLB activities. | | November 30, 2017 | Directives on tenure of independent trustees, independent directors and auditors of mutual funds | Enhancing fund governance for mutual funds | | 3. Insurance Regulatory and Development Authority of India (IRDAI) | | July 25, 2017 | It was decided that all insurers having unclaimed amounts of policyholders for a period of more than 10 years as on 30th September 2017 need to transfer the same to the Senior Citizens’ Welfare Fund (SCWF) on or before 1st March 2018. Insurers will need to get the details of the account as well as the manner in which they are required to transfer the unclaimed amounts from the Department of Financial Services, Ministry of Finance, Government of India. Thereafter, every financial year the process laid down in the SCWF Rules, 2016 shall be followed with regard to transfer of policyholders’ unclaimed amounts. | The Government of India brought in the Senior Citizens’ Welfare Fund Act, 2015 (SCWF) as a part of the Finance Act, 2015, which mandates the transfer of unclaimed amounts of policyholders to the fund (SCWF) after a period of 10 years. The authority in its circular specified modalities of transferring all such funds to SCWF. | | October 12, 2017 | Insurers were advised to take immediate steps for conducting security audits of their information and computer technology (ICT) infrastructures including vulnerability assessment and penetration tests (VAPT) through CERT-In empanelled auditors, identifying the gaps and ensuring that the audit findings are rectified swiftly. Insurers are also requested to firm-up their cyber crisis management plans (CCMPs) for handling cyber incidents more effectively. | Instructions issued for setting up guidelines on information and cyber security for insurers in April 2017. On October 12, 2017 the authority again advised insurers to take immediate steps for conducting security audits, and follow other guidelines mentioned in the April circular. | | October 17, 2017 | A motor insurance service provider (MISP) or its associate companies were advised not to receive directly or indirectly from the insurer any fees, charges, infrastructure expenses, advertising expenses, documentation charges, legal fees, advisory fees or any other payment by whatever name except as specified in these guidelines. | To recognise the role played by automotive dealers in distributing and servicing motor insurance policies, guidelines for motor insurance service provider (MISP) were issued on August 31, 2017. Insurers and insurance intermediaries are required to upload details of MISPs to be appointed by them and the designated persons and sales persons thereof to the Insurance Information Bureau of India (IIB). | | November 8, 2017 | Issued instructions for implementing the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017 making the linkage of Aadhar number and PAN to insurance policies mandatory. | The central government vide gazette notification dated 1st June 2017 notified the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017 making Aadhar and PAN/Form 60 mandatory for availing financial services including insurance and also for linking the existing policies with the same. Accordingly, it was clarified that linkage of Aadhar number to insurance policies was mandatory under the Prevention of Money-laundering (Maintenance of Records) Second Amendment Rules, 2017. | | 4. Pension Fund Regulatory and Development Authority (PFRDA) | | July 5, 2017 | Adherence to the provisions of the Aadhar Act, 2016 and the Information Technology Act, 2000 | As per the government’s directions, various intermediaries were informed to strictly adhere to the provisions of the said acts and a list of do’s and don’ts was also transmitted forward as received from the government. | | August 9, 2017 | Curbing the high number of rejections in subscriber registration forms. | It was noticed that there was a high number of rejections in subscriber registration forms due to various reasons like incorrect PAN and incomplete mandatory personal and communication details. Accordingly, a circular was issued to POPs to ensure that the forms be scrutinised carefully before forwarding them to CRAs. | | August 17, 2017 | Advisory for deposit of NPS Lite contributions directly by the aggregators. | Aggregators responsible for collecting NPS Lite contributions were enabling subscribers to directly deposit their contributions into bank accounts without giving them a receipt. PFRDA instructed the aggregators to stop direct deposits and issue a receipt for every contribution. | | October 9, 2017 | Information on deferment of lump sum, annuity and continuation of Tier-II accounts under the National Pension System. | PFRDA came out with this circular to provide more clarity and a better understanding of various provisions of deferment and continuation of Tier-II accounts as per regulations and operational guidelines. | | October 27, 2017 | New/upgradation of functionalities by CRAs. | Functionalities of the two centralised recordkeeping agencies were enhanced to give them more operational efficiency and ease of access. Functionalities like FATCA compliance, withdrawal, eKYC, Aadhar seeding and subscriber shifting to eNPS were enhanced. | | October 27, 2017 | Revision of service charges to POPs under NPS (all citizen and corporate). | With a view to incentivising the POPs to actively promote and distribute NPS, POPs were allowed to increase the charges for the various services provided by them. | | November 1, 2017 | Increasing the maximum age of joining NPS from the present 60 years to 65 years in the NPS private sector, that is, the NPS-All Citizen Model and the Corporate Sector Model. | PFRDA received feedback/suggestions on increasing the age to join NPS during interactions with the general public, corporates and intermediaries. Due to better healthcare facilities and increased fitness along with opportunities available in the private sector and self-employment, more and more people in their late 50s and 60s are leading an active life. The annuity rates available in the older age fetch better annuities than at the age of 60 or less. | | 5. Insolvency and Bankruptcy Board of India (IBBI) | | June 15, 2017 | Insolvency and Bankruptcy Board of India (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017 | Instruction issued to fast track resolution process for corporate debtors with total assets less than ₹1 crore or a Startup or a small company under the Companies Act, 2013. The process to be completed within a period of 90 days as against 180 days in other cases, and extendable by a further period up to 45 days. | | June 15, 2017 | Clarifying the position under the Code as to who can render services as Insolvency Professionals (IPs) | Instruction issued to clarify that only a person having the required qualification and experience eligible to be enrolled as a member of an IPA and thereafter registered as an IP with the IBBI, can act and render services as an IP under the Code. All those Insolvency Professional Entities (IPEs) who are neither enrolled as member of an IPA nor registered as IP with the IBBI, are not permitted to act as IPs under the Code. | | September 29, 2017 | The IBBI (Information Utilities) (Amendment) Regulations, 2017 | The amended regulations, allow any person to hold up to fifty-one percent of the paid-up equity share capital or total voting power of an information utility up to three years from the date of its registration. It also allows Indian company to hold up to hundred percent equity subject to meeting certain conditions. These provisions are available in respect of information utilities to be registered before 30th September, 2018. | | October 5, 2017 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 and the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017 | According to the amended regulations, a resolution plan shall include a statement as to how it has dealt with the interests of all stakeholders, including financial creditors and operational creditors, of the corporate debtor. | | November 7, 2017 | Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 and the IBBI (Fast Track Insolvency Resolution Process for Corporate Persons) Regulations, 2017 | The amendments make it obligatory for the resolution plan to disclose details of convictions, pending criminal proceedings, disqualifications under the Companies Act, 2013, orders or directions issued by SEBI, categorisation as a wilful defaulter, etc. in respect of the resolution applicant and other connected persons such as holding companies, subsidiary companies, associate companies and related parties, to enable the Committee of Creditors to assess credibility of such applicant and take a prudent decision while considering the resolution plan for its approval. | | November 23, 2017 | The ordinance to amend the Insolvency and Bankruptcy Code is promulgated. | The Ordinance aligns the provisions under Code to strengthen the IBBI amendment to regulations dated 7th November, 2017. It aims at putting in place safeguards to prevent unscrupulous, undesirable persons from misusing or vitiating the provisions of the Code. | Section B Other developments, market practices and supervisory concerns I. The Financial Stability and Development Council 3.31 Since the publication of the last FSR in June 2017, the Financial Stability and Development Council (FSDC) held its 17th meeting on August 22, 2017 under the chairmanship of the Finance Minister where issues related to the state of the economy, setting-up of the Computer Emergency Response Team in the Financial Sector (CERT-Fin), progress regarding the Financial Sector Assessment Program (FSAP) 2017, setting up the Financial Data Management Centre (FDMC), Annual Report of FSDC, the Central KYC Registry (CKYCR) and Credit Rating Agencies (CRAs) were discussed. 3.32 The FSDC sub-committee held a meeting chaired by the Governor on November 23, 2017. It reviewed the major developments on global and domestic fronts impinging the financial stability of the country. The sub-committee also discussed issues related to the establishment of the National Centre for Financial Education (NCFE), operationalisation of information utilities registered by the Insolvency and Bankruptcy Board of India (IBBI), sharing of data among regulators and LEI’s implementation status. Further, the sub-committee also reviewed the activities of its various technical groups and also the functioning of the state level coordination committees (SLCCs) in various states / UTs. The recommendations of the committees on FinTech and Digital Innovations, the Shadow Banking Implementation Group and Stewardship Code were also discussed. II. Fund flows: FPI and mutual funds Mutual funds 3.33 Mutual funds as an asset class seem to be entering the maturity phase in India with broad-basing of investors and geographical spread. Assets under management (AUM) increased from ₹17.55 trillion in March 2017 to ₹20.40 trillion in September 2017. Contributions to mutual funds through systematic investment plans (SIPs) has added further stability to this sector. While the number of outstanding SIPs has continuously increased from 6 million in 2013-14 to 16.5 million in July 2017, the number of premature terminations came down from 1.9 million to 0.6 million during the same period. Added to this, AUM of B-15 cities grew 230 per cent in 2016-17 of what it was in 2012-13. Further, the share of individual holdings in mutual funds’ AUM has increased from 46 per cent in April 2016 to 51 per cent by September 2017, while the share of holdings by institutions (corporates and banks) went down from 54 per cent to 49 per cent during the same period. Diversity in terms of the investor base will provide resilience against redemption pressures in case the markets see corrections in their valuations (Chart 3.9).  III. Ownership patterns of Indian stocks 3.34 A diverse ownership in public listed companies is conducive to the depth and liquidity of stock markets. An analysis of the shareholding patterns of the top-500 scrips in terms of market capitalisation shows a gradual increase in the shareholding percentage of domestic institutional investors (DIIs). The share of mutual funds, especially, increased over the past three years (Chart 3.10). In both NIFTY 50 and top 500 scrips, promoters and the government continue to hold a dominant share of ownership (Chart 3.11)  3.35 Another important feature of the evolution of Indian equity markets is investors’ increasing interest in small cap and mid-cap securities over the last two years as seen from a significant increase in turnovers in beyond top 100 scrips in 2016-17 over the previous financial year (Chart 3.12). The turnover of the scrips in the group 501-1000 (in terms of market capitalisation) increased by nearly 36 per cent as compared to a 12 per cent increase in the case of the top 50 scrips and a 19 per cent increase in the total exchange turnover. However, fresh supply of equities remains muted as capital raised through ‘offer for sale’ (OFS)20 is much more than that raised through ‘initial public offerings‘ (IPOs). During April-September 2017, out of the total primary market equity raising, fresh issues through IPOs and OFSs were 15 per cent and 85 per cent respectively as against 25 per cent and 75 per cent respectively during the corresponding period of the previous year. Over the past six years, growth in listed companies in terms of number has increased marginally by 15 per cent on both the exchanges. In the long run, there is a need to increase the supply of quality listed securities so as to be able to meet rising demand, particularly through the mutual funds route.  IV. Commodity derivatives 3.36 The commodity derivatives market registered encouraging trends during April-September 2017 with metals and agriculture commodities recording positive growth (Charts 3.14 and 3.15).

V. Impact of demonetisation on Basic savings bank deposit (BSBD) accounts and digital transactions 3.37 Withdrawal of specified bank notes (SBNs) had a substantial impact on financial inclusion reflected in increase in the number of BSBD21 accounts and outstanding deposits. The total number of BSBD accounts post-demonetisation increased from 504 million in October 2016 to 533 million by March 2017, while the outstanding amount in such accounts rose from ₹732 billion to ₹976 billion during the corresponding period. Overdraft (OD) facility availed by such accounts also peaked in November 2016, which could be attributed to non-availability of informal sources of credit (Charts 3.16 and 3.17).

3.38 Demonetisation gave a substantial push to electronic transactions (Charts 3.18 and 3.19). Expanding smartphone and internet access and rationalisation of incentives for digital transactions can buttress this trend. The rapidly evolving ecosystem of new technologies will also play an important role as can be seen in the recent data.