The response to the pandemic from central banks, other regulators and fiscal authorities has been unprecedented, mitigating the impact on macroeconomic conditions and financial market stability. Targeted regulatory and other support measures helped to ameliorate sector-specific strains. On the domestic front, regulatory support curtailed solvency risk of financial entities, stabilised markets and provided the necessary impetus for economic revival, while maintaining financial stability. The Financial Stability and Development Council (FSDC) and its Sub- Committee remained vigilant and proactive, ensuring that financial markets and institutions remained resilient in the face of the resurgence of the pandemic to a peak in early 2021-22. Introduction 3.1 The COVID-19 pandemic is noteworthy for the unprecedented and sustained policy support by governments, central banks and other regulators. By and large, these policy actions have been able to dampen and mitigate pandemic-related losses and stresses, cushioning real activity and preserving the soundness of the financial system. Regulatory reforms implemented in the years after the global financial crisis (GFC) enabled banks in many jurisdictions to enter the COVID-19 crisis with sizable capital and liquidity buffers. Concurrently, the swift and aggressive responses of central banks eased financial conditions and liquidity risks were allayed, compressing term spreads. Regulatory easing across jurisdictions facilitated the flow of financial resources to the economy and effectively prevented the amplification of the shock. 3.2 As vaccination drives are being rolled out and the global economy re-charts an uneven upturn, this chapter undertakes an overview of the policy responses that enabled this renewed tryst with recovery. III.1 Global Regulatory Developments and Assessments 3.3 In its assessment of financial stability risks arising out of a potential large wave of insolvencies, the European Systemic Risk Board (ESRB) points out that public authorities have shielded the corporate sector so far from COVID-19 induced stress through a variety of measures, including loan guarantees and moratoria, thereby preventing the rise in insolvencies that typically follow in the wake of a contraction in economic activity1. As current support measures are withdrawn, these authorities should have strategies in place to evolve from addressing liquidity needs towards addressing solvency issues by differentiating between viable and non-viable firms and enabling fundamentally viable companies to thrive again in the post-pandemic period. To avoid moral hazard, it is important that the interests of public authorities and banks are aligned when debt is restructured. This would require banks to bear some of the restructuring costs and downside risks. 3.4 On credit ratings across four asset classes, viz., sovereigns, financial institutions, non-financial corporates and structured finance, the International Organization of Securities Commissions (IOSCO) observed no material changes to credit rating methodologies while noting the significance of government support measures (GSMs) in alleviating the downward pressure on credit ratings2. GSMs are expected to remain in place until the economic environment is stable and resilient enough to allow for a gradual withdrawal, according to credit rating agencies (CRAs). Any premature withdrawal of GSMs, especially in EMEs, is a downside risk to the global economic recovery. III.1.1 Regulatory Restrictions on Dividend Distribution - Calibrated Normalisation 3.5 As the recovery begins to emerge in several parts of the world, a calibrated return to dividend distribution by banks is also taking place after the suspension of dividend payouts and buy-back of ordinary shares was necessitated by the pandemic. The European Central Bank (ECB) has recommended that banks should exercise extreme prudence on dividends and share buy-backs, limiting distributions to below 15 per cent of accumulated 2019-20 profits and not higher than 20 basis points of the common equity tier-1 (CET-1) ratio until September 30, 2021. The US Federal Reserve (Fed) has announced that temporary and additional restrictions on bank holding company dividends and share repurchases currently in place has ended for most firms after June 30, 2021, based on results from stress tests. The Prudential Regulatory Authority of UK has withdrawn its restrictions on dividend distribution and share buy-backs and left it to banks’ boards to decide when to recommence distributions within an appropriately prudent framework. III.1.2 Banking Sector Liquidity 3.6 The ECB has prolonged its support via targeted lending operations for banks upto June 2022 in order to smooth out any temporary funding issues for solvent banks. Additionally, it has provided for a liquidity backstop to support money market functioning during the extended pandemic period, by offering four additional pandemic emergency longer-term refinancing operations in 2021, each with a tenor of one year, allotted on a quarterly basis. 3.7 The US Fed had temporarily modified the provisions relating to the supplementary leverage ratio (SLR) by excluding central bank reserves and US Treasuries from the calculation of SLR so as to ease the strain on the US treasury market and enable banks to continue lending to households during the pandemic. While the accomodation was allowed to expire as scheduled on March 31, 2021 the Fed highlighted the need for recalibration of the SLR in view of the recent growth in central bank reserves and US Treasury reissuance. III.1.3 Reform in Non-Bank Financial Intermediation 3.8 The Financial Stability Board (FSB), G-20 and IOSCO have set out a comprehensive programme for strengthening the resilience of Non-Bank Financial Intermediation (NBFI), which inter alia covers funding and credit intermediaries and markets, including money market funds (MMFs), investment funds, bond funds and the like. The immediate policy emphasis is on money market funds, open-ended funds, margining practices, liquidity, structure and resilience of core bond markets, and cross-border USD funding. The FSB will also launch an evaluation of the effects of G20 financial reforms on bond market liquidity. In the US, the President’s Working Group on Financial Markets (PWG) has focused on analysing the March 2020 market turmoil and potential policy recommendations, particularly for MMFs3. Based on the PWG’s report, the US Securities and Exchange Commission (SEC) has solicited comments on potential reform measures to improve the resilience of MMFs. III.1.4 COVID-19-related Loan Loss Provisioning by Banks 3.9 In response to the pandemic, regulatory authorities granted banks greater leeway in implementing expected credit loss (ECL) provisioning. Provisioning practices by 70 internationally active banks show that relative to loans, the median of the annualised provisions rose from 35 basis points to 105 basis points between H2:2019 to H1:2020, with provisioning under the US Generally Accepted Auditing Principles (GAAP) being somewhat higher than under the International Financial Reporting Standards (IFRS)4. As macroeconomic conditions improved, banks reduced quarterly provisions in Q4:2020, with some banks even releasing provisions, although such releases were substantially smaller than the amount of loan loss reserves added during the previous three quarters. III.1.5 Operational Risk in Banks 3.10 Operational resilience focuses on the ability of firms and the financial system to deliver key services and continue to serve the needs of customers through disruptions. The Basel Committee on Banking Supervision (BCBS) issued principles5 for operational resilience and revised the principles for sound management of operational risk, aiming to strengthen banks’ ability to withstand risk-related events including pandemics, cyber incidents, technology failures and natural disasters that could cause significant operational failures or wide-scale disruptions in financial markets. The Global Financial Markets Association (GFMA) in association with the Institute of International Finance (IIF) has set out ways to continuously improve and strengthen operational resilience in the financial system for the benefit of customers, markets and the broader economy6. III.1.6 Other International Regulatory Developments 3.11 In February 2021, the UK Treasury issued a consultation paper on its proposed central counter party (CCP) resolution framework, which would set out the powers that the Bank of England (BoE) would hold as a resolution authority in closing down a central counter party (CCP) after a fatal default or non-default event. The expanded CCP resolution regime would give the BoE additional powers to mitigate the risk and impact of a CCP failure and the subsequent risks to financial stability and public funds. These additional powers inter alia include the ability to write down CCP members’ unsecured liabilities and to make cash calls on clearing members. 3.12 The European Banking Authority (EBA) has issued draft technical standards on implementing Pillar 3 disclosures on Environmental, Social and Governance (ESG) risks7. Acting on a mandate from the EU Capital Requirements Regulation, the EBA is proposing specific templates for quantitative and qualitative disclosures on climate-change-related transition and physical risks as well as financial institutions’ mitigating actions and adaptation plans. III.1.7 Insurance Sector 3.13 The International Association of Insurance Supervisors (IAIS) has identified the key challenges posed by cyber risk underwriting as: (a) measurement of risk exposure due to the evolving nature of cyber risk; and (b) issues related to the clarity of cyber insurance policies, which inter alia include overlapping coverage, the treatment of ransoms, fines, terrorism and war risk8. III.1.8 Central Bank Digital Currency 3.14 The third BIS Survey on Central Bank Digital Currency (CBDC)9 notes that most central banks are exploring CBDCs, in both wholesale and retail form, progressing from conceptual research to practical experimentation. EMEs were driven by considerations of financial inclusion and payment system safety and efficiency in their approach to CBDCs. While most central banks have no plans to issue CBDCs in the foreseeable future, several are likely to launch retail CBDCs in the next three years. III.2 Domestic Regulatory Developments 3.15 The Sub-Committee of the Financial Stability and Development Council (FSDC-SC), chaired by the Governor, Reserve Bank of India (RBI) met twice since December 2020 to review developments in the financial sector impinging on financial stability and to discuss matters involving inter-regulatory co-ordination. Among the issues taken up in its 26th meeting held on January 13, 2021 the Sub-Committee discussed the scope for improvements in “the corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 (IBC), utilisation of data with the Central KYC Records Registry and changes in the regulatory framework relating to Alternative Investment Funds (AIFs) set up in the International Financial Services Centre (IFSC). At the 27th meeting held on April 29, 2021 the FSDC-SC discussed members’ assessments of the scenario emerging from the second wave of the COVID-19 pandemic as well as inter-regulatory issues and reviewed the activities of various technical groups under its purview as well as the functioning of State Level Coordination Committees (SLCCs) in various states / UTs. The members resolved to remain vigilant and proactive to ensure that financial markets and financial institutions remain resilient in the face of fresh challenges brought on by the resurgence of the pandemic. III.3 Initiatives from Regulators/Authorities 3.16 In order to mitigate pandemic induced stress, financial sector regulators and the government rolled out a number of measures, including extending existing relaxations to provide relief. Additionally, several significant regulatory initiatives were taken towards fortifying the resilience of the financial system (Annex 3). Regulatory forbearances lapsed on the stipulated end dates. III.3.1 Credit Related Measures 3.17 With the objective of alleviating the potential stress to individual borrowers and small businesses due to the COVID-19 pandemic, a limited window upto September 30, 2021 was opened by the Reserve Bank under Resolution Framework 2.0 permitting lending institutions to implement resolution plans in respect of their exposures to individuals, MSMEs and other small businesses with aggregate exposure upto ₹50 crore, while classifying the same as standard. Moreover, priority sector classification was extended to fresh credit advanced by SFBs to specified categories of NBFC-MFIs and other MFIs for the purpose of on-lending to individuals in order to address the emergent liquidity stress faced by smaller MFIs. 3.18 In recognition of the continuing adverse impact of COVID-19 pandemic on certain service sectors, the Government expanded the scope of Emergency Credit Line Guarantee Scheme (ECLGS) on March 31, 2021 through introduction of ECLGS 3.0 to cover the credit needs of business enterprises in hospitality, travel and tourism, leisure and sporting sectors. This was followed by ECLGS 4.0 announced on May 31, 2021 which covered the credit needs of hospitals for setting up oxygen generation plants while expanding the coverage of ECLGS 3.0 to include the civil aviation sector and extending the validity of the schemes to September 30, 2021. 3.19 Asset classification and provisioning norms are prudential guidelines that provide a baseline assessment of risks building up in financial intermediaries and a provision floor for expected losses. Any disturbance or pause in asset classification can have wider implications, particularly in respect of the assessment of the true financial position of banks and other lending institutions. Against the backdrop of the pandemic and the multiple petitions filed seeking more policy support measures from the Government and the Reserve Bank, the Supreme Court had directed that borrowers’ accounts which had not been classified as non-performing as on August 31, 2020 should be retained in the same category till further orders. This stay on asset classification was vacated on March 23, 2021. Post the Supreme Court’s judgement, the Reserve Bank issued instructions dated April 7, 2021 to ensure consistent application of prudent asset classification and income recognition norms by lending institutions. III.3.2 Development of the Credit Risk Market 3.20 In order to facilitate diversification of credit risk originating in the banking sector and to ensure market-based credit products for diversified set of investors having commensurate capacity and risk appetite, the Reserve Bank has been working on a revised securitisation framework, a comprehensive framework for transfer of loan exposures and on institutionalising a secondary market for corporate loans. As part of the latter, it has facilitated the establishment of a self-regulatory body viz., Secondary Loan Market Association (SLMA), comprising of market participants. III.3.3 Pre-Packaged Insolvency for MSMEs 3.21 With the revocation of the suspension on fresh proceedings under the Insolvency and Bankruptcy Code, 2016 (IBC) on March 24, 2021, creditors can again leverage on the instrumentality of IBC for resolution of stressed assets. As regards MSMEs, the Central Government has promulgated the Insolvency and Bankruptcy Code (Amendment) Ordinance 2021 to allow the corporate debtor to initiate pre-packaged insolvency resolution processes in case of a default of ₹10 lakh and above. This hybrid mechanism (a blend of formal and informal mechanisms) is intended to facilitate resolution for MSMEs in an expeditious and cost-effective manner with minimum disruption in business continuity. In this scheme the resolution of a company’s business is explored first with the debtor-in-possession even before the formal initiation of the process. After the process gets underway, in case there is no impairment of operational creditors’ dues in the base resolution plan, the Committee of Creditors (CoC) has the option to call for resolution plans from third parties, while it is mandated to do so if impairment arises. III.3.4 Bad Bank 3.22 In the Union Budget for 2021-22, the Government announced a proposal for setting up the National Asset Reconstruction Company Limited (NARCL), popularly termed as a “bad bank”, to consolidate and take over stressed debt from banks, based on decided characteristics. The aggregation of assets is expected to assist in turning around the assets and eventually offloading them to AIFs and other potential investors for further value unlocking. Drawing from established market principles and global experience, the success of a bad bank initiative would eventually depend upon design aspects, viz., fair pricing; complete segregation of risk from selling banks; investment of external capital; independent and professional management of the new entity; minimising moral hazard; and adequate capitalisation of the banks post-sale of assets to invigorate fresh lending. III.3.5 Customer Protection 3.23 Over the years, the Reserve Bank has taken several measures for improving customer service and grievance redress in banks. With increasing number of complaints received in the offices of the Banking Ombudsman, the need was felt to strengthen the existing mechanism. Accordingly, with effect from January 27, 202110 a comprehensive framework for dealing with customer grievances was implemented which comprises: (a) enhanced disclosures on customer complaints; (b) monetary disincentive in the form of recovery of cost of redress of complaints from banks when maintainable complaints are comparatively high; and (c) intensive review of the grievance redress mechanism and supervisory action against banks that fail to improve their redress mechanism in a time bound manner. III.3.6 Centralised Payment Systems – Permitting Membership to Non-bank Entities 3.24 Currently, the centralised payment systems (CPS), viz., Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) primarily function on a bank-led model. As non-bank entities have emerged as key players in the digital payments space offering innovative products and solutions, granting them direct access in CPS can minimise the cost and time involved in routing payments through banks. Therefore, in line with progress envisaged in the Payment and Settlement Systems in India: Vision 2019-2021, the Reserve Bank announced in April 2021 that entities in the payment space fully regulated by it, viz., non-bank prepaid payment instrument (PPI) issuers, card networks (like Visa and MasterCard), Trade Receivables Discounting System (TReDS) platform operators and white-label ATM operators can obtain direct membership in CPSs after fulfilling the eligibility criteria. Non-bank access to CPS is expected to minimise settlement risk in the financial system and widen the reach of digital financial services to all segments of users. III.3.7 Innovation through Regulatory Sandbox 3.25 The Reserve Bank has adopted a thematic approach to its regulatory sandbox (RS) in the fintech sector, which allows it to pursue specific sector-wise objectives and visualise risks at sub-levels. After the first cohort was launched in November 2019 with “Retail Payments” as its theme, the second cohort was launched in December 2020 with the theme “Cross Border Payments”. The Reserve Bank also selected “MSME lending” as the theme for the third cohort. III.3.8 Strengthening of Cyber Security Preparedness in Supervised Entities 3.26 The cyber threat landscape for the financial system in India is continuously evolving, with new vulnerability exploits, attack vectors and threat groups emerging regularly. The year 2021 has so far seen attempts to target the payment ecosystem of the country by adopting multiple modus operandi, including the theft of payment card credentials and compromise of ATM infrastructure. In response, the Reserve Bank has issued advisories/alerts to mitigate their impact and is also working more intensively with supervised entities to strengthen their cyber security resilience. 3.27 Recognising the growing usage of digital channels in banking and payment services and the need for an enabling environment for customers to use digital payment products in a more safe and secure manner, comprehensive guidelines11 on Digital Payments Security Controls were issued in February 2021 for supervised entities. They stipulate setting up a robust governance structure for digital payment systems and implementing common minimum standards of security controls for channels such as internet/mobile banking and card payments, among others. 3.28 The Computer Security Incident Response Team for the Financial Sector (CSIRT-Fin) under The Indian Computer Emergency Response Team (CERT-In) issued various early warning threat intelligence alerts in near real time to enable mitigation of attacks by the financial sector organisations. CERT-In has on-boarded 158 financial sector organisations in the Cyber Swachhta Kendra to track vulnerable services and malware infections in their respective networks and has been conducting regular cyber security drills / exercises for capacity building. III.3.9 Amalgamation of Urban Co-operative Banks 3.29 The enactment of Banking Regulation (Amendment) Act, 2020 empowers the Reserve Bank to sanction voluntary amalgamations of the urban co-operative banks (UCBs) in specified conditions. In this context, the Reserve Bank issued comprehensive directions12 on various aspects of such amalgamations to help in facilitating amalgamation of weaker UCBs with stronger entities. These include incentives for an amalgamating UCB, such as relaxed conditions for closure/merger of branches as well as minimum entry point capital if the entity becomes a multi-state UCB on account of the amalgamation. III.4 Other Developments III.4.1 Deposit Insurance 3.30 Insured deposits13 of banks amounted to ₹76,21,258 crore as on end-March 2021 constituting 50.9 per cent of total assessable deposits at ₹1,49,67,776 crore. The number of fully protected accounts constituted 98.1 per cent of the total number of deposit accounts, and the amount coverage available to depositors of SCBs and UCBs stood at 49.6 per cent and 69.4 per cent, respectively. 3.31 The Deposit Insurance and Credit Guarantee Corporation (DICGC) processed claims amounting to ₹993 crore during 2020-21, with a view to ensuring payment to insured depositors of liquidated banks under the prevailing pandemic situation. Of this, ₹564 crore pertained to nine co-operative banks. | Table 3.1: Corporate Insolvency Resolution Process | | (Number) | | Year / Quarter | CIRPs at beginning of the period | Admitted | Closure by | CIRPs at the end of the Period | | Appeal/ Review/ Settled | Withdrawal under Section 12A | Approval of Resolution Plan | Commencement of Liquidation | | 2016-17 | 0 | 37 | 1 | 0 | 0 | 0 | 36 | | 2017-18 | 36 | 706 | 94 | 0 | 20 | 91 | 537 | | 2018-19 | 537 | 1,156 | 149 | 97 | 79 | 305 | 1,063 | | Apr-Jun, 2019 | 1,063 | 301 | 53 | 32 | 26 | 96 | 1,157 | | Jul-Sep, 2019 | 1,157 | 596 | 57 | 51 | 34 | 156 | 1,455 | | Oct-Dec, 2019 | 1,455 | 637 | 114 | 60 | 42 | 153 | 1,723 | | Jan-Mar, 2020 | 1,723 | 444 | 95 | 58 | 39 | 137 | 1,838 | | Apr-Jun, 2020 | 1,838 | 84 | 13 | 27 | 20 | 26 | 1,836 | | Jul-Sep, 2020 | 1,836 | 96 | 25 | 35 | 35 | 81 | 1,756 | | Oct-Dec, 2020 | 1,756 | 107 | 8 | 30 | 24 | 83 | 1,718 | | Jan-Mar, 2021 | 1,718 | 212 | 8 | 21 | 29 | 149 | 1,723 | | Total | NA | 4376 | 617 | 411 | 348 | 1,277 | 1,723 | Note: 1) These CIRPs are in respect of 4289 CDs.

2) This excludes 1 CD which has moved directly from BIFR to resolution.

Source: Compilation from website of the NCLT and filing by Insolvency Professionals. | The net outgo of funds towards settlement of claims was lower, aided by a recovery of ₹567 crore during the year. During April 2021, an amount of ₹330 crore was settled in case of one co-operative bank. 3.32 The size of the deposit insurance fund stood at ₹1,29,904 crore as at end-March 2021 leading to a reserve ratio (deposit insurance fund to insured deposits) of 1.7 per cent. The DICGC deployed the funds in central government securities, primarily in the liquid 10-year paper, maintaining a modified duration of 7.41 years to enable availability of funds for settlement of claims in case of failure of banks. 3.33 The Government had announced in the Union Budget a move towards streamlining the provisions of the Deposit Insurance and Credit Guarantee Corporation Act, 1961 so that if a bank is temporarily unable to fulfil its obligations, the depositors can get easy and time-bound access to their deposits to the extent of the deposit insurance cover. | Table 3.2: Sectoral Distribution of CIRPs as on March 31, 2021 | | Sector | No. of CIRPs | | Admitted | Closed | Ongoing | | Appeal/ Review/ Settled | Withdrawal under Section 12A | Approval of Resolution Plan | Commencement of Liquidation | Total | | Manufacturing | 1784 | 214 | 166 | 178 | 566 | 1124 | 660 | | Real Estate, Renting & Business Activities | 862 | 159 | 100 | 46 | 214 | 519 | 343 | | Construction | 458 | 90 | 46 | 32 | 94 | 262 | 196 | | Wholesale & Retail Trade | 442 | 56 | 35 | 20 | 156 | 267 | 175 | | Hotels & Restaurants | 99 | 17 | 12 | 12 | 24 | 65 | 34 | | Electricity & Others | 134 | 15 | 4 | 13 | 32 | 64 | 70 | | Transport, Storage & Communications | 132 | 17 | 9 | 9 | 48 | 83 | 49 | | Others | 465 | 49 | 39 | 38 | 143 | 269 | 196 | | Total | 4376 | 617 | 411 | 348 | 1277 | 2653 | 1723 | | Source: Compilation from website of the NCLT and filing by Insolvency Professionals. | III.4.2 Corporate Insolvency Resolution Process (CIRP) 3.34 At the end of Q4:2020-21, the number of CIRPs commenced under the Insolvency and Bankruptcy Code (IBC) stood at 4376, with the manufacturing sector accounting for the largest share (Tables 3.1 and 3.2). About 61 per cent of these had been closed, with 13 per cent culminating in resolution plans and 48 per cent yielding orders for liquidation. Of the latter, 74.3 per cent had earlier been with the Board for Industrial and Financial Reconstruction (BIFR) or defunct and the assets involved, on average, were valued at less than 5 per cent of the outstanding debt amount (Table 3.3). 3.35 Out of the 348 CIRPs that ended in resolution, 120 were BIFR or defunct cases. Overall, realisation by financial creditors (FCs) in the resolved cases was 39.3 per cent of their claims and 179.9 per cent of liquidation value (Table 3.4). The CIRPs which yielded resolution plans by the end of March 2021 took 406 days on an average (after excluding the time excluded by the Adjudicating Authority) for conclusion of the process. III.4.3 Mutual Funds 3.36 The volume of fund mobilisation and redemption in mutual funds (MF) during H2:2020-21 was subdued as compared to the corresponding period in the previous year. The net inflow of ₹0.7 lakh crore into MF schemes, however, outstripped the level of ₹0.3 lakh crore recorded during H2:2019-20. Income/debt-oriented schemes accounted for inflows of ₹80,937 crore while growth/ equity-oriented schemes witnessed outflows of ₹41,823 crore. Total inflows under all other schemes stood at ₹28,382 crore during H2:2020-21. | Table 3.3: CIRPs Ending with Orders for Liquidation till March 31, 2021 | | State of Corporate Debtor at the Commencement of CIRP | No. of CIRPs initiated by | | Financial Creditor | Operational Creditor | Corporate Debtor | Total | | Either in BIFR or Non-functional or both | 384 | 444 | 118 | 946 | | Resolution Value > Liquidation Value | 75 | 44 | 27 | 146 | | Resolution Value ≤ Liquidation Value | 471 | 528 | 127 | 1126 | Note: 1. There were 67 CIRPs, where CDs were in BIFR or non-functional but had resolution value higher than liquidation value.

2. Includes cases where no resolution plans were received and cases where liquidation value is zero or not estimated.

3. Data of 5 CIRPs are awaited.

Source: Compilation from National Company Law Tribunal (NCLT) website and filing by Insolvency Professionals. |

| Table 3.4: Outcome of CIRPs, initiated Stakeholder-wise, as on March 31, 2021 | | Outcome | Description | CIRPs initiated by | | Financial Creditor | Operational Creditor | Corporate Debtor | Total | | Status of CIRPs | Closure by Appeal/Review/Settled | 164 | 447 | 6 | 617 | | Closure by Withdrawal u/s 12A | 120 | 284 | 7 | 411 | | Closure by Approval of Resolution Plan | 191 | 116 | 41 | 348 | | Closure by Commencement of Liquidation | 548 | 573 | 156 | 1277 | | Ongoing | 852 | 805 | 66 | 1723 | | Total | 1875 | 2225 | 276 | 4376 | | CIRPs yielding Resolution Plans | Realisation by FCs as % of Liquidation Value | 190.4 | 114 | 141 | 179.9 | | Realisation by FCs as % of their Claims | 44.7 | 16.6 | 26 | 39.3 | | Average time taken for Closure of CIRP | 463 | 458 | 439 | 459 | | CIRPs yielding Liquidations | Liquidation Value as % of Claims | 6.3 | 8.9 | 9.9 | 7 | | Average time taken for Closure of CIRP | 366 | 344 | 324 | 351 | | Source: Compilation from website of the NCLT and filing by Insolvency Professionals. | 3.37 The assets under management (AUM) of the mutual fund industry increased by 44.5 per cent during 2020-21 (Chart 3.1). At the end of May 2021, the AUM increased by 34.7 per cent year-on-year. 3.38 The AUM of investment through systematic investment plans (SIPs), which continued to be a favoured choice for investors, recorded 78.1 per cent growth during 2020-21 (Table 3.5). III.4.4 Capital Mobilisation - Equity and Corporate Bonds 3.39 Capital mobilisation through public and rights issues during 2020-21 increased to ₹1,10,088 crore, registering a 42.9 per cent increase over the previous year (Table 3.6). There was a significant fall in fund raising though preferential allotment during 2020-21. Also, on the back of the lower bond yields and low return on bank deposits, corporates raised ₹7.8 lakh crore during 2020-21 as compared with ₹6.9 lakh crore in the previous year. During April-May 2021, debt issues accounted for nearly 69 per cent of the capital raised.

| Table 3.5 : SIPs in 2020-21 | Existing at the beginning of 2020-21

(Excluding STP) | Registered during 2020-21 | Matured during 2020-21 | Terminated prematurely during 2020-21 | Closing no. of SIPs at the end of 2020-21 | AUM at the beginning 2020-21 | AUM at the end of 2020-21 | | (Number in lakhs) | Amount in ₹ crore | | 315 | 131 | 25 | 54 | 368 | 2,38,821 | 4,25,338 | | Source: Securities and Exchange Board of India (SEBI). |

| Table 3.6: Capital/Debt Mobilisation modes | | (Amount in ₹ crore) | | Particulars | 2021-22$ | 2020-21 | 2019-20 | | Number | Amount | Number | Amount | Number | Amount | | Public issue (Equity)# | 8 | 3010 | 56 | 46,030 | 62 | 21,382 | | Rights Issues (Equity) | 4 | 305 | 21 | 64,059 | 17 | 55,670 | | QIP & Institutional placement programme (IPP)* | 6 | 7,857 | 31 | 78,738 | 14 | 54,389 | | Preferential Allotments* | 68 | 14,706 | 230 | 40,876 | 280 | 174,875 | | Total Equity | 86 | 25,878 | 338 | 2,29,703 | 373 | 306,317 | | Public Issue (Debt) | 6 | 3,581 | 18 | 10,587 | 34 | 14,984 | | Private Placement of Corporate Bonds | 192 | 53,632 | 1995 | 7,71,840 | 1,786 | 674,671 | | Total Debt | 198 | 57,213 | 2,013 | 7,82,427 | 1,820 | 6,89,655 | | Total Fund Raised | 284 | 83,091 | 2,351 | 10,12,130 | 2,193 | 9,95,971 | Notes: 1) Equity public issues also includes issues listed on SME platform

2) $ Data upto May 2021.

3) #Data has been prepared based on date of listing of the Issues

4) *Based on trading date.

5) The data of debt is being prepared based on closing date.

Source: SEBI | III.4.5 Credit Ratings 3.40 On an aggregate basis, the share of downgraded listed debt issues in total outstanding ratings declined significantly during Q4:2020-21 vis-à-vis earlier quarters, while the share of upgraded listed debt issues was at a three-year high for both ICRA and CRISIL (Chart 3.2). 3.41 Out of the rating downgrades during Q4:2020-21, the share of the NBFC and HFC sectors as well as banks and financial services went down significantly as compared to the preceding quarter (Chart 3.3). III.4.6 Commodity Derivatives Market 3.42 Reflecting the strong demand for commodities globally and in India, the benchmark domestic commodity derivative indices, MCX iCOMDEX composite and the NKrishi14 index, gained 6.2 per cent and 28.3 per cent, respectively, during the period January – June 2021 (upto June 21, 2021) (Chart 3.4). Apart from external factors such as a surge in China’s industrial demand, adverse weather patterns impacting agri-produce in various countries and rising energy prices due to OPEC production cuts, domestic factors, including increase in export demand, pent-up domestic demand and commodity specific demand–supply imbalances drove up prices.

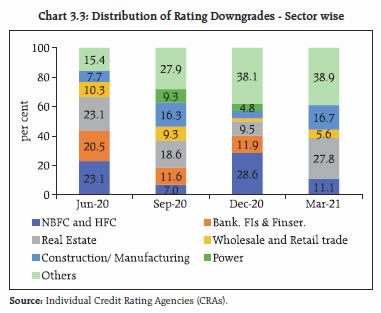

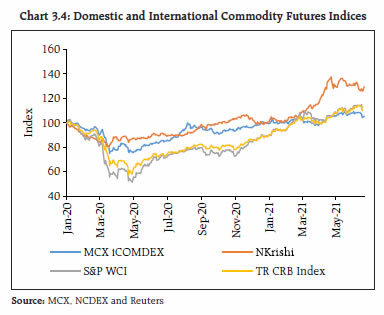

3.43 During January-June 2021 (upto June 21,2021), the iCOMDEX crude oil index registered a rise of 50.7 per cent, reflecting increasing energy prices (Chart 3.5). The iCOMDEX base metal index surged by 9.3 per cent during the same period, clocking an overall rise of 47.9 per cent for 2020-21 as a whole. On the other hand, the iCOMDEX bullion index, which had risen by 10.4 per cent during 2020-21, declined by 7.3 per cent during January – June 2021 due to reduction in the safe haven appeal of precious metals on account of strengthening of the dollar, rise in US bond yields and optimism on economic recovery following rollout of vaccines. Trading Activity in the Commodity Derivatives Market 3.44 Commodity derivatives recorded lower turnover during January – May 2021 relative to August – December 2020 period, driven by fall in bullion segment, which constitutes half of the aggregate turnover (Table 3.7). While turnover of futures contracts declined by 12.4 per cent, that of the options segment increased by 13.9 per cent. Traded volumes in tonnes increased for agriculture and energy and declined for bullion and metals (Chart 3.6).

| Table 3.7: Segment-wise aggregate turnover (Futures + Options) in Commodity Derivatives | | (Amount in ₹ crore) | | Period | Agri. | Bullion | Energy | Metals | Gems & Stones | Total Turnover | | January – May 2021 | 2,73,292 | 19,34,976 | 9,48,218 | 7,48,235 | 0.1 | 39,04,716 | | August – December 2020 | 1,93,585 | 25,83,180 | 8,19,620 | 7,35,792 | 0.3 | 43,32,176 | | Change (per cent) | 41.2 | -25.1 | 15.7 | 1.7 | - | -9.9 | | Share in Jan – May 2021 (in per cent) | 7.0 | 49.5 | 24.3 | 19.2 | 0.0 | 100.0 | | Source: MCX, NCDEX | III.4.7 Insurance 3.45 New business premiums pertaining to life insurance picked up sharply after plunging in Q3:2020-21 (Chart 3.7). Non-linked insurance products with guaranteed benefits increased by nearly 8 per cent in 2020-21. 3.46 The total premium, which includes renewal premium, also continued the uptrend seen since November 2020 (Chart 3.8). 3.47 Insurance premiums collected under various COVID-19 specific policies stood at ₹1,307 crore for an insured sum of ₹13.6 lakh crore up to May 15, 2021 (Table 3.8). 3.48 During 2020-21, the life insurance industry received 22,205 claims worth ₹1,644.56 crore where death was due to COVID-19 and related complications, which amounted to 0.3 per cent of total premium income of the year. Of these, 21,854 death claims amounting to ₹1,492.02 crore were settled and there was no significant impact on the financials of the life insurers. As per the number of claims, the claims paid ratio (provisional) stood at 98.1 per cent for individual claims and 98.6 per cent in the group category in comparison with 96.8 per cent and 97.3 per cent, respectively, for the previous financial year. Thus, the pandemic did not have a significant impact on death claim settlement rates.

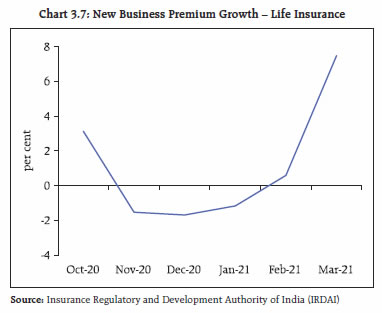

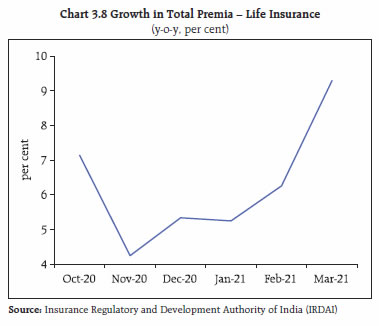

Table 3.8: Business in COVID-19-specific Insurance Products

(April 1, 2020 to May 15, 2021) | | Type of business / Units | No. of Policies | Lives covered | Total Sum Insured | Gross Premium | | Number | ₹ Crore | | Corona Kavach | 27,62,126 | 48,14,096 | 1,60,615 | 679 | | Corona Rakshak | 4,74,807 | 5,48,242 | 9,193 | 71 | | Other COVID-19 specific products | 62,021 | 95,35,366 | 11,92,436 | 557 | | Total | 32,98,954 | 1,48,97,704 | 13,62,244 | 1,307 | Note: The data is as submitted by the insurers through a special format

Source: IRDAI | III.4.8 Pension Funds 3.49 The enrolment and assets under management (AUM) of the National Pension System (NPS) and Atal Pension Yojana (APY) continued to grow (Table 3.9). The coverage of citizens under the pension net expanded and the number of banks registered under APY increased to 414. III.4.9 International Financial Services Centres Authority (IFSCA) 3.50 The IFSCA issued various enabling regulations relating to market infrastructure institutions, banking, bullion exchange, finance companies, global in-house centres, fintech regulatory sandbox, alternate investment funds (AIFs), aircraft leasing and ancillary services. This attracted significant interest and permission was granted for setting up business in IFSC to funds and fund managers, portfolio managers, global inhouse centres, aircraft leasing units and professional and other ancillary services providers. Summary and Outlook 3.51 Central banks and regulatory authorities are at the forefront of the war effort mounted to cushion the damage wrought by the COVID-19 pandemic. As recovery remains hesitant and divergent, they have extended existing regulatory relaxations further and are also addressing emerging sectoral concerns on an ongoing basis. Various initiatives to strengthen the operational resilience of the financial sector entities have been taken up. Learning from the effectiveness of measures, global standard setting agencies have initiated processes to build new capabilities and refine the existing systems. As banks and other financial intermediaries strengthen capital positions and provisions to withstand aftershocks from waves of the pandemic, these buffers will help in managing the rollback of regulatory measures without leaving scars in their wake. | Table 3.9: Subscriber and AUM Growth: NPS and APY | | Sector | Numbers in lakh | Amount in ₹ crore | | Mar-20 | Mar-21 | Mar-20 | Mar-21 | | Central Government | 21.02 | 21.76 | 1,38,046 | 1,81,788 | | State Government | 47.54 | 51.41 | 2,11,023 | 2,91,381 | | Corporate | 9.73 | 11.25 | 41,243 | 62,609 | | All Citizen Model | 12.52 | 16.47 | 12,913 | 22,206 | | NPS Lite | 43.32 | 43.02 | 3,728 | 4,354 | | APY | 211.42 | 280.49 | 10,526 | 15,687 | | Total | 345.55 | 424.4 | 4,17,479 | 5,78,025 | | Source: Pension Fund Regulatory and Development Authority | 3.52 Domestically too, several measures were taken across the regulatory space to strengthen financial sector entities, ease access to financial products, strengthen the grievance redressal mechanism and protect the interests of depositors/investors. As the economy recovers from the pandemic, the financial system will be called upon to support the revival of growth. Therefore, safeguarding and boosting financial sector resilience will remain a policy priority.

|